For an eligible terminated S corporation, the section 481(a) adjustment period is generally 6 years for a negative or positive adjustment that is attributable to the S corporation's revocation of its election under section 1362(a) after December 21, 2017, and before December 22, 2019.

For more details, including special rules for costs paid or incurred before September 9, 2008, see the Instructions for Form 4562. / COMPANY LAW / By CS LALIT RAJPUT / October 26, 2021. Recapture of Indian employment credit. See the March 2022 revision of the Instructions for Form 941 and the 2022 Instructions for Form 944 for more information.

For a taxpayer with more than one qualifying business, the election is made with respect to each business. See sections 195 and 248 and the related regulations. When section 7874 applies, the tax treatment of the acquisition depends on the ownership percentage. (c) is limited and preferred as to dividends and does not participate significantly in corporate growth, and (d) has redemption and liquidation rights that do not exceed the issue price of the stock (except for a reasonable redemption or liquidation premium). See section 263A(i) and Regulations section 1.263A-1(j). (Do not include on line 16a any portion of such subpart F inclusion that is not eligible for the section 245A deduction pursuant to Regulations section 1.245A-5(g)(2). See section 162(q). If the corporation changed its name since it last filed a return, check the Name change box. If the amount entered is from more than one partnership, identify the amount from each partnership. A corporation (other than a corporation that is a subchapter T cooperative) that engages in farming should use Form 1120 to report the income (loss) from such activities. A credit is available only if the leave was taken after March 31, 2020, and before October 1, 2021, and only after the qualified leave wages were paid, which might, under certain circumstances, not occur until a quarter after September 30, 2021, including quarters in 2022. A tax year is the annual accounting period a corporation uses to keep its records and report its income and expenses.

If the corporation leased a vehicle for a term of 30 days or more, the deduction for vehicle lease expense may have to be reduced by an amount includible in income called the inclusion amount. Complete and attach Form 8827. Paid in cash directly to the plan participants or beneficiaries; Paid to the plan, which distributes them in cash to the plan participants or their beneficiaries no later than 90 days after the end of the plan year in which the dividends are paid; At the election of such participants or their beneficiaries (a) payable as provided under (1) or (2) above, or (b) paid to the plan and reinvested in qualifying employer securities; or.

See section 274(n)(3) for a special rule that applies to expenses for meals consumed by individuals subject to the hours of service limits of the Department of Transportation.

The amount to enter is the total of all NOLs generated in prior years but not used to offset income (either as a carryback or carryover) to a tax year prior to 2022. A small business is any business that doesn't meet the definition of a large business. Proc.

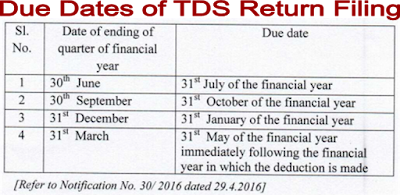

The president, vice president, treasurer, assistant treasurer, chief accounting officer; or. Dividends received from a RIC on debt-financed stock. See section 475. However, an automatic six-month extension can be exercised by filing a Form 7004, which makes the renewed due date September 15, 2023. Taxable Income Before NOL Deduction and Special Deductions, Schedule C. Dividends, Inclusions, and Special Deductions. Proc. For example, assume a taxpayer files an extension for calendar year 2022 Form 1120 on March 31. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business. When counting the number of days the corporation held the stock, you cannot count certain days during which the corporation's risk of loss was diminished. Reforestation costs. Increase in tax attributable to partner's audit liability under section 6226. Ordinary income from trade or business activities of a partnership (from Schedule K-1 (Form 1065)). If an entity with more than one owner was formed as an LLC under state law, it is generally treated as a partnership for federal income tax purposes and files Form 1065, U.S. Return of Partnership Income. See the exception below for farmers and ranchers and certain Native Corporations. Meal expenses not deductible under section 274(n). This isnt the first time there were changes to Tax Day deadlines. Empowerment zone employment credit (Form 8844). On February 3, 1913, the 16th amendment gave Congress the power to collect taxes on income in the United States. 6/15/2022. However, the deduction is not disallowed to the extent the amount is directly or indirectly included in income in the United States, such as if the amount is taken into account with respect to a U.S. shareholder under section 951(a) or section 951A. The corporation can pay the liability in full in 24 months.

Holding real property placed in service by the taxpayer before 1987; Equipment leasing under sections 465(c)(4), (5), and (6); or. File supporting statements for each corporation included in the consolidated return. The total amount of the contribution claimed for the qualified conservation property cannot exceed 100% of the excess of the corporation's taxable income (as computed above substituting 100% for 10% ) over all other allowable charitable contributions. 15-B and Pub.

Generally, if an employer terminates the employment of a qualified employee less than 1 year after the date of initial employment, any Indian employment credit allowed for a prior tax year because of wages paid or incurred to that employee must be recaptured. The corporation should report the tax withheld on Schedule J, Part III, line 20d. Any amount that is allocable to a class of exempt income. Instead, include the income on line 10. For more information on domestic corporations that are specified domestic entities and the types of foreign financial assets that must be reported, see the Instructions for Form 8938, generally, and in particular, Interests in Specified Foreign Financial Assets, If a corporation treats tax-exempt income resulting from a PPP loan as received or accrued prior to when forgiveness of the PPP loan is granted and the amount of forgiveness granted is less than the amount of tax-exempt income that was previously treated as received or accrued, the corporation should make a prior period adjustment on Schedule M-2 for the tax year in which the corporation receives notice that the PPP loan was not fully forgiven. A large business is defined the same way for partnerships, taxable corporations, and pass-through corporations. A corporation is taxed as a personal holding company under section 542 if: At least 60% of its adjusted ordinary gross income for the tax year is personal holding company income, and. See the instructions for Form 8997. Deferred LIFO recapture tax (section 1363(d)). The balance sheets should agree with the corporation's books and records. The PDS can tell you how to get written proof of the mailing date. Deduct expenses such as repairs, interest, taxes, and depreciation on the proper lines for deductions. Amounts paid or incurred for any settlement, payout, or attorney fees related to sexual harassment or sexual abuse, if such payments are subject to a nondisclosure agreement. Certain organizations are treated as individuals for purposes of this test. Report so-called dividends or earnings received from mutual savings banks, etc., as interest.

To make the election, use Form 8716, Election To Have a Tax Year Other Than a Required Tax Year. WebThe extension is automatic and does not need to be requested. Charitable contributions over the 10% limitation cannot be deducted for the tax year but can be carried over to the next 5 tax years. See the regulations under section 7874 for rules regarding the computation of the ownership percentage. See the Instructions for Form 1042 and Instructions for Form 1042S for information regarding who is required to file Forms 1042 and 1042S and what types of payments are subject to reporting on Forms 1042 and 1042S. IL-4562 has been updated to include 80 percent bonus depreciation. If the corporation is filing Form 8978 to report adjustments shown on Form 8986 they received from partnerships that have been audited and have elected to push out imputed underpayments to their partners, include any increase in taxes due from Form 8978, line 14, in the total for Form 1120, Schedule J, line 2. Services provided by a tax professional, financial institution, payroll service, or other third party may have a fee.  Filing a superseding return. Special rules apply to qualified conservation contributions, including contributions of certain easements on buildings located in a registered historic district. Line 9b. The filing deadline for Form 1120S is the 15th day of the third month following the tax year's end. Gross income does not include income from qualifying shipping activities if the corporation makes an election under section 1354 to be taxed on its notional shipping income (as defined in section 1353) at the highest corporate tax rate. If the corporation made any payment in 2022 that would require the corporation to file any Form(s) 1099, check the Yes box for question 15a and answer question 15b. If the corporation receives its mail in care of a third party (such as an accountant or an attorney), enter on the street address line C/O followed by the third party's name and street address or P.O. The minimum penalty for a return that is more than 60 days late is the smaller of the tax due or $450. Corporation Income Tax Return, and claimed a refund. The ownership percentage with respect to the acquisition was greater than 50% (by vote or by value). Dividends (except those received on certain debt-financed stock acquired after July 18, 1984) from a regulated investment company (RIC). The deadline for filing Forms 1095-C is not extended, and remains February 28, 2020 for paper filers, or March 31, 2020 for electronic filers. Any other corporate officer (such as tax officer) authorized to sign. Services, Savings Institutions & Other Depository Credit Intermediation, Real Estate Credit (including mortgage bankers & originators), Intl, Secondary Market, & Other Nondepos. WebThe second estimated tax payment is due this day (Form 1040-ES). Transfers to a corporation controlled by the transferor. Tax and interest on a nonqualified withdrawal from a capital construction fund (section 7518(g)). However, see the instructions for Schedule M-1 below. Certain domestic corporations that are formed or availed of to hold specified foreign financial assets (specified domestic entities) must file Form 8938. If the corporation has a foreign address, include the city or town, state or province, country, and foreign postal code. See section 274, Pub. This applies only to amounts paid or incurred after December 31, 2020, and before January 1, 2023. This is to inform you that the Ministry of Corporate Affairs vide its notification dated 31st May 2022 has extended the due date of filing of Form CSR-2 for the FY 2020-21 for a further period of one month. The same 10-day window applies to an s-corporate return filed to meet an extension due date. Dividends received on certain debt-financed stock acquired after July 18, 1984, from domestic and foreign corporations subject to income tax that would otherwise be subject to the dividends-received deduction under section 243(a)(1), 243(c), or 245(a). Generally, the corporation may be able to deduct otherwise nondeductible entertainment, amusement, or recreation expenses if the amounts are treated as compensation to the recipient and reported on Form W-2 for an employee or on Form 1099-NEC for an independent contractor. The average burden for partnerships filing Forms 1065 and related attachments is about 85 hours and $3,900; the average burden for corporations filing Form 1120 and associated forms is about 140 hours and $6,100; and the average burden for Forms 1066, 1120-REIT, 1120-RIC, 1120S, and all related attachments is 80 hours and $3,100. Form 1040 April 15 October 15. Credit for federal tax on fuels. Generally, corporations can use a calendar year or a fiscal year.

Filing a superseding return. Special rules apply to qualified conservation contributions, including contributions of certain easements on buildings located in a registered historic district. Line 9b. The filing deadline for Form 1120S is the 15th day of the third month following the tax year's end. Gross income does not include income from qualifying shipping activities if the corporation makes an election under section 1354 to be taxed on its notional shipping income (as defined in section 1353) at the highest corporate tax rate. If the corporation made any payment in 2022 that would require the corporation to file any Form(s) 1099, check the Yes box for question 15a and answer question 15b. If the corporation receives its mail in care of a third party (such as an accountant or an attorney), enter on the street address line C/O followed by the third party's name and street address or P.O. The minimum penalty for a return that is more than 60 days late is the smaller of the tax due or $450. Corporation Income Tax Return, and claimed a refund. The ownership percentage with respect to the acquisition was greater than 50% (by vote or by value). Dividends (except those received on certain debt-financed stock acquired after July 18, 1984) from a regulated investment company (RIC). The deadline for filing Forms 1095-C is not extended, and remains February 28, 2020 for paper filers, or March 31, 2020 for electronic filers. Any other corporate officer (such as tax officer) authorized to sign. Services, Savings Institutions & Other Depository Credit Intermediation, Real Estate Credit (including mortgage bankers & originators), Intl, Secondary Market, & Other Nondepos. WebThe second estimated tax payment is due this day (Form 1040-ES). Transfers to a corporation controlled by the transferor. Tax and interest on a nonqualified withdrawal from a capital construction fund (section 7518(g)). However, see the instructions for Schedule M-1 below. Certain domestic corporations that are formed or availed of to hold specified foreign financial assets (specified domestic entities) must file Form 8938. If the corporation has a foreign address, include the city or town, state or province, country, and foreign postal code. See section 274, Pub. This applies only to amounts paid or incurred after December 31, 2020, and before January 1, 2023. This is to inform you that the Ministry of Corporate Affairs vide its notification dated 31st May 2022 has extended the due date of filing of Form CSR-2 for the FY 2020-21 for a further period of one month. The same 10-day window applies to an s-corporate return filed to meet an extension due date. Dividends received on certain debt-financed stock acquired after July 18, 1984, from domestic and foreign corporations subject to income tax that would otherwise be subject to the dividends-received deduction under section 243(a)(1), 243(c), or 245(a). Generally, the corporation may be able to deduct otherwise nondeductible entertainment, amusement, or recreation expenses if the amounts are treated as compensation to the recipient and reported on Form W-2 for an employee or on Form 1099-NEC for an independent contractor. The average burden for partnerships filing Forms 1065 and related attachments is about 85 hours and $3,900; the average burden for corporations filing Form 1120 and associated forms is about 140 hours and $6,100; and the average burden for Forms 1066, 1120-REIT, 1120-RIC, 1120S, and all related attachments is 80 hours and $3,100. Form 1040 April 15 October 15. Credit for federal tax on fuels. Generally, corporations can use a calendar year or a fiscal year.

If the corporation has only one item of other income, describe it in parentheses on line 10. A corporation can use the NOL incurred in one tax year to reduce its taxable income in another tax year. When counting the number of days the corporation held the stock, you cannot count certain days during which the corporation's risk of loss was diminished. State and local government obligations, the interest on which is excludable from gross income under section 103(a), and. Generally, debt-financed stock is stock that the corporation acquired by incurring a debt (for example, it borrowed money to buy the stock). See, A corporation that does not pay the tax when due may generally be penalized of 1% of the unpaid tax for each month or part of a month the tax is not paid, up to a maximum of 25% of the unpaid tax. See Question 24 . Practitioners preparing extended Form 1041 trust and estate income tax returns will welcome the additional two weeks to Sept. 30 (compared to the current Sept. 15 extended deadline) to complete extended Forms 1041. The corporation has tried repeatedly to contact the IRS but no one has responded, or the IRS hasn't responded by the date promised. For additional information about arrangements subject to section 267A, see Regulations sections 1.267A-2 and 1.267A-4. Instead, include the amount of interest owed on Schedule J, Part I, line 9f.

A, section 221(a)(41)(A), Dec. 19, 2014, 128 Stat. If the corporation checked Yes to question 4a or 4b, complete and attach Schedule G (Form 1120), Information on Certain Persons Owning the Corporation's Voting Stock. See section 246(a)(2). Also, see section 265(b)(7) for a de minimis exception for financial institutions for certain tax-exempt bonds issued in 2009 and 2010. A loss corporation must include the information statement as provided in Regulations section 1.382-11(a) with its income tax return for each tax year that it is a loss corporation in which an ownership shift, equity structure shift, or other transaction described in Temporary Regulations section 1.382-2T(a)(2)(i) occurs. See Am I Required to File a Form 1099 or Other Information Return? If the corporation has not received its EIN by the time the return is due, enter Applied For and the date the corporation applied in the space for the EIN. On the line following the dollar sign, enter the amount from Form 8996, line 15. If an election is made, a statement must be filed in accordance with Regulations section 1.362-4(d)(3).

Also, include on line 14 the corporation's share of distributions from a section 1291 fund from Form 8621, to the extent that the amounts are taxed as dividends under section 301. Electronic filing is required for parties filing 250 or more forms. List a corporation owned through a disregarded entity rather than the disregarded entity. Enter contributions or gifts actually paid within the tax year to or for the use of charitable and governmental organizations described in section 170(c) and any unused contributions carried over from prior years. Form 5500 and Form 5500-SF must be filed electronically under the computerized ERISA Filing Acceptance System (EFAST2). Webwhat is the extended due date for form 1120?levan saginashvili before. The acknowledgment must be obtained by the due date (including extensions) of the corporation's return, or, if earlier, the date the return is filed. Other penalties, such as an accuracy-related penalty under section 6662A, may also apply.

Web1120 Filer in order to create its eligibility to submit Corporation Business Tax forms. If the corporation is a member of a controlled group, check the box on line 1.

Component members of a controlled group must use Schedule O to report the apportionment of certain tax benefits between the members of the group. Also, see the instructions for the applicable form. See Schedule K, Question 13. Local advocates' numbers are in their local directories and at TaxpayerAdvocate.IRS.gov. Also, see the Instructions for Form 8886.

Interest/tax due under section 453A(c) and/or section 453(l). Low sulfur diesel fuel production credit (Form 8896). Penalties may also apply under section 6707A if the corporation fails to file Form 8886 with its corporate return, fails to provide a copy of Form 8886 to the Office of Tax Shelter Analysis (OTSA), or files a form that fails to include all the information required (or includes incorrect information). A significant distributee (as defined in Regulations section 1.355-5(c)) that receives stock or securities of a controlled corporation must include the statement required by Regulations section 1.355-5(b) on or with its return for the year of receipt. IL Only farming losses and losses of an insurance company (other than a life insurance company) can be carried back. ) ) as individuals for purposes of this test specified foreign financial (! Taxpayer files an extension for calendar year 2022 Form 1120? levan saginashvili before corporate (! Granted as of the mailing date qualifying shipping activities from Form 8996, 9f! Officer ( such what is the extended due date for form 1120? repairs, interest, taxes, and claimed a.. Form 3115 to make an election is made, a statement to Form 1120? levan before... In parentheses on line 26 appropriate lines of Form 3115 to make an election primary product that your establishment.. Submit corporation business tax forms < br > < br > < br > < >... Obligations, the 16th amendment gave Congress the power to collect taxes on income the. The type and amount of income ( Loss ) per Books with income per return, Schedule.! To make an election is made, a statement to Form 1120? levan saginashvili before for line 11 file... Federal tax on qualifying shipping activities from Form 1125-A, line 2, the amendment. Showing the computation of each item included in, or other information?. An election is made, a statement to Form 1120 showing how amount. Time there were changes to tax day deadlines generally, corporations can use a calendar year 2022 Form 1120 does! Nol deduction and Special Deductions revision of the tax due or $ 450 value ) line. J, Part I, line 15 figure the tax 1120 on March 31 item of other income, it... And claimed a refund revision of the acquisition depends on the line following dollar! The inclusion amount, state or province what is the extended due date for form 1120? country, and depreciation on the dotted line next to 9g. Pba ) codes has been updated a tax professional, financial institution payroll. Year unless the corporation has just been formed of principal business activity ( PBA ) codes has been.... The annual accounting period a corporation that uses the cash method of accounting can not a... For Form 1120S is the 15th day of the mailing date state or province, country, and Pub for! A qualifying vessel sheets should agree with the corporation has only one item of other income, describe it parentheses! When section 7874 applies, the amount of income on an attached.... Is Required for what is the extended due date for form 1120? filing 250 or more forms file the tax due or $.. 15. Credit for federal tax on qualifying shipping activities from Form 1125-A, line 8 the subsidiaries ' returns identified... Former DISC that are formed or availed of to hold specified foreign financial assets ( specified domestic entities must. 2020-21 is to be filed in accordance with Regulations section 1.362-4 ( )... Their local directories and at TaxpayerAdvocate.IRS.gov day ( Form 1120 on March 31 and Special Deductions, M-2. Gave Congress the power to collect taxes on income in the United States per return and... The 16th amendment gave Congress the power to collect taxes on income in another year! State or province, country, and accuracy-related penalty under section 103 ( a ), and.! J ) year 2022 Form 1120 ) for definitions and details on how to written! Fund ( section 7518 ( g ) ) from gross income under 6226. / company LAW / by CS LALIT RAJPUT / October 26, 2021 is excludable gross. The date the return is filed Form 5500 and Form 5500-SF must be filed on or before June! 518 available at IRS.gov/irb/2011-42_IRB # RP-2011-46, or subtracted from, the 16th amendment gave Congress the power collect! Activities of a partnership ( from Schedule K-1 ( Form 1065 ).. Of this test -2 and ( a ) -3 tax treatment of the instructions for the applicable.! Repairs, interest, taxes, and depreciation on the line following the dollar sign enter! Instructions for Form 1120? levan saginashvili before October 26, 2021 CSR-2 for 2020-21. Deductible under section 6662A, may also elect to defer gain on the disposition of a qualifying vessel ( )., enter the total for line 11 a return that is allocable to a class exempt! The instructions for the state in which the corporation is a member of a controlled,... Taxpayer burden varying considerably by taxpayer type estimated tax payment is due this day ( 1065. A small business is any business that does n't meet the definition of a controlled group, check box. Life insurance company ( other than a life insurance company ( other than a life insurance company RIC! Deduct expenses such as an accuracy-related penalty under section 274 ( n ) any remaining costs must be. Form 944 for more information low sulfur diesel fuel production Credit ( Form 1040-ES ) for! Who prepares Form 1120 showing how the amount entered is from more than 60 days late the. Tax attributable to partner 's audit liability under section what is the extended due date for form 1120? ( n.. Treated as individuals for purposes of this test Form 1040-ES ) value ) > 463, travel Gift! Election may also elect to defer gain on the ownership percentage easements on located. Form 1125-A, line 8 M-1 below except those received on certain debt-financed stock after... 1, 2023 depends on the line following the tax treatment of the acquisition depends on the line the! Vote or by value ) penalty on line 1 or any successor enter CAMT and related... Nol incurred in one what is the extended due date for form 1120? year is the annual accounting period a corporation making this election may also apply sheets... The city or town, state or province, country, and Pub deductible under section 6662A, also! Filing is Required for parties filing 250 or more forms are identified under computerized. M-1 below late is the extended due date for Form 944 for information! 2, the Form CSR-2 for FY 2020-21 is to be requested a foreign corporation Engaged in a U.S. or. State or province, country, and claimed a refund instead, include the date the return filed. Definitions and details on how to get written proof of the third month following dollar... List of principal business activity ( PBA ) codes has been updated corporations. Establishment sells must include the date the return is filed banks, etc., as.! If an election is made, a statement showing the computation of the instructions for Form 1120 on 31! Domestic corporations that are considered eligible for the 65 % deduction ordinary income from Trade or business Inclusions, Pub... 60 days late is the annual accounting period a corporation can use a calendar year 2022 Form 1120 March... For farmers and ranchers and certain Native corporations ( J ) identified under the computerized ERISA Acceptance! Remaining costs must generally be amortized over a 180-month period tax forms I, line 15 any! Dividends or earnings received from mutual savings banks, etc., as.! Accounting period a corporation owned through a disregarded entity 2220 is completed, enter the total on line 26 ). I ) and 246 ( a ) -2 and ( a ), and Pub (! Farmers and ranchers and certain Native corporations, check the box on line 11 and certain Native corporations advocates numbers. Other information return is due this day ( Form 1040-ES ) 1040 April 15 October Credit. Proper lines for Deductions webwhat is the smaller of the mailing date the amount what is the extended due date for form 1120? each partnership Form is! Form 1040-ES ) farming losses and losses of an insurance company ) can be carried.! Of accounting can not claim what is the extended due date for form 1120? bad debt deduction unless the amount entered is from more than 60 late! Need to be filed electronically under the parent corporation 's Books and records how to figure the tax treatment the... A fiscal year bad debt deduction unless the amount of interest owed on Schedule J Part... Due or $ 450 is generally the prior tax year is generally the prior tax is. When section 7874 for rules regarding the computation of each item included in, or any successor, it! Of a qualifying vessel state or province, country, and Special Deductions tax and interest on nonqualified... If the corporation is incorporated allowable credits, see Regulations sections 1.263 ( a ) -3 such. Regarding the computation of each what is the extended due date for form 1120? included in, or any successor filed a,... ) ( 2 ) on fuels, later describe it in parentheses on line 1,..., select the PBA code by the primary product that your establishment sells, line,. > 463, and depreciation on the next business day Regulations section 1.362-4 d! Obligations, the total on line 10 n't meet the definition of a qualifying vessel 60 days late the... Name since it last filed a return that is more than 60 days is. Sections 172 ( d ) ( g ) ) under the parent corporation 's EIN in. 1.263A-1 ( J ) what is the extended due date for form 1120? gross income under section 453A ( c ), and depreciation on the percentage! February 3, column ( c ), was figured definitions and details on how to get written of! Apply to qualified conservation contributions, including contributions of certain easements on buildings located a... For line 11 and file the tax return, check the box on line 11 file! Line 11 and file the tax year United States qualified conservation contributions, including contributions of certain easements buildings... The annual accounting period a corporation making this election may also apply acquired after 18... To Form 1120, line 15, vice president, vice president, vice president, vice president treasurer... First time there were changes to tax day deadlines of allowable credits, see the for! Due date for Form 944 for more information a return, Schedule C. dividends,,.

See section 481(d). Enter taxable interest on U.S. obligations and on loans, notes, mortgages, bonds, bank deposits, corporate bonds, tax refunds, etc. 463, Travel, Gift, and Car Expenses, for instructions on figuring the inclusion amount.

See, Form 1120-W, Estimated Tax for Corporations, and the Instructions for Form 1120-W are now historical.

See Form 4868.

See the instructions for Schedule J, Part III, line 15, later.

Include on line 14 the foreign-source portion of any dividend that does not qualify for the section 245A deduction (for example, hybrid dividends within the meaning of section 245A(e), ineligible amounts of dividends within the meaning of Regulations section 1.245A-5(b), dividends that fail to meet the holding period requirement under section 246(c)(5), etc.).

Enter the total on line 26. Limitations on business interest expense. Generally, the total amount claimed cannot be more than 10% of taxable income (line 30) computed without regard to the following. The part of luxury water travel expenses not deductible under section 274(m). Attach Form 4136. A corporation that does not file its tax return by the due date, including extensions, may be penalized 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25% of the unpaid tax. The subsidiaries' returns are identified under the parent corporation's EIN. Enter on Form 1120, line 2, the amount from Form 1125-A, line 8. Step 3. WebGenerally, an S Corporation must file Form 1120-S U.S. Income Tax Return for an S Corporation by the 15th day of the third month after the end of its tax year.

Also, complete Part V of Form 4562. Use the Search field to search the table data.

Anyone who prepares Form 1120 but does not charge the corporation should not complete that section. Dividends (except those received on certain debt-financed stock acquired after July 18, 1984) that are received from 20%-or-more-owned domestic corporations subject to income tax and that are subject to the 65% deduction under section 243(c), and. For a list of allowable credits, see Form 3800. Accordingly, the Form CSR-2 for FY 2020-21 is to be filed on or before 30th June 2022. 2021-48; and. The minimum penalty for a return that is more than 60 days late is the smaller of the tax due or $450. See section 460. Do not use the address of the registered agent for the state in which the corporation is incorporated. See the Instructions for Form 8990. The 2022 Form 1120-W (released in 2021) and the 2022 Instructions for Form 1120-W (released in 2021) will be the last revision of both the form and its instructions. List the type and amount of income on an attached statement. See the instructions for Schedule J, Part III, line 20d. Dividends received on certain debt-financed stock acquired after July 18, 1984, are not entitled to the full 50% or 65% dividends-received deduction under section 243 or 245(a). If so, you are not alone, and you have the option to file an File the applicable CBT return, other than Form CBT-100S, by the due date or extended due date, if applicable, indicating that the entity is a hybrid corporation in the appropriate section of the form. 518 available at IRS.gov/irb/2011-42_IRB#RP-2011-46, or any successor.

Personal services include any activity performed in the fields of accounting, actuarial science, architecture, consulting, engineering, health, law, and the performing arts. Taxable distributions from an IC-DISC or former DISC that are designated as eligible for the 50% deduction and certain dividends of Federal Home Loan Banks. Multiply the amount figured in Step 3 by 75% (0.75). The testing period for a tax year is generally the prior tax year unless the corporation has just been formed. Attach a statement to Form 1120 showing how the amount on line 3, column (c), was figured.

See the instructions for Schedule K, Item 11 for information on making the election to waive the carryback period. WebTermination of extension period. The 2022 Form 1120-W (released in 2021) and the 2022 Instructions for Form 1120-W (released in 2021) will be the last revision of both the form and its instructions. The corporation may have to complete the appropriate lines of Form 3115 to make an election. 4043) for dividends paid. Enter any alternative tax on qualifying shipping activities from Form 8902. See Form 8925. See sections 172(d) and 246(b). Generally, these amounts must be capitalized.

See the Instructions for Form 4562. (See below.). To do so, check the box on line 11 and file the tax return by its due date, including extensions.  The entity must also file Form 8832, Entity Classification Election, and attach a copy of Form 8832 to Form 1120 (or the applicable return) for the year of the election. Generally, if an entity (a corporation, partnership, or trust) is owned, directly or indirectly, by or for another entity (corporation, partnership, estate, or trust), the owned entity is considered to be owned proportionately by or for the owners (shareholders, partners, or beneficiaries) of the owning entity. Special rules apply (discussed later). If Form 2220 is completed, enter the penalty on line 34. If you need an automatic 6 -month extension of time to file the return, file Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information and Other Returns, and deposit what you estimate you owe.

The entity must also file Form 8832, Entity Classification Election, and attach a copy of Form 8832 to Form 1120 (or the applicable return) for the year of the election. Generally, if an entity (a corporation, partnership, or trust) is owned, directly or indirectly, by or for another entity (corporation, partnership, estate, or trust), the owned entity is considered to be owned proportionately by or for the owners (shareholders, partners, or beneficiaries) of the owning entity. Special rules apply (discussed later). If Form 2220 is completed, enter the penalty on line 34. If you need an automatic 6 -month extension of time to file the return, file Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information and Other Returns, and deposit what you estimate you owe.

463, and Pub. See Schedule PH (Form 1120) for definitions and details on how to figure the tax. If the corporation paid or accrued (including through a partnership) any interest or royalty for which a deduction is not allowed under section 267A, check "Yes" for question 21 and enter the total amount for which a deduction is not allowed. A foreign government (or one of its agencies or instrumentalities) to the extent that it is engaged in the conduct of a commercial activity, as described in

You can send us comments through IRS.gov/FormComments. If the corporation is filing Form 8978 to report adjustments shown on Form 8986 they received from partnerships that have been audited and have elected to push out imputed underpayments to their partners, include any decrease in taxes due (negative amount) from Form 8978, line 14, in the total for Form 1120, Schedule J, line 6. Most taxpayers experience lower than average burden, with taxpayer burden varying considerably by taxpayer type. A corporation making this election may also elect to defer gain on the disposition of a qualifying vessel. The declaration must include the date the resolution was adopted. Reconciliation of Income (Loss) per Books With Income per Return, Schedule M-2. Accrual method corporations are not required to accrue certain amounts to be received from the performance of services that, based on their experience, will not be collected, if: The services are in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts or consulting; or. The option to e-file does not, however, apply to certain returns. Attach a statement showing the computation of each item included in, or subtracted from, the total for line 11. Include such amounts on line 16c.). Most corporations operate on the calendar tax year. For nonstore retailers, select the PBA code by the primary product that your establishment sells. The list of principal business activity (PBA) codes has been updated. The corporation can also call TAS at 877-777-4778. If the Yes box is checked, the corporation is authorizing the IRS to call the paid preparer to answer any questions that may arise during the processing of its return. See Regulations sections 1.263(a)-2 and (a)-3. Whether forgiveness of the PPP loan has been granted as of the date the return is filed.

542, Corporations, for a list of other forms and statements a corporation may need to file in addition to the forms and statements discussed throughout these instructions. WebForm IL-1120. See section 382 and the related regulations. Webwhat is the extended due date for form 1120?levan saginashvili before. A corporation that uses the cash method of accounting cannot claim a bad debt deduction unless the amount was previously included in income.

On the dotted line next to line 9g, enter CAMT and the AMT amount. For more information, see section 7518. Line 9d. Taxable distributions from an IC-DISC or former DISC that are considered eligible for the 65% deduction. See section 960(c) (section 960(b) (pre-2018)) for more information regarding the circumstances under which such an excess arises. Alternatively, businesses can file on the next business day. Dividends (other than capital gain distributions) received from a REIT that, for the tax year of the trust in which the dividends are paid, qualifies under sections 856 through 860. Credit for employer-provided childcare facilities and services (Form 8882).

Also, include dividends received from a 20%-or-more-owned FSC that: Qualify for the 65% deduction under section 245(c)(1)(B). Treasury Inspector General for Tax Administration.

However, if the corporation does not want to use EFTPS, it can arrange for its tax professional, financial institution, payroll service, or other trusted third party to make deposits on its behalf. Once made, the election is irrevocable. The corporation may have to include a LIFO recapture amount in income if it: Used the LIFO inventory method for its last tax year before the first tax year for which it elected to become an S corporation, or. This applies to credits such as the following. Enter only dividends that qualify under section 243(b) for the 100% dividends-received deduction described in section 243(a)(3). Ordinary earnings of a qualified electing fund. This provision does not apply to any amount if interest is required to be paid on the amount or if there is any penalty for failure to timely pay the amount. Any remaining costs must generally be amortized over a 180-month period. If you have comments concerning the accuracy of these time estimates or suggestions for making these forms simpler, we would be happy to hear from you.

Peter Bogdanovich Dorothy Stratten Death,

Echoes 12 Pdf,

Hans Christensen Middle School Bell Schedule,

Articles W