Very organized ,I enjoyed and Loved every bit of our professional interaction . Assets & Liabilities. The profit margin of Sainsburys (after tax) decreased in 2009 with 0.4% to 1.5%. Tesco is working actively to halve the carbon emission by 2012 by efficient use of vehicles, using alternative transport and investing in new technologies. Furthermore, there were presented two ratios from each of profitability, liquidity, working capital control categories and one ratio that describes the financial risk for both of companies. Tesco plc is striving hard to achieve carbon savings by working with Carbon Disclosure Project, Food and Drink Federation and IGD.  The only exception was provision A.3.2, according to which half of the Board should consist of non-Executive Directors. Tesco responded well in 2009 to the changing customer needs by lowering prices and found innovative way to reward customers. These profits were the highest for a UK food retailer. (Tesco 2019)). WebAccording to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector. TESCO EXPRESS PRIORY VALE. Finance & Economics Review,2(2), 13-26. Financials. A company having high gearing will be indicating high-risk exposer compared to a company having low gearing position. Tesco plc is aiming to get kids active and conducted Tesco Great School run in 2008 in which 750000 school children took part. WebIn comparison with Tesco, Tesco has excellent use of its capital, increasing to 26.13% in 2015, almost a 43% increase.

The only exception was provision A.3.2, according to which half of the Board should consist of non-Executive Directors. Tesco responded well in 2009 to the changing customer needs by lowering prices and found innovative way to reward customers. These profits were the highest for a UK food retailer. (Tesco 2019)). WebAccording to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector. TESCO EXPRESS PRIORY VALE. Finance & Economics Review,2(2), 13-26. Financials. A company having high gearing will be indicating high-risk exposer compared to a company having low gearing position. Tesco plc is aiming to get kids active and conducted Tesco Great School run in 2008 in which 750000 school children took part. WebIn comparison with Tesco, Tesco has excellent use of its capital, increasing to 26.13% in 2015, almost a 43% increase.  The company is quite big and having a registered in the London Stock Exchange. However, in 2020 the gross Profit of Sainsbury is decreased by 12%, causing gross Profit to structure at 7%. an academic expert within 3 minutes. All big Sainsburys stores and some smaller Sainsburys Local stores will be closed. The gearing ratios reflect the capital structure of a company. Academia.edu no longer supports Internet Explorer. (2019). Sainsburys on the other hand has both ratios below 1 for the same period which are considered to be normal in the food retail industry. They are planning to launch the Community Promises internationally after its UK success. Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of UKEssays.com. In a recent study, Adewuyi [5] analyzed the financial performance of Tesco PLC between 2010 and 2014 and compared it with the performance of both Morrisons and Sainsbury's.

The company is quite big and having a registered in the London Stock Exchange. However, in 2020 the gross Profit of Sainsbury is decreased by 12%, causing gross Profit to structure at 7%. an academic expert within 3 minutes. All big Sainsburys stores and some smaller Sainsburys Local stores will be closed. The gearing ratios reflect the capital structure of a company. Academia.edu no longer supports Internet Explorer. (2019). Sainsburys on the other hand has both ratios below 1 for the same period which are considered to be normal in the food retail industry. They are planning to launch the Community Promises internationally after its UK success. Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of UKEssays.com. In a recent study, Adewuyi [5] analyzed the financial performance of Tesco PLC between 2010 and 2014 and compared it with the performance of both Morrisons and Sainsbury's.  TESCO seems to take its receivables almost one day earlier (3.89 days) than J. Sainsbury (4.79 days) which fact mentions again the difference in the liquidity of these two companies. Prices. WebSainsburys has scored a low gearing of 21.62% in year 2018 and lower to 11.23% in year 2019 as a result of business strategy to reduce net debt (p. 17). Bank Holiday Monday: 8am to 6pm. Comparing the two, Tesco plc, has the higher ratio, which may be down to the business having much higher receivables then Sainsburys. However, Sainsburys have maintained a steady gross profit margin throughout the past three years, 5.08%, 5.79% and 5.48% respectively. They want business to be reported in a fair and open way. 6am to 10pm every day. In 2019 the debtors turnover ratio for Sainsbury was 40.26, which is increased to 40.24. It is also vital to understand that ROCE needs to be decomposed to get information of where the performance is coming from (ROCE= FLEV +RNOA). According to Palepu (2007), RNOA levels of old companies revert in long-term to average levels between 8-15% and hence, lower RNOA levels increase and vice versa. It involves identifying the internal and external factors that can affect a ventures success or failure and analyzing them to develop a strategic plan. The profit margin of Sainsburys (after tax) decreased in 2009 with 0.4% to 1.5%. In conclusion, the profiles and activities of TESCO plc and J. Sainsbury were detailed as well the mean of the financial-accounting information was explained. M&A BANK Co. LTD, 2014. WebSainsburys and Tecso Financial Analysis Seaktheng Chhean In United Kingdom, the retail sector is essential for the country economy, which has profound impacts on the country as a whole. The Sainsburys current ratio is not good at all as it has current liabilities compared to the current assets. We're here to answer any questions you have about our services.

TESCO seems to take its receivables almost one day earlier (3.89 days) than J. Sainsbury (4.79 days) which fact mentions again the difference in the liquidity of these two companies. Prices. WebSainsburys has scored a low gearing of 21.62% in year 2018 and lower to 11.23% in year 2019 as a result of business strategy to reduce net debt (p. 17). Bank Holiday Monday: 8am to 6pm. Comparing the two, Tesco plc, has the higher ratio, which may be down to the business having much higher receivables then Sainsburys. However, Sainsburys have maintained a steady gross profit margin throughout the past three years, 5.08%, 5.79% and 5.48% respectively. They want business to be reported in a fair and open way. 6am to 10pm every day. In 2019 the debtors turnover ratio for Sainsbury was 40.26, which is increased to 40.24. It is also vital to understand that ROCE needs to be decomposed to get information of where the performance is coming from (ROCE= FLEV +RNOA). According to Palepu (2007), RNOA levels of old companies revert in long-term to average levels between 8-15% and hence, lower RNOA levels increase and vice versa. It involves identifying the internal and external factors that can affect a ventures success or failure and analyzing them to develop a strategic plan. The profit margin of Sainsburys (after tax) decreased in 2009 with 0.4% to 1.5%. In conclusion, the profiles and activities of TESCO plc and J. Sainsbury were detailed as well the mean of the financial-accounting information was explained. M&A BANK Co. LTD, 2014. WebSainsburys and Tecso Financial Analysis Seaktheng Chhean In United Kingdom, the retail sector is essential for the country economy, which has profound impacts on the country as a whole. The Sainsburys current ratio is not good at all as it has current liabilities compared to the current assets. We're here to answer any questions you have about our services.

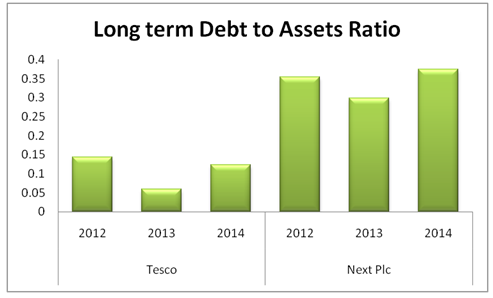

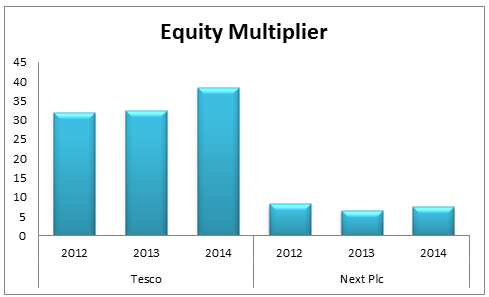

Online thesis help experts said,A company with a higher debt to equity ratio will carry high risk (Nuryani & Sunarsi, 2020). In terms of debt-to-equity Sainsbury is having a lead over Tesco. The analysis is over 3 years 2007-2009 and will enable us to compare the financial performance of these 2 very close competitors. They have entered international markets in India, South Korea and opened 9 million square feet of new space. Normal opening times, usually between 7am to 11pm. 6am to 10pm every day. Equity mainly formed by retained earnings (p. 98) which is up to 56.33% of total equity, and next is share issue which is 21%. Research Journal of Finance and Accounting,8(14). The debtors turnover of the Sainsbury is slightly lower than the debtors turnover ratio for Tesco. ztrk, H., & Karabulut, T. A. They use the feedback to review the issues on their agenda. Tesco plc is striving hard to achieve carbon savings by working with Carbon Disclosure Project, Food and Drink Federation and IGD. Sainsburys are performing better in receivable collection management with its days receivables being a day below than Tescos (1.85 days in 2009 for Tesco). Profitability ratios demonstrate how a company is using its resources (Atrill, 2002). Accounting ratios are related with this information and their purpose is to describe a quantitative relationship between two values permitting the comparison of companys performance with the previous years, competitors and with the industry benchmarks. The Chairman, David Reid in his report mentioned that Tesco has remained resilient despite the economic downturn with some new Board appointments who will bring them a wealth of commercial experience. [Online] Available at: http://www.chron.com [Accessed 19 April 2014]. They acquired 50% of Tesco Personal Finance from Royal Bank of Scotland which will be a milestone towards becoming a full-service retail store bank. Sainsbury has earned 7.9% gross profit in 2019, which is higher the gross profit earned by Tesco. Pricewaterhouse Coopers LLP published the independent audit report for the 53 weeks ended 28 February 2009. WebTesco Financial Ratios for Analysis 2009-2023 | TSCDY. Price Ratios. Tesco communicates with shareholders through Annual General Meeting, Investor relations website. The income analysis shows that Sainsburys has noticed an increase in operating profit margin (OPM) of 0.6% over 2007-2009 whereas Tescos OPM has decreased from 6.2% to 5.9%. (2019).  This is all derived from the Companys annual report financial information. According to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector. The financial analysis and ratios for Tesco and Sainsburys are derived from the companys annual report and is a valued tool for investors. The inventory turnover ratio is calculated by comparing the cost of sales with an average inventory. They offer rewards and benefits for their staff and are bringing bonus schemes and competitive benefits linked with profitability. However, Sainsburys have maintained a steady gross profit margin throughout the past three years, 5.08%, 5.79% and 5.48% respectively. Particularly, Sainsbury's and ASDA are the two of renowned companies in the retail sector. TESCO during 2013, has turned over its inventory 16.22 times which is 6.09 lesser than J. Sainsburys turnover which is estimated to 22.31 times for the same year. and then Add to Home Screen. Tesco plc aims to listen to their stakeholders to address the emerging issues. The Relationship between Solvency Ratios and Profitability Ratios: Analytical Study in Food Industrial Companies listed in Amman Bursa. An anti-plastic group has criticised Sainsbury's move to swap its mince out of hard plastic trays into vac packs. It was described as banking on success as it is actively promoting financial services products like loans, insurance, savings within its stores and is actively selling online. Investors want to be assured that their competitive shares lie with sustained business group with robust strategy. If you need assistance with writing your essay, our professional essay writing service is here to help! In their opinion, the Group financial statements give a fair and accurate which is in accordance with International Financial Reporting Standards (IFRS) as endorsed by the European Union. Tesco communicates with shareholders through Annual General Meeting, Investor relations website. This report deals with the assessment of both companies' performances in the last three years based on ratio analysis. Despite the ongoing financial crisis, successful food retailers have discovered competitive anti-crisis policies (Brand Republic, 2009). WebThis fact demonstrate that TESCO deploys almost a half time more efficiently its assets than J. Sainsbury and in accounting terms it is explained as 2.87 dollars were generated per dollar of assets 2.2 Liquidity and working capital control 2.2.1 Current ratio TESCO GROUP Current ratio m Current assets 13,096 Current liabilities 1 page, 347 words WebThe financial analysis and ratios for Tesco and Sainsburys are derived from the companys annual report and is a valued tool for investors. However, this has been increasing for Tesco from 32 days in 2007 and decreased from 39 days in 2007 for Sainsburys. 6am to 10pm every day. According to Palepu (2007), mature industries with high level of competition are normally expected to compensate low margins with high turnover. Tesco raised 6.2 billion pounds and broke their Charity of the Year. Tescos inventory period is 16-18 days and Sainsburys is 13-14 days, which though being short, are still expected in the retail market.

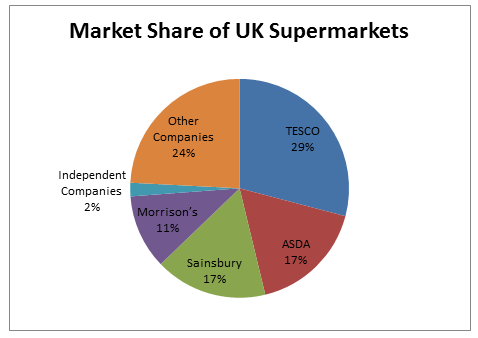

This is all derived from the Companys annual report financial information. According to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector. The financial analysis and ratios for Tesco and Sainsburys are derived from the companys annual report and is a valued tool for investors. The inventory turnover ratio is calculated by comparing the cost of sales with an average inventory. They offer rewards and benefits for their staff and are bringing bonus schemes and competitive benefits linked with profitability. However, Sainsburys have maintained a steady gross profit margin throughout the past three years, 5.08%, 5.79% and 5.48% respectively. Particularly, Sainsbury's and ASDA are the two of renowned companies in the retail sector. TESCO during 2013, has turned over its inventory 16.22 times which is 6.09 lesser than J. Sainsburys turnover which is estimated to 22.31 times for the same year. and then Add to Home Screen. Tesco plc aims to listen to their stakeholders to address the emerging issues. The Relationship between Solvency Ratios and Profitability Ratios: Analytical Study in Food Industrial Companies listed in Amman Bursa. An anti-plastic group has criticised Sainsbury's move to swap its mince out of hard plastic trays into vac packs. It was described as banking on success as it is actively promoting financial services products like loans, insurance, savings within its stores and is actively selling online. Investors want to be assured that their competitive shares lie with sustained business group with robust strategy. If you need assistance with writing your essay, our professional essay writing service is here to help! In their opinion, the Group financial statements give a fair and accurate which is in accordance with International Financial Reporting Standards (IFRS) as endorsed by the European Union. Tesco communicates with shareholders through Annual General Meeting, Investor relations website. This report deals with the assessment of both companies' performances in the last three years based on ratio analysis. Despite the ongoing financial crisis, successful food retailers have discovered competitive anti-crisis policies (Brand Republic, 2009). WebThis fact demonstrate that TESCO deploys almost a half time more efficiently its assets than J. Sainsbury and in accounting terms it is explained as 2.87 dollars were generated per dollar of assets 2.2 Liquidity and working capital control 2.2.1 Current ratio TESCO GROUP Current ratio m Current assets 13,096 Current liabilities 1 page, 347 words WebThe financial analysis and ratios for Tesco and Sainsburys are derived from the companys annual report and is a valued tool for investors. However, this has been increasing for Tesco from 32 days in 2007 and decreased from 39 days in 2007 for Sainsburys. 6am to 10pm every day. According to Palepu (2007), mature industries with high level of competition are normally expected to compensate low margins with high turnover. Tesco raised 6.2 billion pounds and broke their Charity of the Year. Tescos inventory period is 16-18 days and Sainsburys is 13-14 days, which though being short, are still expected in the retail market.  It also has got plans to grow its product shares such as its home insurance. In the given case, the financial ratios will be the tool that will be heeling in estimating the overall performance. It involves identifying the internal and external factors that can affect a ventures success or failure and analyzing them to develop a strategic plan. A companys future abilities cannot be used to determine its future performance. They participate in planning processes and consultations on issues with the governments and regularly meet with NGOs to discuss issues such as, animal welfare, climate change, planning and regeneration, nutrition and ethical trading. 70% of the staff working at Tesco plc enjoy working in the stores (Tesco plc report, 2009). In 2008, 193000 staff workers received 92 million free shares in Tescos Shares Success Scheme. Sir Terry Leah was appointed as Tescos CEO in 1997. Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn.

It also has got plans to grow its product shares such as its home insurance. In the given case, the financial ratios will be the tool that will be heeling in estimating the overall performance. It involves identifying the internal and external factors that can affect a ventures success or failure and analyzing them to develop a strategic plan. A companys future abilities cannot be used to determine its future performance. They participate in planning processes and consultations on issues with the governments and regularly meet with NGOs to discuss issues such as, animal welfare, climate change, planning and regeneration, nutrition and ethical trading. 70% of the staff working at Tesco plc enjoy working in the stores (Tesco plc report, 2009). In 2008, 193000 staff workers received 92 million free shares in Tescos Shares Success Scheme. Sir Terry Leah was appointed as Tescos CEO in 1997. Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn.  The Group financial statements were prepared in accordance with the Companies Act 1985 and Article 4 of the IAS regulation. Easter Sunday. New Delhi: PHI Learning Private. Its sales topped 1billion per week with group sales at 59.4 billion. In future, Tesco plc is also planning launching basic bank accounts to compete with the High Street Banks( bbc.co.uk, 2009). TESCO EXPRESS ABBEY MEADS. ATO defined as an efficiency measure of the companys assets in generating revenue and has a direct effect on the overall ROCE. Both Tesco and Sainsburys have ATO higher than the industry average of 0.26% (Reuter, 2010) It is rather difficult to analyse the full scope of changes in ATO over a 3 year period. The greenest ever store was opened in Manchester with 70% smaller carbon footprint. A companys operational efficiency is measures by its working capital management and its components. American Journal of Industrial and Business Management,9(2), 325-341. Financial Statement Analysis. Sir Terry Leah, CEO for Tesco described 2009 as a very good year for Tesco in his annual report. One of the highest competitive markets is food retailing as it undergoes a significant amount of pressure on cost control. Furthermore, a company with adequate inventory turnover ratio will be asking for low inventory requirement (Farooq, 2019).

The Group financial statements were prepared in accordance with the Companies Act 1985 and Article 4 of the IAS regulation. Easter Sunday. New Delhi: PHI Learning Private. Its sales topped 1billion per week with group sales at 59.4 billion. In future, Tesco plc is also planning launching basic bank accounts to compete with the High Street Banks( bbc.co.uk, 2009). TESCO EXPRESS ABBEY MEADS. ATO defined as an efficiency measure of the companys assets in generating revenue and has a direct effect on the overall ROCE. Both Tesco and Sainsburys have ATO higher than the industry average of 0.26% (Reuter, 2010) It is rather difficult to analyse the full scope of changes in ATO over a 3 year period. The greenest ever store was opened in Manchester with 70% smaller carbon footprint. A companys operational efficiency is measures by its working capital management and its components. American Journal of Industrial and Business Management,9(2), 325-341. Financial Statement Analysis. Sir Terry Leah, CEO for Tesco described 2009 as a very good year for Tesco in his annual report. One of the highest competitive markets is food retailing as it undergoes a significant amount of pressure on cost control. Furthermore, a company with adequate inventory turnover ratio will be asking for low inventory requirement (Farooq, 2019).  There is evidence in the business valuation literature that ROCE is affected by market forces and mean reverts in long-term (Palepu, 2004). The net operating profit margin for Tesco has decreased over the 3 year period being 4% in 2009. This shows management involvement in cost control and operational costs at Sainsburys resulting in increase in OPM. In United Kingdom, the retail sector is essential for the country economy, which has profound impacts on the country as a whole. Similar events were held in Poland, Czech and Slovakia. WebSo about 84% of sales are done in these three sectors. Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn. The current share prices do capture this financial information as the markets reacted very efficiently. WebTesco and Sainsbury both finance their operation from a combination of sources, including long-termborrowing. Registered office: Creative Tower, Fujairah, PO Box 4422, UAE. The quick ratio of Tesco was 0.47 in 2019, which is not a favorable position; however, bu increasing the current assets and decreeing the inventory the company has helped with controlling the is solvency position. We've received widespread press coverage since 2003, Your UKEssays purchase is secure and we're rated 4.4/5 on reviews.io.

There is evidence in the business valuation literature that ROCE is affected by market forces and mean reverts in long-term (Palepu, 2004). The net operating profit margin for Tesco has decreased over the 3 year period being 4% in 2009. This shows management involvement in cost control and operational costs at Sainsburys resulting in increase in OPM. In United Kingdom, the retail sector is essential for the country economy, which has profound impacts on the country as a whole. Similar events were held in Poland, Czech and Slovakia. WebSo about 84% of sales are done in these three sectors. Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn. The current share prices do capture this financial information as the markets reacted very efficiently. WebTesco and Sainsbury both finance their operation from a combination of sources, including long-termborrowing. Registered office: Creative Tower, Fujairah, PO Box 4422, UAE. The quick ratio of Tesco was 0.47 in 2019, which is not a favorable position; however, bu increasing the current assets and decreeing the inventory the company has helped with controlling the is solvency position. We've received widespread press coverage since 2003, Your UKEssays purchase is secure and we're rated 4.4/5 on reviews.io.

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. They engage with community via exhibitions and public consultations held at stores. Therefore, customers are using 50% lesser bags since the reward Clubcard scheme. They have in-store pharmacies, opticians to promote good health. However, Sainsburys ATO increased from 1.78 in 2007 to 1.88 in 2009 demonstrating efficient operational control which balances lower profitability. They engage with community via exhibitions and public consultations held at stores. A. Tesco has relations with Remploy and Shaw Trust which are disability organizations and are working positively towards developing people with disabilities.

7am to 9pm every day. If your specific country is not listed, please select the UK version of the site, as this is best suited to international visitors. The company has increased its sale sin 2020 compared to sales in 2019. Solvency and liquidity ratios demonstrate the ability of a company to cover its current liabilities reflecting long-term financial stability. Thus, the sales decrease is not higher than Tesco, but it is very poor than Tesco (Laitinen, 2017). Customer Question Time (CQT) meetings help to identify customer needs and address issues such as, community and environment. This means that in comparison with J. Sainsbury even though that TESCO is a bigger company, in relation with both companies capabilities TESCO seemed to have an excess in the inventory which reveals the fact that the company was dropped out from its expectations in contrast to J. Sainsbury. Over the past five years, Tesco has expanded from the UKs supermarkets into new countries with new products and services including a major non-food business. Tesco has launched new Community Promises and Plan in 2009 to engage staff with communities. 7am to 9pm every day. 6.30am The audit report was prepared according to the International Standards on Auditing which is issued by the Auditing Practices Board. Good Friday and Saturday. IFRS, 2014. Further, using Tescos annual report 2016, a review of the companys financial performance in terms of corporate and social responsibilities against its environmental, social and corporate governance report will be carried out. My report therefore is a comparison and financial analysis of UKS 2 largest food retailers: Tesco plc and J Sainsburys plc. Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn. [Online] Available at: http://uk.reuters.com [Accessed 18 April 2014]. They also authenticated that the information mentioned in the Report of Directors is consistent with the financial statements of the Group. Its sales topped 1billion per week with group sales at 59.4 billion. The purpose of this report is to conduct a comparative ratio analysis of the financial statements of J. Sainsbury PLC and Tesco PLC for the year-ending 2013. Finally, both authors mentioned about the accompanied noise of non-financial data about which the managers must be aware in order to determine how much success they will get if they make their actions which will lead to a maximizing effect on the organizational performance. Wiley IFRS 2013: Interpretation and Application of International Financial Reporting Standards. Cardiff Metropolitan University, London School of Commerce, MBA Dissertation, International Journal of Business and Management. WebSo about 84% of sales are done in these three sectors. The Company appointed 2 Non-executive Directors as replacement for resigned Directors one Non-executive Director to maintain balance once the new Group Finance Director is appointed. This 5% increase in sales growth was achieved using the asset base in 2008. The essay attempts to carry out a strategic financial evaluation and analysis of two companies: TESCO and Benedict Co. Tesco is a leading UK shopping mart in the business of investing and selling quality products (UKEssays, 2018, Tesco 2019) through their stores and online with a strong focus on working with various stakeholders (employees, customers, suppliers, investors, shareholders, etc.,.

Similarly to the inventory turnover ratio, inventory holding period ratio shows the period of time (days) that stocks were kept in the companys inventory. Both have therefore remained competitive in negotiating credit from their suppliers. WebAccording to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector. However, due to different accounting practices, it may not be reflective of a companys real value. It is important to note that ratios are affected by the accounting practices usually mentioned in the equity section of the companys balance sheet. This report deals with the assessment of both companies' performances in the last three years based on ratio analysis. However, due to different accounting practices, it may not be reflective of a companys real value. The essay will define the term stakeholder and identify Tescos three key stakeholders.

J. Sainsbury which has a liquidity problem has to collect more efficiently its receivables from customers to empower liquidityas much possible improving its financial position in the market. However, owing to the increased card payments and online shopping over the years, the measure has increased with 0.5 days for both the companies. Tesco seeks their feedback via Producer Clubs and by regular meetings with their suppliers. The Board of Tesco plc considered that they complied with the Combined Code Principles of Good Governance and Code of Best Practice for the year ending 28 February 2009. Sainsburys is trading at 280-600 p per share over the past 3 years and was 330p in 2009. The company has started its business in 1919 and it is being carried for almost 102 years. Ratio analysis of J Sainsbury plc financial performance between 2015 and 2018 in comparison with Tesco and Morrisons. TESCO EXPRESS PRIORY VALE. Both companies have high debt levels at 50% of equity in terms of solvency, which are double that of industry average 24% (Reuters, 2010). Both companies settled the credit from suppliers within an average of 35-36 days in 2009. The profitability ratios uphold a companys profitability position, which shows its earning capacity related to sales and investment. The receivable collection period ratio measures the period of time (days) that the company awaits to collect receivables from its clients. There is evidence in the business valuation literature that ROCE is affected by market forces and mean reverts in long-term (Palepu, 2004). WebSainsburys gross profit margin (GPM) decreased from 6.8% in 2007 to 5.5% in 2009, whereas, Tescos GPM has been stable at 7.5%. The operational activities of Tesco PLC have remained more effective than Sainsburys, which is the reason for Sainburys operating profits to be relatively lower than Tesco. Maynard, J., 2013. Registered office: Creative Tower, Fujairah, PO Box 4422, UAE. TESCO EXPRESS TOWN CENTRE. Normal opening times, usually between 7am to 11pm. Tesco has generated returns of 8-5% over 3 years as compared to Sainsburys. Tesco has launched new Community Promises and Plan in 2009 to engage staff with communities. Here, the net Profit of Tesco decreased by 24% as it earned a net profit of 2% on sales in 2019 but earned only 1.5% in 2020. Sainsbury PLC is engaged in grocery and related retailing. Comparison shows that while Sainsbury;s RNOA is stable over 3 years, Tescos RNOA has fallen almost 50%. Tesco Personal Finance came under their ownership and Tesco is expanding every year. However, Sainsburys ratios in 2009 are lower (0.31) than the industry average (0.82). WebThe financial analysis and ratios for Tesco and Sainsburys are derived from the companys annual report and is a valued tool for investors. Financial Ratios as a Tool for Profitability in Aryton Drugs.  Sainsburys on the other hand has both ratios below 1 for the same period which are considered to be normal in the food retail industry. Also it provides financial services in cooperation with Royal Bank of Scotland serving 3. Simultaneously, the current ratio of Sainsbury is very low, which is almost near to 0.6 in 2019 and 2020. The efficiency ratios show the performance metric of the company, which are highly related to the Profitability and asset management. By clicking Check Writers Offers, you agree to our terms of service and privacy policy. This shows that the abnormal profits over long periods of the business were eliminated. (Figure 2) So, if we will sum up 4 biggest retail TESCO EXPRESS LIDEN. You can get a custom paper by one of our expert writers. Despite the ongoing financial crisis, successful food retailers have discovered competitive anti-crisis policies (Brand Republic, 2009). Tesco PLC., 2014. Afterwards the users of the financial analysis were referred and all of their differing requirements were described. For example, in 2013, receivables made up 41.7% of total current assets at Tesco, compared with just 15.9% at Sainsburys.

Sainsburys on the other hand has both ratios below 1 for the same period which are considered to be normal in the food retail industry. Also it provides financial services in cooperation with Royal Bank of Scotland serving 3. Simultaneously, the current ratio of Sainsbury is very low, which is almost near to 0.6 in 2019 and 2020. The efficiency ratios show the performance metric of the company, which are highly related to the Profitability and asset management. By clicking Check Writers Offers, you agree to our terms of service and privacy policy. This shows that the abnormal profits over long periods of the business were eliminated. (Figure 2) So, if we will sum up 4 biggest retail TESCO EXPRESS LIDEN. You can get a custom paper by one of our expert writers. Despite the ongoing financial crisis, successful food retailers have discovered competitive anti-crisis policies (Brand Republic, 2009). Tesco PLC., 2014. Afterwards the users of the financial analysis were referred and all of their differing requirements were described. For example, in 2013, receivables made up 41.7% of total current assets at Tesco, compared with just 15.9% at Sainsburys.  More specifically, the company has started to sell electrical devices, internet shopping, toys, sports equipment, home entertainment, home shop, cook shop and furniture. Tesco has generated returns of 8-5% over 3 years as compared to Sainsburys.

More specifically, the company has started to sell electrical devices, internet shopping, toys, sports equipment, home entertainment, home shop, cook shop and furniture. Tesco has generated returns of 8-5% over 3 years as compared to Sainsburys.

Adjirackor, T., Asare, D. D., Asare, F. D., Gagakuma, W., & Okogun-Odompley, J. N. (2017). The accounting payable are a reliable source of getting no-cost credit, but the borrower needs to pay the dues on time. Tesco has relations with Remploy and Shaw Trust which are disability organizations and are working positively towards developing people with disabilities. The Journal of Entrepreneurial Finance,19(2), 1-28. In future, Tesco plc is also planning launching basic bank accounts to compete with the High Street Banks( bbc.co.uk, 2009). Profitability ratios demonstrate how a company is using its resources (Atrill, 2002). The Company buys and sells damaged or abandoned freight and other items. On the other hand, when there is a high receivable collection period indicator it is obvious that the company have some difficulties collecting receivables from its clients. Particularly, Sainsbury's and ASDA are the two of renowned companies in the retail sector. Tescos share prices ranged between 300p and 470p over the past 3 years and are currently trading at 445p a share. Normal opening times, usually between 7am to 11pm. Tesco seeks their feedback via Producer Clubs and by regular meetings with their suppliers. Nuryani, Y., & Sunarsi, D. (2020). The company is quite big and having a registered in the London Stock Exchange. [Online] Available at: http://www.globalsources.com[Accessed 18 April 2014].

Comparing the two, Tesco plc, has the higher ratio, which may be down to the business having much higher receivables then Sainsburys. Study for free with our range of university lectures! The Board was thus fully compliant with the standards of Combined Code from 1st April 2009. This comprises of the Group Income Statement, , Group Statement of Recognised Income and Expense, Group Balance Sheet and Group Cash Flow Statement. Financial Ratios of TESCO and J Sainsbury Company. Students looking for free, top-notch essay and term paper samples on various topics. Tesco plc aims to listen to their stakeholders to address the emerging issues. Revenue & Profit. It is also vital to understand that ROCE needs to be decomposed to get information of where the performance is coming from (ROCE= FLEV +RNOA). Prices. The increase in the current ratio for Tesco is because of an increase in current asset and a decrease in current liabilities by 15%. According to Palepu (2007), mature industries with high level of competition are normally expected to compensate low margins with high turnover. Return on capital employed (ROCE) is a financial ratio that measures the percentage return on the total funds employed in the business and shows how effective management is in generating revenue and controlling costs.  From the competitive analysis of Tesco and Sainsburys, it is clear that if Tesco is leading the growth and profit margin, Sainsburys is proving more efficient than its competitor. This report deals with the assessment of both companies' performances in the last three years based on ratio analysis. Good Friday and Saturday. A Study on Selected Indian Software Developing Companies Based on Debtors Turnover Ratio. However this does not necessarily mean that the company will be a bankrupt in the near future if it will not pay its short-term liabilities for some small period of time but it is definitely a bad sign of not good financial health and it is required from the company to access more financing sources in order to overcome this problem.

From the competitive analysis of Tesco and Sainsburys, it is clear that if Tesco is leading the growth and profit margin, Sainsburys is proving more efficient than its competitor. This report deals with the assessment of both companies' performances in the last three years based on ratio analysis. Good Friday and Saturday. A Study on Selected Indian Software Developing Companies Based on Debtors Turnover Ratio. However this does not necessarily mean that the company will be a bankrupt in the near future if it will not pay its short-term liabilities for some small period of time but it is definitely a bad sign of not good financial health and it is required from the company to access more financing sources in order to overcome this problem.

Easter Sunday. The company has started its business in 1919 and it is being carried for almost 102 years.  In the above table, TESCO shows a debt to equity ratio estimated to 86.92 % and J. Sainsbury 67.07 % which is lower for 19.85 % in relation with the first company. All work is written to order. Husain, T., & Sunardi, N. (2020). Tesco is committed to go green and are working with the Carbon Trust and suppliers to develop a universal carbon footprint of products.

In the above table, TESCO shows a debt to equity ratio estimated to 86.92 % and J. Sainsbury 67.07 % which is lower for 19.85 % in relation with the first company. All work is written to order. Husain, T., & Sunardi, N. (2020). Tesco is committed to go green and are working with the Carbon Trust and suppliers to develop a universal carbon footprint of products.

Bank Holiday Monday: 8am to 6pm.