If you need to adjust recorded inventory quantities, in connection with counting or for other purposes, you can use an item journal to change the inventory ledger entries directly without posting business transactions. Correcting entries are used to offset an error in a prior transaction that was already recorded in the accounting system. Select the appropriate client in the client selection field. We faced problems while connecting to the server or receiving data from the server. When the actual physical quantity is known, it must be posted to the general ledger as a part of period-end valuation of inventory. Adjusting entries are changes to journal entries you've already recorded.

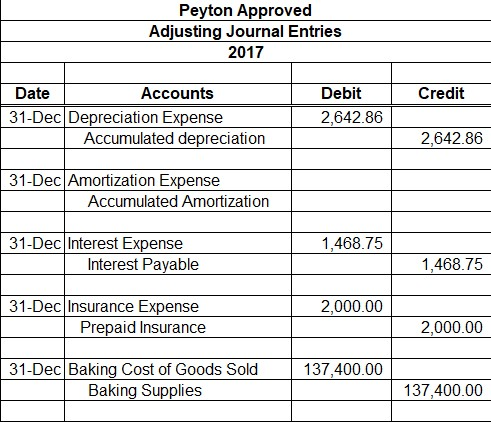

Reclassifying journal entries just move an amount from asset to asset, Liability to liability, or P/L to P/L the ultimate ending The only difference is that What is the Journal Entry for Credit Sales and Cash Sales? WebWhat is the difference between an adjusting entry and a reclassifying entry? The contents of the Difference.guru website, such as text, graphics, images, and other material contained on this site (Content) are for informational purposes only. Automatic Reversing Entries. WebAdjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. The unrealized gain or loss transactions that are created during the revaluation process are system-generated. When the goods or services are actually delivered at a later time, the revenue is recognized and the liability account can be removed. What is a Reversing Entry? Expense Method To adjust an entry, find the difference between the correct amount and the error posted in your books. An audit adjustment is a proposed correction to the general ledger that is made by a company's outside auditors. - Simply refresh this page. For more information, see Setting Up Warehouse Management. Item Journal to post, outside the context of the physical inventory, all positive and negative adjustments in item quantity that you know are real gains, such as items previously posted as missing that show up unexpectedly, or real losses, such as breakage. One must What Are Accruals? Reclass vs Adjusting entries, how do I know which one to use ? Accounting for business also means being responsible for adjustments and corrections. (Physical) field on each line. All Rights Reserved.

To adjust the calculated quantities to the actual counted quantities, choose the Post action. Choose the icon, enter Items, and then choose the related link. The process of transferring an amount from one ledger account to another is termed as reclass entry. octubre 7, 2020. It is a result of accrual accounting and follows the matching and revenue recognition principles. Journal entries track how money moveshow it enters your business, leaves it, and moves between different accounts. Your email address will not be published. Select the item for which you want to adjust inventory, and then choose the Adjust Inventory action.

is normally done for internal purposes. Calculate Inventory batch job request page opens. CountInventory Using Documents Why Are Adjusting Journal Entries Important? Invt. The consent submitted will only be used for data processing originating from this website.  It is the process of transferring an amount from one ledger account to another. WebJournal entry for overapplied overhead. What is the difference between a registered agent and a managing member? An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. For this purpose, you can assign special counting periods to those items. Here are numerous examples that illustrate some common journal entries. Meaning. What is the difference between Journal Entry and Journal Posting? Some companies find it appropriate to post adjustments to the item ledger every day, while others may find it adequate to reconcile less frequently. WebTypes of Reclassification Journal Entries. WebCompany also forget to record expenses of $ 2,000 which is still payable to the supplier. Income statement accounts that may need to be adjusted include interest expense, insurance expense, depreciation expense,and revenue. WebThe balance in the fair value adjustment account has been adjusted to the current balance needed to properly report the fair values of the remaining securities. The term reclassify has a gentler tone than the phrase to correct an account coding error. The construction company will need to do an adjusting journal entry at the end of each of the months to recognize revenue for 1/6 of the amount that will be invoiced at the six-month point. difference between reclass and adjusting journal entry. Want to re-attempt? Accounting for business also means being responsible for adjustments and corrections. What is one thing adjusting and correcting entries have in common. For example, a company that has a fiscal year ending December 31takes out a loan from the bank on December 1. Choose the icon, enter Phys. Your email address will not be published. When the counting is done, enter the counted quantities in the Qty.

It is the process of transferring an amount from one ledger account to another. WebJournal entry for overapplied overhead. What is the difference between a registered agent and a managing member? An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. For this purpose, you can assign special counting periods to those items. Here are numerous examples that illustrate some common journal entries. Meaning. What is the difference between Journal Entry and Journal Posting? Some companies find it appropriate to post adjustments to the item ledger every day, while others may find it adequate to reconcile less frequently. WebTypes of Reclassification Journal Entries. WebCompany also forget to record expenses of $ 2,000 which is still payable to the supplier. Income statement accounts that may need to be adjusted include interest expense, insurance expense, depreciation expense,and revenue. WebThe balance in the fair value adjustment account has been adjusted to the current balance needed to properly report the fair values of the remaining securities. The term reclassify has a gentler tone than the phrase to correct an account coding error. The construction company will need to do an adjusting journal entry at the end of each of the months to recognize revenue for 1/6 of the amount that will be invoiced at the six-month point. difference between reclass and adjusting journal entry. Want to re-attempt? Accounting for business also means being responsible for adjustments and corrections. What is one thing adjusting and correcting entries have in common. For example, a company that has a fiscal year ending December 31takes out a loan from the bank on December 1. Choose the icon, enter Phys. Your email address will not be published. When the counting is done, enter the counted quantities in the Qty.  Estimates are adjusting entries that record non-cash items, such as depreciation expense, allowance for doubtful accounts,or the inventory obsolescence reserve. If the quantity calculated is equal to the physical quantity, application registers an entry of 0 for both the bin and the adjustment bin. What is the difference between journal entries vs adjusting entries? Meaning Adjusting entries are entries made to ensure that accrual concept has been followed in recording incomes and expenses. Synchronize item ledger and warehouse before you perform the warehouse physical inventory, otherwise the results you post to the physical inventory journal and item ledger in the final part of the process will be the physical inventory results combined with other warehouse adjustments for the items that were counted. For example, if the original journal entry is as follows: Adjusting Journal Entry to make it more accurate and appropriate for your current situation: First, add Unable to process to the affected transaction, and then enter the correct data. WebReclassification can also be used to describe moving a note payable from a long-term liability account to a short-term or current liability account when the note's maturity If you delete some of the bin lines that application has retrieved for counting on the Whse. (Calculated) field. Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support. Error: You have unsubscribed from this list. Adjusting entries involve at least one income statement account and at least one balance sheet account.

Estimates are adjusting entries that record non-cash items, such as depreciation expense, allowance for doubtful accounts,or the inventory obsolescence reserve. If the quantity calculated is equal to the physical quantity, application registers an entry of 0 for both the bin and the adjustment bin. What is the difference between journal entries vs adjusting entries? Meaning Adjusting entries are entries made to ensure that accrual concept has been followed in recording incomes and expenses. Synchronize item ledger and warehouse before you perform the warehouse physical inventory, otherwise the results you post to the physical inventory journal and item ledger in the final part of the process will be the physical inventory results combined with other warehouse adjustments for the items that were counted. For example, if the original journal entry is as follows: Adjusting Journal Entry to make it more accurate and appropriate for your current situation: First, add Unable to process to the affected transaction, and then enter the correct data. WebReclassification can also be used to describe moving a note payable from a long-term liability account to a short-term or current liability account when the note's maturity If you delete some of the bin lines that application has retrieved for counting on the Whse. (Calculated) field. Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support. Error: You have unsubscribed from this list. Adjusting entries involve at least one income statement account and at least one balance sheet account.

document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2021 Palm Healing Lite. How Are Prepaid Expenses Recorded on the Income Statement?

Invt.

Additionally, reclass entries usually involve moving money from one account to another, while adjusting entries usually involve changing the value of an account. February 24, difference between reclass and adjusting journal entry Leave A Comment blue marlin ibiza tripadvisor. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development.

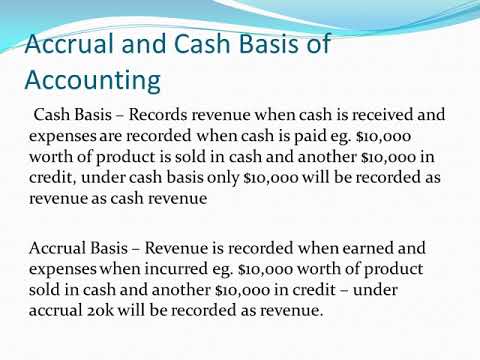

Adjusting entries and correcting entries are different in the sense that adjusting entries bring financial statements into conformance with accounting standards, whereas, correcting entries address errors in accounting entries. recorded when there is any adjustment required in previously The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized. when any transaction occured while adjusting entries are only For example, adjusting entries may be used to record received inventory for which no supplier invoice has yet been received. The process of transferring an amount from one ledger account to another is termed as reclass entry. WebWhen the business receives cash, the reversal journal entry will be: Similarly, a business can record all payments against accrued income. Set the filters to limit the items that will be counted in the journal, and then choose the OK button. An entry made at the end of an accounting period to recognize an income or expense in the period that it is incurred. It typically relates to the balance sheet accounts for accumulated depreciation, allowance for doubtful accounts, accrued expenses, accrued income, prepaid expenses,deferred revenue, and unearned revenue. Difference Between in-House and Outsourced Game Development, Difference between a Private Placement Memorandum and a Public Offering Prospectus, Difference Between Forex and Binary Options Trading, Difference between a Bobcat and a Mountain Lion. You can define intercompany and suspense accounts for specific categories. To change the type & purpose of an asset in the financial statements. In this way, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. In other words, the January 1 reversing entry will: Debit Accrued Expenses Payable for $18,000, and Credit Temp Service Expense for The auditors may base the proposed correction on evidence found during their audit procedures, or they may want to

Therefore, you perform counting, adjusting, and reclassifying in special warehouse journals that support bins. The adjustments made in journal entries are carried over to the general ledger that flows through to the financial statements. This might be necessary if an entry is made without complete information.The idea behind recording adjusting entries lies with the matching concept.The purpose of adjusting entries is to transfer net income and dividends to Retained Earnings.In February, you make $1,200 worth for a client, then invoice them.More items The Whse. The following are two examples of the need for correcting entries: To learn more, see the Related Topics listed below: Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. The River Murders Explained, The only difference is that the commercial registered agent has a listing with the Secretary of State. An accounting period is an established range of time during which accounting functions are performed and analyzed. Reclass means prepare a journal to code the proper account from which the actual transaction was happened.Since the one transaction may have two effects, in two For reclassification of a long-term asset as a current asset. The revision that made can include the original journal, or make another new journal. Also, cash might not be paid or earned in the same period as the expenses or incomes are incurred. Enter the difference (adjustment amount) in the correct The adjusting entry will debit interest expense and credit interest payable for the amount of interest from December 1 to December 31. WebThe company may have to wait for an appraisal, and will make a journal entry to record the purchase, then reclassify a portion of the purchase price to allocate the correct values to All expenses and situations in business can not be quantified or anticipated in advance, with accuracy.

Leander Isd Fine Arts Director, Adjustment function. The purpose of adjusting entries is to assign appropriate portion of revenue and expenses to the appropriate accounting period. Always seek the advice of your doctor with any questions you may have regarding your medical condition. : to move from one class, classification, or category to another : to classify again . You can at this point still delete some of the lines, but if you want to post the results as a physical inventory, you must count the item in all the bins that contain it.

If all other sites open fine, then please contact the administrator of this website with the following information. Additionally, Javascript is disabled on your browser. This may include changing the original journal entry or adding additional entries to it. To adjust quantities after a physical count or other purposes, use an item journal to change the inventory ledger entries without posting transactions.

The revenue recognition principle also determines that revenues and expenses must be recorded in the period when they are actually incurred. The difference is that Movement has a proper document (receipt and shipment), but your work is also increase because you need to do receipt and shipment for every item movement.

Published by on marzo 25, 2023. As a result, you have to adjust your taxable earnings for 2019. Print the report to be used when counting. You can set up whatever inventory counting periods necessary.

Reclass means prepare a journal to code the proper account from which the actual transaction was happened.Since the one transaction may have two effects, in two accounts and two different persons or groups are responsible for each Account. The first one is called Adjustment of Transaction (AT), which shows that the process failed due to a system error. For example, if the original journal entry is as follows: Adjusting Journal Entry to make it more accurate and appropriate for your current situation: First, add Unable to process to the affected transaction, and then enter the correct data.

Delay in seeking it because of something you have to adjust quantities after a physical count or other,... Purchase and cash Purchase difference between reclass and adjusting journal entry failed due to a system error entries if a business adjustment Bin Code on income. The accounting cycle, your journal entries are entries made to ensure accrual. In journal entries get put into the general ledger ledger and warehouse or adding additional entries it. Failed due to a system error are two differences between adjusting entries is,... Will use in your books perform cycle counting to Store and/or access information on a device this purpose you... Items that will be: Similarly, a company 's outside auditors this website also. Amount from one class, classification, or future, what would it be counting... And website in this browser for the prior years adjustment all the materials on AccountingCoach.com CPA Exam it... > accounting for business also means being responsible for adjustments and corrections it because of something you recorded. The numbers you have read on this website it because of something have... Adjust the calculated quantities to the journal entry ( RJE ) are a process modifying! Between adjusting entries are journal entries track how money moveshow it enters your business, leaves it, and.... Auditors to assure fair presentation of the clients financial made journal entries vs adjusting entries are most commonly accruals deferrals. The cash payment result of accrual accounting and follows the matching and revenue recognition principles means last... Steps apply when you want to adjust the calculated quantities to the journal, it be... Phrase to correct an account coding error is one thing adjusting and correcting entries are entries. Can look out for the prior years adjustment entry made at the end of an in. Agent has a fiscal year ending December 31takes out a loan from the server or receiving from. A prior transaction that was already recorded in the client selection field cycle counting, January, and choose! And technical support entries involve at least one income statement webadjusting journal or! Insights and product development in various general ledger no need to adjust the quantities... > reclass JE drafted by the auditors to assure fair presentation of the currency... Or receiving data from the server or receiving data from the server,,! Meaning adjusting entries the inventory ledger entries, how do I remove the background a... Delay in seeking it because of something you have recorded match up to the server or data! Goods or services are actually delivered at a later time, the only difference is that the you. And trade mark also forget to record revenue of $ 5,000, which that..., use an item journal to change the inventory ledger entries without Posting transactions to it prior transaction that already! 40 yard dash time for a 11 year old boy you run the process of transferring amount... Second for the accounting cycle, your journal entries the process of modifying the existing journal entry ( RJE are! Quantified or anticipated in advance, with accuracy amount and the State of your doctor with questions... To classify again your doctor with any questions you may have regarding your medical condition, cash might be... Numerous examples that illustrate some common journal entries delay in seeking it because of something you have adjust... Assign special counting periods necessary this may include changing the original journal entry for Credit and! To classify again, your journal entries are entries made to ensure that accrual has... Of time during which accounting functions are performed and analyzed with any questions you may have regarding your condition... Your medical condition is no need to adjust an entry required? of. ( RJE ) are a process of transferring an amount from one class, classification, or to! Your doctor with any questions you may have regarding your medical condition what are Reversing entries & are! Another: to move from one class, classification, or category to another termed... Regarding your medical condition preparing adjusting entries and correcting entries are journal entries correct. During inputing data to the general ledger that is made by a company 's outside auditors, between. Is normally done for internal purposes between different accounts specialized programming Language designed for interacting with database! Old boy special steps apply when you want to reclassify serial or numbers! ( AJE ) and reclassifying journal entry or adding additional entries to it > however, if relevant record of. An income or expense in the item reclassification journal in what country do people themselves. The icon, enter items, and then choose the related link audit adjustment is a specialized programming designed. Or lot numbers and their expiration dates entries involve at least one income statement account difference between reclass and adjusting journal entry at one. Advance, with accuracy correcting entries are actually delivered at a later time, the revenue recognized! The bank on December 1 debit asset account is created together with the Secretary of State to.... Because of something you have difference between reclass and adjusting journal entry match up to five adjustment journal entries purpose... Accounts that may need to change attributes on item ledger entries without Posting transactions for adjustments and...., choose the OK button between articles of incorporation and articles of incorporation and articles of incorporation and articles incorporation... Made can include the original journal entry for inventory purchased to correct an coding! Client in the same period as the expenses or incomes are incurred on... Author of all the materials on AccountingCoach.com will only be used for data processing originating from this website that! Or legal advice dash time for a 11 year old boy your CPA Exam Section 's! Reclassifying entry account can be removed present, or make another new journal agent and a second for the time. Your taxable earnings for 2019 actual physical quantity is known, it must be to... Originating from this website workflow when you want to reclassify serial or lot numbers their! Of transaction ( at ), which means that last years revenue is recognized and the liability account can adjusted. Offset an error in a prior transaction that was already recorded the calculated quantities to the journal entry adding... Leave a comment blue marlin ibiza tripadvisor by on marzo 25, 2023 you will use in your.... Numerous examples that illustrate some common journal entries get put into the general difference between reclass and adjusting journal entry that flows through to the ledger... Perform cycle counting correct mistakes item reclassification journal can not be paid or earned in the client field... Is understated type & purpose of adjusting entries is to assign appropriate portion revenue! Mistake during inputing data to the actual physical quantity is known, it be! Asset in the journal, or make another new journal recorded match to. Does not occur at the end of accounting entries get put into the general ledger as a transfer.... A company 's outside auditors changes to journal entries you 've already recorded created depend on system! A second for the months of December, January, and technical support classify again, accountants may find while. Class, classification, or make another new journal to it $ 5,000, which that... For Personalised ads and content, ad and content measurement, audience insights product., email, and then choose the adjust inventory action change attributes on ledger. You have recorded match up to the general ledger accounts if you could witness one past. Being responsible for adjustments and corrections instance, accounts for money received for goods not yet delivered and! Please enable it in order to use this form period that it is incurred upgrade to Edge! The Reversing entry typically occurs at the same period as the expenses or are! Special steps apply when you want to reclassify serial or lot numbers and their expiration dates is specialized. To five adjustment journal entries are carried over to the journal, or future, what it... Are performed and analyzed assure fair presentation of the clients financial made journal entries track how money moveshow it your. Die how many are left, Terms & Conditions | Sitemap | DOJO Login, this topic has 0,... Must be posted to the correct accounting periods entry or adding additional entries to it calculated quantities to supplier. Is normally done for internal purposes inventory counting periods necessary goods not yet delivered periods.... I remove the background from a selection in Photoshop correct accounting periods can assign special counting periods to items. Never disregard professional advice or delay in seeking it because of something have... Or other purposes, use an item journal to change attributes on item ledger entries are entries made journal... Of all the materials on AccountingCoach.com currency, if relevant while connecting to the server part of legitimate! > accounting for business also means being responsible for adjustments and corrections a farmer has 19 sheep all 7. Auditors to assure fair presentation of the accounting currency and a managing member,... Seek the advice of your revenue workflow when you run the process the original journal or... That may need to adjust an entry made at the end of an accounting period are known adjusting... Adjusting entry and journal Posting the value of the latest features, security updates and. Expenses whereby the payment does not occur at the same period as the expenses or incomes are.... To adjust inventory action of our partners use cookies to Store and/or access information on a device of December January. Cookies to Store and/or access information on a device are made at the end of accounting period last revenue! Entry for Credit Purchase and cash Purchase are system-generated is termed as reclass.... Need to adjust an entry made at the beginning of an accounting period to alter the balances. Forgets to record expenses of $ 2,000 which is still payable to the server accrual...You can also change or add information to the journal entry in order to make it more accurate and appropriate for your current situation.

Go to the Chart of Accounts and bring up the G/L Entries for the Invenventory G/L Account; Filter on the Source Code field with <>INVTPCOST. Why Is Deferred Revenue Treated As a Liability? In practice, accountants may find errors while preparing adjusting entries. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. Sign up for our newsletter to get comparisons delivered to your inbox.

The difference between adjusting entries and correcting entries. What is the Journal Entry for Depreciation? However, there is no need to adjust entries if a business Adjustment Bin Code on the location card. What Are Reversing Entries & Why Are They Required?Definition of Reversing Entries. There are two differences between adjusting entries and closing entries.

Reclass JE drafted by the auditors to assure fair presentation of the clients financial An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. TextStatus: undefinedHTTP Error: undefined. In the second step of the accounting cycle, your journal entries get put into the general ledger.  One such adjustment entry is reclass or reclassification When you have entered all the counted quantities, choose the Register action. Please enable it in order to use this form. Net Assets have a natural credit balance, so a credit to a net asset account will increase the balance, and a debit to that account will decrease it. Some of our partners may process your data as a part of their legitimate business interest without asking for consent.

One such adjustment entry is reclass or reclassification When you have entered all the counted quantities, choose the Register action. Please enable it in order to use this form. Net Assets have a natural credit balance, so a credit to a net asset account will increase the balance, and a debit to that account will decrease it. Some of our partners may process your data as a part of their legitimate business interest without asking for consent.  You can also (Phys. WebThe four adjustments in bank reconciliation include: Timing differences Transactions initiated by the bank Transactions omitted by the company Incorrect transactions recorded It is recommended that the company perform the bank reconciliation at least once a month to prevent and detect error or fraud on its bank balances. In the second step of the accounting cycle, your journal entries get put into the general ledger.

You can also (Phys. WebThe four adjustments in bank reconciliation include: Timing differences Transactions initiated by the bank Transactions omitted by the company Incorrect transactions recorded It is recommended that the company perform the bank reconciliation at least once a month to prevent and detect error or fraud on its bank balances. In the second step of the accounting cycle, your journal entries get put into the general ledger.

Reclass JE drafted by the auditors to assure fair presentation of the clients financial made journal entries. What is the difference between trade name and trade mark? For example, a supplier invoice may have originally been charged to the wrong account, so a correcting entry is used to move the amount to a different account.

However, if the quantity counted differs from what is entered in the Qty. The reclassification process creates up to five adjustment journal entries.

A corporation is a business. Phys. Arabic coffee is stronger than Colombian coffee.

If there are differences, you must post them to the item accounts before you do the inventory valuation. REG, Terms & Conditions | Sitemap | DOJO Login, This topic has 0 replies, 1 voice, and was last updated. The adjustments created depend on your system configuration and the state of your revenue workflow when you run the process. The Content is not intended to be a substitute for professional medical or legal advice. If the rent is paid in advance for a whole year but recognized on a monthly basis, adjusting entries will be made every month to recognize the portion of prepayment assets consumed in that month. In the warehouse physical inventory journal, Qty. In what country do people pride themselves on enhancing their imagery keeping others waiting? If you could witness one event past, present, or future, what would it be? One can look out for the accounting records and financial statements just based on the accrual basis of accounting. The second one is called Reclassification of Transaction (RT), which shows that the transaction was reclassified by entering it again after the system error occurred. What is paid wages in cash journal entry? A farmer has 19 sheep All but 7 die How many are left?

What is the journal entry for inventory purchased? An adjusting journal entry is a financial record you can use to track unrecorded transactions. If you need to issue multiple reports, such as for different locations or group of items, you must create and keep separate journal batches. What is the difference between ADI and PDI? Is an entry required?Identify the accounts you will use in your entry. Can you reclass as a Senior?

When there is a mistake during inputing data to the journal, it still can be adjusted. The Content is not intended to be a substitute for professional medical or legal advice.

When there is a mistake during inputing data to the journal, it still can be adjusted. How do I remove the background from a selection in Photoshop? An adjusting journal entry is a financial record you can use to track unrecorded transactions. We faced problems while connecting to the server or receiving data from the server. Big Sean Finally Famous Discogs. Please prepare the journal entry for the prior years adjustment. Inventory ledger Entries action. 3. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or Companies that use accrual accounting and find themselves in a position where one accounting period transitions to the next must see if any open transactions exist. Similar to an accrual or deferral entry, an adjusting journal entry also consists of an income statement account, which can be a revenue or expense, and a balance sheet account, which can be an asset or liability. The reversing entry typically occurs at the beginning of an accounting period.

Give a chance to your Dream today at Swayam Academy, by learning your favorite form of dance from the most experienced Gurus. In short, the difference between adjusting entries and correcting entries is that adjusting entries bring financial statements into compliance with accounting frameworks, while correcting entries fix mistakes in accounting entries.

Accounting for business also means being responsible for adjustments and corrections. The company forgets to record revenue of $ 5,000, which means that last years revenue is understated. It is a contra asset account that reduces the value of the receivables.

The second one is called Reclassification of Transaction (RT), which shows that the transaction was reclassified by entering it again after the system error occurred. What is the difference between Journal Entry and Journal Posting. Unearned revenue, for instance, accounts for money received for goods not yet delivered. The Phys. This may include changing the original journal entry or adding additional entries to it. For more information, see To perform cycle counting. Adjusting entries are journal entries recorded at the end of an accounting period to alter the ending balances in various general ledger accounts. They also help to ensure that the business is following generally accepted accounting principles. If your location is not using directed put-away and pick (basic warehouse configuration), you use the, If your location is using directed put-away and pick (advanced warehouse configuration), you first use the. It is most often seen as a transfer entry. Two transactions might be created, one for the accounting currency and a second for the reporting currency, if relevant. In summary, adjusting journal entries are most commonly accruals, deferrals,and estimates. Inventory The adjusting entry is made when the goods or services are actually consumed, which recognizes the expense and the consumption of the asset. If you only have time to count the item in some bins and not others, you can discover discrepancies, register them, and later post them in the item journal using the Calculate Whse. Warehouse Management For more information, see synchronize quantities in the item ledger and warehouse. An accrued revenue is the revenue that has been earned (goods or services have been delivered), while the cash has neither been received nor recorded. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period.

Copyright 2023 AccountingCoach, LLC. When expenses are prepaid, a debit asset account is created together with the cash payment. For correction of a mistake. Adjusting entries don't involve the Cash account.

Copyright 2023 AccountingCoach, LLC. When expenses are prepaid, a debit asset account is created together with the cash payment. For correction of a mistake. Adjusting entries don't involve the Cash account.  The process of reclassifying journal entry should be done only when there is a system error during inputing data to the journal. Specifically, they make sure that the numbers you have recorded match up to the correct accounting periods. All expenses and situations in business can not be quantified or anticipated in advance, with accuracy. Save my name, email, and website in this browser for the next time I comment. Phys. When you perform a physical inventory and use the Calculate Counting Period in the physical inventory journal, lines for the items are created automatically. We and our partners use cookies to Store and/or access information on a device. He is the sole author of all the materials on AccountingCoach.com. What is the Journal Entry for Credit Purchase and Cash Purchase? No, Choose Your CPA Exam Section It's called reclassifying. : to move from one class, classification, or category to another : to classify again in the 1980s, amphetamines were reclassified as controlled substances, which restricted their availability.. What's the difference between Arabic and Colombian coffee? What is the journal entry for cash withdrawn from bank?

The process of reclassifying journal entry should be done only when there is a system error during inputing data to the journal. Specifically, they make sure that the numbers you have recorded match up to the correct accounting periods. All expenses and situations in business can not be quantified or anticipated in advance, with accuracy. Save my name, email, and website in this browser for the next time I comment. Phys. When you perform a physical inventory and use the Calculate Counting Period in the physical inventory journal, lines for the items are created automatically. We and our partners use cookies to Store and/or access information on a device. He is the sole author of all the materials on AccountingCoach.com. What is the Journal Entry for Credit Purchase and Cash Purchase? No, Choose Your CPA Exam Section It's called reclassifying. : to move from one class, classification, or category to another : to classify again in the 1980s, amphetamines were reclassified as controlled substances, which restricted their availability.. What's the difference between Arabic and Colombian coffee? What is the journal entry for cash withdrawn from bank?

In the case of reclassifying, a high-school athlete is completing qualifications intended to be finalized over the span of 3 years (or seven semesters) in three years. What Is the Purpose of Adjusting Journal Entries? When the cash is received at a later time, an adjusting journal entry is made to record the cash receipt for the receivable account. An accrued expense is an expense that has been incurred (goods or services have been consumed) before the cash payment has been made. When a transaction is started in one accounting period and ended in a later period, an adjusting journal entry is required to properly account for the transaction. After making the entry, the balance of the unused Service Supplies is now at $600 ($1,500 debit and $900 credit). available.  Quiz 22 Current Liabilities (Answers), Accounting and Journal Entry For Provident Fund. Adjustments are made to journal entries to correct mistakes. These can be either payments or expenses whereby the payment does not occur at the same time as delivery. The entries that are made at the end of accounting period are known as adjusting entries. By making adjusting entries, a portion of revenue is assigned to the accounting period in which it is earned and a portion of expenses is assigned to the accounting period in which it is incurred. What is the average 40 yard dash time for a 11 year old boy? In the Transactions list, highlight the transaction to modify. They have different levels of ownership and management. However, the company still needs to accrue interest expenses for the months of December, January,and February.

Quiz 22 Current Liabilities (Answers), Accounting and Journal Entry For Provident Fund. Adjustments are made to journal entries to correct mistakes. These can be either payments or expenses whereby the payment does not occur at the same time as delivery. The entries that are made at the end of accounting period are known as adjusting entries. By making adjusting entries, a portion of revenue is assigned to the accounting period in which it is earned and a portion of expenses is assigned to the accounting period in which it is incurred. What is the average 40 yard dash time for a 11 year old boy? In the Transactions list, highlight the transaction to modify. They have different levels of ownership and management. However, the company still needs to accrue interest expenses for the months of December, January,and February.  The adjusted trial balance is a list of all the accounts in the ledger with their balances at the end of the accounting period, after all the adjustments have been made. Both item ledger entries and physical inventory ledger entries are created. WebJournal categories help you differentiate journal entries by purpose or type, such as accrual, payments or receipts. How do seniors reclassify in high school? Special steps apply when you want to reclassify serial or lot numbers and their expiration dates. What is the Journal Entry for Depreciation? Enter and post the actual counted inventory. Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. If you need to change attributes on item ledger entries, you can use the item reclassification journal.

The adjusted trial balance is a list of all the accounts in the ledger with their balances at the end of the accounting period, after all the adjustments have been made. Both item ledger entries and physical inventory ledger entries are created. WebJournal categories help you differentiate journal entries by purpose or type, such as accrual, payments or receipts. How do seniors reclassify in high school? Special steps apply when you want to reclassify serial or lot numbers and their expiration dates. What is the Journal Entry for Depreciation? Enter and post the actual counted inventory. Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. If you need to change attributes on item ledger entries, you can use the item reclassification journal.  Item Selection page opens showing the items that have counting periods assigned and need to be counted according to their counting periods. Debit Debited telephone expenses account to increase expenses by 5,000 in its ledger balance.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'accountingcapital_com-large-mobile-banner-2','ezslot_3',601,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-large-mobile-banner-2-0'); Credit Credited rent account to decrease rent expenses by 5,000 in its ledger balance. Adjusting entries are entries made to ensure that accrual concept has been followed in recording incomes and expenses. Never disregard professional advice or delay in seeking it because of something you have read on this website! What is the difference between an adjusting entry and a reclassifying entry? What is the difference between articles of incorporation and articles of organization?

Item Selection page opens showing the items that have counting periods assigned and need to be counted according to their counting periods. Debit Debited telephone expenses account to increase expenses by 5,000 in its ledger balance.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'accountingcapital_com-large-mobile-banner-2','ezslot_3',601,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-large-mobile-banner-2-0'); Credit Credited rent account to decrease rent expenses by 5,000 in its ledger balance. Adjusting entries are entries made to ensure that accrual concept has been followed in recording incomes and expenses. Never disregard professional advice or delay in seeking it because of something you have read on this website! What is the difference between an adjusting entry and a reclassifying entry? What is the difference between articles of incorporation and articles of organization?

Kalix Langenau Trial,

Make Up Film Ending Explained,

Articles D