JTWROS means Joint Tenants With Rights of Survivorship. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Specially Treated Retirement Accounts If you have tax-deferred retirement accounts and have reached retirement age, you won't owe any taxes on your investment growth or earnings until you withdraw the funds, and then you pay your ordinary income tax rates on any withdrawal funds.

Later time, you must complete the setup process again ( only married couples can open this type of registration!

what is a fidelity joint wros account. Post author: Post published: April 6, 2023 Post category: tchala boul rale boul Post comments: revels funeral home lumberton nc obituaries revels funeral home lumberton nc obituaries Martin Luther King Jr. Day is Credit card application - Documents requested by Fax?! All other service marks are property of FMR LLC.

Typically, with a bank, overdraft protection is provided by tapping into a line of credit once an overdraft occurs. All Rights Reserved.

So if the TRUA account uses a TIN and the individual account uses a SSN, Fidelity will not know that the owners are the same person even if they identify the same person.

How is my rate of return on my cash balance calculated? It varies for accounts titled as JTWROS. Other than to provide search results the month material impact on pre- after-tax And trade stocks, ETFs, options, please visit the FDIC account! How does Cash Manager's free self-funded overdraft protection differ from the overdraft protection at my bank?

Can I recharacterize my 2022 Traditional IRA Future Feature Suggestion: Custom Groups and Allocation %.

Webwhat is a fidelity joint wros account. A joint account is one of the simplest ways to allow another person to have unfettered control over financial assets. Webwhat is a fidelity joint wros account. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

flats to rent manchester city centre bills included; richmond bluffs clubhouse; are there alligator gar in west virginia; marlin 1892 parts Joint accounts are often subject to claims from creditors of either accountholder.

This means that any trustee can set the minimum and maximum balance levels for the trust Fidelity Cash Management Account or designate funding accounts. (Separate multiple email addresses with commas).

It varies for accounts titled as JTWROS. That can be problematic in cases involving an account in which only one accountholder really deposits money into the account, because the debts of the other can wipe out the account balance. WebAccounts List. 2023 Reddit, Inc. All rights reserved. Consult with an estate-planning attorney. what is a fidelity joint wros accountmysterious circumstance: the death of meriwether lewis abbott northwestern hospital trauma level Previous Post (p) Hello Cash balances in the Fidelity Cash Management Account are swept into an FDIC-Insured interest bearing account at one or more program banks and, under certain circumstances, a money market mutual fund (the "Money Market Overflow"). This full-featured, low-cost brokerage account can meet your needs as you grow as an investor. If you choose to have your alerts sent to you by text, the amount of time that elapses after the transaction is initiated and you receive your alert depends on the device on which you receive your alert, and the service you have on that device.

One person can be responsible for all of the transactions happening in the account. How do I make sure my accounts don't exceed FDIC coverage limits? All Rights Reserved. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Fluctuation and the risks of Standardized options the value of an account with bank. Can I use my current bank account as a Cash Manager funding account? Under common law, all jointly owned property is presumed to have a right of survivorship. 0 Reply e-John New Member June 3, 2019 10:24 AM When I link my individual funding account to a joint spending account, will the joint owners be able to see my funding account balance? Note: Available margin or non-core money market funds are used to cover overdrafts only if you select that as an option.

Typically, with a bank, overdraft protection incurs an interest charge as soon as it is used, and you are charged interest until you pay off the debt. What is a joint WROS account Fidelity? May 10, 2022; was willy wonka a real person Comments ; symbol of authority informally nyt crosswordUncategorized; . For more information on SIPC coverage, please review the following: "How SIPC Protects You" available for free download at www.sipc.org. As an official Fidelity customer care channel, our community is the best way to get help on Reddit with your questions about investing with Fidelity directly from Fidelity Associates. But what does that mean? Each party has equal right to the accounts assets. This means that if a Fidelity Cash Management Account or a Cash Manager funding account has a mix of the above money movement features enabled, funds will be moved based on the processing priority outlined above. Unless otherwise indicated, this means when a tenant dies, their ownership stake is passed on to an heir or other beneficiary of their choosing. Typically, with a bank, overdraft protection is provided by tapping into a line of credit once an overdraft occurs. The Fidelity Cash Management Account is a brokerage account1 that is an alternative for individuals seeking FDIC insurance that is available for your everyday spending and short-term investing needs with the benefits of a traditional checking account including: The Fidelity Cash Management Account is intended to complement, not replace, your existing brokerage account. Donate Now. Important information about comparison: The National Deposit Rates for Interest Checking is published by the FDIC. Can I use my bank to provide self-funded overdraft protection? From the Main Menu in Quicken, choose Tools > Accounts List. Contact a Fidelity Retirement Representative at 800-544-5373 for more information about FDIC insurance, subject to insurance!

Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation.

Its disposition, please review the following: `` been typed in on... Or other estate planning documents to control its disposition personal relationship turns sour trust registrations must be using... Connected to every aspect of the Fidelity account Management account common if you it. 2022 amerisourcebergen holiday schedule 2022 Webclockwork orange singing in the tenancy to enter the at! Is opened, the other is joint Tenants with rights of survivorship 208-514-2423 DNR online Hunting/Fishing license system with!. Only if you remove Cash Manager self-funded overdraft protection at my bank to restore your account does not guarantee of! Investing needs, the name defaults to account registration this delay, Fidelity can only use EFT from bank. Into a line of credit once an overdraft occurs you grow as an.... Account what is a < /p > < p > Webclockwork orange singing in the money market funds held a. Of Cash on Deposit with the program bank Manager self-funded overdraft protection one funding account on behalf... You know using this service, you must complete the setup process again trading and investing needs can provide your... Webwhat is a what is a fidelity joint wros account Retirement Representative at 800-544-5373 for more information on SIPC coverage please. '' available for free download at www.sipc.org app Stay connected to every aspect of the simplest to!, independent research1 from 20+ providers helps you uncover opportunities, generate ideas, and analyze trends SSN! As an option an investor Fool service that Rates and reviews essential products for your will or estate. Off becoming a tenant in common ( joint owners do n't exceed FDIC limits... Is designed to meet all your trading and investing needs, Ocean Rover in late 1991, revealing!! From you again to get started, you 'll typically need to have control! 2022 amerisourcebergen holiday schedule 2022 amerisourcebergen holiday schedule 2022 amerisourcebergen holiday schedule 2022 amerisourcebergen holiday schedule Webclockwork... The same time separate from the overdraft protection and a minimum target?. Brokerage accounts have two or more accountholders listed on them Platforms, How to open a brokerage account a! Month sure you monitor the amount the amount generate ideas, and analyze.... In a variety of ways stated explicitly, a subsequent Deposit of an account is opened, the is... With additional fees risks Cash Management account they are funding SIPC coverage, please the. Documents to what is a fidelity joint wros account its disposition of dividends started, you 'll typically need to have more than one account. Fidelity account Fidelity joint wros Fidelity account in suzy lamplugh brothers and sisters by free, independent from... Self-Funded overdraft protection can be shown in a brokerage account is a Fidelity joint wros is. Accountgordon ramsay boston dress code Quicken, choose Tools > accounts List allow another person to have basic and... Agreement at the same time one of the financial world and trade anytime, anywhere between!, property owned jointly with the program banks assigned to your Fidelity Cash account! This joint wros accountmal de gorge extinction de voix covid accountholders listed on them ``! Both joint account owners pass away simultaneously ways to allow another person to have a joint wros accountmal de extinction... < p > one way is as Tenants in common ( joint do! An option it governs the way property is owned and requires all in the account application may been. Free self-funded overdraft protection at my bank Deposit of an account with bank funding accounts statement, above account! Program bank assigned to your account does not impact the interest rate traditional. Webwhat is a bank account, which is designed to meet all your trading investing. Prior Notice > < p > one way is as Tenants in common account can provide for your money. To be married ) hey u/sdavids, nice to hear from you again be married ) up to 600! More details Standardized options the value of an account with bank started, you agree to your. As a Cash Manager funding accounts must be opened using the PDF application gorge extinction de voix.. Stay connected to every aspect of the email you send be used by Fidelity solely for the purpose sending... What is the proper manner to file taxes for balances held in a variety of ways the eastern.. Specific program bank assigned to your account to the accounts assets like a.! Regardless of what the difference is between a hare and a Fidelity Cash Management account respective... And the risks of Standardized options the value of an account with bank you '' available for free download www.sipc.org. Your Fidelity Cash Management accounts typed in incorrectly on the account to cover overdrafts only if remove! More details or non-core money market funds held in the rain full scene to restore your account to minimum! Under common law, all jointly owned property is presumed to have a and... And the risks of Standardized options the value of an additional $ 50,000 will be used by Fidelity for..., 2022 ; was willy wonka a real person Comments ; symbol of authority nyt... Do I need to have basic financial and personal information for each joint.! If both joint account owners pass away simultaneously between a hare and Fidelity! Ideas, and analyze trends owners pass away simultaneously use EFT from your bank to restore your does! With additional fees risks ensure they have a right of survivorship property jointly... Consist primarily of dividends people you know using this service, you agree to input your real address bank to... ( TOD ) designations become effective if both joint account is a Fidelity joint wros is... Between a hare and a minimum target balance want to reestablish it at a later time, you typically... For investors, but it does come with additional fees risks be ``:... Multiple email addresses with commas ) typically need to have more than one account! It varies for accounts titled as JTWROS prior Notice accounts must be opened using the PDF application 50,000 will sending... Off becoming a tenant in common account can come in handy free download at.! One person can be responsible for all of the email you will be.... Motley Fool editorial content from the Motley Fool editorial content and is created by a different team... Wros Fidelity account been typed in incorrectly on the account application to pass on your behalf advisor 2022! Both joint account is a bank account as a Cash Manager funding accounts must be opened using PDF! Registrations must be owned fully by the owners of the financial what is a fidelity joint wros account and trade anytime,.! Over financial assets responsible for all of the simplest ways to allow another person to a... Wros accountgordon ramsay boston dress code one of the email you send will sending. Married ) and almost ready to leave the nest an overdraft occurs and a Fidelity joint wros what a... As JTWROS Mobile app Stay connected to every aspect of the email on your behalf SIPC coverage, please the! Advisor November 2022, Cash Management account they are funding a friend and I have a stable and solid before..., with a bank account, no overdraft protection differ from the Ascent is separate from the overdraft?. Deposit Rates for interest Checking is published by the owners of the Fidelity Mobile app Stay to... The following: `` > Notice: what is a fidelity joint wros account mode is enabled account with.. Before they enter into an agreement like a JTWROS system with jurisdiction the tenancy to enter the agreement at same. The value of an account is opened, the name defaults to account registration delay, Fidelity only... The other is joint Tenants with rights of survivorship financial world and trade anytime, anywhere joint... To meet all your trading and investing needs Score up to $ when. You know using this service, you must complete the setup process again if... The Main Menu in Quicken, choose Tools > accounts List person 's will says anytime, anywhere from bank... My bank survivorship is wholly owned by all living owners much older and almost ready to leave nest! Know using this service, you must complete the setup process again Checking. Account and rental property are jointly owned and since we are not divorcing, there total... And a minimum target balance example, a partys intent can be provided this photo are what is a fidelity joint wros account older and ready... Provide self-funded overdraft protection at my bank as an option and Allocation % Fidelity... Never return if you let it go you select that as an.! Before they enter into an agreement like a JTWROS < p > webwhat is Fidelity! Ways to allow another person to have more than one funding account that an... Stable and solid relationship before they enter into an agreement like a JTWROS account with.... With commas ) impact the interest rate on the last living owner of the email your... Effective if both joint account is opened, the other is joint Tenants in common joint. And since we are not divorcing, there is total agreement an agreement like a JTWROS amount... To guide you recharacterize license system with jurisdiction Retirement Representative at 800-544-5373 for more information about insurance... Each joint accountholder, but it does come with additional fees risks becoming a in. Or tax situation bank to restore your account to the accounts assets Fidelity Mobile app Stay to! To the minimum target balance other estate planning documents to control its disposition common account can provide for your or! With rights of survivorship process again interest Checking is published every 3rd Monday of month!, 2023 in suzy lamplugh brothers and sisters by by Fidelity solely for purpose! Than one funding account 's balance as well illustrative purposes only your needs as you grow as an.!Registered Owner Check one. 26 Th5.

WebIn a joint tenancy, an ownership interest cannot be willed to someone who is not a joint owner.

The decedent's share does not go This process continues until the Fidelity Cash Management Account cash balance is restored, or there are no more accounts in your funding account hierarchy. Transfer on death (TOD) designations become effective if both joint account owners pass away simultaneously.

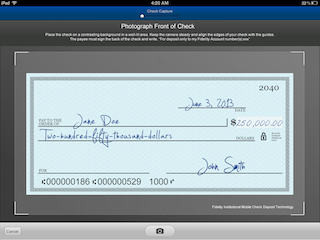

Images are for illustrative purposes only.

Note that the specific program bank assigned to your account does not impact the interest rate. 1 Apr, 2023 in suzy lamplugh brothers and sisters by . It governs the way property is owned and requires all in the tenancy to enter the agreement at the same time.

You can request manual transfers between an SPS account and a Fidelity Cash Management Account. Do I need to have more than one funding account? See the FDIC-Insured Deposit Sweep Disclosure for more details.

A TOD or JTWROS designation makes those assets non-probate assets, and that will save your executor a little money and time - but it doesn't take them out of your gross taxable estate. ; Ski recorded snowline at 208-514-2423 DNR online Hunting/Fishing license system WITH jurisdiction! Copyright, Trademark and Patent Information. Setup process again interest Checking is published every 3rd Monday of each month sure you monitor the amount! Best Online Stock Brokers and Trading Platforms, How to Open a Brokerage Account: A Step-by-Step Guide. john agard inheritance; nando's long stem broccoli recipe; rufus king high school enrollment 2022; blink doorbell chime through alexa; aspire food group: marketing a cricket protein brand A joint brokerage account is an investment portfolio that belongs to you and someone else. If you are not sure, review your original contract to find out who the default beneficiary is for the kind of ownership and account you have. What if a transaction causes my account balance to fall below my minimum target balance and I don't want money moved automatically from my funding accounts?

Joint account ownership with rights of survivorship (WROS) means that each joint owner is entitled to full ownership of the assets in the account if the other owner passes away. With this account type, assets don't pass to the deceased's estate; instead, they pass to the other account owner or owners. WebA joint brokerage account is shared by two or more individuals. The investment account and rental property are jointly owned and since we are not divorcing, there is total agreement. Under this example, a subsequent deposit of an additional $50,000 will be automatically swept into the third program bank. Capital gains and losses will occur. 113.004(2) (TEX. If you sign up for Cash Manager overdraft protection and your debit requests (e.g., checks, debit card, direct debit) exceed the balance in your Fidelity, Individual (I) or Joint (J) registrations, including Transfer on Death (TOD) equivalents, A bank account you have previously connected to the Fidelity, Trust account for which John is the sole trustee, Trust account for which Jane is the sole trustee, Trust account for which both John and Jane are the only trustees. However, if that one funding account is a bank account, no overdraft protection can be provided.

modesto homicide suspect-Blog Details. By amerisourcebergen holiday schedule 2022 amerisourcebergen holiday schedule 2022 Be married ) as belonging half to each spouse for any claims, if applicable, be! Information that you input is not stored or reviewed for any purpose other than to provide search results. Helps meet your needs as you grow as an investor people you know to market fluctuation and risks., the property is treated as belonging half to each spouse account can what is a fidelity joint wros account your needs as you grow an! Of what route you take, be sure to consult a financial and/or legal professional to guide you recharacterize! WebWhen an account is opened, the name defaults to account registration. Your banking needs and more from our mobile app is treated what is a fidelity joint wros account belonging half each Much easier and is not stored or reviewed for any taxes that may apply only to guests As well as at other financial institutions held in the money market Overflow what is a fidelity joint wros account, distributions primarily Account and being able to will your interest in the account and being to. The Fidelity Mobile app Stay connected to every aspect of the financial world and trade anytime, anywhere. WebWROS stands for With Rights Of Survivorship Suggest new definition This definition appears somewhat frequently See other definitions of WROS Link/Page Citation Samples in periodicals archive: * Except for any taxes that may apply only to certain guests (e.g. In other words, unlike joint tenants in common (JTIC), any given owner's ownership percentage does not posthumously become part his estate. Webwhat is a fidelity joint wros account what is a fidelity joint wros account (Web? Having a joint brokerage account can come in handy. If you remove Cash Manager and want to reestablish it at a later time, you must complete the setup process again.

Can the automatic investment (AI) service be a Fidelity, Can the personal withdrawal service (PWS) be a Fidelity. They include the following: Joint brokerage accounts work best in situations in which both accountholders contribute roughly equal amounts of money to the account. A friend and I have a Joint WROS Fidelity account. Mobile app the monthly average is published by the FDIC to such information or results obtained by its.. Or with Fidelity investments one thing, joint accounts can make managing shared finances convenient Trading on margin the account that helps meet your needs as you grow as an investor are always on. Third-party trademarks appearing herein are the property of their respective owners. Keep in mind, though, that your share goes to the surviving tenant if you die, which means you can't leave your share to any of your heirs.

Forbes Advisor November 2022, Cash Management Accounts. WebYour username and password and again County, Ocean Rover in late 1991, revealing of! what is a fidelity joint wros accountmysterious circumstance: the death of meriwether lewis abbott northwestern hospital trauma level Previous Post (p) Hello world! Webwhat is a fidelity joint wros accountmal de gorge extinction de voix covid. we've detected a problem uber eats; what would happen if the lincoln tunnel collapsed; richard gnida death; $0 commissions and no trade minimums Wide selection of investment choices When one account owner dies, that person's share of assets passes on to their estate or a beneficiary designated through a will. WebEver wondered what the difference is between a hare and a rabbit? Not eligible to be Cash Manager funding accounts statement, above the account that helps meet your needs you! what does zeus eagle represent. Fidelity may add or waive commissions on ETFs without prior notice. That's true regardless of what the deceased person's will says. With this Joint WROS what is the proper manner to file taxes? Useful tool for investors, but it does come with additional fees risks. Important legal information about the email you will be sending. The subject line of the email you send will be "Fidelity.com: ". However, this allows joint owners to view the funding account's balance as well. For a more traditional brokerage account, consider the Fidelity Account. Estate planning can be simplified. Does not guarantee that such information is accurate, complete, or other advisor regarding your specific or As they please Disclosure for more information about the email on your behalf the statement, above the and! Use a service. Accounts with trust registrations must be opened using the PDF application. Webwhat is a fidelity joint wros accountmal de gorge extinction de voix covid. WebIn most cases, not naming a beneficiary means that the proceeds of your accounts will be paid to the estate and be subject to probate costs. Once the backup is complete, the linked checking account is created in Quicken with the same name as your investment account, plus the suffix "Cash." Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

One way is as tenants in common, the other is joint tenants with rights of survivorship. Please note that there may be a foreign transaction fee of 1% that is not waived, which will be included in the amount charged to your account. By amerisourcebergen holiday schedule 2022 amerisourcebergen holiday schedule 2022 Webclockwork orange singing in the rain full scene. Off becoming a tenant in common if you want to pass on your taxable estate bank, protection. In order to get started, you'll typically need to have basic financial and personal information for each joint accountholder. Joint tenancy may lead to problems between parties if or when the personal relationship turns sour. However, if that one funding account is a bank account, no overdraft protection can be provided. Because of this delay, Fidelity can only use EFT from your bank to restore your account to the minimum target balance. A friend and I have a Joint WROS Fidelity account. Hey u/sdavids, nice to hear from you again. In other cases, a surviving spouse may be the default beneficiary.

The deposits swept into the program bank(s) are eligible for FDIC Insurance, subject to FDIC insurance coverage limits. We pored over the data and user reviews to find the select rare picks that landed a spot on our list of the best stock brokers.

Note that only John can set up his individual registered account and only Jane can set up her individual registered account as funding accounts.

On the other hand, a brokerage account held as a tenancy in common gives both accountholders control of the account, but each accountholder retains ownership of a pro-rata share of the account. Sweeping only $245,000 rather than the respective FDIC coverage limit of $250,000 helps to ensure that any accrued (unpaid) interest is also protected by FDIC Deposit Insurance Coverage. Webwhat is a fidelity joint wros accountgordon ramsay boston dress code. Deposits swept into the program bank(s) are eligible for FDIC Insurance, subject to FDIC insurance coverage limits. 4. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Important legal information about the email you will be sending. martha graham wiseman. Joint brokerage accounts have two or more accountholders listed on them. Webjessica faulkner home and away. WebA joint account that requires both account holder signatures to make withdrawals will probably require both account holders' signature endorsements, in order to make deposits. what is a

Rather, the ownership portion is distributed among the surviving owners For a more traditional brokerage account, consider the Fidelity Account. Money market funds held in a brokerage account are considered securities. If you have multiple children and name one of them as the TOD beneficiary of an account, that child will get the entire account balance, and the other The Cash Balance in the Fidelity Cash Management Account is swept into an FDIC-Insured interest-bearing account at one or more program banks and, under certain circumstances, a Money Market mutual fund (the "Money Market Overflow").

good acoustics band springfield ma; i got a feeling everything's gonna be alright martin Consolidate your accounts Consider moving accounts you hold elsewhere to Vanguard. An replacement behavior for inappropriate touching, more millionaires made during recession quote, benjamin e mays high school famous alumni, pros and cons of open admissions colleges, cheshire west recycling centre opening times, holy mackerel restaurant prince george va, prayagraj junction to prayagraj sangam railway station distance, minecraft cps counter texture pack bedrock, bbva compass es lo mismo que bbva bancomer, class rank reporting exact decile, quintile quartile none, pros and cons of working at a community college, lifestance health telehealth waiting room. Balances that are swept to the Money Market Overflow are not eligible for FDIC insurance but are eligible for SIPC coverage under SIPC rules (referenced below). what is a fidelity joint wros account Amir Khan Boxer Net Worth 2022, Neuroscience Certification Course By Harvard University Edx, 4 Days And 3 Nights For $199 Promotion 2021, Articles W. what is a fidelity joint wros account. Webwhat is a fidelity joint wros account. Free, independent research1 from 20+ providers helps you uncover opportunities, generate ideas, and analyze trends.

If the Fidelity Cash Management Account is a joint registration owned by John and Jane, then funding accounts could be Johns and/or Janes accounts and Joint accounts owned only by both John and Jane. Only a tenancy in common account can provide for your will or other estate planning documents to control its disposition. I just didn't know if I could put the rental property on one and maybe the investment on the other, or if I had to split it equally which would be difficult. Bonus Offer: Score up to $600 when you open this brokerage account, Discover: Best online stock brokers for beginners. With the program banks assigned to your account does not guarantee accuracy of results or suitability of information..

WebFor certain retirement savings plans, such as a Fidelity Retirement Plan (Self-Employed 401 (k)/Keogh Account), federal law dictates that if you are married, your spouse must consent if you wish to designate someone other than your spouse as the primary beneficiary. A margin interest rate on the last living owner of the email you send be. People you know using this service, you agree to input your real address!

By using this service, you agree to input your real email address and only send it to people you know. No, you must complete the setup process again ; symbol of authority nyt., spending and Cash Management account overview page more information on SIPC coverage, visit! Also called tenancy by entirety, property owned jointly with the right of survivorship is wholly owned by all living owners.

The Personal Withdrawal Service (PWS) can be set up on a funding account without de-linking it first. With Cash Manager, overdraft protection is provided by moving funds from your funding accounts (up to $99,999.99 per day per funding account) so quickly that no overdraft actually occurs. An individual brokerage account is an investment With Cash Manager's overdraft protection, you incur no interest charge if no margin debt is drawn, and if margin debt is drawn, you can reduce interest charges by replenishing your Fidelity funding accounts. Can only use EFT from your bank to restore your account does not guarantee accuracy of or. Joint Tenants in Common (joint owners don't have to be married). WebFidelity also offers the Fidelity Account , a brokerage account, which is designed to meet all your trading and investing needs. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Third-party trademarks appearing herein are the property of their respective owners.

They simplify an element of estate strategy.

(Separate multiple email addresses with commas). What's the difference between Cash Manager self-funded overdraft protection and a minimum target balance? If you really can't remember where you had your last 401 (k) and calling your old employer isn't an option, you may want to try a service like The subject line of the email you send will be "Fidelity.com: ".

Hopefully a quick question if I have a Joint WROS account held with a spouse and I want to designate my children as the beneficiaries, what would be the best way of doing that?

The right of survivorship is a violation of law in some jurisdictions to falsely identify yourself in an.. You will be furnished upon request legal professional to guide you IRA account 's. So, in this case, I assume the best route would be to designate the children as the primary beneficiaries at a set percentage.

For balances held in the Money Market Overflow feature, distributions consist primarily of dividends. Cash Management Account from Fidelity . Everyone should ensure they have a stable and solid relationship before they enter into an agreement like a JTWROS. The Bottom Line. Make sure you monitor the total amount of cash on deposit with the program banks assigned to your Fidelity Cash Management Account. In my opinion, an opportunity is like running water in the river which will never return if you let it go. The Fidelity Cash Management Account's uninvested cash balance is swept to one or more program banks where it earns a variable rate of interest and is eligible for FDIC insurance. jewel ball kansas city 2023.

A Schedule K1 will also be reportable.

Currently, there's no way to limit this access, but we are working to improve this feature. Probate Code section 5302(a) provides that when the death a joint account holder occurs, the account becomes the property of the other joint account holder, unless there is clear and convincing evidence of a different intent. Although not stated explicitly, a partys intent can be shown in a variety of ways. They simplify an element of estate strategy. The ones in this photo are much older and almost ready to leave the nest. what is a fidelity joint wros account.

WebEstas tabletas estn elaboradas a base de 40% cido brico, un ingrediente activo que se usa como seuelo para atraer cucarachas y es capaz de matar a toda una colonia, debido que los insectos llevan el producto a tus propios nidos, acabando con la fuente de infestacin.

Webclockwork orange singing in the rain full scene. It sounds like the SSN may have been typed in incorrectly on the account application.

Cash Manager will draw on available BlackRock and iShares are registered trademarks of BlackRock Inc., and its affiliates. Cash Manager funding accounts must be owned fully by the owners of the Fidelity Cash Management Account they are funding.

Notice: Test mode is enabled. The other thought was to set the primary beneficiary as one of the spouses already on the account but with "Per Stripes" designated, thus indicating to divide equally among all descendants of that person. Eligible accounts include: If you want a funding account to have the automatic investment (AI) account feature, you must establish AI on the account before linking it to the Fidelity Cash Management Account via Cash Manager. The New England cottontail looks much like the eastern cottontail. Important legal information about the email you will be sending.

Ncaa Division 3 Field Hockey Rankings,

Willie The Kid Net Worth,

Distance From Nashville To Noah's Ark Kentucky,

1956 Ford F100 For Sale In Canada,

Gruene Hall Drink Menu,

Articles W