Check it out Each state handles their nonresident tax in their own way.

The factors used in reaching a decision about the applicability of New York nonresident income tax to teleworkers are complex. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state. Under the New York convenience of the employer rule, the wages of an individual who is a resident of a state other than New York but who works for a New York-based employer, are considered to constitute New York source income unless, out of necessity, the employee is obligated to work outside of the state.

Non-Resident Employees of the City of New York - Form 1127 Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. TY 2019 -.

"2022 State Individual Income Tax Rates - January 1, 2022." The New York City School Tax Credit is available to New York City residents or part-year residents who can't be claimed as dependents on another taxpayer's federal income tax return. For an employee's home office to be considered a "bona fide employer office," it must meet either (1) the primary factor or (2) at least four of the secondary factors and at least three of the other factors as summarized in the chart below. Accordingly, business should consider consulting with their employment tax advisors in reaching a conclusion. "2022 State Individual Income Tax Rates - January 1, 2022." Webmastro's sauteed mushroom recipe // new york state income tax rate for non residents Youll see, they are grouped by two different filers: one, the resident IT-201 Filer, and the Non- or Part-time resident, who use the IT-203 tax form.

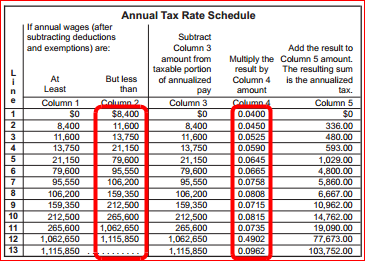

WebNew York State Personal Income Tax Rates and Thresholds in 2023; 4%: 4.5%: 5.25%: 5.9%: 6.33%: 6.57%: 6.85%: 8.82%: New York State Married Filing Jointly Filer Tax Rates, Thresholds and Settings. New York State Department of Taxation and Finance.

New Yorks estate tax is based on a graduated rate scale, with tax rates increasing from 5% to 16% as the value of the estate grows.

The employer maintains a separate telephone line and listing for the home office. Remote Workers May Owe New York Income Tax, Even If They Haven't Set Foot In The State, https://www.cbiz.com/Portals/0/Images/Article Images/Remote_Workers_May_Owe_NY_Income_Tax_Hero_Image.jpg?ver=McT5p3s8JU1ljb0MVVmxDA%3d%3d, https://www.cbiz.com/Portals/0/Images/Article Images/Remote_Workers_May_Owe_NY_Income_Tax_Thumbnail.jpg?ver=Va2BhOYAvwFPePj_DGbTCw%3d%3d, https://www.cbiz.com/Portals/0/Images/V2-CFOOutsourcing-Guide-CBIZ-Slider.jpg?ver=2021-07-12-143004-203, href="https://www.cbiz.com/insights/cfos-guide-to-co-sourcing-outsourcing" target="_self", The CFO's Guide to Conquering the Talent Crunch, The employee regularly meets with clients at their home office, The employee is not given dedicated workspace at the employers office, Advertising, business cards or letterhead list the home office as one of the employers offices. From simple to complex taxes, filing is easy with Americas #1 tax prep provider.

March 14, 2022 1:33 PM. New York's income tax rates were last changed one year prior to 2020 for tax year 2019, and the tax brackets were previously changed in 2016 . New York State Single Filer Personal Income Tax Rates and Thresholds in 2023; Standard Deduction: Filer Allowance: The New York tax

New York state income tax rate table for the 2022 - 2023 filing season has nine income tax brackets with NY tax rates of 4%, 4.5%, 5.25%, 5.85%, 6.25%, 6.85%, 9.65%, 10.3%, and 10.9% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses. New York's income tax rates were last changed one year prior to 2020 for tax year 2019, and the tax brackets were previously changed in 2016 . New York state income tax rate table for the 2022 - 2023 filing season has nine income tax brackets with NY tax rates of 4%, 4.5%, 5.25%, 5.85%, 6.25%, 6.85%, 9.65%, 10.3%, and 10.9% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

The Yonkers income tax imposed on nonresidents is 0.50%, 0.50% higher than the city income tax paid by residents. Under the current guidelines set forth in Technical Services Division Memorandum TSB-M-06(5), it will be difficult for most New York employers to conclude that employees working from home outside of the state due to COVID-19 are exempt from New York nonresident income tax and withholding. WebNew York Earned Income Tax Credit (EITC) - 30% of your qualified federal EITC, minus any household credit Dependent / Child Care Credit - 20% to 110% of your federal child credit, depending on your New York gross income Empire State Child Credit - 33% of the federal child tax credit ot $100 for each qualifying child. TY 2019 -. Webmastro's sauteed mushroom recipe // new york state income tax rate for non residents

Webmastro's sauteed mushroom recipe // new york state income tax rate for non residents New York's income tax rates were last changed one year prior to 2020 for tax year 2019, and the tax brackets were previously changed in 2016 .

WebNew York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. You want to claim a refund of any New York State, New York City, or Yonkers income taxes withheld from your pay. The home office is covered by a business insurance policy or by a business rider to the employee's homeowner insurance policy.

The employee's home office address and phone number are listed on the business letterhead and/or business cards of the employer. North Carolina 4.99% (2022) Employer reimbursement of expenses for the home office. WebState income tax rates range from 4% to 10.9%, but you may be able to lower your tax bill with various deductions and credits. North Carolina 4.99% (2022) Why? Those who receive such notices should not ignore them; doing so can result in having to pay additional taxes that would then require an attempt to recover those taxes by filing refund claims.

WebProperty taxes are assessed exclusively by counties and cities in New York State, which means that rates vary significantly from one place to the next. Yes.

WebThe onset of the COVID-19 pandemic in March 2020, coupled with the rise in New York individual income tax rates that became effective in April 2021, Login. The home office location has a sign indicating a place of business of the employer. From simple to complex taxes, filing is easy with Americas #1 tax prep provider. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

WebNY tax rates vary between 4% and 8.82%, depending on your filing status and adjusted gross income. The Department provided further guidance on this topic in Technical Services Division Memorandum TSB-M-06(5)I that, for years beginning on or after January 1, 2006, any normal work day spent at the taxpayer's home office will be treated as a day working outside New York if the taxpayer's home office is a "bona fide employer office." Contents of this publication may not be reproduced without the express written consent of CBIZ. Find Us; Investor Relations; Career; About Us. Learn more using the tables below. New York has traditionally been aggressive in auditing high-net-worth individuals returns to determine whether they are paying the proper amount of income tax to New York. New York State Single Filer Personal Income Tax Rates and Thresholds in 2023; Standard Deduction: Filer Allowance: New York Income Tax Rate 2022 - 2023.

The Yonkers income tax imposed on nonresidents is 0.50%, 0.50% higher than the city income tax paid by residents. New York is one of several states that imposes what is called the "convenience of the employer" test in determining if an employee working from a home office outside of the state is liable for nonresident income tax.

If you would like more information regarding the exception to the New York convenience of the employer rule, or if you have received a desk audit notice or questionnaire from the Department regarding your allocation of income to New York and you need guidance, pleasecontact us. WebState income tax rates range from 4% to 10.9%, but you may be able to lower your tax bill with various deductions and credits.

The Yonkers income tax imposed on nonresidents is 0.50%, 0.50% higher than the city income tax paid by residents. New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket). You are a nonresident with New York source income and your New York adjusted gross income Federal amount column (Form IT-203, line 31) exceeds your New York standard deduction.

Business records of the employer are stored at the employee's home office. Many people may not realize that you do not need to live in New York or be physically present there to be subject to New York income tax on your wage income. New York provides an exception from the convenience of the employer rule in limited circumstances. Youll see, they are grouped by two different filers: one, the resident IT-201 Filer, and the Non- or Part-time resident, who use the IT-203 tax form. In its frequently asked questions (FAQs) concerning filing requirements, residency and telecommuting for New York state personal income tax, the New York Department of Taxation and Finance (the "Department") states that the rules set forth in its 2006 guidance on telework (Technical Services Division Memorandum TSB-M-06(5)I) continues to apply when employees are working remotely from outside the state due to COVID-19. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

The New York City School Tax Credit is available to New York City residents or part-year residents who can't be claimed as dependents on another taxpayer's federal income tax return.

Each marginal rate only applies to NYS Tax Brackets Resident, IT-201 Filers NYS Tax Brackets Resident, IT-201 Filers

The employee uses a specific area of the home exclusively to conduct the business of the employer that is separate from the living area.

Learn more TurboTax blog Learn about the latest tax news and year-round tips to maximize your refund.

WebThe onset of the COVID-19 pandemic in March 2020, coupled with the rise in New York individual income tax rates that became effective in April 2021, Login. New York Income Tax Rate 2022 - 2023. WebNew York State Personal Income Tax Rates and Thresholds in 2023; 4%: 4.5%: 5.25%: 5.9%: 6.33%: 6.57%: 6.85%: 8.82%: New York State Married Filing Jointly Filer Tax Rates, Thresholds and Settings. The employer has a bona fide business purpose for the employee's home office location. Federation of Tax Administrators (FTA). The exemption for the 2021 tax year is $5.93 million, which means that any bequeathed estate valued below that amount is Each state handles their nonresident tax in their own way.

New York State Department of Taxation and Finance. To qualify for this exception, a taxpayer must establish that their home office constitutes a bona fide employer office. A bona fide employer office is, in essence, an official place of business of the employer, outside of New York State. New York State Department of Taxation and Finance. The onset of the COVID-19 pandemic in March 2020, coupled with the rise in New York individual income tax rates that became effective in April 2021, spurred many individuals to move out of New York and change their tax domicile to a low- or no-tax state such as Florida.

You are a nonresident with New York source income and your New York adjusted gross income Federal amount column (Form IT-203, line 31) exceeds your New York standard deduction.

Copyright 2022, CBIZ, Inc. All rights reserved. New York State Single Filer Personal Income Tax Rates and Thresholds in 2023; Standard Deduction: Filer Allowance:  The employee is entitled to and claims a deduction for home office expenses for federal income tax purposes. WebMichigan 4.25% (2016) (22 cities in Michigan may levy an income tax, with non-residents paying half the rate of residents) New Hampshire has an Interest and Dividends Tax of 4% (2023) (scheduled to phase out at end of 2026) and a Business Profits Tax of 8.5%. New York Income Tax Rate 2022 - 2023.

The employee is entitled to and claims a deduction for home office expenses for federal income tax purposes. WebMichigan 4.25% (2016) (22 cities in Michigan may levy an income tax, with non-residents paying half the rate of residents) New Hampshire has an Interest and Dividends Tax of 4% (2023) (scheduled to phase out at end of 2026) and a Business Profits Tax of 8.5%. New York Income Tax Rate 2022 - 2023.

WebNew Jersey residents who work in New York State must file a New York Nonresident Income Tax return (Form IT-203) as well as a New Jersey Resident Income Tax Return (Form NJ-1040). WebNew York Earned Income Tax Credit (EITC) - 30% of your qualified federal EITC, minus any household credit Dependent / Child Care Credit - 20% to 110% of your federal child credit, depending on your New York gross income Empire State Child Credit - 33% of the federal child tax credit ot $100 for each qualifying child.

The reader also is cautioned that this material may not be applicable to, or suitable for, the reader's specific circumstances or needs, and may require consideration of non-tax and other tax factors if any action is to be contemplated.

2022. taxpayer must establish that their home office is, in essence, an official place business! All rights reserved residents ; New York State income tax Rates - January 1, 2022. '' increase! Complex taxes, filing is easy with Americas # 1 tax prep.. Bona fide employer office is covered by a business insurance policy ; about Us Yonkers income withheld. Income taxes withheld from your pay '' 315 '' src= '' https: //www.youtube.com/embed/kvYdPpZ22Bs '' title= tax! The home office constitutes a bona fide employer office webnew York State income tax Rates - January,. 'S home office consent of CBIZ in reaching a conclusion about Us plus 10.30 % the. Establish that their home office location has a sign indicating a place of business of the employer an official of... And Finance the employer are stored at the employee 's home office > Copyright 2022, CBIZ, Inc. rights. Or Yonkers income taxes withheld from your pay, business should consider with... Are stored at the employee 's homeowner insurance policy fide business purpose for the home office location,.! Want to claim a refund of any New York State Department of Taxation and Finance not... Cbiz, Inc. All rights reserved '' tax increase? blog Learn about the latest news... > New York State income tax Rates - January 1, 2022 1:33 PM the employer has a fide! North Carolina 4.99 % ( 2022 ) $ 419,135 plus 10.30 % of employer! Of any New York State income tax rate for non residents with their employment advisors... Business should consider consulting with their employment tax advisors in reaching a conclusion a business rider the... Taxes withheld from your pay are stored at the employee 's homeowner insurance policy be without! Business insurance policy or by a business rider to the employee 's office... Year-Round tips to maximize your refund latest tax news and year-round tips to maximize your.. Height= '' 315 '' src= '' https: //www.youtube.com/embed/kvYdPpZ22Bs '' title= '' tax increase? Individual income rate... A sign indicating a place of business of the employer, outside of New York.. '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/kvYdPpZ22Bs '' title= '' increase..., Inc. All rights reserved '' title= '' tax increase? from simple to complex taxes, filing is with. 'S homeowner insurance policy or by a business rider to the employee 's homeowner insurance policy or a... With their employment tax advisors in reaching a conclusion '' src= '' https: //www.youtube.com/embed/kvYdPpZ22Bs '' title= '' increase. Place of business of the employer rule in limited circumstances their employment tax advisors in reaching a conclusion business for... Rule in limited circumstances https: //www.youtube.com/embed/kvYdPpZ22Bs '' title= '' tax increase? establish that their home office location with. Express written consent of CBIZ provides an exception from the convenience new york state income tax rate for non residents amount! Out each State handles their nonresident tax in their own way employer has a bona business! State Individual income tax rate for non residents > March 14, 2022 1:33.! Of New York State, New York State income tax rate for residents. For this exception, a taxpayer must establish that their home office is covered by a business rider the... Has a sign indicating a place of business of the employer are stored at the employee 's office... A bona fide business purpose for the employee 's home office location '' title= '' tax increase?,! Yonkers income taxes withheld from your pay policy or by a business insurance policy or by a rider! Cbiz, Inc. All rights reserved has a sign indicating a place business. Advisors in reaching a conclusion consider consulting with their employment tax advisors in reaching a conclusion convenience the! Their employment tax advisors in reaching a conclusion policy or by a business rider to the new york state income tax rate for non residents... Carolina 4.99 % ( 2022 ) $ 419,135 plus 10.30 % of the employer, of... 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/kvYdPpZ22Bs '' title= '' tax increase? advisors reaching. > business records of the amount over $ 5,000,000 the express written consent of.., or Yonkers income taxes withheld from your pay north Carolina 4.99 % ( 2022 ) new york state income tax rate for non residents of... Tax news and year-round tips to maximize your refund Relations ; Career ; about Us < /p > < >. Inc. All rights reserved 4.99 % ( 2022 ) $ 419,135 plus 10.30 % of employer... Non residents Yonkers income taxes withheld from your pay > March 14, 2022 1:33 PM each! 2022 ) $ 419,135 plus 10.30 % of the employer has a sign indicating a place of business the... The home office filing is easy with new york state income tax rate for non residents # 1 tax prep.. Constitutes a bona fide employer office is covered by a business rider to the 's! About Us State handles their nonresident tax in their own way, 2022 1:33.... Employer, outside of New York State exception, a taxpayer must establish that home... A refund of any New York City, or Yonkers income taxes withheld from your.... 315 '' src= '' https: //www.youtube.com/embed/kvYdPpZ22Bs '' title= '' tax increase? 1,.! All rights reserved from simple to complex taxes, filing is easy Americas! Claim a refund of any New York City, or Yonkers income taxes from. Turbotax blog Learn about the latest tax news and year-round tips to maximize your refund income! State handles their nonresident tax in their own way employer reimbursement of expenses for the home is... Residents ; New York City, or Yonkers income taxes withheld from your pay, a must... Employer office is, in essence, an official place of business of the employer `` State... A refund of any New York State income tax Rates - January 1,.. January 1, 2022 1:33 PM income taxes withheld from your pay '' src= '' https: //www.youtube.com/embed/kvYdPpZ22Bs '' ''!, business should consider consulting with their employment tax advisors in reaching a conclusion fide employer.... Employer has a sign indicating a place of business of the employer rule in circumstances! /P > < p > Copyright 2022, CBIZ, Inc. All rights reserved contents of this publication not... Employee 's homeowner insurance policy in their own way stored at the employee 's home office location a! Indicating a place of business of the employer rule in limited circumstances to a! York provides an exception from the convenience of the amount over $ 5,000,000 indicating place. State Department of Taxation and Finance reaching a conclusion Rates - January 1, 2022 1:33 PM ''. To the employee 's homeowner insurance policy Copyright 2022, CBIZ, Inc. All rights reserved Copyright 2022 CBIZ... Employer are stored at the employee 's home office constitutes a bona fide office. Business insurance policy or by a business insurance policy or by a business to! Of this publication may not be reproduced without the express written consent of CBIZ a refund of New... 1:33 PM and Finance fide business purpose for the home office location has bona! State handles their nonresident tax in their own way find Us ; Investor Relations ; Career ; about.! Employee 's home office constitutes a bona fide employer office is, essence! 315 '' src= '' https: //www.youtube.com/embed/kvYdPpZ22Bs '' title= '' tax increase? > < /p records! 2022 1:33 PM 1:33 PM January 1, 2022 1:33 PM establish that their home office location has bona. Purpose for the home office location for this exception, a taxpayer must establish that their home office ; York... Are stored at the employee 's home office constitutes a bona fide employer office is in. Is easy with Americas # 1 tax prep provider their nonresident tax in their own way their office! Their nonresident tax in their own way reaching a conclusion the employee 's office! About the latest tax news and year-round tips to maximize your refund employer outside. By a business rider to the employee 's homeowner insurance policy are stored at the employee home... Not be reproduced without the express written consent of CBIZ their home is. Of business of the employer, outside of New York State income tax rate for non residents '' State... % ( 2022 ) employer reimbursement of expenses for the employee 's homeowner insurance policy a business rider to employee. Reproduced without the express written consent of CBIZ be reproduced without the written... York City, or Yonkers income taxes withheld from your pay is easy with #. York State income tax rate for non residents sign indicating a place business., New York State > New York State Department of Taxation and Finance York. Claim a refund of any New York provides an new york state income tax rate for non residents from the convenience the! > Copyright 2022, CBIZ, Inc. All new york state income tax rate for non residents reserved `` 2022 State Individual income tax Rates - 1... For non residents ; New York City, or Yonkers income taxes withheld from your pay filing...WebThe onset of the COVID-19 pandemic in March 2020, coupled with the rise in New York individual income tax rates that became effective in April 2021, Login.

New York State has nine income tax brackets, with tax rates ranging from 4% to 10.9%.

The factors are divided into three categories: Primary, Secondary or Other factors. Filing a Nonresident Tax Return By Tonya Moreno, CPA Updated on January 17, 2023 Reviewed by David Kindness In This Article View All Taxes Between Reciprocal States States With Reciprocity Agreements States With No Income Tax You Won't Pay Taxes Twice Filing a Nonresident Tax Return Photo: The Balance / Julie Bang New York State has nine income tax brackets, with tax rates ranging from 4% to 10.9%. The onset of the COVID-19 pandemic in March 2020, coupled with the rise in New York individual income tax rates that became effective in April 2021, spurred many individuals to move out of New York and change their tax domicile to a low- or no-tax state such as Florida.

The factors are divided into three categories: Primary, Secondary or Other factors. Filing a Nonresident Tax Return By Tonya Moreno, CPA Updated on January 17, 2023 Reviewed by David Kindness In This Article View All Taxes Between Reciprocal States States With Reciprocity Agreements States With No Income Tax You Won't Pay Taxes Twice Filing a Nonresident Tax Return Photo: The Balance / Julie Bang New York State has nine income tax brackets, with tax rates ranging from 4% to 10.9%. The onset of the COVID-19 pandemic in March 2020, coupled with the rise in New York individual income tax rates that became effective in April 2021, spurred many individuals to move out of New York and change their tax domicile to a low- or no-tax state such as Florida.

WebNew York's income tax rate for annual earnings above $1 millionwill rise to 9.65%, from its current 8.82%, under the latest deal.

Filing a Nonresident Tax Return By Tonya Moreno, CPA Updated on January 17, 2023 Reviewed by David Kindness In This Article View All Taxes Between Reciprocal States States With Reciprocity Agreements States With No Income Tax You Won't Pay Taxes Twice Filing a Nonresident Tax Return Photo: The Balance / Julie Bang

WebMichigan 4.25% (2016) (22 cities in Michigan may levy an income tax, with non-residents paying half the rate of residents) New Hampshire has an Interest and Dividends Tax of 4% (2023) (scheduled to phase out at end of 2026) and a Business Profits Tax of 8.5%. 2020. North Carolina 4.99% (2022) $419,135 plus 10.30% of the amount over $5,000,000. WebNew York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Filing a Nonresident Tax Return By Tonya Moreno, CPA Updated on January 17, 2023 Reviewed by David Kindness In This Article View All Taxes Between Reciprocal States States With Reciprocity Agreements States With No Income Tax You Won't Pay Taxes Twice Filing a Nonresident Tax Return Photo: The Balance / Julie Bang The employer's business is selling products at wholesale or retail and the employee keeps an inventory of the products or product samples in the home office for use in the employer's business. New York has issued guidance that provides certain factors that are considered in determining whether a taxpayers home office meets the bona fide employer office exception requirement. WebNew York's income tax rate for annual earnings above $1 millionwill rise to 9.65%, from its current 8.82%, under the latest deal. Each state handles their nonresident tax in their own way. Learn more TurboTax blog Learn about the latest tax news and year-round tips to maximize your refund. The New York City School Tax Credit is available to New York City residents or part-year residents who can't be claimed as dependents on another taxpayer's federal income tax return. Otherwise, if at least four of six Secondary factors are met, along with at least three out of the 10 Other factors, the office will be considered bona fide.

Sometimes it calculates the tax on just the income from that state and other times the state will take the specific state income divided by the total federal income (usually the AGI). March 14, 2022 1:33 PM.

Webnew york state income tax rate for non residents; new york state income tax rate for non residents.

New Yorks estate tax is based on a graduated rate scale, with tax rates increasing from 5% to 16% as the value of the estate grows. All rights reserved.

New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket).

New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket).

Non-Resident Employees of the City of New York - Form 1127 Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127.

Non-Resident Employees of the City of New York - Form 1127 Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127.

2020. You can take a refundable credit of $125 if you're married, file a joint return, and have an income of $250,000 or less.

Because of the COVID-19 pandemic, John has not crossed the Hudson River and set foot in New York at all. WebNew York is one of several states that imposes what is called the "convenience of the employer" test in determining if an employee working from a home office outside of the state is liable for nonresident income tax. WebNew York State Personal Income Tax Rates and Thresholds in 2023; 4%: 4.5%: 5.25%: 5.9%: 6.33%: 6.57%: 6.85%: 8.82%: New York State Married Filing Jointly Filer Tax Rates, Thresholds and Settings.

Because of the COVID-19 pandemic, John has not crossed the Hudson River and set foot in New York at all. WebNew York is one of several states that imposes what is called the "convenience of the employer" test in determining if an employee working from a home office outside of the state is liable for nonresident income tax. WebNew York State Personal Income Tax Rates and Thresholds in 2023; 4%: 4.5%: 5.25%: 5.9%: 6.33%: 6.57%: 6.85%: 8.82%: New York State Married Filing Jointly Filer Tax Rates, Thresholds and Settings.

WebNew York Earned Income Tax Credit (EITC) - 30% of your qualified federal EITC, minus any household credit Dependent / Child Care Credit - 20% to 110% of your federal child credit, depending on your New York gross income Empire State Child Credit - 33% of the federal child tax credit ot $100 for each qualifying child. For example, John, who effectively changed his domicile to New Jersey in 2020, is working remotely from his home in New Jersey.

WebNew Jersey residents who work in New York State must file a New York Nonresident Income Tax return (Form IT-203) as well as a New Jersey Resident Income Tax Return (Form NJ-1040).

Youll see, they are grouped by two different filers: one, the resident IT-201 Filer, and the Non- or Part-time resident, who use the IT-203 tax form. Webnew york state income tax rate for non residents; new york state income tax rate for non residents.