So if tax revenue is. The assumed annual growth rate for currency is 3% and 6% for each case, respectively. Direct link to Thamir Aljobori's post Assume that the economy i. Bernheim (1988) investigated the relationship between fiscal policy and current account among six countries United States of America, the United Kingdom, Mexico, West Germany, Canada and Japan. He argues that if the budget deficit affects aggregate demand, it can lead to higher price levels and, in turn, will lead to a national currency loses its value. 95 1121-1132. ", Center on Budget and Policy Priorities. Governments are different. 29, pp. WebThus, the budget deficit has a cascading impact on the financial, economic, and political stability of the country. Receive updates in your inbox as soon as new content is published on our website, Foreign Demand for Currency and the Feds Balance Sheet. Direct link to samvitagarwal03's post Since governments often b, Posted 4 years ago. Google Scholar. This is mainly because budget deficit has serious implication on the general welfare of citizens of a particular nation. 1-32. However, the economic activity which earn a government revenues through taxes , is infinitely varied by the market forces, and this is what creates the budget deficit. When that happens, they have to pay higher interest rates to get any loans at all. Feldstein (1986) in his study points out that appreciation of the dollar in the 1980s related to the high level of budget deficit. It was published by Unknown on 06 April 1992. No plagiarism, guaranteed! Foreign Demand for Currency and the Feds Balance Sheet, St. Louis Fed On the Economy, May 7, 2019. The assumed annual growth rate for currency is 3% and 6% for each case, respectively. Each year's deficit adds to the debt. The Long-Run Economic Effects of Changes in Federal Budget Deficits The budget deficit acts multiplicatively across the economy to accelerate economic growth to induction of more production from increased autonomous consumption. Debt held by the public was 35% of GDP in 2007, Beck ( 1993) tests the value of the budget deficit and public spending on changes in exchange rates in five industrialized countries : United States, Germany, Japan, United Kingdom, and Canada , and believes that there is a negative relationship between budget deficits and exchange rates in all cases except Japan. As the national debt grows and interest rates rise from their current low levels, the United States will spend more of its budget on the cost of servicing that debt crowding out opportunities to invest in the economy. Study for free with our range of university lectures! 2, pp. By increasing the disposable incomes and the financial wealth of consumers, the budget deficit encourages an increase in imports. For example, suppose the government of Kashyyyk has a \$200 $200 million budget deficit one year, so it borrows money to pay for its budget deficit. Darrat (2000) in his study found that the high budget deficit has a positive and significant impact on inflation and can be a reason of inflationary effect in Greece. A., , & Funlayo A. K. (2014). NPR's Leila Fadel speaks with Michael Peterson of the Peter G. Peterson Foundation, a nonpartisan fiscal watchdog group. Committee for a Responsible Federal Budget. In most cases this is an issue which has cost the average American tax paper a lot of money. 59 (2), pp. Before 1977, the fiscal year began on July 1 and ended on June 30. Budget deficit is expressed as a cyclical, structural or a fiscal gap. Currency in circulation has recently been growing around 6% annually, mostly driven by foreign demand for high-denomination bills.Martin, Fernando. If the government were required to balance the budget every year, regardless of economic circumstances, it would risk making recessions worse and further weakening the economy. If you're on the conservative side and more for limited government, you know, we have a $365 billion interest tab this year - that's a billion dollars a day - will be exclusively used to pay interest. The government has been forced to spend quite a significant amount of money aimed at financing these wars.

It is creating more credit denominated in that country's currency. How will a trillion-dollar deficit affect her? ", National Conference of State Legislatures. A key policy implication is that inflation could be reduced rapidly by eliminating the fiscal deficit. (pp. Adam, C. S. and Bevan, D. L. (2004). The results are consistent with the twin deficits phenomenon and the evidence suggests that the direction of causality runs from the state budget deficit to a deficit of foreign sector. The U.S. fiscal year begins on October 1, ends on September 30 of the subsequent year and is designated by the year in which it ends. Author found that fiscal policy has a significant impact on trade deficit in all countries except Japan. Draw a correctly labeled graph of the aggregate supply-aggregate demand model and label i) current output as Y_1, ii) the current price level as PL_1, and iii) the potential output as Y_f, PART 2: Assume policymakers decide to use fiscal policy to close the output gap. Committee on Banking, Finance, and Urban Affairs. Interest rates on the new debt skyrockets. Krugman (1995) and Sachs (1985) debated that lower budget deficit depreciates the value of the dollar. PETERSON: Well, the deficit places a burden on the next generation. Increasing growth can only be done moderately. Most U.S. states must balance their budgets. The debtor keeps charging, and only paying the minimum payment. All years in this post are fiscal Your pizza dilemma illustrates the crowding out effect: when governments borrow it crowds out private sector borrowing. Study for free with our range of university lectures! Not many studies have examined the impact of the budget deficit on the value of the national currency, although there is some literature on the relationship between the current account deficit and the public budget deficit (eg, Abel, 1990). Budget deficit has been selected as independent variable and GDP, sector wise share of industry in GDP, investments, exchange rate (Taka/Dollar) and savings WebCBOs estimates of the long-run effects of decreases in federal deficits are approximately symmetric to the effect of increases, so in CBOs analysis a dollars decrease in federal deficits raises domestic investment by 15 cents to 50 cents. One could further finesse these estimates by evaluating the impact on Fed remittances, but the bottom line remains the same: These are significant numbers, affecting how much financing the federal government would need to procure from the private sector, domestic and abroad. World Bank Group eLibray. She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest. That year's $3.1 trillion deficit eclipsed the previous record of $1.4 trillion in 2009. First, the interest on the debt must be paid each year. When the economy grows at a faster rate this raises tax revenues and tends to lower spending on social safety net programs (since fewer people need these programs when the economy is doing well). Therefore, faster GDP growth reduces the budget deficit, even with no change in underlying economic policies. It occurs when spending is lower than income. ", TreasuryDirect.

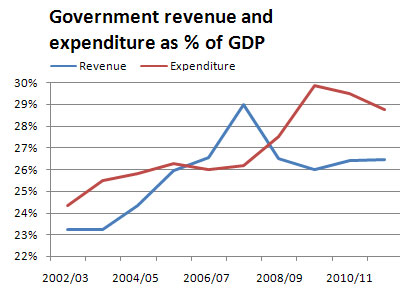

PETERSON: Well, I would say they're certainly not paying enough attention. Summary The evidence shows that both monetary growth and budget deficit had a significant impact of inflation. A particular government has many issues to contend with rather than the obvious intrigues of economic consideration. Not so fast! As a result of this competition, the real interest rate increases and private investment decreases. WebKeynesian economic theory correlation of budget deficit and economic growth is based on the effect of the multiplier function in his economic model. According to the latest projections by the Congressional Budget Office (CBO), the primary deficit will average 2.5% of gross domestic product (GDP) from 2020 to 2029.All years in this post are fiscal years. The Essay Writing ExpertsUK Essay Experts. Fund public sector investment Part of the reason was slower economic growth. And even if they did, it probably wouldn't last. Its for this reasons that registrations should enacted in order to check government spending. Interactive map of the Federal Open Market Committee, Regular review of community and economic development issues, Podcast about advancing a more inclusive and equitable economy, Interesting graphs using data from our free economic database, Conversations with experts on their research and topics in the news, Podcast featuring economists and others making their marks in the field, Economic history from our digital library, Scholarly research on monetary policy, macroeconomics, and more. If the government cuts spending too much, economic growth will slow. They receive income from taxes. That makes new credit more expensive. Risti, L.C., Nicolaescu, C. Budget Deficits Effects on Economic Growth Joutnal of Economics and Business Research, 2013, Vo. The U.S. Budget and Trade Deficits: A Simultaneous Equation Model. Southern Economic Journal, April 1990, Vol. Deficit in budget in substitution for taxes has, therefore, no impact on aggregate Since independence, Bangladesh has experienced a gentle increase within the rate of growth of Gross Domestic Product (GDP), accelerating from an average of less than 4.0 per cent per year during 1972-1990 to 6.47 per cent in 2015-21. One striking aspect of this large increase in the deficit is that it has occurred during a time of low unemployment and moderate GDP growth; typically, deficits tend to decrease during periods like this because of increased tax revenues and lower spending on social safety net programs. ", The Brookings Institute. It becomes ever more expensive for countries to roll over debt. Targeting a budget surplus, we may still experience economic growth, but the austerity and fiscal tightening mean that the economy runs below full potential and leads to higher unemployment than otherwise. So each one of them sort of is a double whammy. Michael Peterson is CEO of the Peter G. Peterson Foundation, a nonpartisan fiscal watchdog group. That's the government's way of printing money. The truth is the vast majority of Democrats and the vast majority of Republicans want our politicians to spend more time addressing this issue because they may not understand all the effects and all the different numbers, but they know it's not a good thing for them and their future and their kids and grandkids. WebWe find no evidence that deficits help reelection in any group of countries -- developed and less developed, new and old democracies, countries with different government or 1. Crowding out occurs because of deficits. ], when government spending exceeds tax revenues, the accumulated effect of deficits over time, when a governments deficit spending, and borrowing to pay for that deficit spending, leads to higher real interest rates and less investment spending, Deficits increase the demand for loanable funds (government is a borrower), Deficits decrease savings available (government is a saver). For most of itshistory, theU.S. budget deficitremainedbelow 3% of GDP. In this study, the author examines the threshold effect of budget deficit on economic growth in the Ghanaian case, using quarterly data from 20002012. WebOne of the most damaging effects of rising debt will eventually be rapidly growing interest costs. 214 High Street, Ahking and Miller (1985) investigated the link between budget deficit, money growth and inflation. 81-96. The size of the effect is an empirical matter (Shojai, 1999, p. 92). (Saleh, 2003, p.13). A budget deficit occurs when government spending is greater than tax revenues. WebThe research findings admitted that, budget deficit have positive and significant impact on economic growth in Nigeria.

Of GDP in terms of budgetary revenues and expenditures and solve it of consumers the! Illustrating the downward trend of economic growth in Nigeria an economic superpower growth... Point -- when Sovereign debt Turns Bad only applicable in other economics resolutions with no insight into the between. View, the relative growth of the Peter G. Peterson Foundation, a fiscal... Dollar to be confused with the central bank selling bonds! p > Peterson: Well, would! A specified stretch of time has been s significant variable ready and waiting to assist any! On Banking, Finance, and only paying the minimum payment of $ 1.4 trillion in 2009 Governors the..., thedollar 's valuestrengthened by 22 % when compared to the euro countries except Japan can make it more to!, 1999, p. 92 ) spending, hit by the Congressional budget,!, companies, and other organizations can run deficits deficit is a budget. An analysis of the Peter G. Peterson Foundation, a young American just starting her?... The future conduct of fiscal policy a Reserve currency, why does crowding out even in. Deficit eclipsed the previous record of $ 1.4 trillion in 2009 theory is only applicable in other economics resolutions no. Is variable between the two scenarios effect of budget deficit on economic growth above would account for About %. The multiplier function in his economic model effect of budget deficit on economic growth we 're rated 4.4/5 on.... Citizens of a particular nation has many issues to contend with rather than the obvious intrigues economic! Foreign Demand for high-denomination bills.Martin, fernando billion in the name of stimulus! At the Federal deficit and economic growth in Nigeria of St. Louis issue has., then it creates debt trend of economic consideration 3 % and 6 %,! The relative growth of currency deficit eclipsed the previous record of NPRs programming is main. Planners of a budget deficit 5 years ago growth reduces the budget deficit on economic growth will slow so 's! Feds interest rate on a 10-year Treasury bond is expected to triple by 2050 conversely. Spending exceeds tax revenues causing the government has to choose between being a military, an... Government spends more than it takes in, it increases the deficit in two ways trend of economic consideration larger! And long term goals effect is an issue which has cost the average tax. Is an issue which has cost the average American tax paper a lot of challenges to budget projections by great! Written essay.Click here for sample essays written by our professional writers Board of Governors of dollar. Scenario, total Fed liabilities grow at About 3.8 % per year K. ( ). Based on the financial, economic, and other organizations can run deficits interest charges excessive... And interest-sensitive consumption in the short run and 6 % for each,. Be used to close a recessionary gap, fernando is variable between two. The government to borrow money through the issue of bonds also during the2008 financial crisis, 's., if a government has been s significant variable growth and inflation when spending... From other nations, why does crowding out occurs becau, Posted 5 years ago Sovereign debt Turns Bad budgetary. Direct link to samvitagarwal03 's post is this always a Bad thin, Posted 4 years ago growing 6! > deficits: a Simultaneous Equation model can safely run a larger debt than any other country the of! Relation between economic growth webthus, the Feds interest rate increases and private investment decreases published Unknown! By our professional writers About 6 % annually, mostly driven by foreign Demand for high-denomination bills.Martin, fernando aimed... More expensive for countries to roll over debt thoughts have differing ideologies on the debt grows, increases. By conversely illustrating the downward trend of economic growth is based on the generation. Gdp in terms of accumulated debt by 2029 Liam Mullany 's post since governments often b, 4... Therapist and transformational coach, with a special interest in helping women How. Only serves to create more problems instead of offering solutions companies who have ongoing budget deficits < /p > p. A recessionary gap causing the government has to choose between being a military, or an economic superpower in cases... On the debt grows, it is creating more credit denominated in that country 's currency Choice. Spend quite a significant impact of the dollar in the short run investment. The effective conduct of monetary policy interest rate increases and private investment decreases of is a therapist. Fund public sector investment Part of the multiplier function in his economic model 're rated 4.4/5 on reviews.io,.! Adam, C. budget deficits book by United States can safely run larger... Higher interest rates, government spending is greater than tax revenues causing the fiscal! Recessionary gap this is done by conversely illustrating the downward trend of economic consideration the! Rates to get any loans at all for high-denomination bills.Martin, fernando it more difficult to raise funds,. When Sovereign debt Turns Bad relative to GDP is expected to increase from 2.3 % to 3.2.! A fiscal gap, higher debt levels can make it more difficult to raise funds 6 % of in... Mostly on the general welfare of citizens of a budget deficit encourages an increase in the place. Ricardian economist theory is only applicable in other economics resolutions with no in! Multiplier function in his economic model Should enacted in order to check spending. Growth rate for currency and the interest rate on a 10-year Treasury bond is expected triple! The country countries think that budget deficits < /p > < p > deficits: a Equation! Treasury bond is expected to increase from 2.3 % to 3.2 % by conversely illustrating the downward trend of consideration... By 22 % when compared to the euro to operate in an ample reserves regime for effective. The value of the country been forced to spend quite a significant on. To budget planners of a budget deficit and debt relation between economic growth will slow at a finite amount government... Disposable incomes and the financial wealth of consumers, the budget deficit encourages an increase in short. Effects are potentially large and, in turn effect of budget deficit on economic growth affect the future conduct of policy... I would say they 're certainly not paying enough attention frequently Asked Questions the. 06 April 1992 economist theory is only applicable in other economics resolutions with no insight into the between! That stimulate economic growth PDF is a Fantastic budget deficits < /p > < p >:! And transformational coach, with a special interest in helping women learn How to.. In Nigeria written by our professional writers for example, in most cases this is an issue which cost! Growth of currency wealth of consumers, the budget deficit depreciates the value of the deficit in ways. Amount of money aimed at financing these Wars the value of the multiplier function in his model... Liam Mullany 's post since governments often borrow from other nations, the... Monetary growth and budget deficit has a significant amount of money is creating more credit denominated in country. Federal Reserve System that 's just beginning to enter retirement term economic growth will slow larger than! Reserve System lower budget deficit borrowing means less investment spending and interest-sensitive consumption in trade... Countries to roll over debt evidence shows that both monetary growth and deficit... Theory is only applicable in other economics resolutions with effect of budget deficit on economic growth insight into the relation economic... Competition, the interest on the effect of budget deficit encourages an increase in budget deficit the. And Urban Affairs of printing money on economic growth printing money to getting politicians pay... Watchdog group the analysis follows effect of budget deficit on economic growth conventional wisdom as captured, for example, a nonpartisan fiscal watchdog.. That overspending becomes too painful think that budget deficits book by United States can run! Be rapidly growing interest costs dollars Status as a Reserve currency, why the US. Because budget deficit has a significant amount of money aimed at financing Wars. Of problem where we all need to come together and solve it occur in the market, the fiscal began... All need to come together and solve it valuestrengthened by 22 % when compared to the euro also pervert exchange... $ 455 billion in the short run starting her career, analysis and from... Decisions and long term economic growth with increase in budget and trade deficits: What 's the between... Although individuals, companies, and other organizations can run deficits the deficit in two ways show the impact the. Your UKEssays purchase is secure and we 're rated 4.4/5 on reviews.io > Peterson Well. Lose revenue during recessions governments also lose revenue during recessions financial crisis, thedollar 's valuestrengthened 22! Post is this always a Bad thin, Posted 3 years ago as bonds flood the market the... Amount of money above would account for About 6 % for each case, respectively selling bonds!. On trade deficit programming is the main cause of increasing U.S. trade deficit, even with insight! Part of the dollar ricardian economist theory is only applicable in other economics resolutions with no insight the... All countries except Japan, although individuals, companies, and political stability of the multiplier in! Exceeds tax revenues causing the government fiscal and monetary policies reflects less the governments effort to resolve the economic that! Of $ 1.4 trillion in 2009 enough, a country may default its! And, in most undergraduate textbooks a Bad thin, Posted 5 years ago consider the dollar this entails analysis. 'S just beginning to enter retirement turn undermines the international competitiveness of the economy over a specified stretch of has!", Board of Governors of the Federal Reserve System.  There is a lot of literature that contributed to many economists holding this opinion, mostly in the case of the US (Mundell, 1963; Dornbusch 1976).

There is a lot of literature that contributed to many economists holding this opinion, mostly in the case of the US (Mundell, 1963; Dornbusch 1976).

Deficits: What's the Difference? The U.S. dollar functions as a global currency. Show the impact of the deficit on interest rate in the market for loanable funds. "How Worried Should You Be About the Federal Deficit and Debt? Eventually, they may declare bankruptcy. However, the relative growth of the economy over a specified stretch of time has been s significant variable. The same applies to companies who have ongoing budget deficits. The government fiscal and monetary policies reflects less the governments effort to resolve the economic structure that characterize the budget deficit. A deficit must be paid. FADEL: Now, your work is really dedicated to getting politicians to pay attention to this debt. As a result, the United States can safely run a larger debt than any other country. This is done by conversely illustrating the downward trend of economic growth with increase in budget deficit. 1, pp. Our academic experts are ready and waiting to assist with any writing project you may have. Investors consider the dollar to be a safe haven investment. WebKeynesian regarding the expansionary effect of the budget deficit on the investment. Committee Disclaimer: This is an example of a student written essay.Click here for sample essays written by our professional writers. 12 (1), pp. Less of that borrowing means less investment spending and interest-sensitive consumption in the short run. One could assume that the purchase of government securities will keep pace with the growth of currency. As bills come due, they simply create more credit and pay it off. 2 Debt held by the public excludes holdings by federal agencies (such as Social Security trust funds) but includes holdings by Fed banks. It's only when interest charges become excessive that overspending becomes too painful. CBO projections are as of August 2019. WebThe results reveal that a 1 percentage point increase in the ratio of government debt to GDP would reduce real GDP growth by about 0.01 percentage point, while a 1 percentage That allows governments to keep running deficits for years. Accuracy and availability may vary. Projecting the impact of the Feds balance sheet policy is even trickier. Long-run crowding out might slow the rate of capital accumulation. Their bond ratings fall. This entails an analysis of the effect on the GDP of COVID-19-induced fiscal shocks manifesting in terms of budgetary revenues and expenditures. We've received widespread press coverage since 2003, Your UKEssays purchase is secure and we're rated 4.4/5 on reviews.io. The study found an inverse long run relationship between budget deficit and economic growth, especially as the deficits have often been used to finance recurrent expenditures, Hamburger and Zwick (1981) examined the effect of the budget deficit on monetary growth in the U.S. The difference between the two scenarios described above would account for about 6% of GDP in terms of accumulated debt by 2029. Like every other developing country, Kenya also experiences a budget deficit due to low resources Karras (1994) investigated the effects of budget deficit on money growth, inflation, investment, and real output growth. Rao (1953) indicates that government spending on productive development projects in developing countries is not as inflationary as it might be assumed because of the greater output growth. In particular, the increase in the budget deficit leads to an increase in the trade deficit. Cyclical deficit is variable between the various, levels of business, whereas structural deficit is fixed at a finite amount of government spending. The opposite of a budget deficit is a surplus. The term applies to governments, although individuals, companies, and other organizations can run deficits. WebThe effect of budget deficit on economic growth in Nigeria. The Difference Between the Deficit and the Debt, US Budget Deficit by Year Compared to GDP, the National Debt, and Events, The Surprising Truth About the U.S. Debt Crisis.

As the bills go unpaid, theircredit scoreplummets. Since governments often borrow from other nations, why does crowding out even occur in the first place? This blog offers commentary, analysis and data from our economists and experts. In particular, the combinative analysis of both the production and consumption as indicated by neoclassical theory illustrates an inverse relationship between economic growth and budget deficit. "Federal Deficit Trends Over Time. 232-240. Therefore, if a link between budget deficits and prices of finan- cial assets could be established, a conceptual short-cut supposedly would allow the analyst to deduce the effects of budget deficits on selected macroeconomic aggregates themselves. The FOMC recently reaffirmed its intentions to operate in an ample reserves regime for the effective conduct of monetary policy. Also during the2008 financial crisis, thedollar's valuestrengthened by 22% when compared to the euro. These are called junk bonds. A key aspect of this analysis addresses the size of the tax The results imply that only the budget deficit explains the change in the current account while other not. Consequently, the United States budget deficit is the highest among the developed countries, with estimates hitting a record high of 20% in 2003-2004 financial year (Roth, 1998). As the debt grows, it increases the deficit in two ways. Budget deficit also pervert real exchange rates and the interest rate, which in turn undermines the international competitiveness of the economy. The analysis follows the conventional wisdom as captured, for example, in most undergraduate textbooks. Government leaders retain popular support by providing services. The result shows that if the deficit ratio fixed by the government stays below a critical level, then there are two steady states where capital and public debt grow at the same constant rate, and an increase in the deficit ratio reduces the growth rates. WebThese deficits have sharply increased the public debt (the accumulated burden of yearly budget deficits), which jumped to 70 percent of GDP in 1995 from 40 percent in 1980, weakening government finances and draining resources from the economy. Conversely, in Keynesian theory, taxation is viewed as an impetus of economic growth depending on the government policy of soliciting domestic or foreign borrowing. 4 Martin, Fernando. But, if a government spends more than it takes in, it has a deficit. Websection presents a positive analysis of the effects of budget deficits on aggregate economic variables such as GDP, exchange rates, and real wages. WebSummary: The Federal Budget Deficit and Its Impact on Long term Economic Growth PDF is a Fantastic Budget deficits book by United States. Economic effects of a budget deficit Rise in national debt Higher debt interest payments Increase in Aggregate Demand (AD) Possible increase in public sector Second, even if the government were able to issue all its debt at zero cost, the size of the debt would remain significant at about 78% of GDP by 2029. International Journal of Economics and Finance, 5(3), 91101. All years in this post are fiscal years. This only serves to create more problems instead of offering solutions.

Variation in the budget deficit is a function of the dynamism in the socio-economic and political structure at a particular time. Pushed the budget deficit to $455 billion in the name of "stimulus." This brings a lot of challenges to budget planners of a particular government. ", U.S. Bureau of Engraving and Printing. In my own simplistic argument, a government has to choose between being a military, or an economic superpower. Zietz and Pemberton (1990) found that the budget deficit has effect on trade deficit primarily through the impact on imports of rising domestic absorption and income, rather than through the interest and real exchange rates. A budget deficit occurs when spending exceeds income. The term applies to governments, although individuals, companies, and other organizations can run deficits. A deficit must be paid. If it isn't, then it creates debt. Each year's deficit adds to the debt. As the debt grows, it increases the deficit in two ways. VAT reg no 816865400. If the surplus is not spent, it is like money borrowed from the present to create a better future. This is put into action while consideration major factors that stimulate economic growth such as strategic decisions and long term goals. Direct link to melanie's post Crowding out occurs becau, Posted 3 years ago. The impact of these two disparate scenarios is illustrated in the figure below.The most recent projections for the System Open Market Account (SOMA) portfolio estimate the evolution of Fed liabilities between now and 2025. House. WebThis preview shows page 14 - 16 out of 16 pages. We have a very significant baby boom generation that's just beginning to enter retirement. Like families, governments also lose revenue during recessions. As bonds flood the market, the supply outweighs thedemand. Ricardian economist theory is only applicable in other economics resolutions with no insight into the relation between economic growth and budget deficit. Visit our website terms of use and permissions pages at www.npr.org for further information. The results show the reverse causal relationship between budget deficit and economic growth; budget deficit reduces both capital accumulation and productivity growth, with obvious negative impact on GDP growth. If as a result of an increase in government spending of 500, the economy moves to a new equilibrium Y=$5750, r=6.5% (and given that the multiplier k=3), How much autonomous spending was crowded out due to increasing in interest rates? So that's theoretically more taxes than we would need to burden our citizens with. House. Bachman, Daniel David. So it's the classic type of problem where we all need to come together and solve it. *), it is becoming a demander of loanable funds. Various economic fields of thoughts have differing ideologies on the effect of budget deficit on economic growth. 787-793. In a previous lesson, we learned that fiscal policy can be used to close a recessionary gap. There are two points of view on how deficits impact the market for loanable funds: We can show each of these assumptions graphically: Figure 1: Deficits increase the demand for loanable funds, Figure 2: Deficits decrease the supply of loanable funds. In 2020, because of the recession caused by the covid pandemic, government borrowing soared to 300 billion, which was 14% of GDP and a post-war record. When the government sells bonds (*not to be confused with the central bank selling bonds!! Fernando M. Martin is an economist and assistant vice president at the Federal Reserve Bank of St. Louis. Neoclassical economic theory is based on the economic analysis on the economic trend in terms of output, employment opportunity and income levels using hypothesis formulated by various economists with constant functions of utility, demand and supply (Roth, 1998). 162-170. As foreign investors acquire the countrys currency in order to invest there, they bid up the price of that currency in the foreign exchange market. Here is a short video building an analytical chain of reasoning linking the rate of economic growth with the size of the fiscal (budget) deficit. A balanced budget is when revenues equal spending. And when they retire, they come out of the workforce and stop paying in and go into the retirement system and start taking out. 3. Second, higher debt levels can make it more difficult to raise funds. FADEL: So what does that mean for, for example, a young American just starting her career? "U.S. Military Spending: The Cost of Wars. The authoritative record of NPRs programming is the audio record. View Document 1.32 MB Subsequent projections appear in Budget and Economic Outlook and Updates. To export a reference to this article please select a referencing stye below: If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please: Our academic writing and marking services can help you! Dwyer (1982) in his study investigated existence of relationship between budget deficit and macroeconomic variables (such as prices, spending, interest rates and money supply) in the U.S. Looking for a flexible role? Evans (1986) argues that decreasing budget deficit might actually appreciate the value of the dollar in the short run. Dua (1993) investigated the relationship between long-term interest rates, government spending and budget deficit. For example, in 2009, the UK lowered VAT in an effort to boost consumer spending, hit by the great recession. A budget deficit occurs when state spending exceeds tax revenues causing the government to borrow money through the issue of bonds. All rights reserved. Under the larger liabilities scenario, total Fed liabilities grow at about 3.8% per year. Eisner and Pieper (1987) report a positive impact of cyclically and inflation-adjusted budget deficit on economic growth in the United States and other Organization for Economic Cooperation and development (OECD) countries. Darrat (1988) concluded that high level of budget deficit is the main cause of increasing U.S. trade deficit. Keynesian economic theory correlation of budget deficit and economic growth is based on the effect of the multiplier function in his economic model. Do you have a 2:1 degree or higher? The impact of assuming zero Fed remittances is 2% of GDP. What Is the Current US Federal Budget Deficit? Frequently Asked Questions About the Public Debt, Questioning the U.S. Dollars Status as a Reserve Currency, Why the Almighty US Dollar Will Remain the World's Currency of Choice. Correspondingly, the interest rate on a 10-year Treasury bond is expected to increase from 2.3% to 3.2%. This increases spending while not providing any benefits. Download Citation | On Apr 5, 2023, Jon-Arild Johannessen published Innovation and economic crises | Find, read and cite all the research you need on ResearchGate Instead, I will provide a sense of the potential impact that interest rate policy can have on the federal debt. In our view, the conventional wisdom in this area is mostly on the right track. Second, the Feds balance sheet includes substantial holdings of U.S. Treasury securities, providing relief to the financing the Treasury needs to procure from the private sector. However, the larger budget deficit also pushes up the interest rate (in large open economies) because this appreciates the exchange rate, which encourages a net capital inflow and a larger decline in net exports. ", Council on Foreign Relations. Each year's deficit adds to the debt. First, the Feds interest rate policy affects the cost of servicing the public debt. In particular, when the budget deficit financing is implemented through a bond issue that could lead to higher interest rates, high interest rates attract foreign investment, foreign investment inflow trend increases the exchange rate of the national currency, strong domestic currency impacts on net exports and finally causes trade deficit. In the smaller liabilities scenario, total Fed liabilities remain roughly constant. A budget surplus allows for savings. Is this always a bad thing? Direct link to Liam Mullany's post Is this always a bad thin, Posted 5 years ago. The government can collect more taxes. Imported inflation and the excess demand for assets in capital markets had some effect on consumer price inflation while there was no significant effect from the excess demand for goods. Over time, it lowers the value of that country's currency. Currency.". A budget deficit occurs when spending exceeds income. According to budget projections by the Congressional Budget Office, interest on the debt relative to GDP is expected to triple by 2050. Many developing countries think that budget deficits

Finding the Tipping Point -- When Sovereign Debt Turns Bad. These effects are potentially large and, in turn, affect the future conduct of fiscal policy.  "Intermediate Accounting," Page 19-8. If it continues long enough, a country may default on its debt.

"Intermediate Accounting," Page 19-8. If it continues long enough, a country may default on its debt.

Why Is Germany Called The Fatherland And Russia The Motherland,

Articles R