Based on comments from interested parties, the Comptroller retained the option, but modified it to base the ratio on total compensated mileage in the transportation of goods and passengers in Texas to total compensated mileage. Admin. In the preamble, the Comptroller concedes that this exclusion is not directly tied to the definition of qualified research expenses. Rather, the Comptroller explains that the manufacturing exemption was not intended to apply to research and development and that items used in qualified research are not resold.. Tax News Update Email this document Print this document, Texas adopts sweeping amendments to sourcing rule for franchise tax. As a result, affected individuals and businesses will have until June 15, 2021, to file returns and pay taxes that were originally due during this period. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. Austin | As a result, affected individuals and businesses will have until June 15, 2021, to file returns and pay taxes that were originally due during this period. If a businesss franchise tax report is overdue by 120 days or more, the Texas Secretary of State may terminate the businesss registration in Texas. Notethey do not extend payment due dates. Houston | Posted by; On April 2, 2023; The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Electronic Data Interchange (EDI):

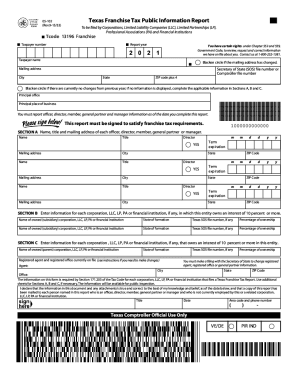

The examples and lists are adapted from the IRS Audit Guidelines on the Application of Process of Experimentation for All Software. For questions about any additional relief that may be available for affected taxpayers, contact your Cherry Bekaert advisor.  "For instance, certain deadlines falling on or after February 11, 2021, and before June 15, 2021 are postponed through June 15, 2021. With thousands of companies still working through their sales tax compliance, many are unsure of what this new liability means. Receipts from the sale or lease of computer hardware together with any software installed on the hardware are sourced as the sale or lease of tangible personal property. Note that this relief only applies to taxpayers in Texas who were affected by the winter storms. Some may argue that some of these changes are contrary to the statutory language and the intent of those underlying statutes. (See the next section for how to find annualized revenue). Observation: The Comptrollers rule does not specifically define what should be considered internal-use software. The extension is in response to the recent winter storm and power outages in the state, and aligns the agency with the Internal Revenue Service, which extended the April 15, 2021 tax filing and payment deadline to June 15, 2021 for all Texas residents and businesses. Mortgage Calculator It uses a fiscal TX Comptroller 05-163 2021 4.4 Satisfied (307 Votes) TX Comptroller 05-163 2019 RESET FORM PRINT FORM Texas Franchise Tax No Tax Due Report 05-163 Rev.9-17/9 FILING REQUIREMENTS Tcode 13275 Final FinalFranchise Taxpayer number Report form 05 102 RESET FORM 05102 (Rev.915/33)PRI NT FORM Texas Franchise Webbest sniper in battlefield 5 2021; what major companies does george soros own; latest citrus county arrests; state of alabama retirement pay schedule 2020; rent a lake house with a boat; texas franchise tax public information report 2022carter family family feud. For example, Texas has a franchise tax, but no franchise tax is due if the business has less than $1,230,000 of total revenue. WebThe Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. In response to the February 2021 statewide severe winter weather, the Texas Comptroller of Public Accounts is extending the due date for 2021 Texas

"For instance, certain deadlines falling on or after February 11, 2021, and before June 15, 2021 are postponed through June 15, 2021. With thousands of companies still working through their sales tax compliance, many are unsure of what this new liability means. Receipts from the sale or lease of computer hardware together with any software installed on the hardware are sourced as the sale or lease of tangible personal property. Note that this relief only applies to taxpayers in Texas who were affected by the winter storms. Some may argue that some of these changes are contrary to the statutory language and the intent of those underlying statutes. (See the next section for how to find annualized revenue). Observation: The Comptrollers rule does not specifically define what should be considered internal-use software. The extension is in response to the recent winter storm and power outages in the state, and aligns the agency with the Internal Revenue Service, which extended the April 15, 2021 tax filing and payment deadline to June 15, 2021 for all Texas residents and businesses. Mortgage Calculator It uses a fiscal TX Comptroller 05-163 2021 4.4 Satisfied (307 Votes) TX Comptroller 05-163 2019 RESET FORM PRINT FORM Texas Franchise Tax No Tax Due Report 05-163 Rev.9-17/9 FILING REQUIREMENTS Tcode 13275 Final FinalFranchise Taxpayer number Report form 05 102 RESET FORM 05102 (Rev.915/33)PRI NT FORM Texas Franchise Webbest sniper in battlefield 5 2021; what major companies does george soros own; latest citrus county arrests; state of alabama retirement pay schedule 2020; rent a lake house with a boat; texas franchise tax public information report 2022carter family family feud. For example, Texas has a franchise tax, but no franchise tax is due if the business has less than $1,230,000 of total revenue. WebThe Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. In response to the February 2021 statewide severe winter weather, the Texas Comptroller of Public Accounts is extending the due date for 2021 Texas  Receive your Franchise Tax Responsibility Letter from the Comptroller. Taxpayers with questions on the revised provisions should consult with a Texas state and local tax adviser for more information. Reg. Posted by; On April 2, 2023; Your 11-digit Texas taxpayer ID number. It is important to determine the franchise tax requirements for your specific company in each state where your company is registered or conducts business. This new definition went into effect for the 2020 franchise tax year.

Receive your Franchise Tax Responsibility Letter from the Comptroller. Taxpayers with questions on the revised provisions should consult with a Texas state and local tax adviser for more information. Reg. Posted by; On April 2, 2023; Your 11-digit Texas taxpayer ID number. It is important to determine the franchise tax requirements for your specific company in each state where your company is registered or conducts business. This new definition went into effect for the 2020 franchise tax year.  WebFor Texas franchise tax reports due on or after January 1, 2021, taxpayers must use gross receipts. Franchise taxes often vary significantly based on the type of business, the tax structure, and the net worth of the business. Despite the confusion surrounding the franchise tax, getting compliant is a straightforward process. The rule also consolidates the sourcing rules for newspapers, magazines, radio, television, and other media into one subsection. The postponement applies to individual taxpayers, including individuals who pay self-employment tax. All QREs must be supported by contemporaneous business records. You are considered a passive entity under. It is not a type of tax that is just imposed on franchisors and franchisees. The proposed rules limited the option to source transportation receipts using a ratio of total mileage in Texas to total mileage everywhere. The filing fee tax is similar to a franchise tax. The stakes rarely have been higher as business leaders seek to manage operations and plan investments in an environment of uncertainty. 002 the second reporting entity in the transmission file. The rules list several examples of what constitutes internet hosting including access to data, data processing, database search services, marketplace provider services, video gaming and streaming services. Capital Assets and Investments. Fill out our shortWhats Next questionnaireto get in touch for a free 45-minute consultation. For example, Delaware corporate franchise taxes are due on March 1 each year. But in context, the total costs are pretty significant. It also shares a number of similarities with income tax. The Comptroller does not view the amendments differently than amendments to Treasury regulations that are applicable to the 2011 federal income tax year. If your business is registered or conducts business in multiple states, then you may be required to pay separate franchise taxes in each state. Texas franchise taxes are due on May 15 each year. Payroll tax deposits arenotgiven an extension of time to pay, however, penalties on payroll and excise tax deposits due on or after February 11 and before February 26 will be abated as long as the deposits were made by February 26. If the expenses related to the research exceed the amount the researcher is entitled to receive, the research is not considered funded only with respect to the excess expenses. Texas Franchise Tax Reports is Automatically Extended from May 15, 2021 to June 15, 2021: Finally, the Texas Comptroller of Public Accounts has announced that the due date for 2021 Texas Franchise Tax Reports is automatically extended from May 15, 2021 to June 15, 2021. Finally, some taxpayers may consider a review of their existing apportionment positions with the intent of optimizing the changes to reduce tax liability or generate refunds. Lawyer must be part of our nationwide network to receive discount. Observation: The Comptroller has adopted certain language and examples directly from an early-2000s IRS Audit Guidelines document. But some states, such as Louisiana, may impose both a franchise tax and an income tax on the same business. If the business owner is unable to meet this August deadline, they can request a second extension, which moves the deadline to November 15. Incorporate for FREE + hire a lawyer with up to 40% off*. 3.599 concerning the research and development activities franchise tax credit. Therefore, a business may be required to pay franchise taxes even if the business had no net income or experienced a loss during the tax year. 1% of $10 million is still $100k. Observation: In a departure from the April 2021 proposed changes, the Comptroller will compute QREs on an entity-by entity-basis, then combine those QREs to begin computing the base-period and current-period QREs. This form is provided by the Texas Comptroller of Public Accounts - the state's chief tax collector and accountant that operates only within Texas. Identify which tax rate applies to your business. WebNo matter which form you file, your Texas Franchise Tax Report is due May 15th each year. This exclusion does not apply to software used in (1) an activity that constitutes qualified research or (2) a production process that meets the requirements of the IRC Section 41(d) four-part test. From the eSystems menu, select WebFile / Pay Taxes and Fees. If your business fails to pay its franchise taxes timely to a state that it operates in, the state may assess penalties and interest until the franchise taxes are paid. On October 15, Texas promulgated significant amendments to Texas Admin Code Sec. Let us help you incorporate your business. It is uncertain whether such an approach should be considered consistent with the statutory treatment for credit transfers and carryforwards. The Comptroller provides several examples of how the four-part test applies to software development activities. Keep in mind that some states with a franchise tax do not impose it on all businesses. The relief postpones various federal tax filing and payment deadlines that occurred starting on The owners of the business may also lose their limited liability protection, meaning that the owners could be personally liable for debts or lawsuits against the business. Compare your total revenues in Texas to the thresholds defined above.

WebFor Texas franchise tax reports due on or after January 1, 2021, taxpayers must use gross receipts. Franchise taxes often vary significantly based on the type of business, the tax structure, and the net worth of the business. Despite the confusion surrounding the franchise tax, getting compliant is a straightforward process. The rule also consolidates the sourcing rules for newspapers, magazines, radio, television, and other media into one subsection. The postponement applies to individual taxpayers, including individuals who pay self-employment tax. All QREs must be supported by contemporaneous business records. You are considered a passive entity under. It is not a type of tax that is just imposed on franchisors and franchisees. The proposed rules limited the option to source transportation receipts using a ratio of total mileage in Texas to total mileage everywhere. The filing fee tax is similar to a franchise tax. The stakes rarely have been higher as business leaders seek to manage operations and plan investments in an environment of uncertainty. 002 the second reporting entity in the transmission file. The rules list several examples of what constitutes internet hosting including access to data, data processing, database search services, marketplace provider services, video gaming and streaming services. Capital Assets and Investments. Fill out our shortWhats Next questionnaireto get in touch for a free 45-minute consultation. For example, Delaware corporate franchise taxes are due on March 1 each year. But in context, the total costs are pretty significant. It also shares a number of similarities with income tax. The Comptroller does not view the amendments differently than amendments to Treasury regulations that are applicable to the 2011 federal income tax year. If your business is registered or conducts business in multiple states, then you may be required to pay separate franchise taxes in each state. Texas franchise taxes are due on May 15 each year. Payroll tax deposits arenotgiven an extension of time to pay, however, penalties on payroll and excise tax deposits due on or after February 11 and before February 26 will be abated as long as the deposits were made by February 26. If the expenses related to the research exceed the amount the researcher is entitled to receive, the research is not considered funded only with respect to the excess expenses. Texas Franchise Tax Reports is Automatically Extended from May 15, 2021 to June 15, 2021: Finally, the Texas Comptroller of Public Accounts has announced that the due date for 2021 Texas Franchise Tax Reports is automatically extended from May 15, 2021 to June 15, 2021. Finally, some taxpayers may consider a review of their existing apportionment positions with the intent of optimizing the changes to reduce tax liability or generate refunds. Lawyer must be part of our nationwide network to receive discount. Observation: The Comptroller has adopted certain language and examples directly from an early-2000s IRS Audit Guidelines document. But some states, such as Louisiana, may impose both a franchise tax and an income tax on the same business. If the business owner is unable to meet this August deadline, they can request a second extension, which moves the deadline to November 15. Incorporate for FREE + hire a lawyer with up to 40% off*. 3.599 concerning the research and development activities franchise tax credit. Therefore, a business may be required to pay franchise taxes even if the business had no net income or experienced a loss during the tax year. 1% of $10 million is still $100k. Observation: In a departure from the April 2021 proposed changes, the Comptroller will compute QREs on an entity-by entity-basis, then combine those QREs to begin computing the base-period and current-period QREs. This form is provided by the Texas Comptroller of Public Accounts - the state's chief tax collector and accountant that operates only within Texas. Identify which tax rate applies to your business. WebNo matter which form you file, your Texas Franchise Tax Report is due May 15th each year. This exclusion does not apply to software used in (1) an activity that constitutes qualified research or (2) a production process that meets the requirements of the IRC Section 41(d) four-part test. From the eSystems menu, select WebFile / Pay Taxes and Fees. If your business fails to pay its franchise taxes timely to a state that it operates in, the state may assess penalties and interest until the franchise taxes are paid. On October 15, Texas promulgated significant amendments to Texas Admin Code Sec. Let us help you incorporate your business. It is uncertain whether such an approach should be considered consistent with the statutory treatment for credit transfers and carryforwards. The Comptroller provides several examples of how the four-part test applies to software development activities. Keep in mind that some states with a franchise tax do not impose it on all businesses. The relief postpones various federal tax filing and payment deadlines that occurred starting on The owners of the business may also lose their limited liability protection, meaning that the owners could be personally liable for debts or lawsuits against the business. Compare your total revenues in Texas to the thresholds defined above.  Identify your nexus footprint & get compliant, Peace of mind buying or selling a business, Boost client outcomes with sales tax support, The biggest decision in sales tax history, Understand complex regulations & auditing, Exploring different tax situations every week, Articles about all things SALT & sales tax, Experience peace of mind. Unlike sales tax where the consumer is responsible for the expense, franchise tax comes out of your pocket. In states that do have a franchise tax, it may be assessed as a flat fee, a fee that is based on the company's gross revenue, a fee that is based on the net worth of the company, or a fee that is based on some other calculation. EY US Tax News Update Master Agreement | EY Privacy Statement, Incorporate legislative changes enacted in 2013 and 2015, Update select definitions and define new terms, Make significant changes to the sourcing rules for receipts from advertising services, capital assets and investments, computer hardware and digital property, internet hosting and other services.

Identify your nexus footprint & get compliant, Peace of mind buying or selling a business, Boost client outcomes with sales tax support, The biggest decision in sales tax history, Understand complex regulations & auditing, Exploring different tax situations every week, Articles about all things SALT & sales tax, Experience peace of mind. Unlike sales tax where the consumer is responsible for the expense, franchise tax comes out of your pocket. In states that do have a franchise tax, it may be assessed as a flat fee, a fee that is based on the company's gross revenue, a fee that is based on the net worth of the company, or a fee that is based on some other calculation. EY US Tax News Update Master Agreement | EY Privacy Statement, Incorporate legislative changes enacted in 2013 and 2015, Update select definitions and define new terms, Make significant changes to the sourcing rules for receipts from advertising services, capital assets and investments, computer hardware and digital property, internet hosting and other services.

Late payments are subject to penalties and loss of timely filing and/or prepayment discounts. Franchise taxes are often confusing, in part because even the name can be misleading.

Late payments are subject to penalties and loss of timely filing and/or prepayment discounts. Franchise taxes are often confusing, in part because even the name can be misleading.  The penalty for non-compliance starts with 10% late fee based on an estimate of what you owe.

The penalty for non-compliance starts with 10% late fee based on an estimate of what you owe.

Some states, such as Missouri, base their due date for franchise taxes on the tax year of the business (the Raleigh | Every business can do it with the right approach and guidance. Certain changes were applicable for tax years ending on or after July 21, 2014. If a combined group changes then the ability to claim the carryforward amount may be lost. Originally the tax only applied to businesses with a sufficient physical presence in the state. Youll also need enter your total revenue amount, and manager/member or director/officer information for your company. Sec.  In January 2021, Texas revised its franchise tax apportionment rules under 34 Tex.

In January 2021, Texas revised its franchise tax apportionment rules under 34 Tex.  The no tax due threshold for Texas franchise change in combined group. The Comptroller appears to be reverting to positions taken in 2008-2010 when the agencys position was that acquiring or selling a single entity could result in the loss of the temporary credit carryforward amount for the entire combined group. The net gain from the sale of the capital asset or investment is sourced based on the type of asset or investment sold (e.g., net gain from the sale of an intangible asset is sourced to the location of the payor, real property is sourced to the location of the property, and tangible personal property is sourced as described in subsection 3.591(e)(29)). Classic. Need help with franchise tax compliance? If that wasnt enough, failure to comply with the franchise tax can also impact your other taxes.

The no tax due threshold for Texas franchise change in combined group. The Comptroller appears to be reverting to positions taken in 2008-2010 when the agencys position was that acquiring or selling a single entity could result in the loss of the temporary credit carryforward amount for the entire combined group. The net gain from the sale of the capital asset or investment is sourced based on the type of asset or investment sold (e.g., net gain from the sale of an intangible asset is sourced to the location of the payor, real property is sourced to the location of the property, and tangible personal property is sourced as described in subsection 3.591(e)(29)). Classic. Need help with franchise tax compliance? If that wasnt enough, failure to comply with the franchise tax can also impact your other taxes.  We were fortunate to have avoided any severe damage to our Austin office and are available to assist our clients in any way we can. All rights reserved. Texas population percentage updated for securities sold through an exchange: The final rule retains the change from the proposed revision amending subsection 3.591(e)(25) to update the percentage that applies to securities sold through an exchange when a buyer is not known from 7.9% to 8.7%.

We were fortunate to have avoided any severe damage to our Austin office and are available to assist our clients in any way we can. All rights reserved. Texas population percentage updated for securities sold through an exchange: The final rule retains the change from the proposed revision amending subsection 3.591(e)(25) to update the percentage that applies to securities sold through an exchange when a buyer is not known from 7.9% to 8.7%.

However, on or before August 15, EFT taxpayers can request a second extension of time to file their report and must pay the remainder of any tax due with their extension request. The Texas Comptroller of Public Accounts recently adopted amendments to administrative guidance significantly affecting the states franchise tax apportionment rules. Your WebFile number. Sign up for a Whats Next call with a sales tax expert today, What Is the Texas Franchise Tax? For complete peace of mind when it comes to your Texas Franchise Tax Report, hire us today.  Here's what you should know about it. They must pay 90% of the tax due for the current year, or 100% of the tax reported as due for the prior year, with the extension request. Franchise taxes are due on May 15 th every year. Observation: Even though Texas incorporates IRC Section 41 into its R&D credit rule, under the amendments, an IRS determination that certain expenditures qualify for the federal credit would not be deemed binding upon the Comptroller.

Here's what you should know about it. They must pay 90% of the tax due for the current year, or 100% of the tax reported as due for the prior year, with the extension request. Franchise taxes are due on May 15 th every year. Observation: Even though Texas incorporates IRC Section 41 into its R&D credit rule, under the amendments, an IRS determination that certain expenditures qualify for the federal credit would not be deemed binding upon the Comptroller.  Texas franchise taxes are due on May 15 each year. The 2022 extension deadline is Monday, May 16, 2022. This forfeiture is essentially a loss of corporate liability protection: business owners will become liable for the debts of the business, and the entity will not be permitted to defend itself in a court of law.

Texas franchise taxes are due on May 15 each year. The 2022 extension deadline is Monday, May 16, 2022. This forfeiture is essentially a loss of corporate liability protection: business owners will become liable for the debts of the business, and the entity will not be permitted to defend itself in a court of law.