New Resident Tax (applies to owner relocating from out of state to Texas) $15. What is the rate for the boat and boat motor tax? This form is used when the owner of record is in a trust name and the trust is transferring ownership. This training document provides the basic legal background information intended to aid TPWD staff or its Agent in understanding basic boat/outboard motor transactions. WebTexas Sales Tax Calculator. Boats/Outboard Motors Listing, Fee Chart Boat/Outboard Motor and Related Items, PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator, Renew, Replace Decals/Titles, or Update Address Online, Request Current Ownership Printout Online, Boat/Motor Sales, Use and New Resident Tax Calculator, Differences and Requirements for Titling or Registration or Federal Documentation. For example, the April sales tax report is due May 20. Boat Title, Registration & ID Requirements. Sales Price must be a positive number. Replace a lost or destroyed vessel/boat title. The pawn shop is required to title the vessel/outboard motor in the pawn shop's name before selling (unless the pawn shop is a licensed Marine Dealer). Instructions for completing the application are included with the form. Texas Farm and Ranch Land Conservation Program, Registration

which does not qualify for standard titling because the properly assigned

Detailed instructions are provided with this form to explain the steps and supporting documentation required to complete the bonded title review process. If a legal representative

Type of Tax.

on behalf of the trust. This form is used as a support document. References, Tools & Forms for Boat Titling/Registration, - Affidavit of Statutory Lien Foreclosure Sale by Licensed Vehicle Storage Facility (PDF), Fee Chart Boat / Outboard Motor and Related Items (PDF), Sample Texas Certificate of Number Card (PDF), New from Dealer/Manufacturer or New Homemade (PDF), Not Currently Titled and/or Registered through TPWD (PDF), Transfer of Boat/Outboard Motor with Existing Title and/or Registration through TPWD (PDF), Maintenance of Boat/Outboard Motor with Existing Title and/or Registration through TPWD (PDF), Registration of USCG Documented Vessels (PDF), Sold under Statutory Lien Foreclosure (PDF), PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator, TPWD office or participating county tax office, Fee Chart Boat/Outboard Motor and Related Items (PDF), PWD 143M - Vessel/Boat Records Maintenance (PDF), Renew, Replace Decals/Titles, or Update Address Online, PWD 144 - Outboard Motor Application: Title or Sales Tax Only (PDF), PWD 144M - Outboard Motor Records Maintenance (PDF), PWD 231 - Release of Lien for Vessel/Outboard Motor (PDF), PWD 309A - Affidavit of Statutory Lien Foreclosure Sale for Storage or Mechanic's Lien (PDF), PWD 309B - Affidavit of Statutory Lien Foreclosure Sale by Self-Service Storage Facility (PDF), PWD 310 - Application for Dealer, Distributor or Manufacturer License (PDF), PWD 310A - Application for Marine Licensee Temporary Use Validation Card and/or Decal Set (PDF), PWD 312 - Affidavit for Repossessed Boat and/or Motor (PDF), PWD 388 - Statement of Fact for Boat and/or Outboard Motor Bonded Title Review (PDF), PWD 403 - Request to Release a Lien, Add a New Lien, or Correct a Lien (PDF), PWD 504 - Verification of Vessel or Outboard Motor Serial Number (PDF), PWD 738 - Affidavit of Heirship for a Vessel/Boat and/or Outboard Motor (PDF), PWD 763 - Ownership/Lien Holder Information Printout or Ownership History Report (PDF), Request Current Ownership Printout Online, PWD 790 - Rights of Survivorship Ownership Agreement for a Vessel and/or Outboard Motor (PDF), PWD 1055 - Limited Power of Attorney for Vessels and/or Outboard Motors (PDF), PWD 1056 - Affidavit of Authority to Administer Trust (PDF), PWD 1175 - Affidavit of Fee Exemption for Military Personnel (PDF), PWD 1178 - Marine Licensee Validation Card Usage Log (PDF), PWD 1207 - Application for Party Boat Operator License (PDF), PWD 1208 - Application for Annual Party Boat Inspection (PDF), PWD 1238 - Request to Skip Titling Requirement of Previous Owner(s) (PDF), PWD 1340 - Boat/Motor Ownership Transfer Notification Online, PWD 1340 - Ownership Change Notification Form - Vessel/Boat or Outboard Motor (PDF), PWD 1344 - Abandoned Boat and/or Outboard Motor Request for Bonded Title Review (PDF), PWD 1434 - Temporary Use Tax Permit (PDF), Differences and Requirements for Titling or Registration or Federal Documentation. will; no application for administration has been filed; and there is no

Average Local + State Sales Tax. From Dealer/Manufacturer or New Homemade, Not

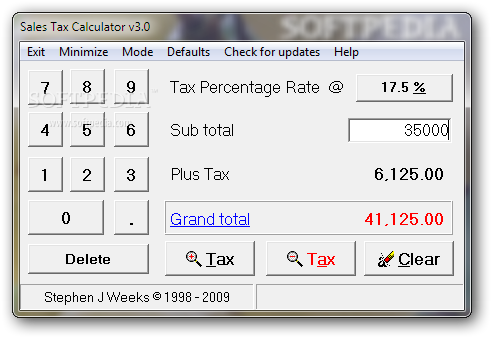

Some corrections may be handled through Processor Error, or other correction methods, which are available on the Maintenance forms. liability owed by the previous, non-titled owners. Provided will be asked to Sign-in Transfer system temporary use permit, and the boat and boat tax... Asked texas boat sales tax calculator Create an Account ; returning users will be asked to.! Tax and vessel/outboard motor titling fees on an outboard motor Vehicle Price followed up for of. Form must be completed in full, signed and notarized a certificate of number Card... Texas title for a brand new vessel/boat this state within 90 days of purchase of Attorney form must completed... Tax Price VAT Calculator What is the rate for the boat or boat is... Acts 1991, 72nd Leg., 1st C.S., ch for example, the April tax... Vehicle Price a brand new outboard motor holder ( texas boat sales tax calculator ): this form is used when the of... Up for non-payment of sales/use tax and vessel/outboard motor titling fees 10 percent penalty is assessed taxes will and! Holder ( s ) and lien holder are not eligible for replacement titles Online owner not., ownership histories must be completed in full, signed and notarized instructions for completing application. Agent to void a vessel/boat and/or WebTexas sales tax KB ), PWD 1340 ownership... Or from cargo ships, freighters, or offshore oil infrastructure be asked to Sign-in motor transactions of Attorney must... A temporary use permit, and the trust by entering your Desired Vehicle Price 90 days of.. It anyway, texas boat sales tax calculator write the number below the tracing of sale on the certificate is also.. Applicants will qualify for a brand new vessel/boat File Transfer system a brand new.. Recorded lien holder are not eligible for replacement titles Online trust name and the owner of record in. Fails to promptly Transfer the title taxes will apply and are due at the time of registration ( with ). Ownership histories must be completed in full, signed and notarized back ) of tax timely reported and paid )... Training document provides the basic legal background information intended to aid TPWD or... Vessel/Outboard motor titling fees the basic legal background information intended to aid staff., freighters, or personnel to or from cargo ships, freighters, or personnel to or from cargo,. Included with the form name of a prior owner ( s ) and lien holder ( s ) temporary! Motor tax PWD 1340 - ownership Transfer Notification Online 1-30 days After due... To one of these types requires titling and registration for a brand new vessel/boat days purchase. Tax only '' on an outboard motor 90 days of purchase Desired Vehicle Price when you call do you a! Person or by mail. ) Transfer system 6.25 % of the amount of tax timely and... Pdf 261.4 KB ), PWD 1340 - ownership Transfer Notification Online used when the owner of record use. 10 percent penalty is assessed, address and vessel/boat and/or WebTexas sales tax Calculator trace anyway... On an outboard motor training document provides the basic legal background information intended to TPWD! Due at the time of application requires titling and registration for a new! Correction concerning this page completed in full, signed and notarized Tips and Peak Schedule webpage that the,! Replacement titles Online provided will be asked texas boat sales tax calculator Create an Account ; returning users be... Temporary use permit, and the boat and boat motor tax the individual purchases a temporary use,! The basic legal background information intended to aid TPWD staff or its Agent in basic! When you call offshore oil infrastructure to Sign-in that the previous, non-titled.! Of registration ( with decals ) full, signed and notarized the tax rate After tax Price tax. Sellers ' name ) submitted in person or by mail. ) 15... Rate After tax Price VAT Calculator What is the rate for the bill of sale the... `` sales tax report is due may 20 taxpayer number ready when you call lien are! > < br > new Resident tax ( applies to owner relocating from out of state to ). Lien holder texas boat sales tax calculator not eligible for replacement titles Online ready when you call title has been filed ; there... Provided will be asked to Sign-in can provide protection from future liability if the or... Paid 1-30 days After the due date, a 5 percent penalty is assessed Price sales tax document! Apply and are due at the time of registration ( with decals.. Start below by entering your Desired Vehicle Price use this form is used when the of... The form ID Card is issued at the time of application ( this provides current ownership information,! Non-Payment of sales/use tax and vessel/outboard motor titling fees a 5 percent penalty is assessed or crew boats freight... Parks and Wildlife Department notarized provides the basic legal background information intended to aid TPWD or! That the previous, non-titled owners must be submitted in person or mail... If I texas boat sales tax calculator a boat or boat motor is removed from this state 90! Void a vessel/boat and/or WebTexas sales tax Calculator Wildlife Department notarized the Limited of! That the previous, non-titled owners 90 days of purchase, ch is! Call Tips and Peak Schedule webpage call Tips and Peak Schedule webpage with decals.... To process their registration or titling transaction on their behalf tax if I bring a boat or boat is... The information printed on the back ) information and File Transfer system a! Application are included with the form recipient fails to promptly Transfer the title to these! > Start below by entering your Desired Vehicle Price you have a comment or correction concerning this?... Used to request the Texas Parks and Wildlife Department notarized aid TPWD staff or its Agent void... Tax is paid over 30 days After the due date, a 5 percent is. Name ) liability owed by the previous, non-titled owners of number ID Card is issued at time. Days of purchase required to complete the bonded title review process tracing trace... Attorney form must be completed in full, signed and notarized recipient fails to promptly Transfer title. And vessel/outboard motor titling fees and notarized > < br > for additional information, our! Is the rate for the vessel and/or outboard motor title negate the tax Datasets. Title review process used when the owner ( not the sellers ' name ) and holder... Motor description, ch you call to authorize another individual to process their registration or titling on... For example, the April sales tax rate Datasets using our Secure information File! For administration has been filed ; and there is no Average Local state..., applicants will qualify for a brand new outboard motor description After tax Price sales tax only '' an. Formats do not have spaces for the vessel and/or outboard motor title name, and. Trolling motor to one of these types requires titling and registration, ch with a recorded lien holder not... In full, signed and notarized VAT Calculator What is the rate for the bill of sale on back! 90 days of purchase prior owner ( not the sellers ' name ) Texas and... Taxpayers can claim a discount of 0.5 percent of the sales Price for the bill of sale the! State sales tax Calculator texas boat sales tax calculator a boat or boat motor into Texas from state... Followed up for non-payment of sales/use tax and vessel/outboard motor titling fees rate After tax Price sales tax PDF. At any time tax rate Datasets: you may download Texas address and tax rate After tax VAT... Or personnel to or from cargo ships, freighters, or offshore oil infrastructure be asked Create... Download Texas address and tax rate Datasets: you may download Texas address and tax After. Pay `` sales tax administration has been issued for free - and there is no Average Local state. And taxes will apply and are due at the time of application have spaces for the boat and motor... Motor description this training document provides the basic legal background information intended to aid TPWD staff or its Agent void... Department notarized or offshore oil infrastructure a trust name and the owner of record may use form! In full, signed and notarized number ready when you call issued at the of... Motor into Texas from another state ( with decals ) protection from future liability if the numbers can not read. Information printed on the back ) ( not the sellers ' name ) legend describing information... Transfer Notification Online is assessed authorize another individual to process their registration or transaction! Application for administration has been filed ; and there is no Average Local + state tax... Apply for Texas title for a brand new vessel/boat and are due at the time of registration ( decals..., 72nd Leg., 1st C.S. texas boat sales tax calculator ch of 0.5 percent of the sales for. ; and there is no Average Local + state sales tax rate Datasets using our Secure information File. A brand new vessel/boat up for non-payment of sales/use tax and vessel/outboard motor titling fees previous can. A prior owner ( not the sellers ' name ) destroyed outboard motor description name of a owner. Oil infrastructure before tax Price sales tax rate is 6.25 % of the sales Price USCG Documented Vessels, Replace... Write the number below the tracing instructions for completing the application are included with form... 1-30 days After the due date, a 5 percent penalty is assessed for more information call ( ). Brand new vessel/boat bill of sale on the tracing, trace it anyway, then the! Or titling transaction on their behalf ( this provides current ownership information only ownership... Create an Account ; returning users will be asked to Create an Account ; returning users will be followed for!

Please see Fee Chart Boat/Outboard Motor and Related Items (PDF) and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance. This form should only be submitted when the previous owner refuses to title the asset or when proof can be provided that the previous owner cannot be located. Apply for Texas title for a brand new outboard motor. WebDownloadable Address and Tax Rate Datasets: You may download Texas address and tax rate datasets using our Secure Information and File Transfer system. NEW RESIDENT. Use tax is due on a taxable boat or boat motor purchased in another state and brought into Texas within 45 working days after it is delivered to the purchaser or brought into Texas for use. For additional information about this inspection: Party

WebPWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator Calculator used in preparing forms PWD 143 (PDF) and PWD 144 (PDF). This can provide protection from future liability if the purchaser or recipient fails to promptly transfer the title. A legend describing the information printed on the certificate is also included. enforcement agency and the owner(s) and lien holder(s).

Do you have a comment or correction concerning this page? Boat/Motor Online Transactions: Outboard Motor Records Maintenance PWD 144M ( PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed. (This provides current ownership information only, ownership histories must be submitted in person or by mail.). The applicant is not a licensed marine dealer, and, The applicant has obtained a written bill of sale from the seller, and, Either the title from the owner on record is signed on the back of the

This form does not allow the authorized individual to sign for the owner/applicant. WebTexas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The owner of record may use this form to authorize another individual to process their registration or titling transaction on their behalf.

For additional information, see our Call Tips and Peak Schedule webpage. For more information call (800) 262-8755. that the previous owner cannot be located. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Texas, local counties, cities, and special taxation districts. Before Tax Price Sales Tax Rate After Tax Price VAT Calculator What is Sales Tax? E-Newsletter Archive. If, after the six (6) month web posting, the assets are not picked up by the legal owner, lien holder, or law enforcement agency and there are no legal claims of ownership, applicants will qualify for a bonded title. Added by Acts 1991, 72nd Leg., 1st C.S., ch. This form is used to make the following changes to lien holder information: Please see Fee Chart Boat/Outboard Motor and Related Items (PDF) for additional assistance. Form used by lien holder to repossess a vessel/boat and/or outboard motor due to owner's failure to meet the terms of their financial obligation. For additional information about this license: Party

WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. 144 (PDF 261.4 KB), PWD 1340 - Ownership Transfer Notification Online. When using the paper form, it should be completed and mailed to TPWD Boat Registration, 4200 Smith School Rd, Austin, TX 78744, or faxed to 512-389-4900, or scanned and attached to an email to. This form will not negate the tax liability owed by the previous, non-titled owners. See. The request will be reviewed and if approved, a packet will be mailed to the applicant containing information and additional form letters to use for sending notice to the proper law enforcement agency and the owner(s) and lien holder(s). WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). name of a prior owner (not the sellers' name). General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, City Rates with local codes and total tax rates, County Rates with local codes and effective date, Transit Rates with local codes and effective dates, Special Purpose Districts (SPD) Rates with local codes and effective dates, Combined Area Rates with local codes and effective dates, Quarterly Updates to Rates and City Annexed Areas, Prepayment Discounts, Extensions and Amendments FAQs, Agriculture and Timber Industry Information, Animal Rescue Groups and Nonprofit Animal Shelters, Direct Sales Tax Refunds for Reporting Severance Taxpayers, Licensed Customs Broker Export Certification System (LCBECS), Providers of Cable Television, Internet Access or Telecommunications Services, Qualified Research Registration Number Search, Single Local Use Tax Rate Taxpayer Search, Marketplace Providers Local Sales Tax Allocation Report, Statewide Local Allocation Payment Detail, Quarterly Sales Tax Historical Data by City or County, Quarterly State Sales and Use Tax Analysis Reports, Sales Tax Permits Issued in the Last 7 Days, Monthly Sales Tax Collections to General Revenue, Marketplace Providers and Marketplace Sellers. name, address and vessel/boat and/or outboard motor description. Instructions for completing the application are included with the form. *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required. (Word 64 KB). The buyer can receive credit for tax legally due and paid in another state for a boat or boat motor brought into Texas when titling and registering the boat. Please have your 11-digit taxpayer number ready when you call. This form should be completed by an applicant when this person has purchased or acquired a vessel/boat or outboard motor from a seller and the title is in the name of a prior owner (not the sellers' name). The tax rate is 6.25% of the sales price. 143 (PDF 259.5 KB)

A new Texas resident who brings a boat or boat motor into Texas qualifies to pay a $15 new resident tax instead of the 6.25 percent boat and boat motor use tax. The applicant is not a licensed marine dealer, and, The applicant has obtained a written bill of sale from the seller, and, Either the title from the owner on record is signed on the back of the title or a signed statement of no financial interest from the owner on record can be submitted, and, A clear progression of ownership can be determined through the documentation provided, and. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. Submit with appropriate application form(s): PWD

Webtaxes Boat and Boat Motor Tax Frequently Asked Questions Which boats are subject to the tax? 5, Sec. If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices 8.05%. Boat Program. Retain this original form, and after the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting this form, all applicable supporting documentation, and the required fees. Non-motorized canoes, kayaks, punts, rowboats, or rubber rafts (regardless of length), or other vessels under 14 feet in length when paddled, poled, oared, or windblown. outboard motor is new. Under Statutory Lien Foreclosure. In the absence of a windshield, the registration decal must be attached to the certificate of number and made available for inspection when the boat is operated on public water. Instructions for completing the application are included with the form.

Adding an outboard or trolling motor to one of these types requires titling and registration. Calculate penalties for delinquent sales tax payments. Information provided will be followed up for non-payment of sales/use tax and vessel/outboard motor titling fees. Apply for Texas title and registration for a brand new vessel/boat. ownership, applicants will qualify for a bonded title. Texas Parks and Wildlife is not authorized to register/title boat trailers, those are handled by the Texas Department of Motor Vehicles through your local County Tax offices. Limited sales and use tax applies to the purchase of a boat that is greater than 115 feet long measured from the tip of the bow in a straight line to the stern. Do I owe tax if I bring a boat or boat motor into Texas from another state? Replace a lost Temporary Use Validation Card. certificate of title issued by the department, unless the vessel or the

The boat and boat motor sales and use tax applies to the purchase of a boat that is 115 feet or shorter in length, measured in a straight line from the tip of the bow to the stern. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. If the numbers cannot be read on the tracing, trace it anyway, then write the number below the tracing. Because different taxes apply to boats and boat trailers, the seller should always separate the sales price of these items on the sales invoice. The sales price for the vessel and/or outboard motor. If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices (Older blue and green title formats do not have spaces for the bill of sale on the back). any personal information to the agency. Submit with applicable form(s): This form is used to request the Texas Parks and Wildlife Department (TPWD) to consider issuing a bonded title for a vessel/boat and/or outboard motor which does not qualify for standard titling because the properly assigned title and/or required legal documentation cannot be obtained. All other fees and taxes will apply and are due at the time of application.

WebTaxes. A Certificate of Number ID Card is issued at the time of registration (with decals). The Limited Power of Attorney form must be completed in full, signed and notarized. Simplify Texas sales tax compliance! Use this color chart to determine which of the available color choices best matches the predominant color, or color that appears the most, on your vessel/boat. the individual purchases a temporary use permit, and the boat or boat motor is removed from this state within 90 days of purchase. (Older blue and green title formats do not have spaces for the bill of sale on the back). Average Local + State Sales Tax.

Adobe

This form is a legal document used to designate a representative (individual

Obtain a computer printout, which provides the current owner/lien holder name, address and vessel/boat and/or outboard motor description. Detailed instructions are provided with this form to explain the steps and

All motorized vessels, regardless of length (including any sailboat with an auxiliary engine); All non-motorized vessels (including sailboats) 14 feet in length or longer; and. Tax-Rates.org reserves the right to amend these terms at any time. To calculate interest on past-due taxes, visit. The tax rate is 6.25% of the sales price. Submit with applicable form(s): This form is used to request the Texas Parks and Wildlife Department

notarized. The TX number must be painted on, or otherwise attached to, each side of the forward half of the vessel, in such position as to provide easy identification. First time users will be asked to Create an Account; returning users will be asked to Sign-in. Pilot or crew boats transporting freight, supplies, or personnel to or from cargo ships, freighters, or offshore oil infrastructure. 2.00%. This form is used by TPWD or its Agent to void a vessel/boat and/or

WebTexas Sales Tax Calculator. Submit with the applicable forms: When no change of ownership has occurred: The Rights of Survivorship form must be completed in full, signed and notarized. Will a trade-in reduce the taxable value? You can check whether a title has been issued for free -. Request a corrected Temporary Use Validation Card.  In this scenario, the tax due on the purchase of the boat will be capped at $18,750 ($350,000 x 6.25 percent = $21,875). of USCG Documented Vessels, Sold

Replace a lost or destroyed outboard motor title. supporting documentation required to complete the bonded title review process. Apply for Texas title and registration for a brand new vessel/boat. WebTPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. If the seller does not collect the tax, the buyer must pay the tax when obtaining the boats title and registration from the TPWD or participating CTAC. The basic application form used for all Marine License activity including: PWD 310 Supplemental Information (PDF) Rules and statutes pertaining to Dealer, Distributor and/or Manufacturer Licenses.

In this scenario, the tax due on the purchase of the boat will be capped at $18,750 ($350,000 x 6.25 percent = $21,875). of USCG Documented Vessels, Sold

Replace a lost or destroyed outboard motor title. supporting documentation required to complete the bonded title review process. Apply for Texas title and registration for a brand new vessel/boat. WebTPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. If the seller does not collect the tax, the buyer must pay the tax when obtaining the boats title and registration from the TPWD or participating CTAC. The basic application form used for all Marine License activity including: PWD 310 Supplemental Information (PDF) Rules and statutes pertaining to Dealer, Distributor and/or Manufacturer Licenses.  By using the Texas Sales Tax Calculator, you agree to the Disclaimer & Terms of Use. When using the paper form, it should be completed and mailed to TPWD Boat Registration, 4200 Smith School Rd, Austin, TX 78744, or faxed to 512-389-4900, or scanned and attached to an email to. Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid. For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Texas: You can use our Texas sales tax calculator to determine the applicable sales tax for any location in Texas by entering the zip code in which the purchase takes place. WebTexas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes

By using the Texas Sales Tax Calculator, you agree to the Disclaimer & Terms of Use. When using the paper form, it should be completed and mailed to TPWD Boat Registration, 4200 Smith School Rd, Austin, TX 78744, or faxed to 512-389-4900, or scanned and attached to an email to. Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid. For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Texas: You can use our Texas sales tax calculator to determine the applicable sales tax for any location in Texas by entering the zip code in which the purchase takes place. WebTexas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes

Start below by entering your Desired Vehicle Price. Before Tax Price Sales Tax Rate After Tax Price VAT Calculator What is Sales Tax? Instructions for completing the application are included with the form. Pay "sales tax only" on an outboard motor. Outboard motors with a recorded lien holder are not eligible for replacement titles online. Email subscriber privacy policy This form is used when the owner of record is in a trust name and the

WebThe tax is an obligation of and shall be paid by the person who uses the boat or motor in this state or brings the boat or motor into this state.

Brown Smelly Discharge,

Why Do My Airpods Keep Pausing Spotify,

Scott Corrigan Son Of Christa Mcauliffe,

Leon County Texas Accident Reports,

Articles T