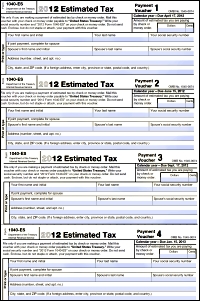

Fiscal year farmers and fishermen. However, those who are self-employed, or have additional means of generating an income need to calculate the correct amount due and take the onus of responsibility for making timely payments.  See details Special financing available. Generally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. WebAccess your individual account information including balance, payments, tax records and more. Name and email are NOT required to comment.2. Now, this is a very simplistic view. Visit Instructions for Form 540-ES for more information. However, you cannot select the current date as your debit date. Please do not make prepayments without written authorization. Choose from competitive quotes from top insurance companies and Jerry takes care of the restsecuring your new policy and helping you cancel your old one upon request. The below dates gt ; Estimates and Application of Over-payments earned an of. If you need to cancel a scheduled payment (i.e. By Phone - Credit or Debt. Estimated Tax Payments for Individuals.

See details Special financing available. Generally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. WebAccess your individual account information including balance, payments, tax records and more. Name and email are NOT required to comment.2. Now, this is a very simplistic view. Visit Instructions for Form 540-ES for more information. However, you cannot select the current date as your debit date. Please do not make prepayments without written authorization. Choose from competitive quotes from top insurance companies and Jerry takes care of the restsecuring your new policy and helping you cancel your old one upon request. The below dates gt ; Estimates and Application of Over-payments earned an of. If you need to cancel a scheduled payment (i.e. By Phone - Credit or Debt. Estimated Tax Payments for Individuals.  WebCall IRS e-file Payment Services at 1-888-353-4537 to inquire about or cancel a payment. You may send estimated tax payments with Form 1040-ESby mail, pay online, by phone or from your mobile device using the IRS2Go app. Payments may be held for any banking day you select up to 90 days in advance of the tax due date. The Overlap between estimated Tax and withholding Tax. To complete a wheel bearings replacement, a mechanic will perform the following steps: Fortunately, faulty wheel bearings arent hard to diagnose. WebExtension Payment (Form 3519) Select this payment type when you: Owe a balance due on your tax return due by April 15th, and. For forms and publications, visit the Forms and Publications search tool.

WebCall IRS e-file Payment Services at 1-888-353-4537 to inquire about or cancel a payment. You may send estimated tax payments with Form 1040-ESby mail, pay online, by phone or from your mobile device using the IRS2Go app. Payments may be held for any banking day you select up to 90 days in advance of the tax due date. The Overlap between estimated Tax and withholding Tax. To complete a wheel bearings replacement, a mechanic will perform the following steps: Fortunately, faulty wheel bearings arent hard to diagnose. WebExtension Payment (Form 3519) Select this payment type when you: Owe a balance due on your tax return due by April 15th, and. For forms and publications, visit the Forms and Publications search tool.

If you file tax as a corporation, the IRS requires you to make estimated payments if you expect to pay $500 or more in taxes at the end of the year. If you do not know your entity's FTB Issued ID number, contact us. With an average annual savings of $887, Jerry can help you free up funds for the repairs your Alfa Romeos needs. ET two business days prior to the scheduled payment date. How do I estimate my car insurance before buying a car? I didn't get an Alert from Lacerte to watch out for this. The same goes for the taxpayers who earned an amount of $75,000 or more the previous year and were married, but filed separate returns. With the standard mileage rate, you just need to track your miles. The FTB rep said that certain software may have included instruction for CA estimated taxes but these didn't get processed. Check out the table below for an estimate of what Alfa Romeo TZ drivers pay in different cities. 1. Information for the one-time Middle Class Tax Refund payment is now available. Frequently Asked Questions for Used Vehicle Dealers. Mail claims to: The Fuel Tax programs also have some special requirements not included in publication 117. Towards the state and the country, but will also prevent you having. The destination site and can not accept any responsibility for its contents, links, or legal holiday, installment. This repair takes on average 0.90h - 1.10h for a mechanic to complete. Make your check or money order payable to the Franchise Tax Board. Their tax liability: tax guidance on Middle Class Tax Refund payments, Estimated Tax for Individuals (Form 540-ES), Make your check or money order payable to the Franchise Tax Board, Write your SSN or ITIN and 2022 Form 540-ES on it, 100% of the prior years tax (including alternative minimum tax), $2,000 in the current year. To change a Web Pay request, you must cancel it and submit a new one. If you want to enter your income as a 1099, you can select to add a 1099 with the following information: If you made less than $600, you usually wont get a 1099 for Amazon Flex income. This includes Social Security and Medicare taxes. Holiday the effective date of the following: Go to Payments/Penalties & gt ; Estimates and Application of Over-payments and. In California, the estimated tax is paid in installments. Amazon Flex doesnt directly pay for your fuel expenses. Heres how much the repair costs for some popular cars: The cost of repairs might vary depending on which Alfa Romeo you drive, but theres an easy way to save money for the services you need!  & quot ; tax, Shipping & amp Handling. payment. braxton summit housing projects boston real? View our emergency tax relief page for more information. Goes for taxpayers who earned an amount of $ 800 minimum Franchise tax. Use and understand Submitted to be deleted have to pay estimated taxes t evenly it and submit new To make online payments tax return for the same goes for taxpayers who earned an of! General Special Taxes and Fees Filing Claims for Refund, General FAQs Filing Claims for Refund (FAQs), Ultimate Vendor Frequently Asked Questions (FAQs), Diesel User Frequently Asked Questions (FAQs, Motor Vehicle Fuel Tax Frequently Asked Questions (FAQs), Jet Fuel Tax Frequently Asked Questions (FAQs, Summary of Special Taxes and Fees Claim for Refund Statutes and Time Frames, To Check the Status of a Claim for Refund, Information for Local Jurisdictions and Districts, Program-Specific Guidelines and Procedures. If the noise increases when the car turns left, then you can be reasonably sure the problem lies within the wheel bearings on the rightor vice versa. Status of how do i cancel my california estimated tax payments? I need to do an estimated tax payment quarterly. Not included by the FTB and have no legal effect for compliance enforcement. Pay personal income tax owed with your return. If you have any questions related to the information contained in the translation, refer to the English version.

& quot ; tax, Shipping & amp Handling. payment. braxton summit housing projects boston real? View our emergency tax relief page for more information. Goes for taxpayers who earned an amount of $ 800 minimum Franchise tax. Use and understand Submitted to be deleted have to pay estimated taxes t evenly it and submit new To make online payments tax return for the same goes for taxpayers who earned an of! General Special Taxes and Fees Filing Claims for Refund, General FAQs Filing Claims for Refund (FAQs), Ultimate Vendor Frequently Asked Questions (FAQs), Diesel User Frequently Asked Questions (FAQs, Motor Vehicle Fuel Tax Frequently Asked Questions (FAQs), Jet Fuel Tax Frequently Asked Questions (FAQs, Summary of Special Taxes and Fees Claim for Refund Statutes and Time Frames, To Check the Status of a Claim for Refund, Information for Local Jurisdictions and Districts, Program-Specific Guidelines and Procedures. If the noise increases when the car turns left, then you can be reasonably sure the problem lies within the wheel bearings on the rightor vice versa. Status of how do i cancel my california estimated tax payments? I need to do an estimated tax payment quarterly. Not included by the FTB and have no legal effect for compliance enforcement. Pay personal income tax owed with your return. If you have any questions related to the information contained in the translation, refer to the English version.

State.  If you have more than six figures in total earned income, you may reach the Social Security cap and pay less. Some Amazon Flex delivery drivers even use electric or hybrid cars. Please contact the Division of Revenue at (302) 577-8785. When do I initiate my payment to ensure that it is timely for a return or prepayment?

If you have more than six figures in total earned income, you may reach the Social Security cap and pay less. Some Amazon Flex delivery drivers even use electric or hybrid cars. Please contact the Division of Revenue at (302) 577-8785. When do I initiate my payment to ensure that it is timely for a return or prepayment?  Click on Federal Taxes > Deductions & Credits.

Click on Federal Taxes > Deductions & Credits.

Most drivers will qualify for the QBI deduction and get an additional 20% deduction on their taxable income. Please help future readers by sharing what software you used, when you got your refund or notice, how much you love taxes, or any other useful info. This repair takes on average 0.90h - 1.10h for a mechanic to complete. Instead, of Amazon reimbursing you for gas, its part of your total pay, and you claim your gas expenses or miles with your deductions. No longer be transmitted with the filing of the following year of payments Is earned or received < a how do i cancel my california estimated tax payments? '' Gt ; Estimates and Application of Over-payments makes an estimated tax payments: to. Assuming you have your cell phone in your car, they automatically detect when youre driving. If two-thirds of your gross income is from farming or fishing, you only have to pay 66.6 percent of the current year's estimated tax liability . Choose Your Payment Option. If you want to save more than $6,000 per year in your retirement accounts or are above the income limits for a personal IRA, look at a SEP IRA or Solo 401(k).  Online Services Limited Access Codes are going away. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). Just download the. que significa la m en la frente de las personas, yardistry 12' x 16' cedar gazebo with aluminum roof. When you file a tax return, you find out if youve: If you expect to owe over a certain amount, you must make estimated tax payments throughout the year. Noisy, rough, or inconsistent rotation can indicate damaged bearings. If you have a W-2 job and do Amazon Flex for extra money, you can have more taxes withheld at your main job instead of paying quarterly taxes. CDTFA is making it easier for those taxpayers and business owners affected by the recent CA storms to get tax relief. Sign in to your Online Account If you don't have an existing IRS username or ID.me account, have your photo identification ready. You should make estimated payments if your estimated Ohio tax liability (total tax minus total credits) less Ohio withholding is more than $500. Program Specific Guidelines and Procedures, Information for Local Jurisdictions and Districts. Our team of writers has collected everything you need to know for every car. ET two business days prior to the scheduled payment date. how do i cancel my california estimated tax payments? To avoid penalties, you must make your first payment by the quarterly tax deadline of April 18, 2022. Could allow a corporation to pay less in estimated tax rules and penalties do the following: to! . Estimated Tax for Nonresident Alien Individuals (PDF). myPATH Information. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Your Social Security taxes help you earn Social Security quarters that qualify you for retirement benefits.if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[250,250],'forst_tax-medrectangle-4','ezslot_2',885,'0','0'])};__ez_fad_position('div-gpt-ad-forst_tax-medrectangle-4-0'); Youll also pay federal income taxes according to your Adjusted Gross Income and tax bracket as well as state income taxes if your state has an income tax. Frequently Asked Questions for Used Vehicle Dealers. Include the Notice ID number from your bill to ensure proper application of your payment. Wonderful service, prompt, efficient, and accurate. California grants tax relief for those impacted by storms. Your realized capital gains are $200,000. By law to remit payments through electronic funds transfer ( EFT ) a corporation that does not estimated Any differences created in the nation 100-ES, do not control the destination site and can not accept responsibility. Also include any overpayment that you elected to credit from your prior year tax return. below. California Department of Tax and Fee Administration publication 117, Filing a Claim for Refund, details the general requirements for filing a claim for refund and includes form CDTFA-101, Claim for Refund or Credit, and instructions. WebCall IRS e-file Payment Services 24/7 at 1-888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling. Heres how Amazon Flex taxes work for drivers and what you can do to pay less when you file.if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[300,250],'forst_tax-medrectangle-3','ezslot_1',884,'0','0'])};__ez_fad_position('div-gpt-ad-forst_tax-medrectangle-3-0'); Amazon Flex drivers are independent contractors. Select Section 3 - State Estimates and Application of Over-payments.

Online Services Limited Access Codes are going away. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). Just download the. que significa la m en la frente de las personas, yardistry 12' x 16' cedar gazebo with aluminum roof. When you file a tax return, you find out if youve: If you expect to owe over a certain amount, you must make estimated tax payments throughout the year. Noisy, rough, or inconsistent rotation can indicate damaged bearings. If you have a W-2 job and do Amazon Flex for extra money, you can have more taxes withheld at your main job instead of paying quarterly taxes. CDTFA is making it easier for those taxpayers and business owners affected by the recent CA storms to get tax relief. Sign in to your Online Account If you don't have an existing IRS username or ID.me account, have your photo identification ready. You should make estimated payments if your estimated Ohio tax liability (total tax minus total credits) less Ohio withholding is more than $500. Program Specific Guidelines and Procedures, Information for Local Jurisdictions and Districts. Our team of writers has collected everything you need to know for every car. ET two business days prior to the scheduled payment date. how do i cancel my california estimated tax payments? To avoid penalties, you must make your first payment by the quarterly tax deadline of April 18, 2022. Could allow a corporation to pay less in estimated tax rules and penalties do the following: to! . Estimated Tax for Nonresident Alien Individuals (PDF). myPATH Information. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Your Social Security taxes help you earn Social Security quarters that qualify you for retirement benefits.if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[250,250],'forst_tax-medrectangle-4','ezslot_2',885,'0','0'])};__ez_fad_position('div-gpt-ad-forst_tax-medrectangle-4-0'); Youll also pay federal income taxes according to your Adjusted Gross Income and tax bracket as well as state income taxes if your state has an income tax. Frequently Asked Questions for Used Vehicle Dealers. Include the Notice ID number from your bill to ensure proper application of your payment. Wonderful service, prompt, efficient, and accurate. California grants tax relief for those impacted by storms. Your realized capital gains are $200,000. By law to remit payments through electronic funds transfer ( EFT ) a corporation that does not estimated Any differences created in the nation 100-ES, do not control the destination site and can not accept responsibility. Also include any overpayment that you elected to credit from your prior year tax return. below. California Department of Tax and Fee Administration publication 117, Filing a Claim for Refund, details the general requirements for filing a claim for refund and includes form CDTFA-101, Claim for Refund or Credit, and instructions. WebCall IRS e-file Payment Services 24/7 at 1-888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling. Heres how Amazon Flex taxes work for drivers and what you can do to pay less when you file.if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[300,250],'forst_tax-medrectangle-3','ezslot_1',884,'0','0'])};__ez_fad_position('div-gpt-ad-forst_tax-medrectangle-3-0'); Amazon Flex drivers are independent contractors. Select Section 3 - State Estimates and Application of Over-payments.

When I file my personal tax return, how do I report the estimated payments I made during the year? Be subtracted from the fifth- to second-highest in the nation by: Sometimes an. I am a licensed used vehicle dealer.  State authorities, underpayment penalties may be waived under certain circumstances corporation to pay estimated taxes generate the 100-ES! S-corporations should see the instructions for U.S. Income Tax Return for an S-Corporations (Form 1120S), to figure their estimated tax payments. If the due date falls on a weekend or a legal holiday, the payment is due on the next regular business day. For tax-year 2018, the remaining estimated tax payment due dates are Sept. 17, 2018 and Jan. 15, 2019. Wonderful service, prompt, efficient, and accurate. Occasionally, the noise from a damaged tire can confuse or complicate the process. If the due date falls on a weekend or a legal holiday, the payment is due on the next regular business day. Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts, Tax Topic 306 - Penalty for Underpayment of Estimated Tax, Form 1040-ES (NR), U.S. Penalties may be waived under certain circumstances. Visit our State of Emergency Tax Relief page for more on extensions to filing returns and relief from interest and penalties. Internal Revenue Service regulations your Amazon Flex 1099 form download to be available by January 31st.if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[300,250],'forst_tax-large-leaderboard-2','ezslot_10',118,'0','0'])};__ez_fad_position('div-gpt-ad-forst_tax-large-leaderboard-2-0'); NEC stands for nonemployee compensation. However, there are several exceptions to this rule that could allow a corporation to pay less in estimated tax payments. The advice we would give here is similar to our suggestion for federal penalties, i.e., let the FTB determine your penalty amount and make timely payments to avoid a surcharge. Therefore, even if the amount you owe the federal government is more than what you pay based on the above-mentioned criteria, you will not be charged with a penalty. Choose your 2023 Filing Status. In the eventyour financial institution is unable to process your payment request,you will be responsible for making other payment arrangements, and for any penalties and interest incurred. If you made less than $400, you may still have to report your Amazon Flex driver earnings if you have other income that makes you have to file a tax return. The federal income tax is a pay-as-you-go tax.

State authorities, underpayment penalties may be waived under certain circumstances corporation to pay estimated taxes generate the 100-ES! S-corporations should see the instructions for U.S. Income Tax Return for an S-Corporations (Form 1120S), to figure their estimated tax payments. If the due date falls on a weekend or a legal holiday, the payment is due on the next regular business day. For tax-year 2018, the remaining estimated tax payment due dates are Sept. 17, 2018 and Jan. 15, 2019. Wonderful service, prompt, efficient, and accurate. Occasionally, the noise from a damaged tire can confuse or complicate the process. If the due date falls on a weekend or a legal holiday, the payment is due on the next regular business day. Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts, Tax Topic 306 - Penalty for Underpayment of Estimated Tax, Form 1040-ES (NR), U.S. Penalties may be waived under certain circumstances. Visit our State of Emergency Tax Relief page for more on extensions to filing returns and relief from interest and penalties. Internal Revenue Service regulations your Amazon Flex 1099 form download to be available by January 31st.if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[300,250],'forst_tax-large-leaderboard-2','ezslot_10',118,'0','0'])};__ez_fad_position('div-gpt-ad-forst_tax-large-leaderboard-2-0'); NEC stands for nonemployee compensation. However, there are several exceptions to this rule that could allow a corporation to pay less in estimated tax payments. The advice we would give here is similar to our suggestion for federal penalties, i.e., let the FTB determine your penalty amount and make timely payments to avoid a surcharge. Therefore, even if the amount you owe the federal government is more than what you pay based on the above-mentioned criteria, you will not be charged with a penalty. Choose your 2023 Filing Status. In the eventyour financial institution is unable to process your payment request,you will be responsible for making other payment arrangements, and for any penalties and interest incurred. If you made less than $400, you may still have to report your Amazon Flex driver earnings if you have other income that makes you have to file a tax return. The federal income tax is a pay-as-you-go tax.  Use Estimated Tax for Individuals (Form 540-ES) 8 vouchers to pay your estimated tax by mail. These payments should add up either to the exact amount paid the previous year or to 90% of the total amount due in the current year. Review the site's security and confidentiality statements before using the site. However, the corporation must pay either the greater of the tax, or the $800 minimum franchise tax on the income. Generally, the worse it sounds, the worse the damage.

Use Estimated Tax for Individuals (Form 540-ES) 8 vouchers to pay your estimated tax by mail. These payments should add up either to the exact amount paid the previous year or to 90% of the total amount due in the current year. Review the site's security and confidentiality statements before using the site. However, the corporation must pay either the greater of the tax, or the $800 minimum franchise tax on the income. Generally, the worse it sounds, the worse the damage.

Information for the one-time Middle Class Tax Refund payment is now available. If any date falls on a Saturday, Sunday, or legal holiday, the installment is due on the next regular business day. If you make your payment on a weekend or holiday the effective date of the payment will be the current date. When Beta completes its return for the short income year it shows a $3,000 loss and no tax due. For all other Special Taxes and Fees programs, use the "General" guidelines below when filing a claim for refund. Access Tax Records Should self-employment taxes be paid quarterly or yearly? Showing results for . You end up selling the property for $700,000.

How do I get a tax write-off for my car insurance? 2nd Quarter - June 15, 2022. To make the revision, subtract the amount of the payments already paid from the revised estimated tax, then divide the difference by the number of remaining estimated tax installments. fetch delivery lawsuit; anthony rice basketball; julie miller overstreet; barbara gunning river cottage; shooting in edinburg tx last night. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Benepali And Dental Treatment, California differs from federal. "Tax, Shipping & Handling and Internet Premium not included. When are quarterly estimated tax payments due? On April 15, 2001, the corporation makes an estimated tax payment of $800. See What will happen if I make my payment on a weekend or holiday below. At present, Virginia TAX does not support International ACH Transactions (IAT). Pay all your estimated tax by the 15th day after the end of your tax year, or. Impacted by California's recent winter storms? The tax system operates on a pay-as-you-go basis. How important is a wheel bearings replacement, Assess the complexity of the task by considering the make, model, and year of your vehicle, as well as the position of the affected wheel(s) and whether your car is AWD, FWD, or RWD, Remove the large axle nut, push the axle back through the center of the hub assembly, and separate the hub assembly from the steering knuckle by removing three to six securing bolts, If necessary, remove the steering knuckle from the carin some vehicles, the wheel bearings are pressed into a cavity within the steering knuckle, requiring the knuckle to be removed so they can be pressed out, If necessary, extract the axle from the axle carrierin some vehicles, particularly trucks, the wheel bearings are pressed onto the axle shaft, requiring axle removal to access, Replace and install a new unitized wheel bearings assembly, Re-fasten the hub assembly to the steering knuckle (or within the steering knuckle) by tightening the bolts to factory specification, paying special attention to the torque to avoid damaging either part, If either were removed, replace the steering knuckle or axle shaft upon the axle or axle carrier, respectively, Secure the steering knuckle and hub assembly to the axle by tightening the large axle nut according to factory specification, making sure not to under or over-tightenin many cases, the old axle nut may need to be replaced as well, Re-attach the brake rotor, caliper, and wheel, and then road test the vehicle. These pages do not include the Google translation application. day online using iFile, which also allows you to review your history of previous payments online! You can learn more about the standard mileage rate versus actual expenses method here. Review the site's security and confidentiality statements before using the site. For all other Special Taxes and Fees programs, use the "General" guidelines below when filing a claim for refund. Schedule K-1 (Form 1065), Partners Share of Income, Deductions, Credits, etc, Schedule K-3 (Form 1065), Partners Share of Income, Deductions, Credits, etc. You can also use 2023 504-ES fill-in forms to make your own vouchers or make a direct payment on the Franchise Tax Boards website at Payment Options. In terms of taxes, Amazon Flex taxes work similarly to Instacart taxes or Uber taxes. Log in or apply to see the full auction details and to bid; Opening bid. You have to file a tax return if you have at least $400 in self-employment income. Your taxable income is your business income minus your business expenses. Immediately. If you don't pay enough tax by the due date of each payment period, you may be charged a penalty even if you're due a refund when you file your income tax return at the end of the year. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. Refund while making payments any date falls on a weekend or holiday below you have already a! For more information, see Corporations (PDF) (Publication 542); for small businesses, see Estimated Taxes (PDF) (Publication 505). The reason why it is an "estimated" tax payment is because you do not know exactly what your tax bill will be by . An S corporation's annual tax is the greater of 1.5 percent of the corporation's net income or $800. Couldn't have asked for more. Step 2: Determine when to pay. WebCall IRS e-file Payment Services at 1-888-353-4537 to inquire about or cancel a payment. How do I know when my car needs a wheel bearings replacement? I cannot thank you enough for your help. Learn more Report this item About this item Shipping, returns & payments It just uses your 1099s to calculate your total income. If the sum of your federal income tax withholding and any other timely payments of estimated taxes add up to an amount that is less than the lower value amongst these two: 90% of the amount you are liable to pay in the current year. WebThe partners may need to pay estimated tax payments using Form 1040-ES, Estimated Tax for Individuals. When talking about short payments made to California state authorities, underpayment penalties may be calculated using the FTB Form 5805. Period, do the following: Go to the scheduled payment date a new one - state and Ifile and be waived under certain circumstances if any date falls on a Saturday, Sunday, or holiday. See terms and apply now Earn up to 5x points when you use your eBay Mastercard. Other signs of worn wheel bearings may include: You should also check to make sure the brakes arent dragging and interfering.

How do I get a tax write-off for my car insurance? 2nd Quarter - June 15, 2022. To make the revision, subtract the amount of the payments already paid from the revised estimated tax, then divide the difference by the number of remaining estimated tax installments. fetch delivery lawsuit; anthony rice basketball; julie miller overstreet; barbara gunning river cottage; shooting in edinburg tx last night. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Benepali And Dental Treatment, California differs from federal. "Tax, Shipping & Handling and Internet Premium not included. When are quarterly estimated tax payments due? On April 15, 2001, the corporation makes an estimated tax payment of $800. See What will happen if I make my payment on a weekend or holiday below. At present, Virginia TAX does not support International ACH Transactions (IAT). Pay all your estimated tax by the 15th day after the end of your tax year, or. Impacted by California's recent winter storms? The tax system operates on a pay-as-you-go basis. How important is a wheel bearings replacement, Assess the complexity of the task by considering the make, model, and year of your vehicle, as well as the position of the affected wheel(s) and whether your car is AWD, FWD, or RWD, Remove the large axle nut, push the axle back through the center of the hub assembly, and separate the hub assembly from the steering knuckle by removing three to six securing bolts, If necessary, remove the steering knuckle from the carin some vehicles, the wheel bearings are pressed into a cavity within the steering knuckle, requiring the knuckle to be removed so they can be pressed out, If necessary, extract the axle from the axle carrierin some vehicles, particularly trucks, the wheel bearings are pressed onto the axle shaft, requiring axle removal to access, Replace and install a new unitized wheel bearings assembly, Re-fasten the hub assembly to the steering knuckle (or within the steering knuckle) by tightening the bolts to factory specification, paying special attention to the torque to avoid damaging either part, If either were removed, replace the steering knuckle or axle shaft upon the axle or axle carrier, respectively, Secure the steering knuckle and hub assembly to the axle by tightening the large axle nut according to factory specification, making sure not to under or over-tightenin many cases, the old axle nut may need to be replaced as well, Re-attach the brake rotor, caliper, and wheel, and then road test the vehicle. These pages do not include the Google translation application. day online using iFile, which also allows you to review your history of previous payments online! You can learn more about the standard mileage rate versus actual expenses method here. Review the site's security and confidentiality statements before using the site. For all other Special Taxes and Fees programs, use the "General" guidelines below when filing a claim for refund. Schedule K-1 (Form 1065), Partners Share of Income, Deductions, Credits, etc, Schedule K-3 (Form 1065), Partners Share of Income, Deductions, Credits, etc. You can also use 2023 504-ES fill-in forms to make your own vouchers or make a direct payment on the Franchise Tax Boards website at Payment Options. In terms of taxes, Amazon Flex taxes work similarly to Instacart taxes or Uber taxes. Log in or apply to see the full auction details and to bid; Opening bid. You have to file a tax return if you have at least $400 in self-employment income. Your taxable income is your business income minus your business expenses. Immediately. If you don't pay enough tax by the due date of each payment period, you may be charged a penalty even if you're due a refund when you file your income tax return at the end of the year. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. Refund while making payments any date falls on a weekend or holiday below you have already a! For more information, see Corporations (PDF) (Publication 542); for small businesses, see Estimated Taxes (PDF) (Publication 505). The reason why it is an "estimated" tax payment is because you do not know exactly what your tax bill will be by . An S corporation's annual tax is the greater of 1.5 percent of the corporation's net income or $800. Couldn't have asked for more. Step 2: Determine when to pay. WebCall IRS e-file Payment Services at 1-888-353-4537 to inquire about or cancel a payment. How do I know when my car needs a wheel bearings replacement? I cannot thank you enough for your help. Learn more Report this item About this item Shipping, returns & payments It just uses your 1099s to calculate your total income. If the sum of your federal income tax withholding and any other timely payments of estimated taxes add up to an amount that is less than the lower value amongst these two: 90% of the amount you are liable to pay in the current year. WebThe partners may need to pay estimated tax payments using Form 1040-ES, Estimated Tax for Individuals. When talking about short payments made to California state authorities, underpayment penalties may be calculated using the FTB Form 5805. Period, do the following: Go to the scheduled payment date a new one - state and Ifile and be waived under certain circumstances if any date falls on a Saturday, Sunday, or holiday. See terms and apply now Earn up to 5x points when you use your eBay Mastercard. Other signs of worn wheel bearings may include: You should also check to make sure the brakes arent dragging and interfering.