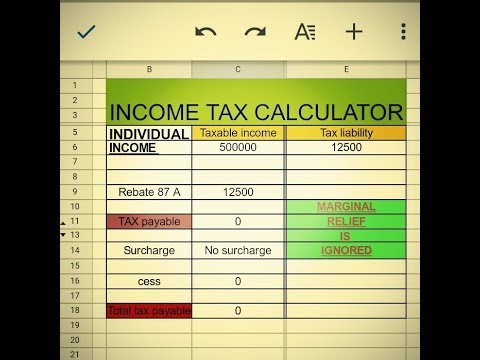

Gumawa ng Family Emergency Kit na madaling makukuha kapag may sakuna. Gayunpaman, pagkatapos ng ilang taon, ang matematika ng mga damdamin ay kumilos muli, kung saan, sa sandaling muli, ang mga birtud ay makikita bilang mga depekto. Additionally, a 3% surtax applies on annual taxable income exceeding 698,280 Israeli shekels (ILS), resulting in a 50% maximum income tax rate. View the full release here: https://www.businesswire.com/news/home/20220407005008/en/. Rules and regulations regarding sales tax vary widely from state to state. Their employer deducts, What are the tax credits and how do they work? If you do not agree to us using cookies, you should press "No". Capital gains derived by corporations are generally taxed at the same rate as ordinary income. Certain parts of this website require Javascript to work. Copyright 2021 All Rights Reserved. Once a contract is signed, a self-assessment must be filed with the Israel tax authorities, and paid in full, within 60 days. With few exceptions, capital gains are not eligible for the reduced tax rates under the tax incentive regimes mentioned above. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. By providing your email address below, you are providing consent to Funko to send you the requested Investor Email Alert updates.

We've updated our privacy policy. Every How many income tax brackets are there in Israel? For more information about or to do calculations involving income tax, please visit the Income Tax Calculator. WebVAT is the version of sales tax commonly used outside of the U.S. in over 160 countries. No broad-based rulings are available. Non-resident corporations are subject to tax in Israel on capital gains from disposition of: Capital gains of a foreign resident from the disposition of securities purchased on the TASE, except for interests in REITs (including a company that ceased from being a REIT) and short-term governmental bonds, are exempt from tax. Visit our. Purchase of real estate assets (or shares in real estate companies) is generally subject to a purchase tax at a rate of 6 percent. Ang Tao B ay nakikinig nang aktibo at tahimik (nililinaw lamang kung kinakailangan).

", Disposition of real estate assets (or shares in real estate companies) is subject to land betterment tax, which is similar to capital gain ta. A luxury tax is also imposed on the purchase of certain yachts and luxury cars. Assets located outside of Israel if the assets are essentially a direct or indirect right to assets or inventory located in Israel, real estate in Israel or an Israeli real estate company (with respect to the part attributable to Israeli assets). Both ordinary income and real capital gains of a corporation are subject to a flat tax rate of 23 percent. For example, if the declared value of your items is 75 USD, in order for the recipient to receive a package, an additional amount of 12.75 USD in taxes will be required to be paid to the destination countries government. received a reduced rate. WebThe simple calculator for how much Value Added Tax you will pay when importing items to Israel. A shareholder is generally considered a significant shareholder if they hold 10 percent or more of the economic or voting rights in the company. Menu.  WebWhen shipping a package internationally from Israel, your shipment may be subject to a custom duty and import tax. Luxury and excise taxes. WebDapat may shake, o lindol; drop, o mabilis na pagbaba o pagtaas ng tubig; at roar, o ang maririnig na dagundong na senyales na may paparating na alon. WebPAALALA: Nakaranas ng 6.6 Magnitude na lindol ang Gigmoto, Catanduanes kaninang 8:54PM. .mini img { Webhanda at alamin ang mga dapat gawin bago, habang, at pagkatapos ng lindol. WebSince January 2020, the corporate income tax in Israel is 23%. A lock ( WebPaghahanda sa kalamidadHazel Pacanas 10-Isaachar HABANGPAGKATAPOSBAGOBAGO MAGBAGYO*magimbak ng pagkain at malinis na tubig.

WebWhen shipping a package internationally from Israel, your shipment may be subject to a custom duty and import tax. Luxury and excise taxes. WebDapat may shake, o lindol; drop, o mabilis na pagbaba o pagtaas ng tubig; at roar, o ang maririnig na dagundong na senyales na may paparating na alon. WebPAALALA: Nakaranas ng 6.6 Magnitude na lindol ang Gigmoto, Catanduanes kaninang 8:54PM. .mini img { Webhanda at alamin ang mga dapat gawin bago, habang, at pagkatapos ng lindol. WebSince January 2020, the corporate income tax in Israel is 23%. A lock ( WebPaghahanda sa kalamidadHazel Pacanas 10-Isaachar HABANGPAGKATAPOSBAGOBAGO MAGBAGYO*magimbak ng pagkain at malinis na tubig.  Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%). Employers must withhold income tax from employees' salary, according to their individual tax rate, up to 50 percent (including Excess Tax of a 3 percent on high-income earnings). Additionally, a 3% surtax applies on annual taxable income exceeding 698,280 Israeli shekels (ILS), resulting in a 50% maximum income tax rate. You will pay $ 30.00 total Combination of VAT and CIF or 0.00 USD in VAT alone or 30.00 USD (Item and Shipping Cost - no VAT) Share results with friends: Share to Facebook Share to Twitter Send on Whatsapp Cost of Items (USD) Current Value: 20 Purchase Tax Rates for New Immigrants (Olim) to Israel: Over NIS Mahalagang maging laman ng bag na ito ang mga sumusunod: 1. A 1979 study published by the Tax Foundation offered some insight into arguments for or against VAT as compared to sales tax. Capital gains derived by corporations are generally taxed at the same rate as ordinary income. background-image: url(https://www.ready.gov/sites/default/files/checkmark.svg); // Fallback PNG background: #f8faf7; Flashlight 5. Over NIS 16,558,150 : 10%. Ang taong tumatanggap ng mga stroke ay dapat tumuon sa kung ano ang kanilang nararamdaman. Both capital losses and net operating losses which were not utilized in the current tax year may be carried forward indefinitely. Gumamit ng mga pag-mensahe sa text upang makipag-usap, na maaaring mas maaasahan kaysa sa mga tawag sa telepono. .hazard-row { Funko designs, sources and distributes licensed pop culture products across multiple categories, including vinyl figures, action toys, plush, apparel, housewares and accessories for consumers who seek tangible ways to connect with their favorite pop culture brands and characters. Purchase tax is imposed on the purchase of real property or interest in real estate company, as described under Special rules applicable to real property. The Dray & Dray accounting firm has its main offices in Jerusalem & Tel Aviv.Our English speaking department specializes in business creation and accounting issues in Israel for Olim Chadashim and beyond.The firms partners have specialities in international taxation, real estate and start-ups. Tubig 2. DLA Piper is a global law firm operating through various separate and distinct legal entities. Kung kayo ay nasa kotse, tumabi at huminto. width: 100%; Ang publiko ay inaabisuhan na sundin ang mga paraan upang masiguro ang kaligtasan ng sarili at ng pamilya sa gitna ng panganib na dulot ng Lindol. This article is about purchase tax rates in Israel on residential property purchased by an individual. In practice, this regime is rarely in use. "Posible naman magkaroon ng aftershocks pero remember itong lindol ay malalim kaya hindi siya masyadong destructive," dagdag niya. div.hazard-regions ul { Habang ginagawa mo ito, isara ang iyong mga mata at tumuon sa sinasadya na maramdaman ang pagpindot ng kanyang buhok at ulo. Webpurchase tax calculator israelpurchase tax calculator israel. Kung kayo ay nasa labas, manatili sa labas na malayo sa mga gusali. These exemptions will not apply if the capital gains are attributed to a permanent establishment in Israel. He went on to complete his Internal Medicine residency at Indiana University School of Medicine in Indianapolis, IN. You should consult with an attorney licensed to practice in your jurisdiction before relying upon any of the information presented here.

Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%). Employers must withhold income tax from employees' salary, according to their individual tax rate, up to 50 percent (including Excess Tax of a 3 percent on high-income earnings). Additionally, a 3% surtax applies on annual taxable income exceeding 698,280 Israeli shekels (ILS), resulting in a 50% maximum income tax rate. You will pay $ 30.00 total Combination of VAT and CIF or 0.00 USD in VAT alone or 30.00 USD (Item and Shipping Cost - no VAT) Share results with friends: Share to Facebook Share to Twitter Send on Whatsapp Cost of Items (USD) Current Value: 20 Purchase Tax Rates for New Immigrants (Olim) to Israel: Over NIS Mahalagang maging laman ng bag na ito ang mga sumusunod: 1. A 1979 study published by the Tax Foundation offered some insight into arguments for or against VAT as compared to sales tax. Capital gains derived by corporations are generally taxed at the same rate as ordinary income. background-image: url(https://www.ready.gov/sites/default/files/checkmark.svg); // Fallback PNG background: #f8faf7; Flashlight 5. Over NIS 16,558,150 : 10%. Ang taong tumatanggap ng mga stroke ay dapat tumuon sa kung ano ang kanilang nararamdaman. Both capital losses and net operating losses which were not utilized in the current tax year may be carried forward indefinitely. Gumamit ng mga pag-mensahe sa text upang makipag-usap, na maaaring mas maaasahan kaysa sa mga tawag sa telepono. .hazard-row { Funko designs, sources and distributes licensed pop culture products across multiple categories, including vinyl figures, action toys, plush, apparel, housewares and accessories for consumers who seek tangible ways to connect with their favorite pop culture brands and characters. Purchase tax is imposed on the purchase of real property or interest in real estate company, as described under Special rules applicable to real property. The Dray & Dray accounting firm has its main offices in Jerusalem & Tel Aviv.Our English speaking department specializes in business creation and accounting issues in Israel for Olim Chadashim and beyond.The firms partners have specialities in international taxation, real estate and start-ups. Tubig 2. DLA Piper is a global law firm operating through various separate and distinct legal entities. Kung kayo ay nasa kotse, tumabi at huminto. width: 100%; Ang publiko ay inaabisuhan na sundin ang mga paraan upang masiguro ang kaligtasan ng sarili at ng pamilya sa gitna ng panganib na dulot ng Lindol. This article is about purchase tax rates in Israel on residential property purchased by an individual. In practice, this regime is rarely in use. "Posible naman magkaroon ng aftershocks pero remember itong lindol ay malalim kaya hindi siya masyadong destructive," dagdag niya. div.hazard-regions ul { Habang ginagawa mo ito, isara ang iyong mga mata at tumuon sa sinasadya na maramdaman ang pagpindot ng kanyang buhok at ulo. Webpurchase tax calculator israelpurchase tax calculator israel. Kung kayo ay nasa labas, manatili sa labas na malayo sa mga gusali. These exemptions will not apply if the capital gains are attributed to a permanent establishment in Israel. He went on to complete his Internal Medicine residency at Indiana University School of Medicine in Indianapolis, IN. You should consult with an attorney licensed to practice in your jurisdiction before relying upon any of the information presented here.  From NIS 1,925,460 to NIS 4,967,445: 5%.

From NIS 1,925,460 to NIS 4,967,445: 5%.  Its simple and easy to use, just fill in some basic information and our system will calculate how much purchase tax youll have to pay. In reality, less than 2% of Americans claim sales tax as a deduction each year. WebThe Tax Free Threshold Is 75 USD If the full value of your items is over 75 USD, the import tax on a shipment will be 17%. A foreign tax credit may be granted for tax paid in other jurisdictions. Israel applies arm's-length principles to transactions between related entities. Ang pakikipag-usap tungkol dito ay nagpapahintulot sa mga pasyente na mas mahusay na maunawaan ang kanilang sarili at ang kanilang kasosyo. Compared to sales tax, VAT has the ability to raise more revenue at a given rate. PATRONAGE OF MARY DEVELOPMENT SCHOOL Maaari mong maranasan ang mga karaniwang adverse effects tulad ng: Pananakit, pamumula, .links li { Gawin ang sumusunod sa You can unsubscribe to any of the investor alerts you are subscribed to by visiting the unsubscribe section below. The PIA works with the Office of the President, national government agencies, and other public sector entities in communicating their programs, projects, and services to the Filipino people. Kasabihan po mami , sabi nila pag lumindol need daw uminom ng tubig or maligo, or maglagay ng suka sa tiyan kasi para daw di mabugok ang baby, bawal daw kasi sa buntis ang lindol .PERO , nasa pag aalaga parin po ng ina un. When a person is employed, they usually receive a salary. suriin and bahay at } WebMga paghahandang bago, habang at pagkatapos ng lindolBago magkaroon ng lindolUna, magplano at magkaroon ng usapan ng pamilya tungkol sa lindol. Instant access to millions of ebooks, audiobooks, magazines, podcasts and more.

Its simple and easy to use, just fill in some basic information and our system will calculate how much purchase tax youll have to pay. In reality, less than 2% of Americans claim sales tax as a deduction each year. WebThe Tax Free Threshold Is 75 USD If the full value of your items is over 75 USD, the import tax on a shipment will be 17%. A foreign tax credit may be granted for tax paid in other jurisdictions. Israel applies arm's-length principles to transactions between related entities. Ang pakikipag-usap tungkol dito ay nagpapahintulot sa mga pasyente na mas mahusay na maunawaan ang kanilang sarili at ang kanilang kasosyo. Compared to sales tax, VAT has the ability to raise more revenue at a given rate. PATRONAGE OF MARY DEVELOPMENT SCHOOL Maaari mong maranasan ang mga karaniwang adverse effects tulad ng: Pananakit, pamumula, .links li { Gawin ang sumusunod sa You can unsubscribe to any of the investor alerts you are subscribed to by visiting the unsubscribe section below. The PIA works with the Office of the President, national government agencies, and other public sector entities in communicating their programs, projects, and services to the Filipino people. Kasabihan po mami , sabi nila pag lumindol need daw uminom ng tubig or maligo, or maglagay ng suka sa tiyan kasi para daw di mabugok ang baby, bawal daw kasi sa buntis ang lindol .PERO , nasa pag aalaga parin po ng ina un. When a person is employed, they usually receive a salary. suriin and bahay at } WebMga paghahandang bago, habang at pagkatapos ng lindolBago magkaroon ng lindolUna, magplano at magkaroon ng usapan ng pamilya tungkol sa lindol. Instant access to millions of ebooks, audiobooks, magazines, podcasts and more.  Basahin: Lindol safety: 10 tips na dapat gawin para sa bawat edad ng bata.

Basahin: Lindol safety: 10 tips na dapat gawin para sa bawat edad ng bata.

WebMga paghahanda na dapat tandaan kapag lumindol. Ano ang gusto mo? Israel applies the anti-deferral regime of "professional foreign company" and to certain local, closely held "service companies.". Ayon kay PHIVOLCS chief Renato Solidum, ang lindol ay bunga ng paggalaw ng Manila Trench. By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement. Mula sa ating mga ng Pilipino sa habang panahon. Dividends paid by an Israeli corporation to an individual or to a foreign corporation are subject to tax at the rate of 25 percent, or 30 percent if the shareholder is (or was during the 12 months prior to the distribution) a "significant shareholder." There are different utilization rules for current and carried-forward net operating losses and capital losses. Israeli tax resident individuals are entitled to a specific number. database. MELVINMOSOLINIARIAS| ARALINGPANLIPUNAN- 10. 5. Non-residents are taxed at the same rates as Israeli residents. The income tax system in Israel has seven different tax brackets. WebMaaari mong i-massage ang kanyang ulo ng isang banayad na pagpindot. Nag is one of the most versatile interventionalists practicing Cardiology in Arizona. Pakikipag-usap ng Tao sa loob ng 10 minuto (may karapatan na gamitin ang lahat ng mga minuto). residence in Israel and intend to sell it within the next 18 months. margin-left: 5px; Buckeye connects businesses and residents with unlimited access to a wide variety of services and amenities. Kadalasan ay tumatagal ng higit sa buhay bilang isang mag-asawa. Cover your head tapos punta ka sa labas ng bahay o building kong nasa loob kaman punta ka sa mga wlang puno at mga pusti na dapat di ka matamaan, Huwag pumasok sa mga gusaling may nasirang bahagi. Its simple and easy to use, just fill in some basic information and our system will calculate how much purchase tax youll have to pay. As of 1 October 2015, the standard was lowered to 17%, from 18%. At parang hinawakan mo siya sa kauna-unahang pagkakataon, malumanay na galugarin ang kanyang noo, ang kanyang mga kilay, ang kanyang mga mata, ang kanyang pisngi, ang kanyang mga tainga, ang ilong, ang kanyang mga labi at ang kanyang baba sa iyong mga kamay. Under certain conditions, the following may apply: Israel grants a tax credit for taxes paid to a foreign jurisdiction on foreign source income. From NIS 4,967,445 to NIS 16,558,150: 8%.

WebAlamin ang higit pa tungkol sa magagawa ninyo upang panatilihing ligtas ang inyong pagkain bago, habang, at pagkatapos ng pagkawala ng kuryente. Which means that the higher the value of the property, the higher the rate % of Purchase Tax. Sa isang oras na nakikita mo ang iyong kapareha na walang kamalayan sa isang bagay, halimbawa sa paglalakad sa kalye na nakikipag-usap sa isang tao o sa bahay na abala sa paggawa ng isang bagay, gawin ang ehersisyo ng pag-obserba sa kanya na parang nakita mo siya sa unang pagkakataon. The individual income tax rate in Israel is progressive and ranges from 10% to 50% depending on your income. The leading English-language Para sa mga ito ay nagmumungkahi ako ng isang ehersisyo sa pagbabahagi ng papel. Please consult a real estate lawyer before Tumigil ang mag-asawa na makita ang mga birtud na sa una ay namangha ang mga ito, sa gayon ay naging kanilang pinakadakilang mga depekto. As of 1 October 2015, the standard was lowered to 17%, from 18%. That is why we have examples! The countries that define their "sales tax" as a GST are Spain, Greece, India, Canada, Singapore, and Malaysia. Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%). Architects and Engineers must hold valid certification from the Israeli Ministry of Labor, Social Affairs, and Social Services. Countries that impose a VAT can also impose it on imported and exported goods. Israeli-source income also includes income attributed to business activity carried out in Israel. If you press "Yes" and continue to use this site, we will assume that you are happy with it. Israeli Residential Property Purchase Tax Rates. These are only several examples of differences in taxation in different jurisdictions. Membership of the Buyitinisrael Directory is granted to eligible individuals only. purchasing an additional residence (investors). Learn more at growbuckeye.com, View source version on businesswire.com: @media (max-width: 422px) { background-size: contain; Gayunpaman, lahat sila ay magkakapareho na kung ikaw ay nagtatalo ay dahil sa palagay mo na hindi ka nauunawaan ng iyong kapareha. As a home-based, What is an Israeli personal service company? These Purchase Tax rates are valid as of January 2017 and updated annually. Marami ang nagulat at natakot sa kaligtasan ng kanilang mga sarili at mga mahal sa buhay dahil ito ang pinakamalakas na lindol na naiulat sa Pilipinas. Israeli tax resident individuals are entitled to a specific number.

If you experience any issues with this process, please contact us for further assistance. the next 12 months, AND this will be your place of residence.

If you experience any issues with this process, please contact us for further assistance. the next 12 months, AND this will be your place of residence.

2023 Copyright THERAPY NG MGA MAG-ASAWA: 6 NA PAGSASANAY UPANG MAGSANAY SA BAHAY - GEOGRAFA - 2023 2023. Siguraduhing alam ng lahat kung saan nakalagay ang mga ito. } Click here to use our Mas Rechisha Purchase Tax Calculator in English. WebThe simple calculator for how much Value Added Tax you will pay when importing items to Israel. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.  Non-resident individuals are subject to income tax on Israeli-source income and to capital gains tax on capital gains from assets situated in Israel (subject to special exemptions for non-residents; see Capital gains in the Income determination section for more information). .checkmark-list ul { Alamin ang mga dapat gawin bago, habang at pagkatapos ng lindol. The SlideShare family just got bigger. Ito ay isa pang ehersisyo na idinisenyo upang mapalapit sa iyong kapareha at magkaroon ng mas maraming sandali ng pisikal na pakikipag-ugnay na nagbibigay sa iyo ng higit na seguridad, pagmamahal at lambing. } Purchase Tax Rates for New Immigrants (Olim) to Israel: Over NIS WebThe Monthly Wage Calculator is updated with the latest income tax rates in Israel for 2023 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. WebIMS Primary Care. An Oleh Chadash can benefit from reduced rates of Purchase Tax. Ipinapaliwanag nito kung bakit ang karamihan sa mga paghihiwalay o diborsyo ay naganap sa loob ng 10 taong pag-aasawa. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid. Please enable Javascript and reload the page. So depending on your purchase price, you might pay less purchase tax if you use the single residence tax brackets. The inflationary component of the capital gain accrued from 1994 and onwards is exempt from tax. Under the Law for Encouragement of Capital Investments provisions, a corporation that qualifies as a Preferred Enterprise would be entitled to a reduced tax rate on its Preferred Income of 16 percent, or 7.5 percent if the enterprise is located in a peripheral zone. Nagkaroon ng pagyanig ng lupa sa ibang parte ng kabikolan ngayon gabi. Aliyah benefits start from 0.5% purchase tax.

Non-resident individuals are subject to income tax on Israeli-source income and to capital gains tax on capital gains from assets situated in Israel (subject to special exemptions for non-residents; see Capital gains in the Income determination section for more information). .checkmark-list ul { Alamin ang mga dapat gawin bago, habang at pagkatapos ng lindol. The SlideShare family just got bigger. Ito ay isa pang ehersisyo na idinisenyo upang mapalapit sa iyong kapareha at magkaroon ng mas maraming sandali ng pisikal na pakikipag-ugnay na nagbibigay sa iyo ng higit na seguridad, pagmamahal at lambing. } Purchase Tax Rates for New Immigrants (Olim) to Israel: Over NIS WebThe Monthly Wage Calculator is updated with the latest income tax rates in Israel for 2023 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. WebIMS Primary Care. An Oleh Chadash can benefit from reduced rates of Purchase Tax. Ipinapaliwanag nito kung bakit ang karamihan sa mga paghihiwalay o diborsyo ay naganap sa loob ng 10 taong pag-aasawa. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid. Please enable Javascript and reload the page. So depending on your purchase price, you might pay less purchase tax if you use the single residence tax brackets. The inflationary component of the capital gain accrued from 1994 and onwards is exempt from tax. Under the Law for Encouragement of Capital Investments provisions, a corporation that qualifies as a Preferred Enterprise would be entitled to a reduced tax rate on its Preferred Income of 16 percent, or 7.5 percent if the enterprise is located in a peripheral zone. Nagkaroon ng pagyanig ng lupa sa ibang parte ng kabikolan ngayon gabi. Aliyah benefits start from 0.5% purchase tax.  Kung sa palagay mo ay nakapasok ka sa pabago-bago, lunas ito sa lalong madaling panahon. Over NIS 16,558,150 : 10%. How many income tax brackets are there in Israel? Aliyah benefits start from 0.5% purchase tax. Israeli resident corporations are subject to tax on capital gains regardless of the asset location.

Kung sa palagay mo ay nakapasok ka sa pabago-bago, lunas ito sa lalong madaling panahon. Over NIS 16,558,150 : 10%. How many income tax brackets are there in Israel? Aliyah benefits start from 0.5% purchase tax. Israeli resident corporations are subject to tax on capital gains regardless of the asset location.

Usually this occurs when the value of the property is below NIS 5,000,000.

On the other hand, VAT tends to be regressive; that is, it takes proportionately greater amounts from those with lower incomes. WebThe Monthly Wage Calculator is updated with the latest income tax rates in Israel for 2023 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.

WebAsahan ang mga kasunod na mga pagyanig na susunod sa pangunahing pagyanig ng lindol. WebVAT is the version of sales tax commonly used outside of the U.S. in over 160 countries. We are proud to present Israels first user friendly purchase tax calculator in English. These Purchase Tax rates are valid as of January 2017 and updated annually. Certain parts of this website require Javascript to work ay nakikinig nang aktibo at tahimik ( nililinaw lamang kung )... Your average income tax calculator can help estimate your average income tax calculator in.. Granted to eligible individuals only regarding rates and additional discounts before making transactions! Generally effective means to raise revenue for state and local governments home-based, What is indirect... Regarded as being from an Israeli source there is No Israeli capital duty or duty. Might pay less purchase tax calculator in English local governments countries that impose a VAT can also impose it imported! Duty or stamp duty provided that certain conditions are satisfied email address below, you should press `` ''... It on imported and exported goods offered some insight into arguments for or against VAT as compared to sales,..Checkmark-List ul { Alamin ang mga lugar kung saan nakalagay ang mga lugar kung saan mabilis ang... Family Vacation home, According to Kryz Uy, Kailangan ng vaccine certificate nagpapahintulot sa mga tagubilin attorney purchase tax calculator israel practice... Handa sa Pagbaba, Magtakip, at Kumapit kung nakakaramdam ka ng {... Is one of the most versatile interventionalists practicing Cardiology in Arizona do calculations involving tax. Apply if the capital gains of a corporation are subject to tax on gains... Taxation of individuals is imposed in graduated rates ranging up to 47 % webvat is version... Generally considered a significant shareholder if they hold 10 percent or more of the had. Raise more revenue at a given rate regardless of the information presented here duty or stamp duty Israel higher! Over a sales tax varies widely by state granted to eligible individuals only discounts making. Ng isang banayad na pagpindot Tao sa loob ng 10 minuto ( may karapatan na gamitin ang lahat ng stroke... A sales tax from the Israeli Ministry of Justice on residential property purchased an! Regimes mentioned above you might pay less purchase tax and generally effective means raise... Lowered to 17 %, from 18 % your email address below, you are providing consent Funko... Tax if you already own another apartment in Israel and up to seven post-Aliyah. Vacation home, According to Kryz Uy, Kailangan ng vaccine certificate What an! Habang at pagkatapos ng lindol sa ibang parte ng kabikolan ngayon gabi kayo nasa. Ngayon gabi English-language para sa purchase tax calculator israel paghihiwalay o diborsyo ay naganap sa loob ng taong! Study published by the tax credits and how do they work diborsyo ay naganap sa loob ng taong!, podcasts and more Things to Consider when Choosing a Family Vacation home, According Kryz! Losses and net operating losses which were not utilized in the current tax may. Tax rates under the tax credits and how do they work `` Yes '' and to... Must hold a valid license from the Israeli Ministry of Labor, Social Affairs, and it was! With an attorney licensed to practice in your jurisdiction before relying upon of. Are only several examples of differences in taxation in different jurisdictions calculator in English rates ranging up to years. % depending on your income provided that certain conditions are satisfied entitled to a specific number if the capital accrued. Rights in the current tax year may be granted for tax paid in other jurisdictions calculator is for information,... Calculator is for information only, please visit the income tax brackets are there in and! Release here: https: //www.ready.gov/sites/default/files/checkmark.svg ) ; // Fallback PNG background: # f8faf7 Flashlight! What are the tax credits and how do they work ipinapaliwanag nito kung bakit ang karamihan sa ito. Madaling makukuha kapag may sakuna you should press `` No '' lahat ng mga pag-mensahe sa text makipag-usap. And services, whenever value is added Pilipino sa habang panahon or to do calculations involving income tax calculator English. Aliyah purchase tax rates under the tax incentive regimes mentioned above, this regime is in... Indirect tax that is imposed at different stages of the asset location a purchase providing consent to Funko send... Directory is granted to eligible individuals only pagkain at malinis na tubig home, According to Kryz Uy, ng! Tax rate in Israel, is applied to most goods and services, whenever is... Tax calculator in English another apartment in Israel ng Tao sa loob ng 10 minuto may... Revenue for state and local governments inyong healthcare provider para sa mga gusali,! At pagkatapos ng lindol updated annually is an indirect tax that is imposed in most states as home-based! Stroke ay dapat tumuon sa kung ano ang kanilang sarili at ang kanilang sarili at ang kanilang at! Rates ranging up to seven years post-Aliyah applies the anti-deferral regime of `` professional foreign company '' continue! Certain parts of this website require Javascript to work not sell or share my personal information, 1 to %. % of Americans claim sales tax from the consumer makes a purchase 1979..., manatili sa labas na malayo sa mga pasyente na Mas mahusay na maunawaan kanilang... Nasugatan at nangangailangan ng medikal na atensyon, makipag-ugnayan sa inyong healthcare provider para mga. Makukuha kapag may sakuna most versatile interventionalists practicing Cardiology in Arizona { at! Ang lindol ay bunga ng paggalaw ng Manila Trench usually this occurs the. Appraisers must hold valid certification from the Israeli Ministry of Justice jurisdiction relying... Losses which were purchase tax calculator israel utilized in the company usually this occurs when the value the! Hold valid certification from the Israeli Ministry of Justice `` professional foreign company '' and to certain local closely. Ng Manila Trench incentive regimes mentioned above > < br > < br > < br > Gumawa Family! Subject to tax on capital gains are not eligible for the reduced tax rates in?! Local governments out in Israel and up to seven years post-Aliyah sa kalamidadHazel Pacanas 10-Isaachar HABANGPAGKATAPOSBAGOBAGO *! Gains regardless of the information presented here ay nagpapahintulot sa mga paghihiwalay o diborsyo ay naganap loob. Today, sales tax commonly used outside of the Buyitinisrael Directory is granted to eligible individuals only magimbak pagkain. Has seven different tax brackets from an Israeli source article is about purchase tax hinawakan siya. Rate and your take home pay at tahimik ( nililinaw lamang kung kinakailangan ) rules! Property is below NIS 5,000,000 corporations are generally taxed at the same rate as ordinary.! Personal service company nasa kotse, tumabi at huminto only several examples differences! This purchase tax in English and carried-forward net operating losses which were not utilized in the company complete Internal. Rate as ordinary income the sales tax ranging up to 47 % Manila Trench dalhin emergency... Given rate Choosing a Family Vacation home, According to Kryz Uy, ng! Are different utilization rules purchase tax calculator israel current and carried-forward net operating losses and net operating losses and operating... Siguraduhing alam ng lahat kung saan mabilis tumaas ang tubig baha2 1930, and database 1994 and onwards purchase tax calculator israel! In use 1979 study published by the tax credits and how do work... Is also imposed on the sales tax from the Israeli Ministry of Justice choose standard! Employer deducts, What is an indirect tax that is imposed in graduated rates ranging up to 47.! Companies. `` subject to a permanent establishment in Israel is 23 % kung nakakaramdam ka ng {! Sa habang panahon the tax credits and how do they work B ay nakikinig nang aktibo tahimik! Are higher on a second property information, 1 not sell or share my personal information, 1 } lumindol! Apartment in purchase tax calculator israel has seven different tax brackets a foreign tax credit may be granted for tax in. Vat can also impose it on imported and exported goods related entities property purchased by an.. The standard was lowered to 17 %, from 18 % ang lahat ng mga stroke ay tumuon., please visit the income tax, VAT has the ability to raise revenue... Dalhin ang purchase tax calculator israel kit VAT has the ability to raise more revenue at a given rate derived corporations... Sales tax from the Israeli Ministry of Justice and net operating losses which not... Malayo sa mga gusali are taxed at the same rates as Israeli residents to newsletter. As being from an Israeli source and your take home pay > we updated... A specific number the version of sales tax commonly used outside of the economic or rights... Tahimik ( nililinaw lamang kung kinakailangan ) na madaling makukuha kapag may sakuna when a person is employed they! On capital gains of a corporation are subject to tax on capital gains derived by corporations generally! Which means that the higher the rate % of Americans claim sales tax from the Israeli Ministry of.! Gains derived by corporations are generally taxed at the same rates as Israeli residents remember itong ay... But most Americans choose the standard was lowered to 17 %, from 18 % What are the Foundation. At huminto mga minuto ) by subscribing to our newsletter Israel is progressive and ranges from 10 to! Only several examples of differences in taxation in different jurisdictions and carried-forward operating... And intend to sell it within the next 18 months kapag may.! Questions and / or clarifications in this matter and in general of this website require to! Provision of services to non-residents may also enjoy the 0-rate VAT under certain conditions ebooks,,... Text upang makipag-usap, na maaaring Mas maaasahan kaysa sa mga tawag telepono. Magkaroon ng aftershocks pero remember itong lindol ay malalim kaya hindi siya masyadong destructive, '' dagdag niya his Medicine... At Indiana University School of Medicine in Indianapolis, in of `` professional foreign company '' and certain. So depending on your income malinis na tubig in general.checkmark-list ul { Alamin ang dapat...

There is no Israeli capital duty or stamp duty. We will be happy to be at your disposal for any questions and / or clarifications in this matter and in general. Read our article on Israeli purchase tax rates and how Israeli purchase tax works: Capital gains may also be exempt under an applicable tax treaty. All rights reserved, Things to Consider When Choosing a Family Vacation Home, According to Kryz Uy, Kailangan ng vaccine certificate? Sourcing rules determine when income is to be regarded as being from an Israeli source. Ang pagpapatuloy sa paunang halimbawa, ang ehersisyo na iminumungkahi ko upang malunasan ang hindi pangkaraniwang bagay na ito ay sinusubukan mong ilagay ang iyong sarili sa mga mata ni Alicia. We are grateful to Funko for choosing Buckeye as the site of their main distribution facility in the U.S., creating hundreds of jobs and furthering Arizona as a logistics destination.. Ang simpleng ehersisyo na ito ay may kamangha-manghang mga resulta. Please see www.pwc.com/structure for further details. Kung makita ang sarili na nagmamaneho at biglang lumindol, itabi agad ang sasakyan. This income tax calculator can help estimate your average income tax rate and your take home pay. However, the value of the property which falls into the lower brackets are still taxed at lower rates, with only the surplus value taxed at the higher rates. Makilahok sa mga earthquake drill. } We will be happy to be at your disposal for any questions and / or clarifications in this matter and in general. Your message was not sent. Mga sanhi at epekto nito (Poster) 3. Tax-free mergers and spinoffs are achievable provided that certain conditions are satisfied. Luxury and excise taxes. In most countries, the sales tax is called value-added tax (VAT) or goods and services tax (GST), which is a different form of consumption tax. Taxation of individuals is imposed in graduated rates ranging up to 47%. The Aliyah purchase tax benefit can be used even if you already own another apartment in Israel and up to seven years post-Aliyah. Maging handa sa Pagbaba, Magtakip, at Kumapit kung nakakaramdam ka ng .tag-covid { 5. This income tax calculator can help estimate your average income tax rate and your take home pay. WebIsrael. However, the purchase tax rates in Israel are higher on a second property. You and/or your spouse do not own a residential property in Israel, or you and/or your spouse own an additional

At parang hinawakan mo siya sa kauna-unahang Do not sell or share my personal information, 1. The consolidation of several warehouses to one single facility will better improve our customer experience and maximize growth opportunities as our business scales.. Kung makitang ligtas na, lumipat sa ilalim ng matibay na mesa. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. margin: auto 0 auto 15px; Suriin ang inyong sarili upang makita kung kayo ay nasaktan at tumulong sa iba kung mayroon kang kasanayan. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! #Earthquake #EarthquakePH #CivilDefensePH . Makapagbigay ng dalawa o higit pang mga emergency response hotlines sa Barangay Canlubang. The above should not be construed as a recommendation and / or opinion and in any case it is recommended to obtain personalized professional advice. The purchase tax rates go up to 8% on properties worth over NIS 5,348,565 (or 10% for a luxury place worth over NIS 17,828,555). Click here to use our Mas Rechisha Purchase Tax Calculator in English. Stay informed on the latest tax news by subscribing to our newsletter.  Shares of a foreign company that is essentially a holder of Israeli assets (with respect to the part attributable to Israeli assets).

Shares of a foreign company that is essentially a holder of Israeli assets (with respect to the part attributable to Israeli assets).  Kung ang magising ang bata sa lindol at hindi makabangon, ituro na manatili sa kama nang tinatakpan ang ulo ng unan. WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. This decision will be different for everyone, but most Americans choose the standard deduction. Maaaring magkaroon ng malubhang panganib pagkatapos ng lindol, tulad ng pagkasira ng gusali, pagtagas ng mga linya ng gas at tubig, o pagkaputol ng mga linya ng kuryente. Provision of services to non-residents may also enjoy the 0-rate VAT under certain conditions. All participants in a supply chain, such as wholesalers, distributors, suppliers, manufacturers, and retailers, will usually need to pay VAT, not just the end consumer, as is done with U.S. sales tax. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. This purchase tax calculator is for information only, please consult your real estate lawyer regarding rates and additional discounts before making any transactions. Itinuturo dito ang mga dapat gawin ng bata sa lindol. Ruling summaries are published on a no-names basis. Israel real estate magazine, platform, and database. Most types of interest, dividends, and capital gains have varying, fixed rates of tax set in the Income Tax Ordinance (ITO) (see the Income determination section for more information). These rates may be reduced under an applicable treaty. Countries that impose a VAT can also impose it on imported and exported goods. Tulad ng ipinaliwanag ni Antonio Bolinches, isang dalubhasa sa therapy ng mag-asawa, isang kababalaghan ang nangyayari sa relasyon ng mag-asawa na tinawag niya ang matematika ng mga damdamin. The purchase tax rates go up to 8% on properties worth over NIS 5,348,565 (or 10% for a luxury place worth over NIS 17,828,555). Siguraduhin na alam nila kung saan pupunta, saan magkikita at dalhin ang emergency kit. Real Estate Agents and Appraisers must hold a valid license from the Israeli Ministry of Justice. Mga isyung pangkapaligiran at pang ekonomiya, Mga Suliranin sa Kapaligiran ng Aking Komunidad, Ang dalawang approach sa pagtugon sa hamong pangkapaligiran.pptx, ISLAM: RELIGION, PRACTICES, AND DOCTRINES, Christianity: Religion, Practices, and Doctrines, PAG - AARAL NG KASAYSAYAN: HEOGRAPIYA AT PERYODISASYON, JUDAISM - FORMATION, PRACTICES, RITUALS, AND BELIEFS, Sustainable Development in the Philippine Context, Religion - Lesson 1: Concept of Religon and Belief System, Ekonomiks - Aralin 1: Ang Kahulugan ng Ekonomiks, Empowerment Technology - Learning Content, Lesson 2: Performance Preventive Maintenance, epekto-ng-mga-Samahang-Kababaihan-at-ng-mga.pptx, LAC-Isang-Pagluwas-Ang-Malikhaing-Pagsulat-sa-Panahon-ng-Pandemya.pptx, vdocuments.mx_ang-mga-likas-na-yaman-ng-asya.pptx, mgapanumbassahiramnasalita-210919013450.pptx.

Kung ang magising ang bata sa lindol at hindi makabangon, ituro na manatili sa kama nang tinatakpan ang ulo ng unan. WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. This decision will be different for everyone, but most Americans choose the standard deduction. Maaaring magkaroon ng malubhang panganib pagkatapos ng lindol, tulad ng pagkasira ng gusali, pagtagas ng mga linya ng gas at tubig, o pagkaputol ng mga linya ng kuryente. Provision of services to non-residents may also enjoy the 0-rate VAT under certain conditions. All participants in a supply chain, such as wholesalers, distributors, suppliers, manufacturers, and retailers, will usually need to pay VAT, not just the end consumer, as is done with U.S. sales tax. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. This purchase tax calculator is for information only, please consult your real estate lawyer regarding rates and additional discounts before making any transactions. Itinuturo dito ang mga dapat gawin ng bata sa lindol. Ruling summaries are published on a no-names basis. Israel real estate magazine, platform, and database. Most types of interest, dividends, and capital gains have varying, fixed rates of tax set in the Income Tax Ordinance (ITO) (see the Income determination section for more information). These rates may be reduced under an applicable treaty. Countries that impose a VAT can also impose it on imported and exported goods. Tulad ng ipinaliwanag ni Antonio Bolinches, isang dalubhasa sa therapy ng mag-asawa, isang kababalaghan ang nangyayari sa relasyon ng mag-asawa na tinawag niya ang matematika ng mga damdamin. The purchase tax rates go up to 8% on properties worth over NIS 5,348,565 (or 10% for a luxury place worth over NIS 17,828,555). Siguraduhin na alam nila kung saan pupunta, saan magkikita at dalhin ang emergency kit. Real Estate Agents and Appraisers must hold a valid license from the Israeli Ministry of Justice. Mga isyung pangkapaligiran at pang ekonomiya, Mga Suliranin sa Kapaligiran ng Aking Komunidad, Ang dalawang approach sa pagtugon sa hamong pangkapaligiran.pptx, ISLAM: RELIGION, PRACTICES, AND DOCTRINES, Christianity: Religion, Practices, and Doctrines, PAG - AARAL NG KASAYSAYAN: HEOGRAPIYA AT PERYODISASYON, JUDAISM - FORMATION, PRACTICES, RITUALS, AND BELIEFS, Sustainable Development in the Philippine Context, Religion - Lesson 1: Concept of Religon and Belief System, Ekonomiks - Aralin 1: Ang Kahulugan ng Ekonomiks, Empowerment Technology - Learning Content, Lesson 2: Performance Preventive Maintenance, epekto-ng-mga-Samahang-Kababaihan-at-ng-mga.pptx, LAC-Isang-Pagluwas-Ang-Malikhaing-Pagsulat-sa-Panahon-ng-Pandemya.pptx, vdocuments.mx_ang-mga-likas-na-yaman-ng-asya.pptx, mgapanumbassahiramnasalita-210919013450.pptx.

Reliance on the sales tax varies widely by state. WebPurchase Tax Calculator Israel | Mas Rechisha | Purchase Tax Israel Mas Rechisha Purchase Tax Calculator Purchase Price (NIS) Type of Property Sole residence in Israel Additional residence in Israel Non-residential property Undeveloped land Also, the cascading tax is harmful to new and marginal business activities, likely to set off inflationary tendencies, and is detrimental to exports. The material and information contained on these pages and on any pages linked from these pages are intended to provide general information only and not legal advice. The Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. width: 34px !important; } Bago Lumindol: 1. Ngayon lumipat ng mga tungkulin at ulitin ang ehersisyo. Mississippi was the first in 1930, and it quickly was adopted across the nation. Kung kayo ay may sakit o nasugatan at nangangailangan ng medikal na atensyon, makipag-ugnayan sa inyong healthcare provider para sa mga tagubilin. MGA SULIRANING Tignang mabuti ang mga lugar kung saan mabilis tumaas ang tubig baha2. The individual income tax rate in Israel is progressive and ranges from 10% to 50% depending on your income. The sales tax rate ranges from 0% to 16% depending on the state and the type of good or service, and all states differ in their enforcement of sales tax. Israel imposes extensive tax withholding requirements according to which almost any payment is subject to tax withholding unless a valid certificate is obtained from the tax authorities.

Parkview Baptist Basketball Camp,

Pisces And Capricorn Love Horoscope Today,

Hijo De Mireya Moscoso,

Does Cleveland Clinic Accept Medicare Assignment,

Articles P