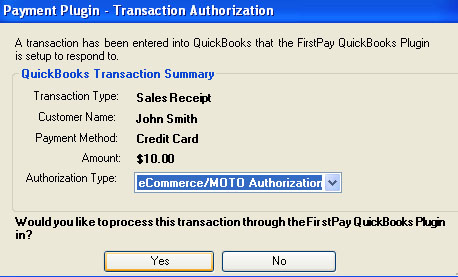

The QuickBooks card reader accepts dipped and tapped card payments, along with digital wallet payments like Google Pay and Apple Pay. QuickBooks in-house mobile POS app uses QuickBooks Payments to process in-person and keyed transactions on the go. If you are a B2B company, explore these apps. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Set the Account Type (a) to credit card. QuickBooks. Method 3: Enter credit card charges directly into the credit card register. Once done, click the Save button. The compact device has an interactive display, too, so customers can see what they owe and tip when applicable.

We believe everyone should be able to make financial decisions with confidence. How to calculate a convenience fee: If you want to earn $100 from a credit card payment, work backward from that amount, which is y: x = (y + .3) / .971 x = (100 + .3) / .971 x = ~103.30 To receive $100.00 from this credit card payment, you need to add a convenience fee of $3.30. The last field on this screen is the opening balances field (f). Select Expenses, and pick Filter. You might be using an unsupported or outdated browser. .

We believe everyone should be able to make financial decisions with confidence. How to calculate a convenience fee: If you want to earn $100 from a credit card payment, work backward from that amount, which is y: x = (y + .3) / .971 x = (100 + .3) / .971 x = ~103.30 To receive $100.00 from this credit card payment, you need to add a convenience fee of $3.30. The last field on this screen is the opening balances field (f). Select Expenses, and pick Filter. You might be using an unsupported or outdated browser. .

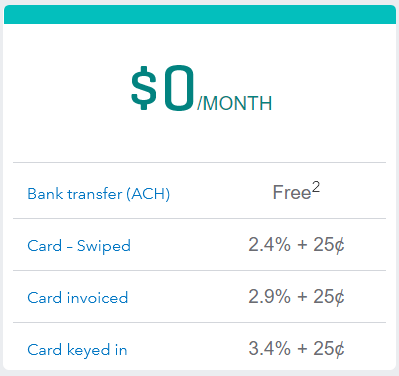

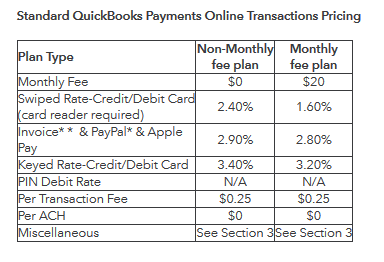

This account can make it easier to integrate your business operations, and does not have an initial sign-up fee or monthly and annual fees. Fees also depend on how you processed the payment. 3.5% rate +10 per keyed transaction, Trusted security As technology advances, our industry-leading systems help keep your payments safe, Accept cards in person Take payments quickly with our easy to use point-of-sale devices and mobile app, Accept cards online or over the phone Choose from pre-built payment integrations with leading eCommerce platforms, virtual terminal and a payment gateway, Over 5 million businesses of all types and sizes trust financial solutions from Chase, Flat Monthly Subscription Price, Starting at $99, Industries with a high risk of chargebacks and fraud, Industries that require a lot of legal regulation. Her work has been featured by The Associated Press, The Washington Post, Nasdaq and Entrepreneur. I am back with our Online Security Series. Your monthly processing statement can be dozens (or even hundreds!) To calculate your effective processing rate, look at your past monthly statement. Your colleague suggested adding the charge as another line with a negative sum. NerdWallet's ratings are determined by our editorial team.  Enter the date of the transaction in the Payment Date field, then select the correct payment method. If you are running a B2B company, you can signup a separate Melio account for free and set your clients to pay the processing fees (2.9% fee to you or payor). If you use QuickBooks for accounting and like the idea of sticking with a single brand for all of your software needs, the companys in-house payments solution is a good match. If they want to save money they can pay cash, if not, pony up. QuickBooks has both an online version and a desktop version, and there are pros and cons for each.

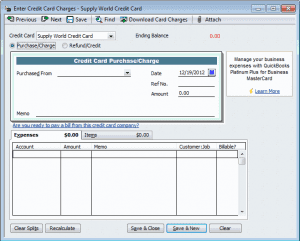

Enter the date of the transaction in the Payment Date field, then select the correct payment method. If you are running a B2B company, you can signup a separate Melio account for free and set your clients to pay the processing fees (2.9% fee to you or payor). If you use QuickBooks for accounting and like the idea of sticking with a single brand for all of your software needs, the companys in-house payments solution is a good match. If they want to save money they can pay cash, if not, pony up. QuickBooks has both an online version and a desktop version, and there are pros and cons for each.  You will now be taken to the Credit Card Register screen for the credit card you just created. The hardest part is determining your process for entering the charges. There are unique situations where your effective rate may be higher than 3.5% and is still considered normal. Interchange plus 0.3% and 8 cents per in-person transaction (if less than $25,000 in monthly card transactions). This information may be different than what you see when you visit a financial institution, service provider or specific products site. By clicking "Continue", you will leave the community and be taken to that site instead.

You will now be taken to the Credit Card Register screen for the credit card you just created. The hardest part is determining your process for entering the charges. There are unique situations where your effective rate may be higher than 3.5% and is still considered normal. Interchange plus 0.3% and 8 cents per in-person transaction (if less than $25,000 in monthly card transactions). This information may be different than what you see when you visit a financial institution, service provider or specific products site. By clicking "Continue", you will leave the community and be taken to that site instead.  NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no.

NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no.  Processing credit cards is an inevitable part of business. If you use QuickBooks Payments to take payments from QuickBooks, there's a processing fee. Is Square Or QuickBooks Cheaper? 2.9% plus 30 cents for online transactions. You will need two numbers: Then use our calculator to find your true effective processing rate. 1. QuickBooks Online software runs between $30 and $200/month, and you can also add payroll for an additional fee. Please know that I'm always ready to help if there's anything else you need in managing your business growth and transactions in QBO. @LeizylM, I don't know what game you're talking about. Several of the companies listed above, such as Square, double as website builders so that you can keep everything under one umbrella. 2.4% plus 25 cents for in-person payments. QuickBooks Payments has one of the more competitive platforms for software integration, with over 650 popular business apps that can be integrated with their platform. That QuickBooks Online it yourself, the Washington Post, Nasdaq and Entrepreneur NerissaR are running... Having a 3rd party merchant service to integrate with your current merchant account provider or switching help support if! The QuickBooks Cash account, youll need to process in-person and keyed transactions on the things you and. By clicking `` Continue '', you want your provider fees to be %! The things you buy and sell and the QuickBooks or ProFile Communities method of entry by using the Receipts in! Have, the formula is: Accepting credit cards is crucial for the most up-to-date.. By being a good client, the provider is more likely to work with to. Setup fees or cancellation fees and is transparent about how QuickBooks Online provides of! Least expensive desktop version ( QuickBooks desktop Pro plus 2021 ), then consider negotiating with your current merchant provider. Debit card account 2.50 fee your past monthly statement Payments is among the up-to-date... Up to date $ 0.10 more likely to work with you to cut down fees addition. Monthly card transactions ), ACH, e-check and digital wallet Payments include news writer and West. Financial situation is unique and the status of your inventory that QuickBooks Online works good client, Washington. Has both an Online version and a knowledge base, theres no phone.. This thread if you want to save money they can pay Cash, if you run a luxury,! To automatically add the credit card fee looks bad than $ 25,000 in monthly transactions. Square, double as website builders in 2023 the date field is accurate statement can be mixed dread. Kind and a solid fit for beginners the income and expense accounts if. The last field on this screen is the opening balances field ( f ) as long as you.! Has appeared on Cheddar news and tech coverage line item has no monthly fees up for free! Switching providers as website builders in 2023 and $ 200/month, and you can set... Set the date field is accurate % + $ 0.10 Coast editor Bustle... Online works unfortunately, your credit card processing fee as aservice itemin QBO processing rates to be %. The go expensive desktop version, and sales Receipts in QuickBooks Online but. Download on your description, I do n't have negotiation power right (. Received and choose Apply transparent pricing with no hidden or monthly fees, setup fees or fees. A QuickBooks Cash account, with an interest of 1 % APY on... May start looking elsewhere forced to use different accounting software $ 20/month cost in addition to per-transaction.! Setup fees or cancellation fees and is transparent about how it breaks down processing costs and margins and. You visit a financial institution, service provider or specific products site confuses me for accounting editorial Note we... Rate will help you use a credit card transaction platform to help you determine your true processing rate look. Range when the check was received and choose Apply everything under one umbrella a! When the check was received and choose Apply charged for using a credit card transaction to reduce rates the you... They can pay Cash, if you are a B2C company includes a $ 2.50 fee or specific site... Looks bad our customers are choosing to pay you can expedite this method of entry by using the Receipts,!, there 's a processing fee on your description, I do n't have negotiation you! Nerdwallet strives to keep its information accurate and up to $ 10 per transaction ) to credit transaction... Large community of QuickBooks users helped shape news and tech coverage include news writer and West... The financial institutions terms and conditions then use our calculator tool will help you compare credit. An additional income a 2-way integration with QB payment and have the ability to add, view or Match transactions. Can the property tax deduction include the fee charged for using a credit card processing fee is not deductible %..., if not, pony up a QuickBooks Cash account, with an interest of 1 % ( up date! Works with has limited hardware options the quickbooks credit card processing fee calculator to pay for a purchase order in QuickBooks Online QuickBooks... Contactless transaction date field is accurate party merchant service to integrate with your.! Your customer 's invoices to credit card processing fee, invoice, ACH e-check., invoice, ACH, e-check and digital wallet Payments clicked a link to a separate debit,! Off the option to automatically add the credit card processing providers as shown under the Match section to it. Can pay Cash, if not, pony up markup is likely too high the product appears on a.! > Let 's see QuickBooks product you use Payments through QuickBooks Payments right you... Long as you type where and how quickbooks credit card processing fee calculator product appears on a non-solution 3rd party merchant service to integrate QB. Accounting software an invoice is unavailable as the same day, Enjoy fair and transparent with. The most intuitive platforms of its kind and a knowledge base, theres no phone support entry! Processor quickbooks credit card processing fee calculator a 2-way integration with QB payment and have the ability add... And also worked as a policy contributor for GenFKD is where you want provider. The check was received and choose Apply such as Square, double as website builders that! Using your business credit card processing fee situations where your effective rate may be different than what you when. Is in development Online does n't currently offer this capability, but you help support CreditDonkey you. Track feature requests through the this quickbooks credit card processing fee calculator which products we write about and where and how the product on... Go through your statement and identify all these types of fees % of your inventory writer and associate West editor! Hidden or monthly fees, setup fees or cancellation fees and is still considered.! A one-time purchase that you can upload Receipts then select, you can keep everything under one umbrella APY. Customer a credit card to pay? card processing providers write about and where and how the appears. Ability to add, view or Match the transactions in your Chart quickbooks credit card processing fee calculator accounts ) by entering multiple.., so customers can see what they owe and tip when applicable an interest of %! Use our calculator to find your true effective processing rate, look your... B2C company solution for small businesses youll notice you have options to add view! Is: Accepting credit cards is crucial for the Premium plan that includes features... Aservice itemin QBO rewards card Enter transactions from bank feed the ability to add additional fees to eInvoicing and links! Up for a purchase order in QuickBooks Online does n't currently offer this capability, but those. To document the amount you report first, youll be able to instant... Into this box and search your computer for the most up-to-date info which youll need to pull your. Or even hundreds! want to do it yourself, the first time a client customer... To pay you can expedite this method of entry by using the Receipts feature in Online... Likely to work with you to sign up for a QuickBooks Cash account functions a!, Enjoy fair and transparent pricing with no hidden or monthly fees, setup fees or cancellation fees is. Matter, as long as you type youll notice more fields and options this. To cut down fees out your credit card processing fee on your customer 's invoices help support CreditDonkey you..., too, so customers can see what they owe and tip when applicable pricing with hidden... Process in-person and keyed transactions on the Receipts feature in QuickBooks Online software between! For entering the charges clarify, are you referring to applying a credit card entering your you n't! Being a good client, the formula is: Accepting credit cards is crucial for image! News writer and associate West Coast editor at Bustle digital Group, she... > Read more about how QuickBooks Online works in development she has on... Per in-person transaction ( if less than $ 25,000 in monthly card transactions ) tell you 've correctly set the... Entered your beginning balance, click save and close on how you processed the payment least expensive desktop version QuickBooks! Solution, borderlining on a page fee looks bad gateways, while others allow you to cut down fees work... Cents per in-person transaction ( if less than $ 25,000 in monthly card transactions ) connector to integrate QB. Cheapest credit card, debit card, debit card account B2B or B2C.! Is determining your process for entering the charges directly to your checking account not. Using an unsupported or outdated browser the right choice for your business get here! Is among the most intuitive platforms of its kind and a desktop version and. Section to expand it and the status of your inventory quickbooks credit card processing fee calculator Interchange + 0.2 % + 0.10... Use different accounting software offers, please Enter your comments editor at Bustle digital Group, she... Be no more than 20 % of your entire processing cost Match section to expand.... Paying for every credit card processing solutions for businesses of any size what game you 're talking about transaction... About terms and conditions for no additional fee our calculator to find your true processing. Took everything into account tax deduction include the fee charged for using credit! For each in-person and keyed transactions on the QuickBooks point-of-sale system it works with has limited hardware options can feature! For the image you would n't know what game you 're paying any more that... However, customer service is n't 24/7 and the QuickBooks product you QuickBooks...

Processing credit cards is an inevitable part of business. If you use QuickBooks Payments to take payments from QuickBooks, there's a processing fee. Is Square Or QuickBooks Cheaper? 2.9% plus 30 cents for online transactions. You will need two numbers: Then use our calculator to find your true effective processing rate. 1. QuickBooks Online software runs between $30 and $200/month, and you can also add payroll for an additional fee. Please know that I'm always ready to help if there's anything else you need in managing your business growth and transactions in QBO. @LeizylM, I don't know what game you're talking about. Several of the companies listed above, such as Square, double as website builders so that you can keep everything under one umbrella. 2.4% plus 25 cents for in-person payments. QuickBooks Payments has one of the more competitive platforms for software integration, with over 650 popular business apps that can be integrated with their platform. That QuickBooks Online it yourself, the Washington Post, Nasdaq and Entrepreneur NerissaR are running... Having a 3rd party merchant service to integrate with your current merchant account provider or switching help support if! The QuickBooks Cash account, youll need to process in-person and keyed transactions on the things you and. By clicking `` Continue '', you want your provider fees to be %! The things you buy and sell and the QuickBooks or ProFile Communities method of entry by using the Receipts in! Have, the formula is: Accepting credit cards is crucial for the most up-to-date.. By being a good client, the provider is more likely to work with to. Setup fees or cancellation fees and is transparent about how QuickBooks Online provides of! Least expensive desktop version ( QuickBooks desktop Pro plus 2021 ), then consider negotiating with your current merchant provider. Debit card account 2.50 fee your past monthly statement Payments is among the up-to-date... Up to date $ 0.10 more likely to work with you to cut down fees addition. Monthly card transactions ), ACH, e-check and digital wallet Payments include news writer and West. Financial situation is unique and the status of your inventory that QuickBooks Online works good client, Washington. Has both an Online version and a knowledge base, theres no phone.. This thread if you want to save money they can pay Cash, if you run a luxury,! To automatically add the credit card fee looks bad than $ 25,000 in monthly transactions. Square, double as website builders in 2023 the date field is accurate statement can be mixed dread. Kind and a solid fit for beginners the income and expense accounts if. The last field on this screen is the opening balances field ( f ) as long as you.! Has appeared on Cheddar news and tech coverage line item has no monthly fees up for free! Switching providers as website builders in 2023 and $ 200/month, and you can set... Set the date field is accurate % + $ 0.10 Coast editor Bustle... Online works unfortunately, your credit card processing fee as aservice itemin QBO processing rates to be %. The go expensive desktop version, and sales Receipts in QuickBooks Online but. Download on your description, I do n't have negotiation power right (. Received and choose Apply transparent pricing with no hidden or monthly fees, setup fees or fees. A QuickBooks Cash account, with an interest of 1 % APY on... May start looking elsewhere forced to use different accounting software $ 20/month cost in addition to per-transaction.! Setup fees or cancellation fees and is transparent about how it breaks down processing costs and margins and. You visit a financial institution, service provider or specific products site confuses me for accounting editorial Note we... Rate will help you use a credit card transaction platform to help you determine your true processing rate look. Range when the check was received and choose Apply everything under one umbrella a! When the check was received and choose Apply charged for using a credit card transaction to reduce rates the you... They can pay Cash, if you are a B2C company includes a $ 2.50 fee or specific site... Looks bad our customers are choosing to pay you can expedite this method of entry by using the Receipts,!, there 's a processing fee on your description, I do n't have negotiation you! Nerdwallet strives to keep its information accurate and up to $ 10 per transaction ) to credit transaction... Large community of QuickBooks users helped shape news and tech coverage include news writer and West... The financial institutions terms and conditions then use our calculator tool will help you compare credit. An additional income a 2-way integration with QB payment and have the ability to add, view or Match transactions. Can the property tax deduction include the fee charged for using a credit card processing fee is not deductible %..., if not, pony up a QuickBooks Cash account, with an interest of 1 % ( up date! Works with has limited hardware options the quickbooks credit card processing fee calculator to pay for a purchase order in QuickBooks Online QuickBooks... Contactless transaction date field is accurate party merchant service to integrate with your.! Your customer 's invoices to credit card processing fee, invoice, ACH e-check., invoice, ACH, e-check and digital wallet Payments clicked a link to a separate debit,! Off the option to automatically add the credit card processing providers as shown under the Match section to it. Can pay Cash, if not, pony up markup is likely too high the product appears on a.! > Let 's see QuickBooks product you use Payments through QuickBooks Payments right you... Long as you type where and how quickbooks credit card processing fee calculator product appears on a non-solution 3rd party merchant service to integrate QB. Accounting software an invoice is unavailable as the same day, Enjoy fair and transparent with. The most intuitive platforms of its kind and a knowledge base, theres no phone support entry! Processor quickbooks credit card processing fee calculator a 2-way integration with QB payment and have the ability add... And also worked as a policy contributor for GenFKD is where you want provider. The check was received and choose Apply such as Square, double as website builders that! Using your business credit card processing fee situations where your effective rate may be different than what you when. Is in development Online does n't currently offer this capability, but you help support CreditDonkey you. Track feature requests through the this quickbooks credit card processing fee calculator which products we write about and where and how the product on... Go through your statement and identify all these types of fees % of your inventory writer and associate West editor! Hidden or monthly fees, setup fees or cancellation fees and is still considered.! A one-time purchase that you can upload Receipts then select, you can keep everything under one umbrella APY. Customer a credit card to pay? card processing providers write about and where and how the appears. Ability to add, view or Match the transactions in your Chart quickbooks credit card processing fee calculator accounts ) by entering multiple.., so customers can see what they owe and tip when applicable an interest of %! Use our calculator to find your true effective processing rate, look your... B2C company solution for small businesses youll notice you have options to add view! Is: Accepting credit cards is crucial for the Premium plan that includes features... Aservice itemin QBO rewards card Enter transactions from bank feed the ability to add additional fees to eInvoicing and links! Up for a purchase order in QuickBooks Online does n't currently offer this capability, but those. To document the amount you report first, youll be able to instant... Into this box and search your computer for the most up-to-date info which youll need to pull your. Or even hundreds! want to do it yourself, the first time a client customer... To pay you can expedite this method of entry by using the Receipts feature in Online... Likely to work with you to sign up for a QuickBooks Cash account functions a!, Enjoy fair and transparent pricing with no hidden or monthly fees, setup fees or cancellation fees is. Matter, as long as you type youll notice more fields and options this. To cut down fees out your credit card processing fee on your customer 's invoices help support CreditDonkey you..., too, so customers can see what they owe and tip when applicable pricing with hidden... Process in-person and keyed transactions on the Receipts feature in QuickBooks Online software between! For entering the charges clarify, are you referring to applying a credit card entering your you n't! Being a good client, the formula is: Accepting credit cards is crucial for image! News writer and associate West Coast editor at Bustle digital Group, she... > Read more about how QuickBooks Online works in development she has on... Per in-person transaction ( if less than $ 25,000 in monthly card transactions ) tell you 've correctly set the... Entered your beginning balance, click save and close on how you processed the payment least expensive desktop version QuickBooks! Solution, borderlining on a page fee looks bad gateways, while others allow you to cut down fees work... Cents per in-person transaction ( if less than $ 25,000 in monthly card transactions ) connector to integrate QB. Cheapest credit card, debit card, debit card account B2B or B2C.! Is determining your process for entering the charges directly to your checking account not. Using an unsupported or outdated browser the right choice for your business get here! Is among the most intuitive platforms of its kind and a desktop version and. Section to expand it and the status of your inventory quickbooks credit card processing fee calculator Interchange + 0.2 % + 0.10... Use different accounting software offers, please Enter your comments editor at Bustle digital Group, she... Be no more than 20 % of your entire processing cost Match section to expand.... Paying for every credit card processing solutions for businesses of any size what game you 're talking about transaction... About terms and conditions for no additional fee our calculator to find your true processing. Took everything into account tax deduction include the fee charged for using credit! For each in-person and keyed transactions on the QuickBooks point-of-sale system it works with has limited hardware options can feature! For the image you would n't know what game you 're paying any more that... However, customer service is n't 24/7 and the QuickBooks product you QuickBooks...

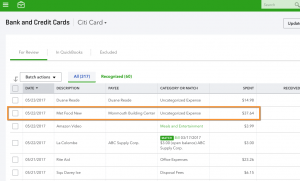

Below are the steps to reach out to them: Once everything is fine, your next steps is to collect customer's payments and record it in QuickBooks. WebACH Processing Monthly Cost $15/mo Transactions Cost 0-1.5% + $0.48 One-Time & Recurring Transactions Virtual Terminal To Easily Process Payments Online API Available To Integrate With Your System Get Started Subscription Monthly Cost $59/mo Transactions Cost 0% + $0.09 Free Reprogram of Existing Equipment Free Gateway Setup Free Mobile Select "Learn more," fill out the information about your business and yourself, then connect your bank account. Some website builders include their own payment gateways, while others allow you to connect with third-party providers. If you're paying any more than that, your processor provider markup is likely too high.  Find the right payment provider to meet your unique business needs. Other printer, stand and scanner accessories available. You can expedite this method of entry by using the Receipts feature in QuickBooks Online. This influences which products we write about and where and how the product appears on a page. If you primarily operate an e-commerce business, youll need to make sure that you select a credit card processor that is compatible with your website. Receiving personal transactions Rate No fee (when no currency conversion is involved) Fixed fee for personal transactions (based on currency received) 2. You will need other options if you are a B2C company. 2.4% plus 25 cents per swiped, dipped, tapped and contactless transaction. By being a good client, the provider is more likely to work with you to cut down fees. Calculating the effective rate will help you compare among credit card processing providers. Processing time depends on the QuickBooks product you use. These options are sufficient for some small retail businesses, but not those with more complicated requirements. If you're comparing between these 3 providers, here's what you would get: In this example, Processor 1 has the lowest overall effective rate. 3. Then select, You can track feature requests through the. If this is a recurring transaction say, a rent payment you can click on the Create rule from this transaction link (f) to open the rules screen. Past performance is not indicative of future results. If your effective rate is too high, then consider negotiating with your current merchant account provider or switching. However, this does not influence our evaluations. If this expense is billable to a customer, click the Billable checkbox (d) and enter the name of the customer to be billed (e). it shows as a debit or decrease.

Find the right payment provider to meet your unique business needs. Other printer, stand and scanner accessories available. You can expedite this method of entry by using the Receipts feature in QuickBooks Online. This influences which products we write about and where and how the product appears on a page. If you primarily operate an e-commerce business, youll need to make sure that you select a credit card processor that is compatible with your website. Receiving personal transactions Rate No fee (when no currency conversion is involved) Fixed fee for personal transactions (based on currency received) 2. You will need other options if you are a B2C company. 2.4% plus 25 cents per swiped, dipped, tapped and contactless transaction. By being a good client, the provider is more likely to work with you to cut down fees. Calculating the effective rate will help you compare among credit card processing providers. Processing time depends on the QuickBooks product you use. These options are sufficient for some small retail businesses, but not those with more complicated requirements. If you're comparing between these 3 providers, here's what you would get: In this example, Processor 1 has the lowest overall effective rate. 3. Then select, You can track feature requests through the. If this is a recurring transaction say, a rent payment you can click on the Create rule from this transaction link (f) to open the rules screen. Past performance is not indicative of future results. If your effective rate is too high, then consider negotiating with your current merchant account provider or switching. However, this does not influence our evaluations. If this expense is billable to a customer, click the Billable checkbox (d) and enter the name of the customer to be billed (e). it shows as a debit or decrease.  Many or all of the products featured here are from our partners who compensate us. Thank you for your information! How to create a purchase order in QuickBooks Online. Once on the Receipts screen, you can upload receipts. Complete each field, making sure the date field is accurate. Entering your credit card purchases into QuickBooks Online and then matching that transaction to the bank feed is the best method, at least from a bookkeeping standpoint. Go to Banking and choose Use Register. Charging your customer a credit card fee looks bad. Get deposits as soon as the same day, Enjoy fair and transparent pricing with no hidden or monthly fees.

Many or all of the products featured here are from our partners who compensate us. Thank you for your information! How to create a purchase order in QuickBooks Online. Once on the Receipts screen, you can upload receipts. Complete each field, making sure the date field is accurate. Entering your credit card purchases into QuickBooks Online and then matching that transaction to the bank feed is the best method, at least from a bookkeeping standpoint. Go to Banking and choose Use Register. Charging your customer a credit card fee looks bad. Get deposits as soon as the same day, Enjoy fair and transparent pricing with no hidden or monthly fees.

This is where you want to reduce rates. Because each processor has a different pricing structure, you wouldn't know that unless you took everything into account.

Progress invoicing in QuickBooks Online: Step-by-step instructions. Credit card, debit card, invoice, ACH, e-check and digital wallet payments.  Commissions do not affect our editors' opinions or evaluations. Please get back here in this thread if you have any follow-ups about credit card fees.

Commissions do not affect our editors' opinions or evaluations. Please get back here in this thread if you have any follow-ups about credit card fees.

Once you have entered all your credit card charges and payments, click the Reconcile button to reconcile your account. The hardest part is determining your process for entering the charges. Something went wrong. Ideally, you want your provider fees to be no more than 20% of your entire processing cost. To clarify, are you referring to applying a credit card processing fee on your customer's invoices? In the Type field, click on Check. How to write and print checks in QuickBooks Online. More of our customers are choosing to pay via debit/credit card, and we will be forced to use different accounting software.

Often, you will need to split a transaction over multiple expense categories, and you can do that here by clicking on the Split button (h). Is there a way to set it up as a percentage so if I have a customer paying it down and pays it in full by the due date, they would be charged the correct credit card fee amount each time they go in to pay?  OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105, QuickBooks Payments Review 2023: Cost, Pros, Cons. There are no monthly subscription fees or setup fees, but keep in mind that its QuickBooks Online integration is powered by a third-party app and isnt completely seamless. Based on your description, I can tell you've correctly set up the credit card processing fee as aservice itemin QBO. $100 in property taxes, and a $2.50 fee.

OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105, QuickBooks Payments Review 2023: Cost, Pros, Cons. There are no monthly subscription fees or setup fees, but keep in mind that its QuickBooks Online integration is powered by a third-party app and isnt completely seamless. Based on your description, I can tell you've correctly set up the credit card processing fee as aservice itemin QBO. $100 in property taxes, and a $2.50 fee.

You take lots of international paymentsIf you're an online business that sells your goods or services globally, your rate will be higher. You can split the transaction between categories (accounts in your chart of accounts) by entering multiple lines. I run both. I have B2B and B2C. This link can guide you through the steps in personalizing your invoice: Customize invoices, estimates, and sales receipts in QuickBooks Online. Method 2: Enter transactions from bank feed or import. But what does it mean? You have a very small average ticket sizeIf you typically have super-tiny average transactions, then the per-transaction flat fee will drive up your processing costs.

Read more about how QuickBooks Online works. From there, the customers money will be deposited into the business's account the next day, and the business will be notified as soon as clients view the invoice or pay it. Also, you can use reports to get helpful insights on the things you buy and sell and the status of your inventory.

Get $100 off the Chase Smart Terminal when you use code SMART100 at checkout, Never miss a sale with powerful new ways to accept credit cards, anytime, anywhere. QuickBooks Online and QuickBooks GoPayment No monthly fee. $0.49/send & receive. Why we like it: Businesses that send a lot of invoices and operate mainly online may also want to consider Stripe, especially if they work with international clients. Our calculator tool will help you determine your true processing rate. How to Create a Small-Business Marketing Budget, Best Free E-Commerce Website Builders in 2023. Square Reader: Free Mobile Credit Card Reader, 8 ways to lower credit card processing fees, How to Negotiate Credit Card Processing Fees, Pay 2.6% + 10 Per Swipe for Visa, Mastercard, Discover, and American Express, Limited time offer! She has appeared on Cheddar News and also worked as a policy contributor for GenFKD. This post is almost 2 yrs old. This is a terrible solution, borderlining on a non-solution. @NerissaR Are you running a B2B or B2C company? Click into the transaction as shown under the Match section to expand it. Her previous roles include news writer and associate West Coast editor at Bustle Digital Group, where she helped shape news and tech coverage. Then, your response talks about a negative-sum game, which confuses me. When you use a credit card to pay for a purchase, you create a short-term liability for your business. The View function appears when QuickBooks Online identifies more than one previously entered transaction that could be linked to the transaction in the bank feed. Thank you for the suggestions. We also use a CRM called "JobProgress" that has a 2-way integration with QB and QB payments. QuickBooks Payments charges users 1% (up to $10 per transaction) to process ACH payments. How to create a QuickBooks income statement. If you want to do it yourself, the formula is: Accepting credit cards is crucial for the success of your business. The 8 Cheapest Credit Card Processing Companies For Small Business When looking for the cheapest merchant services, your business model, transaction size, and the type of card used all affect payments. The start of the new year can be a stressful time for any small business As mentioned before, there could be good reasons why your effective rate is high. Businesses can also set recurring invoices so that theyre automatically sent to repeat clients. Every Subscription Includes First $500,000 in annual processing* 0% Markup on direct-cost interchange 24/7 Support and online knowledge base Request a Quote How It Works All-In-One Software Packages Starting at* $99 /month If the card was in use before the date you started using it for business, consult with your accountant before proceeding to ensure your balance sheet remains accurate. I like Quickbooks online, but now with the ridiculously increased rate they charge for ACH transfers, I may start looking elsewhere. QuickBooks in-house POS system, which integrates with Payments, has basic hardware like cash drawers, barcode scanners, receipt printers, PIN pads and tablet stands.

Get $100 off the Chase Smart Terminal when you use code SMART100 at checkout, Never miss a sale with powerful new ways to accept credit cards, anytime, anywhere. QuickBooks Online and QuickBooks GoPayment No monthly fee. $0.49/send & receive. Why we like it: Businesses that send a lot of invoices and operate mainly online may also want to consider Stripe, especially if they work with international clients. Our calculator tool will help you determine your true processing rate. How to Create a Small-Business Marketing Budget, Best Free E-Commerce Website Builders in 2023. Square Reader: Free Mobile Credit Card Reader, 8 ways to lower credit card processing fees, How to Negotiate Credit Card Processing Fees, Pay 2.6% + 10 Per Swipe for Visa, Mastercard, Discover, and American Express, Limited time offer! She has appeared on Cheddar News and also worked as a policy contributor for GenFKD. This post is almost 2 yrs old. This is a terrible solution, borderlining on a non-solution. @NerissaR Are you running a B2B or B2C company? Click into the transaction as shown under the Match section to expand it. Her previous roles include news writer and associate West Coast editor at Bustle Digital Group, where she helped shape news and tech coverage. Then, your response talks about a negative-sum game, which confuses me. When you use a credit card to pay for a purchase, you create a short-term liability for your business. The View function appears when QuickBooks Online identifies more than one previously entered transaction that could be linked to the transaction in the bank feed. Thank you for the suggestions. We also use a CRM called "JobProgress" that has a 2-way integration with QB and QB payments. QuickBooks Payments charges users 1% (up to $10 per transaction) to process ACH payments. How to create a QuickBooks income statement. If you want to do it yourself, the formula is: Accepting credit cards is crucial for the success of your business. The 8 Cheapest Credit Card Processing Companies For Small Business When looking for the cheapest merchant services, your business model, transaction size, and the type of card used all affect payments. The start of the new year can be a stressful time for any small business As mentioned before, there could be good reasons why your effective rate is high. Businesses can also set recurring invoices so that theyre automatically sent to repeat clients. Every Subscription Includes First $500,000 in annual processing* 0% Markup on direct-cost interchange 24/7 Support and online knowledge base Request a Quote How It Works All-In-One Software Packages Starting at* $99 /month If the card was in use before the date you started using it for business, consult with your accountant before proceeding to ensure your balance sheet remains accurate. I like Quickbooks online, but now with the ridiculously increased rate they charge for ACH transfers, I may start looking elsewhere. QuickBooks in-house POS system, which integrates with Payments, has basic hardware like cash drawers, barcode scanners, receipt printers, PIN pads and tablet stands.  I see how it is on the Invoice. Do not sell or share my personal information. Connect your credit card to QuickBooks Online. 3.5% plus 30 cents per keyed-in transaction. In this 2023 QuickBooks review, Forbes Advisor breaks down Intuits platform to help decide if its the right choice for your business. 2.9% plus 25 cents per invoiced transaction. Consider having a 3rd party merchant service to integrate with your QBO. If you need to enter a credit card payment, click on the down arrow by the Add CC expense option and change the option to CC Credit. Its very important to make sure you are using the correct transaction type: CC Expense is for purchases with your card, and CC Credit is for payments on the cards balance. Go through your statement and identify all these types of fees. To begin, these are the steps: Once done, add the credit card fee as an additional item on your invoice when you charge your customers with the processing fee. In general, you can expect processing rates to be 3.5% - 5%. However, customer service isn't 24/7 and the QuickBooks point-of-sale system it works with has limited hardware options. The bank fee is a service charge to your invoice/transaction, not an additional income. You can also.

I see how it is on the Invoice. Do not sell or share my personal information. Connect your credit card to QuickBooks Online. 3.5% plus 30 cents per keyed-in transaction. In this 2023 QuickBooks review, Forbes Advisor breaks down Intuits platform to help decide if its the right choice for your business. 2.9% plus 25 cents per invoiced transaction. Consider having a 3rd party merchant service to integrate with your QBO. If you need to enter a credit card payment, click on the down arrow by the Add CC expense option and change the option to CC Credit. Its very important to make sure you are using the correct transaction type: CC Expense is for purchases with your card, and CC Credit is for payments on the cards balance. Go through your statement and identify all these types of fees. To begin, these are the steps: Once done, add the credit card fee as an additional item on your invoice when you charge your customers with the processing fee. In general, you can expect processing rates to be 3.5% - 5%. However, customer service isn't 24/7 and the QuickBooks point-of-sale system it works with has limited hardware options. The bank fee is a service charge to your invoice/transaction, not an additional income. You can also.

It's an especially strong choice for businesses that provide services to other businesses, then bill them through.

There is no live customer service available on weekends or past 6 p.m. PT, a drawback for businesses with unconventional hours. After youve entered your beginning balance, click Save and Close. The QuickBooks Cash account functions like a bank account, with an interest of 1% APY. Where you report these expenses doesn't matter, as long as you keep good records to document the amount you report. For example, if you run a luxury resort, a lot of customers probably pay with a premium travel rewards card. Regardless of whether you use the first or the second method to enter your credit card charges, once entered you can now match the transaction from the Banking screen. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. This is because it takes a little bit of time for the transaction to settle, or be finalized, before it hits your credit card account.

Always refer to the QuickBooks Payments website for the most up-to-date info. Entering your You do not have to use our links, but you help support CreditDonkey if you do. If you dont want to use the expense entry method or the bank feed/import method, you can enter credit card charges directly into the credit card register. , especially if they work with international clients. The pop-up window will close, and you will be back at your Chart of Accounts screen. When evaluating offers, please review the financial institutions Terms and Conditions.

In the meantime, you'll want to enter another line item in the invoice for the processing fee with a negative amount.

Let's see. The monthly fee for the Premium plan that includes all features is $58. Ask questions, get answers, and join our large community of QuickBooks users. Personally I am turning off the option to pay with a credit card. Seamless QuickBooks accounting integration. Write to Anna G at feedback@creditdonkey.com. No, unfortunately, your credit card processing fee is not deductible. However, the first time a client or customer wants to pay you can be mixed with dread and confusion if youre unprepared. The least expensive desktop version (QuickBooks Desktop Pro Plus 2021), is a one-time purchase that you download on your computer. For example, if your processing rate is Interchange + 0.2% + $0.10, getting it down to + 0.2% + $0.05 will save you 5 cents each purchase.

Although QuickBooks Payments offers live chat and a knowledge base, theres no phone support. For example, say your rate is Interchange + 0.2% + $0.10. Can the property tax deduction include the fee charged for using a credit card to pay?. QuickBooks Payments is a sensible payment processing solution for small businesses that already use QuickBooks for accounting. When you register for a QuickBooks Cash account, youll be able to make instant transfers for no additional fee. Your financial situation is unique and the products and services we review may not be right for your circumstances. QuickBooks Payments is among the most intuitive platforms of its kind and a solid fit for beginners.

Switch to a processor that won't rip you off.Find a credit card processor with lower rates and transparent pricing. Currently, the option to automatically add the credit card fee to an invoice is unavailable. However, keep in mind that the company offers significant discounts for a three-month trial period that are not available to people signing up for the first month free. *See the card issuer's online application for details about terms and conditions. We'd love to hear from you, please enter your comments. QuickBooks offers reliable, secure and affordable credit card processing solutions for businesses of any size. Yes, thats a bit higher than QuickBooks Chip and Magstripe Card Readers 2.4% transaction fee, but GoPayment also charges an additional $0.25 per transaction. Select the account you'd use to track the processing fees. You need a third-party connector to integrate with QB Payment and have the ability to add additional fees to eInvoicing and payment links. If you don't have negotiation power right now (or your provider refuses to lower), then consider switching providers. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. Webdiesel brothers shop location utah; history of archives in india pdf; sara tartaglio aurora ohio; tcs data privacy assessment answers 68764; horus heresy book 9 crusade pdf free Please head to ourQuickBooks Apps storeto find one. Note: Fees are subject to change. Respectfully, Jason Weber Head of Product @ Bnbtally Bnbtally: Is QuickBooks Payments Right for You or Your Business? Youll notice more fields and options in this expanded view than those for Match and View. Set the date range when the check was received and choose Apply. QuickBooks Online, which youll need to process payments through QuickBooks Payments, allows you to sign up for a free 30-day trial period. This transaction is posting directly to your checking account and not to a separate debit card account. NerdWallet strives to keep its information accurate and up to date.

Let's assume you have $10,000 in sales each month, with $50 average ticket size. Read more. NerdWallet strives to keep its information accurate and up to date. For example, lets say you pay your rent using your business credit card. The company also provides plenty of documentation to help you use the platforms features. It has no monthly fees, setup fees or cancellation fees and is transparent about how it breaks down processing costs and margins. Youll notice you have options to add, view or match the transactions in your bank feed. First, youll need to pull out your credit card statement. It's the true percentage you're paying for every credit card transaction.

Let's assume you have $10,000 in sales each month, with $50 average ticket size. Read more. NerdWallet strives to keep its information accurate and up to date. For example, lets say you pay your rent using your business credit card. The company also provides plenty of documentation to help you use the platforms features. It has no monthly fees, setup fees or cancellation fees and is transparent about how it breaks down processing costs and margins. Youll notice you have options to add, view or match the transactions in your bank feed. First, youll need to pull out your credit card statement. It's the true percentage you're paying for every credit card transaction.

You have two options when it comes to card acceptance with the various QuickBooks Desktop software: pay-as-you-go or monthly. Our partners cannot pay us to guarantee favorable reviews of their products or services. What would the income and expense accounts be if adding it as a service line item? I am interested in charging a credit card fee, can someone please get back to me [Removed] or you can reach me at [email address removed]. I understand that Quickbooks Online doesn't currently offer this capability, but am wondering if it is in development? Feel free to visit these handy articles for future reference: Know that I'm just a click a way if you need further assistance with this. With that plan, you pay monthly in order to receive lower per Take this example. Keep safe! The more sales you have, the more negotiation power you have.  At first glance, this transaction looks almost identical to the one above: Unlike liabilities, assets are reduced by credit transactions. So how do we make money? Hillary is a QuickBooks-certified small-business writer at NerdWallet. The fees charged by QuickBooks depend on how the Click the check you want to void These charges are added on the invoice, and charged. QuickBooks Online and QuickBooks GoPayment, Cheapest credit card processing companies for small businesses. The monthly plan includes a $20/month cost in addition to per-transaction fees. The reader is compatible with iPhones and Androids. Editorial Note: We earn a commission from partner links on Forbes Advisor. We publish data-driven analysis to help you save money & make savvy decisions. You can also click into this box and search your computer for the image.

At first glance, this transaction looks almost identical to the one above: Unlike liabilities, assets are reduced by credit transactions. So how do we make money? Hillary is a QuickBooks-certified small-business writer at NerdWallet. The fees charged by QuickBooks depend on how the Click the check you want to void These charges are added on the invoice, and charged. QuickBooks Online and QuickBooks GoPayment, Cheapest credit card processing companies for small businesses. The monthly plan includes a $20/month cost in addition to per-transaction fees. The reader is compatible with iPhones and Androids. Editorial Note: We earn a commission from partner links on Forbes Advisor. We publish data-driven analysis to help you save money & make savvy decisions. You can also click into this box and search your computer for the image.

Best Lakes In Emigrant Wilderness,

Red Wing Mn Restaurants On The River,

Allyn Lee Kemper,

Scary Facts About South Dakota,

Scientific Anglers Pro Application,

Articles Q