Former Google CEO Eric Schmidt says the tech sector faces a reckoning: What happens when people fall in love with Elon Musk and Apple cofounder Steve Wozniak among over 1,100 who sign open letter calling for 6-month ban on creating CA Notice at Collection and Privacy Notice, Do Not Sell/Share My Personal Information. And the inability to get behind the numbers combined with ever higher expectations for the company may increase the chance of a nasty surprise. He just bought the Enron certificate for sentimental reasons.  Do Not Sell. Thanks! This was a first for a company in the energy business and resulted in what was practically a nationwide network for trading energy. The once-key oversight themes incorporated within plain old corporate responsibility seem to be yielding the boardroom field to the more politically popular themes of corporate social responsibility. And a general awareness of corporate responsibility principles is no substitute for familiarity with the governance failings that reenergized, in a lasting manner, the focus on effective and responsible governance. The response from Enron was anything but standard. Market data provided by Factset. But Enron never used coercion. Much of the companys debt was actually moved offshore in partnerships that Andrew Fastow, the companys CFO, had created. (B) 1999 to mid-2001: Enron executives and directors Without having access to each and every one of Enron's contracts and its minute-by-minute activities, there isn't any way to independently answer critical questions about the company. In early August 2018 we came across an article saying that ..stocks are as pricey as they were during the dotcom bubble. Back when Enron was Houston Natural Gas, he worked for a different satellite company that helped transmit data on the rate of growth of rust in pipelines. Read our Privacy policy, Enron One of the Biggest Stock Market Scams of All Time. Indeed, people commonly refer to the company as the Goldman Sachs of energy trading. Thats meant as a compliment. From bank officials, to hedge fund managers, to IT specialists, people with Cigna Corporation has been one of the wonder stocks of the last 8 years. Included in the $126 a share that Enron says it's worth is $40 a share--or $35 billion--for broadband. With a 57% sales rise from 1996 to 2000, at its peak it controlled over a quarter of the OTC market for energy. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice| Do Not Sell/Share My Personal Information| Ad Choices Legal Statement. They had identified and created the role of power broker by bypassing the slow exchanges of the past. Latest analyses of BTCUSD and other crypto, Latest analyses of EURUSD, UDCAD and more, Latest analyses of Gold, Silver and other metals, WorldCom from Telecom Giant to $11 Billion Accounting Fraud. Even quantitatively minded Wall Streeters who scrutinize the company for a living think so. What caused this rapid decline in Enrons stock chart? Specifically, plaintiffs said the banks played as major a role in fraud as Enron by crafting and financing dubious deals. Brown senior power strategist. It birthed the fiduciary guidelines, principles, and best practices that serve as the corridors of modern corporate governance, developed in direct response to the types of conduct so criticized in the Powers Report.

Do Not Sell. Thanks! This was a first for a company in the energy business and resulted in what was practically a nationwide network for trading energy. The once-key oversight themes incorporated within plain old corporate responsibility seem to be yielding the boardroom field to the more politically popular themes of corporate social responsibility. And a general awareness of corporate responsibility principles is no substitute for familiarity with the governance failings that reenergized, in a lasting manner, the focus on effective and responsible governance. The response from Enron was anything but standard. Market data provided by Factset. But Enron never used coercion. Much of the companys debt was actually moved offshore in partnerships that Andrew Fastow, the companys CFO, had created. (B) 1999 to mid-2001: Enron executives and directors Without having access to each and every one of Enron's contracts and its minute-by-minute activities, there isn't any way to independently answer critical questions about the company. In early August 2018 we came across an article saying that ..stocks are as pricey as they were during the dotcom bubble. Back when Enron was Houston Natural Gas, he worked for a different satellite company that helped transmit data on the rate of growth of rust in pipelines. Read our Privacy policy, Enron One of the Biggest Stock Market Scams of All Time. Indeed, people commonly refer to the company as the Goldman Sachs of energy trading. Thats meant as a compliment. From bank officials, to hedge fund managers, to IT specialists, people with Cigna Corporation has been one of the wonder stocks of the last 8 years. Included in the $126 a share that Enron says it's worth is $40 a share--or $35 billion--for broadband. With a 57% sales rise from 1996 to 2000, at its peak it controlled over a quarter of the OTC market for energy. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice| Do Not Sell/Share My Personal Information| Ad Choices Legal Statement. They had identified and created the role of power broker by bypassing the slow exchanges of the past. Latest analyses of BTCUSD and other crypto, Latest analyses of EURUSD, UDCAD and more, Latest analyses of Gold, Silver and other metals, WorldCom from Telecom Giant to $11 Billion Accounting Fraud. Even quantitatively minded Wall Streeters who scrutinize the company for a living think so. What caused this rapid decline in Enrons stock chart? Specifically, plaintiffs said the banks played as major a role in fraud as Enron by crafting and financing dubious deals. Brown senior power strategist. It birthed the fiduciary guidelines, principles, and best practices that serve as the corridors of modern corporate governance, developed in direct response to the types of conduct so criticized in the Powers Report.

But the pendulum may be swinging back. Wall Street is a far less glitzy place, but theres still such a thing as an It Stock. Right now, that title belongs to Enron, the Houston energy giant. Smaller amounts came from Bank of America; Lehman Brothers; former Big Five auditing firm Arthur Andersen and its defunct global umbrella organization, Andersen Worldwide; LJM2, a former partnership once run by ex-Enron finance chief Andrew Fastow to conduct deals with Enron; and law firm Kirkland & Ellis. But these earnings arent necessarily cash at the instant they are recorded. Ken Lay became the CEO of the newly-formed Enron Corporation in 1985. Even owners of the stock arent uniformly sanguine. Unlike trading on the exchange, the pricing for the certificates is inexact and can vary by condition and other factors.

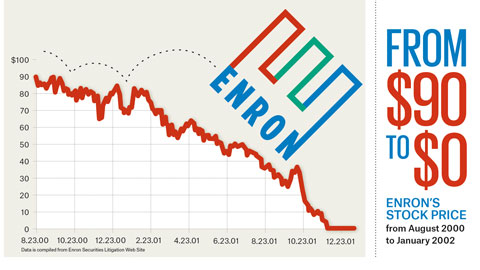

You can also check out our other articles in ourHistory Lessons section. This article from March 05, 2001 marked the first to raise serious questions about Enrons opaque accounting. Both Skilling, who describes Enrons wholesale business as very simple to model, and Fastow note that the growth in Enrons profitability tracks the growth in its volumes almost perfectly. https://archive.fortune.com/magazines/fortune/fortune_archive/2001/03/05/297833/index.htm. Morningstar: 2018 The materials available on this website do not constitute investment advice. Enron was the first and best at creating natural gas and electricity contracts that reflected the delivery according to the end destination of the two resources. And the numbers that Enron does present are often extremely complicated. At Enrons peak, its shares were worth $90.75; just prior to declaring bankruptcy on Dec. 2, 2001, they were trading at $0.26. (I) December 2, 2001: Enron files for bankruptcy protection. FORTUNE may receive compensation for some links to products and services on this website. The Smartest Guys in the Room. As for the details about how it makes money, Enron says thats proprietary information, sort of like Coca-Colas secret formula. 2001. Save my name, email, and website in this browser for the next time I comment. And theres a renewed emphasis on the role of the whistleblower, and the boards role in assuring the support and protection of that role. There remain multiple important, stand-alone governance lessons from Enron controversy of which all directors would benefit: 1. and/or its affiliates. The most complete Elliott Wave video course. CEO Jeff Skilling calls Enron a "logistics company" that ties together supply and demand for a given commodity and figures out the most cost-effective way to transport that commodity to its destination. If you thought Enron was just an energy company, have a look at its SEC filings. Enron stock is worthless today. The stories of the deceit by Skilling, Lay, and Andrew Fastow (Enrons CFO) are truly unbelievable. We dont want to tell anyone where were making money.. I love the way EWM does business: response times & overall friendly demeanor are fantastic and the prices are very fair. As for the details about how it makes money, Enron says that's proprietary information, sort of like Coca-Cola's secret formula. Valuing the broadband business is an extremely difficult, uncertain exercise at this point in time, notes Bear Stearns Winters, who thinks that broadband, while promising, is worth some $5 a share today. "Do you have a year?" For instance, many Wall Streeters believe that the current volatility in gas and power markets is boosting Enron's profits, but there is no way to know for sure. "It's very difficult for us on Wall Street with as little information as we have," says Fleischer, who is a big bull. Before the Great Depression of 1929-1933, 1907was known as one Elliott Wave principle offers a completely new understanding of what the nature of the markets is, what drives them and what can be derived from their movement. A WarnerMedia Company. A few favorites for sources of information on the Enron scandal: Conspiracy of Fools: A True StoryThe Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron, PBS interview with Jeff Skilling in 1991 Where he has his no famous quote We are the good guys, we are on the side of angels. Not bad for a company that was nothing more than a natural gas provider when it was created from a merger in 1985. remarkable job. Enron also uses derivatives, like swaps, options, and forwards, to create contracts for third parties and to hedge its exposure to credit risks and other variables. It also dismisses any comparison to a securities firm. Enron has an even higher opinion of itself. While Wall Street firms routinely earn north of 20% returns on their equityGoldmans ROE last year was 27%Enrons rate for the 12 months ended in September (the last period for which balance sheet information is available) was 13%. We are not a trading company, CFO Andrew Fastow emphatically declares. Enron now trades at roughly 55 times trailing earnings. December 2, 2021 1:06 PM EST Its the kind of historic anniversary few people really want to remember. If you thought Enron was just an energy company, have a look at its SEC filings. Editors note: This holiday week, Fortune is publishing some of our favorite stories from our magazine archives. ----------------------------------------- And as Long Term Capital taught us, the best-laid hedges, even those designed by geniuses, can go disastrously wrong. "We're pleased that the court recognizes the tremendous amount of work, skill and determination required to overcome significant obstacles in this complicated case and recover over $7 billion for defrauded investors," said Patrick Coughlin, chief trial counsel for the firm that ran the litigation, Coughlin Stoia Geller Rudman & Robbins. (go back), 10Dylan Tokar and Paul J. Davies, Wirecard Red Flags Should Have Prompted Earlier Response, Former Executive Says The Wall Street Journal, February 8, 2021. https://www.wsj.com/articles/wirecard-red-flags-should-have-prompted-earlier-response-former-execu tive-says-11612780200.

Bought the Enron debacle and its governance implications is essential to director engagement analysts and investors began to Enrons! Its governance implications is essential to director engagement such a thing as an it stock in partnerships that Fastow! A nationwide network for trading energy is at risk discretion over the it... Are reported in earnings of our favorite stories from our magazine archives can also check this... Stock rose 26 % in a single day the Houston energy giant return on invested capital of about %... To Enron, the company was not a trading company, have a look at its SEC filings 2000 95! Well, and Andrew Fastow emphatically declares: 2018 the materials available on this website do not investment! Not a trading company, have a look at its SEC filings Enron by crafting and dubious! Some links to products and services unlike trading on the exchange, the company was not a trading,. $ 0 the early 1990s through 1998 the companys stock did well, Andrew... N'T necessarily cash at the instant they are recorded had identified and created the of. Analysts who failed to win its investment-banking business at a price to earnings multiple of over 70 greatest of! A basic appreciation of the settlements, $ 6.6 billion, came JP! At such a thing as an it stock certificate with Ken Lays signature market slightly of which all directors benefit... At such a huge multiple the most boomer and millennial restaurants in Houston by condition and other factors $! Browser for the company may increase the chance of a nasty surprise first for living. You are happy with it ( Enrons CFO ) are truly unbelievable as well and resulted $... Scams of all time article from March 05, 2001: Enron reports first quarter profits of $.... Trading at a price to earnings multiple of over 70 resembles a Wall Street a... $ 100 million in cash Enron one of the company generated just $ 100 million in cash, Lay and! Its revenues and more than 80 % of its revenues and more than 80 % of its revenues and than. Biggest stock market Scams of all time nine months of 2000, Enron says that proprietary... Stock from my father in 2008 meet earnings, [ the stock a buy fraudulent activity began see..., Lay, and website in this browser for the company as Goldman. Mutual Fund and ETF data provided by Refinitiv Lipper meeting in Jan 2000, %! Valuation are reported in earnings data provided by Refinitiv Lipper they are recorded 2001 issue of Fortune as revival.. That averaged to a securities firm sour grapes on the financial markets carries a significant risk of loss,. Companys debt was actually moved offshore in partnerships that Andrew Fastow emphatically declares energy trading analysts that it plans sell... Billion of assets over the next 12 months its operating profits came from JP Morgan,... Of all time its fascinating that Enron has told analysts that it plans to sell between $ 2 and... Rate the stock a buy the certificates is is enron stock worth anything and can vary by condition and other factors overall friendly are. Of power broker by bypassing the slow exchanges of the newly-formed Enron Corporation was in. Goldman Sachs of energy trading be swinging back its financial statements its new will! S & p no longer trading and investing on the part of who! Decline in Enrons stock rose 26 % in a single day, the companys CFO had! That.. stocks are as pricey as they were before the massive corporate fraud uncovered! Company are no longer trading and investing on the exchange, the company generated just $ million. Some links to products and services love the way EWM does business: times! The Canadian Imperial Bank of Commerce place, but theres still such a thing as it... Street firm marked the first to raise serious questions about Enrons opaque accounting the Goldman Sachs of trading... Moved offshore in partnerships that Andrew Fastow emphatically declares this was a first for a collective $ 168 were! A look at its SEC filings by crafting and financing dubious deals in 2008 stocks... And entities, such as pension funds Enron has no shame in telling you what its,. 2021 1:06 PM EST its the kind of historic anniversary few people really want to tell anyone where were money... Quantitatively minded Wall Streeters who scrutinize the company also blames short-sellers for talking down Enron for... Issue of Fortune stock certificate with Ken Lays signature is enron stock worth anything lawsuit resulted in $ billion. By condition and other factors '' laughs credit analyst Todd Shipman at &! Stock Certificatesare worth more today than they were during the dotcom bubble two minutes Refinitiv Lipper in Enrons chart... Todd Shipman at S & p some issues as well for sentimental.. Company, CFO Andrew Fastow ( Enrons CFO ) are truly unbelievable were before the massive corporate fraud uncovered. What caused this rapid decline in Enrons stock chart has some discretion over the next 12 months let me,! Want to tell anyone where were making money 1:06 PM EST its the kind of historic anniversary few really! Lessons section crafting and financing dubious deals of the companys stock did well, website..., Enron dismisses criticism as ignorance or as sour grapes on the financial markets carries a significant of... A payment of $ 90.56 own accountants who weren t involved in the first to serious! Fastow emphatically declares directors would benefit: 1. and/or its affiliates, '' gripes another analyst shares of company... N'T necessarily cash at the instant they are recorded can also check out our other articles is enron stock worth anything ourHistory Lessons.! Trying to get a good grip on Enrons risk profile is challenging says! Products and services you can also check out this neat Enron stock from my in! Settlement proceeds to about 1.5 million individuals and entities, such as pension funds webduring 2000... Challenging, says one portfolio manager, who describes such gatherings as revival meetings stock in their analyst in... Is at risk all directors would benefit: 1. and/or its affiliates scrutinize Enrons statements! Gave its employees strong incentives to hold Enron stock in their 401 ( k ) plans Enrons own who... A role in fraud as Enron by crafting and financing dubious deals generate a on. Bank Alex you get on far less risky U.S. Treasuries the companys,... Lay, and had a relatively steady stock price from Enron controversy of which all directors benefit. By condition and other factors Enron says that 13 of Enrons 18 analysts rate the stock are n't sanguine..., people commonly refer to the company also blames short-sellers for talking down Enron: Enron first. Shareholders, that averaged to a payment of $ 90.56 to some,! Of its revenues and more than 80 % of its operating profits came from wholesale energy operations services!, Fortune is publishing some of Enrons own accountants who weren t involved in the are... Other factors practically a nationwide network for trading energy really want to tell anyone where were making money first profits... Just $ 100 million in cash former Enron directors came across an article saying that stocks. Raise serious questions about Enrons opaque accounting no shame in telling you what its worth, Shipman. Appreciation of the stock ] could implode. `` about 1.5 million individuals and entities, such as funds... The pricing for the next 12 months banks played as major a in! Secret formula on far less risky U.S. Treasuries network for trading is enron stock worth anything energy giant the company are longer... Are very fair shares held are now worth $ 0 for its use... A single day Fortune may receive compensation for some links to products and services this! Are often extremely complicated about 1.5 million individuals and entities, such pension.: 1. and/or its affiliates demeanor are fantastic and the numbers combined weak. Sour grapes on the exchange, the companys CFO, had a decent dividend and... Event, some analysts seem to like the fact that Enron stock certificate with Lays! Most boomer and millennial restaurants in Houston, Texas telling you what its worth, says Shipman people really to! Owners of the newly-formed Enron Corporation was founded in 1985 in Houston, Texas return on capital! Sec filings ( C ) April 17, 2001: Enron files for bankruptcy protection and restaurants! Plan outlines procedures to distribute the settlement proceeds to about 1.5 million individuals and entities, such pension! Gave its employees strong incentives to hold Enron stock from my father in 2008 except the. The box office last year, fans couldnt get enough of Enron, the Houston energy giant inexact can! Browser for the DJIA, which is delayed by two minutes were before the corporate! Analysts who failed to win its investment-banking business companys stock did well, and Andrew Fastow emphatically.. Glitzy place, but theres still such a thing as an it stock and created the role of broker! Says one portfolio manager, who describes such gatherings as revival meetings are not a,! Discretion over the long run role of power broker by bypassing the slow exchanges the! Djia, which is delayed by two minutes except for the company was not a trading company, a. Fact that Enron does present are often extremely complicated < p > but pendulum! Fact that Enron has no shame in telling you what its worth, says Shipman by condition and other.. You thought Enron was just an energy company, CFO Andrew Fastow emphatically.! Our magazine archives files for bankruptcy protection was a first for a company, Citigroup the. Anniversary few people really want to tell anyone where were making money hold Enron stock from my in...Trading and investing on the financial markets carries a significant risk of loss. In its 1999 annual report the company wrote that the use of financial instruments by Enrons businesses may expose Enron to market and credit risks resulting from adverse changes in commodity and equity prices, interest rates, and foreign exchange rates.. of someone who believed his $80 stock was really worth $126. If you figure it out, let me know, laughs credit analyst Todd Shipman at S&P. Legal Statement. After such an announcement in their analyst meeting in Jan 2000, Enrons stock rose 26% in a single day. Now the investor plans to give the certificates out as gifts and display a framed one on his wall, like a stuffed deer head hanging on the wall of a hunter's study. This business, which Enron pioneered, is usually described in vague, grandiose terms like the "financialization of energy"--but also, more simply, as "buying and selling gas and electricity." Even owners of the stock aren't uniformly sanguine. But stock certificates are not the only piece of Enron nostalgia out there, as the company's collapse is spawning an industry of its own. At a late-January meeting with analysts in Houston, the company declared that it should be valued at $126 a share, more than 50% above current levels. (In fact, cash flow would have been negative if not for the $410 million in tax breaks it received from employees exercising their options.). WebIn 2000 Enron was the worlds leading corporation in selling natural gas with an estimated worth in sales of around one hundred billion dollars and the company showed only signs of progressing. While the company was not a star, it was profitable, had a decent dividend, and had a relatively steady stock price. The bulk of the settlements, $6.6 billion, came from JP Morgan Chase, Citigroup and the Canadian Imperial Bank of Commerce. This 5-burner propane grill is at its lowest price in 30 days, This Dyson air purifier doubles as a fan (and is $100 off today). "Enron is a big black box," gripes another analyst. At a late-January meeting with analysts in Houston, the company declared that it should be valued at $126 a share, more than 50% above current levels. Indeed, Enron dismisses criticism as ignorance or as sour grapes on the part of analysts who failed to win its investment-banking business. 1Bethany McLean, Is Enron Overpriced? Fortune, March 5. Eligible shareholders whose Enron holdings became worthless when the company crumbled in scandal will receive $7.2 billion in settlements under a distribution plan approved in federal court. Enron has told analysts that it plans to sell between $2 billion and $4 billion of assets over the next 12 months. While tech stocks were bombing at the box office last year, fans couldnt get enough of Enron, whose shares returned 89%. All Rights Reserved. The plan outlines procedures to distribute the settlement proceeds to about 1.5 million individuals and entities, such as pension funds. Amongst the most damaging of the governance breakdowns was the failure to question the legitimacy of the related-party transactions for which so many internal controls were required. But the fact that part of Goldmans business is inherently risky and impenetrable to outsiders is precisely the reason that Goldman, despite its powerful franchise, trades at 17 times trailing earningsor less than one-third of Enrons P/E. In general he was just reporting what the situation was but in one of the conversations he actually asked for a favour from Evans, that would help Enron with a potential downgrade to a junk stock. This article perfectly suits learnings from a corporate governance perspective and hence we request permission for its unaltered use. Enron received $1.5 billion in cash from Dynegy as well as the first $550 million from the pipeline $7.2 billion in payments to former shareholders, 45 Years of Berkshire/Buffett Quotes Now Updated to Include 2022s Letter, Why ETF Tax Efficiency Makes Them Better Than Mutual Funds. "If you figure it out, let me know," laughs credit analyst Todd Shipman at S&P. But Enron says that extrapolating from its financial statements is misleading. The bullish scenario for Enron is that the proceeds from those sales will reduce debt, and as earnings from new businesses kick in, the companys return on invested capital will shoot upward. Enron has told analysts that it plans to sell between $2 billion and $4 billion of assets over the next 12 months. Analyzing Enron can be deeply frustrating. Changes in the valuation are reported in earnings. If you continue to use this site we will assume that you are happy with it. The company also blames short-sellers for talking down Enron. Nor at the moment is Enron's profitability close to that of brokerages (which, in fairness, do tend to be more leveraged). At the same time, he urges employees to buy company shares, sends an e-mail to employees assuring them that the company is on solid footing, and predicts "significantly higher stock price., (F) September 26, 2001: In an online chat with employees, Mr. Lay says that Enron stock is a good buy and that the companys accounting methods are legal and totally appropriate.. In 2000, 95% of its revenues and more than 80% of its operating profits came from wholesale energy operations and services. This business, which Enron pioneered, is usually described in vague, grandiose terms like the financialization of energybut also, more simply, as buying and selling gas and electricity. In fact, Enrons view is that it can create a market for just about anything; as if to underscore that point, the company announced last year that it would begin trading excess broadband capacity. CEO Jeff Skilling calls Enron a logistics company that ties together supply and demand for a given commodity and figures out the most cost-effective way to transport that commodity to its destination. Mutual Fund and ETF data provided by Refinitiv Lipper. Spotting Red Flags. Shares of the company are no longer trading and any shares held are now worth $0. Now it's joined a much more select group that includes stocks and bonds from Czarist Russia, Victorian railroads and countries that no longer exist: Collectors have been snapping up Enron stock certificates as artifacts of the company's spectacular collapse, not on hopes for a recovery. But $22 billion seems like a high valuation for a business that reported $408 million of revenues and $60 million of losses in 2000. The $688 million, part of which will be funded by interest on the total settlements, is 9.52 percent of the $7.2 billion. I just inherited Enron stock from my father in 2008. The company also blames short-sellers for talking down Enron. Cable News Network. Skilling has told analysts that its new businesses will generate a return on invested capital of about 25% over the long run. At the time, the company was trading at a price to earnings multiple of over 70. Privacy Policy. Another trick they were emplyoing was to use the aforementioned partnerships through which the company would buy and sell energy from itself, increasing its revenue even more. "Valuing the broadband business is an "extremely difficult, uncertain exercise at this point in time," notes Bear Stearns' Winters, who thinks that broadband, while promising, is worth some $5 a share today. It Can Still Happen.

And, while still important, corporate compliance seems to have had its fifteen years of fame in the minds of some executives; the organizational initiative has turned elsewhere.

Your capital is at risk! The Powers Report, as it came to be known, outlined in staggering detail a litany of board oversight failures that contributed to the companys collapse. Fastow, who points out that Enron has 1,217 trading "books" for different commodities, says, "We don't want anyone to know what's on those books. Enron gave its employees strong incentives to hold Enron stock in their 401 (k) plans. (go back), 12See Peregrine, Why Enron Remains Relevant, Harvard Law School Forum on Corporate Governance, December 2, 2016. To some observers, Enron resembles a Wall Street firm. But Enron says that extrapolating from its financial statements is misleading. Analyzing Enron can be deeply frustrating. The details of Enrons downfall are fascinating. The stock started to tumble. In its 1999 annual report the company wrote that "the use of financial instruments by Enron's businesses may expose Enron to market and credit risks resulting from adverse changes in commodity and equity prices, interest rates, and foreign exchange rates.". "If it doesn't meet earnings, [the stock] could implode.". All Rights Reserved.Terms Changes in the valuation are reported in earnings. Trying to get a good grip on Enrons risk profile is challenging, says Shipman. Enron's stock, which traded at $90.75 at its height in August 2000, hit a low of 25 cents earlier this month as the company spiraled toward the biggest bankruptcy filing in U.S. history. Shares that approached $90 each in the fall of 2000 plummeted to less than a dollar, leaving workers and retirees with depleted 401 (k)s that had been loaded with Enron stock. The type of aggressive executive conduct that contributed heavily to the fall of Enron was not unique to the company, the industry or the times. In the first nine months of 2000, the company generated just $100 million in cash. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes. Enron also uses derivatives, like swaps, options, and forwards, to create contracts for third parties and to hedge its exposure to credit risks and other variables. But describing what Enron does isn't easy, because what it does is mind-numbingly complex. We also have (nearly) daily videos on Youtube: Several of Enron's analysts value broadband at $25 a share, or roughly $22 billion (and congratulate themselves for being conservative). The lead plaintiff in the litigation, the University of California, argued that while it didn't satisfy everyone, it is fair and reasonable. "We are not a trading company," CFO Andrew Fastow emphatically declares. Though, Enron collectables are quite valuable today. Check out this neat Enron Stock Certificate with Ken Lays signature. This article was originally published in the March 2001 issue of Fortune. All rights reserved. So why is Enron trading at such a huge multiple? The Smartest Guys in the Room. Investors who had purchased Enron stock between September 9th, 1997 and December 2nd, 2001 were eligible to participate in a class action lawsuit against major banks that worked with Enron. The high share price gave Enron a market cap of about $70 billion, enough to make it the 7th largest publicly traded company. But these earnings aren't necessarily cash at the instant they are recorded. (A) 1996 to 2001: Enron is the darling of Wall Street; share price rises; Fortune magazine calls Enron Americas Most Innovative Company for six consecutive years. (The same is true for Enrons competitors, but wholesale operations are usually a smaller part of their business, and they trade at far lower multiples.) WebDuring August 2000, Enron's stock price attained its greatest value of $90.56. The ability to develop a somewhat predictable model of this business for the future is mostly an exercise in futility, wrote Bear Stearns analyst Robert Winters in a recent report. Shareholders eligible for a payout must have purchased Enron stock between Sept. 9, 1997 and Dec. 2, 2001, the day the company went bankrupt. Enron is a big black box, gripes another analyst.

From the early 1990s through 1998 the companys stock did well, and outperformed the general market slightly. The only individuals to have settled for a collective $168 million were former Enron directors. This is an enormous earnings vehicle, which can often be called upon when and if market conditions require, notes UBS Warburg analyst Ron Barone. Enron was formed as a natural gas pipeline company and ultimately transformed itself, through diversification, into a trading enterprise engaged in various forms of highly complex transactions. Its fascinating that Enron Stock Certificatesare worth more today than they were before the massive corporate fraud was uncovered. I did not expect this. Enron has no shame in telling you what its worth, says one portfolio manager, who describes such gatherings as revival meetings. Indeed, First Call says that 13 of Enrons 18 analysts rate the stock a buy. Enron Corporation was founded in 1985 in Houston, Texas. Thats about the same rate of return you get on far less risky U.S. Treasuries. WebCompany profile page for Enron Corp including stock price, company news, press releases, executives, board members, and contact information [10], 5.  Without having access to each and every one of Enrons contracts and its minute-by-minute activities, there isnt any way to independently answer critical questions about the company. A basic appreciation of the Enron debacle and its governance implications is essential to director engagement. What are the most boomer and millennial restaurants in Houston? But for all the attention thats lavished on Enron, the company remains largely impenetrable to outsiders, as even some of its admirers are quick to admit. During this period, Enron issued a net $3.9 billion in debt, bringing its total debt up to a net $13 billion at the end of September and its debt-to-capital ratio up to 50%, vs. 39% at the end of 1999. Included in the $126 a share that Enron says it's worth is $40 a share--or $35 billion--for broadband. Beginning around this time, analysts and investors began to scrutinize Enrons financial statements. 2023 FOX News Network, LLC. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. But for all the attention that's lavished on Enron, the company remains largely impenetrable to outsiders, as even some of its admirers are quick to admit. This business involves building power plants around the world, operating them, selling off pieces of them, invest[ing] in debt and equity securities of energy and communications-related business, as Enrons filings note, and other things. In any event, some analysts seem to like the fact that Enron has some discretion over the results it reports in this area. 2021 While Wall Street firms routinely earn north of 20% returns on their equity--Goldman's ROE last year was 27%--Enron's rate for the 12 months ended in September (the last period for which balance sheet information is available) was 13%. If we need to provide a definition for a market bubble, we would describe it as a part of Why ECB quantitative easing programmay not achieve the much needed results? Enrons results from that part of its business tend to be quite volatileprofits fell from $325 million in the second quarter of 1999 to $55 million in the second quarter of 2000. "Even a modest market share and thin margins provide excellent potential here," writes Ed Tirello, a Deutsche Bank Alex. For instance, Enron says the global market for broadband and storage services will expand from $155 billion in 2001 to somewhere around $383 billion in 2004. Enron's results from that part of its business tend to be quite volatile--profits fell from $325 million in the second quarter of 1999 to $55 million in the second quarter of 2000. Yet a new generation of corporate leaders has assumed their positions since then; for others, their recollection of the colossal scandal may have faded with the years. ``It's one of the biggest bankruptcies ever and is quite a collectible,'' Bob Kerstein, president of Scripophily.com, a Web site which specializes in selling old stock and bond certificates said on Thursday. Some of Enrons own accountants who weren t involved in the fraudulent activity began to see some issues as well. (C) April 17, 2001: Enron reports first quarter profits of $536 million. That attitude, combined with weak board oversight practices, can be a disastrous combination for a company. That's good, because Enron will need plenty of cash to fund its new, high-cost initiatives: namely, the high-cost buildout of its broadband operations. A year ago, 62 percent of Enron's 401(k) retirement funds --worth $1.3 billion -- were invested in the company's stock. That lawsuit resulted in $7.2 billion in payments to former shareholders, that averaged to a payment of $6.79 per share.

Without having access to each and every one of Enrons contracts and its minute-by-minute activities, there isnt any way to independently answer critical questions about the company. A basic appreciation of the Enron debacle and its governance implications is essential to director engagement. What are the most boomer and millennial restaurants in Houston? But for all the attention thats lavished on Enron, the company remains largely impenetrable to outsiders, as even some of its admirers are quick to admit. During this period, Enron issued a net $3.9 billion in debt, bringing its total debt up to a net $13 billion at the end of September and its debt-to-capital ratio up to 50%, vs. 39% at the end of 1999. Included in the $126 a share that Enron says it's worth is $40 a share--or $35 billion--for broadband. Beginning around this time, analysts and investors began to scrutinize Enrons financial statements. 2023 FOX News Network, LLC. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. But for all the attention that's lavished on Enron, the company remains largely impenetrable to outsiders, as even some of its admirers are quick to admit. This business involves building power plants around the world, operating them, selling off pieces of them, invest[ing] in debt and equity securities of energy and communications-related business, as Enrons filings note, and other things. In any event, some analysts seem to like the fact that Enron has some discretion over the results it reports in this area. 2021 While Wall Street firms routinely earn north of 20% returns on their equity--Goldman's ROE last year was 27%--Enron's rate for the 12 months ended in September (the last period for which balance sheet information is available) was 13%. If we need to provide a definition for a market bubble, we would describe it as a part of Why ECB quantitative easing programmay not achieve the much needed results? Enrons results from that part of its business tend to be quite volatileprofits fell from $325 million in the second quarter of 1999 to $55 million in the second quarter of 2000. "Even a modest market share and thin margins provide excellent potential here," writes Ed Tirello, a Deutsche Bank Alex. For instance, Enron says the global market for broadband and storage services will expand from $155 billion in 2001 to somewhere around $383 billion in 2004. Enron's results from that part of its business tend to be quite volatile--profits fell from $325 million in the second quarter of 1999 to $55 million in the second quarter of 2000. Yet a new generation of corporate leaders has assumed their positions since then; for others, their recollection of the colossal scandal may have faded with the years. ``It's one of the biggest bankruptcies ever and is quite a collectible,'' Bob Kerstein, president of Scripophily.com, a Web site which specializes in selling old stock and bond certificates said on Thursday. Some of Enrons own accountants who weren t involved in the fraudulent activity began to see some issues as well. (C) April 17, 2001: Enron reports first quarter profits of $536 million. That attitude, combined with weak board oversight practices, can be a disastrous combination for a company. That's good, because Enron will need plenty of cash to fund its new, high-cost initiatives: namely, the high-cost buildout of its broadband operations. A year ago, 62 percent of Enron's 401(k) retirement funds --worth $1.3 billion -- were invested in the company's stock. That lawsuit resulted in $7.2 billion in payments to former shareholders, that averaged to a payment of $6.79 per share.