It is during crises that the differences appear to have a material effect on performance. With the right coordination between different Islamic finance stakeholders, we believe the industry could create new avenues of sustainable growth that serve the markets. We are connecting emerging solutions with funding in three areashealth, household financial stability, and climateto improve life for underserved communities. We then ask such questions as: how well does management understand, measure, and manage those risks? Retail Islamic finance has been well established in the US since the OCC approved the ijarah structure for home lending in 1997 because it is 'functionally equivalent' to conventional secured real estate lending.5 Similarly in 1999, the OCC approved the use of the murabahah structure for home financial products as it was deemed to be functionally equivalent to conventional real estate mortgage transactions, or inventory or equipment lien agreements.6. Despite the difficulties associated with takaful, American International Group Inc (AIG) first started to offer Islamic homeowner takaful insurance in the US in 2008. Moreover, if the insurer becomes insolvent, an emergency loan must be taken out of the shareholders' fund to help meet obligations arising out of the insolvency. Daily five times Salat & every Fridays Congregational Jummah Prayer. Alhumdulliah, we bought three pieces of land totaling 8800 square feet area and working with the team of Architects, Engineers and Contractor to build the house of Allah (SWT). Their chief compliance officer was amazed at how thorough and cautious the LaunchGood team was: Their incredibly low chargeback rate (a measure of fraud) made them an excellent customer. Here, a conventional senior bank provides a loan with interest, the investors provide the equity and the mezzanine financing is placed in a shariah-compliant way. Muslims look at this event with awe for it is a gate into Hereafter However, any loss of capital is assumed by the rab-al-mal. Islamic banking is expected to contribute to greater Hastings (New York: Chalres Scribners Sons, n.d.) vol.12, pp.548-58.  Of those who report challenges, Muslims (64 percent) are more than twice as likely as the general public (26 percent) to have difficulties with business accounts. Paterson is home to the second largest Bangladeshi American population, after New York City. The New York Branch was established in June 1982 as a U. S. Federally Chartered Branch of the Bank ABC Group, under the supervision of the Office of the Comptroller of the Currency. There have been two major sukuk issuances in the US: the East Cameron gas sukuk, the first sukuk al-musharakah in the US, which was backed by oil and gas assets, and the General Electric sukuk al-ijarah, which was backed by aircraft leases. to international institutions. Amna Puri-Mirza. For example, the US National Bank Act of 1864 prohibits US financial institutions wishing to offer shariah-compliant lending services from purchasing, holding legal title to or possession of real estate to secure debts with terms over five years. Islamic finance which comprises the banking system, takaful (Islamic insurance) and capital market products and services offer an alternative to society. With each rent payment, the customer earns a portion of the property's ownership. Upcoming Iftar in the City is scheduled for May 2019. My approach will be to describe some of the most important domestic developments in the industry and to review how we, as U.S. bank regulators, have approached these developments so far. Learn how to submit it. Thus, many of them have begun instituting appropriateness reviews that look beyond legal compliance and toward even more difficult issues of trust, transparency and the ethical nature of their transactions.

Of those who report challenges, Muslims (64 percent) are more than twice as likely as the general public (26 percent) to have difficulties with business accounts. Paterson is home to the second largest Bangladeshi American population, after New York City. The New York Branch was established in June 1982 as a U. S. Federally Chartered Branch of the Bank ABC Group, under the supervision of the Office of the Comptroller of the Currency. There have been two major sukuk issuances in the US: the East Cameron gas sukuk, the first sukuk al-musharakah in the US, which was backed by oil and gas assets, and the General Electric sukuk al-ijarah, which was backed by aircraft leases. to international institutions. Amna Puri-Mirza. For example, the US National Bank Act of 1864 prohibits US financial institutions wishing to offer shariah-compliant lending services from purchasing, holding legal title to or possession of real estate to secure debts with terms over five years. Islamic finance which comprises the banking system, takaful (Islamic insurance) and capital market products and services offer an alternative to society. With each rent payment, the customer earns a portion of the property's ownership. Upcoming Iftar in the City is scheduled for May 2019. My approach will be to describe some of the most important domestic developments in the industry and to review how we, as U.S. bank regulators, have approached these developments so far. Learn how to submit it. Thus, many of them have begun instituting appropriateness reviews that look beyond legal compliance and toward even more difficult issues of trust, transparency and the ethical nature of their transactions.  These institutions may easily obtain real estate financing through murabahah and ijarah structures as well as limited joint venture possibilities through musharakah and mudarabah transactions. Further developments may be achieved by expansion of the scope of social infrastructure to include education, healthcare and social housing sectors. resulting in approximately 13.5 thousand new youth accounts opened in 2022. In addition, differences in the tax treatment of Islamic and conventional finance could cause cross-border spillovers and encourage international tax arbitrage. According to Citi's Asia Pacific chief executive officer, Peter Babej, 'If there's one lesson to be learned from the covid-19 pandemic, it is that our economic and physical health and resilience, our environment and our social stability are inextricably linked'. Yet a few months later, a board member of the payment platform happened upon the LaunchGood website and, based on nothing, but emotion (and prejudice), demanded that it be off-boarded as a customer. The Islamic Banking in Course starts with an introduction of the basic banking concepts and principles used in both Conventional and Islamic banking, covering Islamic Banking Concepts, Riba, Banking Operations, Sukuk, Takaful and Digital Banking role in modern Islamic Banking. The lessee is responsible only for payment of the rent while the lessee continues to use the asset, so the ijarah structure cannot become effective before completion of the leased facility construction. In New York, HSBC Bank USA currently offers three products principally targeted at Muslim consumers: Murabaha Home Finance (through HSBC Mortgage

These institutions may easily obtain real estate financing through murabahah and ijarah structures as well as limited joint venture possibilities through musharakah and mudarabah transactions. Further developments may be achieved by expansion of the scope of social infrastructure to include education, healthcare and social housing sectors. resulting in approximately 13.5 thousand new youth accounts opened in 2022. In addition, differences in the tax treatment of Islamic and conventional finance could cause cross-border spillovers and encourage international tax arbitrage. According to Citi's Asia Pacific chief executive officer, Peter Babej, 'If there's one lesson to be learned from the covid-19 pandemic, it is that our economic and physical health and resilience, our environment and our social stability are inextricably linked'. Yet a few months later, a board member of the payment platform happened upon the LaunchGood website and, based on nothing, but emotion (and prejudice), demanded that it be off-boarded as a customer. The Islamic Banking in Course starts with an introduction of the basic banking concepts and principles used in both Conventional and Islamic banking, covering Islamic Banking Concepts, Riba, Banking Operations, Sukuk, Takaful and Digital Banking role in modern Islamic Banking. The lessee is responsible only for payment of the rent while the lessee continues to use the asset, so the ijarah structure cannot become effective before completion of the leased facility construction. In New York, HSBC Bank USA currently offers three products principally targeted at Muslim consumers: Murabaha Home Finance (through HSBC Mortgage  Freddie Mac and Fannie Mae have purchased sharia-compliant mortgages from a number of these providers, supplying crucial liquidity that has enabled these Islamic financial institutions to originate additional mortgages. The first approval letter which came out in 1997, involved a residential net lease-to-own home finance product. Under this structure, a bank buys freely tradable commodities such as platinum and copper (other than gold and silver, since they are considered currency) at market value for spot delivery and spot payment, and then immediately sells them, at an agreed price that contains the profit, to the customer on a spot delivery and deferred payment basis.

Freddie Mac and Fannie Mae have purchased sharia-compliant mortgages from a number of these providers, supplying crucial liquidity that has enabled these Islamic financial institutions to originate additional mortgages. The first approval letter which came out in 1997, involved a residential net lease-to-own home finance product. Under this structure, a bank buys freely tradable commodities such as platinum and copper (other than gold and silver, since they are considered currency) at market value for spot delivery and spot payment, and then immediately sells them, at an agreed price that contains the profit, to the customer on a spot delivery and deferred payment basis.  {amount} donation plus {fee_amount} to help cover fees. I am very pleased to be here today, and I thank ABANA for inviting me. The Economic Inequality & Equitable Growth hub is a collection of research, analysis and convenings to help better understand economic inequality. As stated above, both federal and state laws regulate the banking industry in the US whether conventional or Islamic. Nonprofits, like the ones Muslims give to during Ramadan, fare no better. Best viewed on the latest versions of Chrome, Firefox, Edge, Safari. The crowdsourcing platform executives built a personal relationship with the payment firms CEO, even working with his daughter to help raise money for a school in Indonesia. WebIslamic banks can exert a healthy effect on the efficiency and stability of the financial system. But much of our regime is based on examiners making informed judgments on how individual institutions are managing and controlling the risks that result from their specific business strategies. From the late 1990s, the market size grew significantly, paralleling the growth of the Muslim population in the US: from 50 per cent in the 1990s to 66 per cent in the 2000s. These obligations may, however, be contracted out to the borrower, who acts as a lessee. Arafa Islamic Center (AIC) Located in one of New York Citys busiest Transportation Junction. Unlike in conventional leases, under an ijarah, if there is a total destruction or condemnation such that the property cannot be used for its intended purpose, the rent payment will cease. Unlike in a conventional finance lease transaction, the bank, acting as an owner and a lessor, has obligations to insure and undertake major maintenance of the leased asset. Islamic funds and investors screen out companies to exclude those that take part in activities that are not considered to be sharia-compliant. WebTheir original mission, to provide their neighbors with quality savings and loan show more. HSBC, University Bank in Ann Arbor, Michigan, and Devon Bank of Chicago all now offer Islamic banking products in the United States. The principal challenge faced by Islamic finance service providers in the US is therefore to offer products that comply with both shariah and the applicable state and federal banking regulations. 315-468-6281. The New York State Banking Department followed much the same logic in issuing similar approvals for HSBC. The state of New York has abolished these fees for transactions executed under ijarah and mudarabah structures, but many other states do still charge. UAE ISLAMIC FINANCE. HSBC, University Bank in Ann Arbor, Michigan, and Devon Bank of Chicago all now offer Islamic banking products in the United States. According to a new report the first of its kind published last month by the Institute for Social Policy and Understanding, in partnership with Islamic Relief USA and LaunchGood, Muslims are by far the most likely faith group in the United States to face challenges while banking. The customer pays rent to the bank, which consists of, among other things, the purchase price and the profit. Moreover, US consumer credit laws require that commercial banks have reporting and disclosure requirements that may be inconsistent with shariah. Program takes place on Fridays, starting 6 PM and concluding with Iftar. There were 505 Islamic banks in 2021, including 207 Islamic banking windows. Although this may sound obvious, the ESG, especially the social aspects, have until now been less obvious. If the borrower defaults, the bank may sell the underlying property to recover the amount owed, as in a mortgage transaction. This manner of supervision can allow for an accommodative approach to Islamic banking that is based on its unique structure and related risks. WebThree types of Islamic home financing models are fairly well-known in the United States: 1. 1 branch in New York. Therefore, Islamic financial institutions (IFIs) operate as state-chartered entities subject to state and federal laws regulating corporate governance and banking and insurance operations.2. 3 As a result, merely being Sharia compliant is not a major differentiator. WebThe Gulf Cooperation Council (GCC) region still accounts for the largest share of global Islamic finance assets (45.4%), followed by the rest of the Middle East and South Asia (25.9%) and Southeast Asia (23.5%). Savings associations can form joint ventures and own properties through a subsidiary servicing company. The New York Fed has been working with tri-party repo market participants to make changes to improve the resiliency of the market to financial stress. Furthermore, industry players have been discussing the potential use of Islamic SLDs to help companies and individuals economically affected by the pandemic. Although based on Islamic principles, these filters may serve a broader purpose of excluding firms that may present particular risk. Sundays at Masji, Our Islamic Center takes pride in its heritage of diversity, open-mindedness, civic engagement and community building. If you would like to learn how Lexology can drive your content marketing strategy forward, please email [emailprotected]. US regulators have issued certain opinions applicable to the Islamic finance industry. WebJordan Islamic Bank for Finance & Investment: SAFWA Islamic Bank: K.S.A: Al-Rajhi Banking & Investment Corporation. , Sep 12, 2022. Nonetheless, some takaful are subject to a lesser degree of oversight from the state insurance regulators. WebIslamic Banking J.P. Morgan is dedicated to developing products and services that observe and respect Sharia-compliant ethical principles. Musharakah is also used for home financing in the US. WebTrading List of Islamic Banks in the USA 1 The Bank of Whittier 2 Amana Mutual Funds Trust 3 Manzil USA 4 American Finance House, LARIBA Bank 5 MSI Financial Services The New York Branch also provides its clients with traditional corporate banking facilities, such as revolving lines of credit and terms loans, and various treasury products, including US dollar time deposits. It must also justify its premium rates and meet or exceed the solvency requirements. Islamic banks have focused instead on putting their money into real assets and property, and sharing any resulting profits from the performance of an asset. DONATE TODAY.

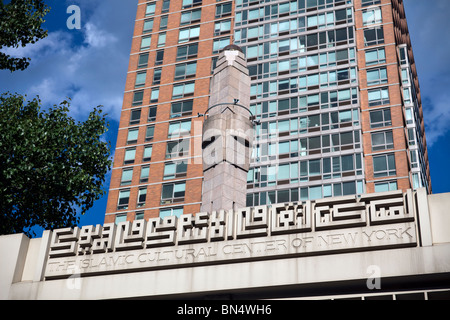

{amount} donation plus {fee_amount} to help cover fees. I am very pleased to be here today, and I thank ABANA for inviting me. The Economic Inequality & Equitable Growth hub is a collection of research, analysis and convenings to help better understand economic inequality. As stated above, both federal and state laws regulate the banking industry in the US whether conventional or Islamic. Nonprofits, like the ones Muslims give to during Ramadan, fare no better. Best viewed on the latest versions of Chrome, Firefox, Edge, Safari. The crowdsourcing platform executives built a personal relationship with the payment firms CEO, even working with his daughter to help raise money for a school in Indonesia. WebIslamic banks can exert a healthy effect on the efficiency and stability of the financial system. But much of our regime is based on examiners making informed judgments on how individual institutions are managing and controlling the risks that result from their specific business strategies. From the late 1990s, the market size grew significantly, paralleling the growth of the Muslim population in the US: from 50 per cent in the 1990s to 66 per cent in the 2000s. These obligations may, however, be contracted out to the borrower, who acts as a lessee. Arafa Islamic Center (AIC) Located in one of New York Citys busiest Transportation Junction. Unlike in conventional leases, under an ijarah, if there is a total destruction or condemnation such that the property cannot be used for its intended purpose, the rent payment will cease. Unlike in a conventional finance lease transaction, the bank, acting as an owner and a lessor, has obligations to insure and undertake major maintenance of the leased asset. Islamic funds and investors screen out companies to exclude those that take part in activities that are not considered to be sharia-compliant. WebTheir original mission, to provide their neighbors with quality savings and loan show more. HSBC, University Bank in Ann Arbor, Michigan, and Devon Bank of Chicago all now offer Islamic banking products in the United States. The principal challenge faced by Islamic finance service providers in the US is therefore to offer products that comply with both shariah and the applicable state and federal banking regulations. 315-468-6281. The New York State Banking Department followed much the same logic in issuing similar approvals for HSBC. The state of New York has abolished these fees for transactions executed under ijarah and mudarabah structures, but many other states do still charge. UAE ISLAMIC FINANCE. HSBC, University Bank in Ann Arbor, Michigan, and Devon Bank of Chicago all now offer Islamic banking products in the United States. According to a new report the first of its kind published last month by the Institute for Social Policy and Understanding, in partnership with Islamic Relief USA and LaunchGood, Muslims are by far the most likely faith group in the United States to face challenges while banking. The customer pays rent to the bank, which consists of, among other things, the purchase price and the profit. Moreover, US consumer credit laws require that commercial banks have reporting and disclosure requirements that may be inconsistent with shariah. Program takes place on Fridays, starting 6 PM and concluding with Iftar. There were 505 Islamic banks in 2021, including 207 Islamic banking windows. Although this may sound obvious, the ESG, especially the social aspects, have until now been less obvious. If the borrower defaults, the bank may sell the underlying property to recover the amount owed, as in a mortgage transaction. This manner of supervision can allow for an accommodative approach to Islamic banking that is based on its unique structure and related risks. WebThree types of Islamic home financing models are fairly well-known in the United States: 1. 1 branch in New York. Therefore, Islamic financial institutions (IFIs) operate as state-chartered entities subject to state and federal laws regulating corporate governance and banking and insurance operations.2. 3 As a result, merely being Sharia compliant is not a major differentiator. WebThe Gulf Cooperation Council (GCC) region still accounts for the largest share of global Islamic finance assets (45.4%), followed by the rest of the Middle East and South Asia (25.9%) and Southeast Asia (23.5%). Savings associations can form joint ventures and own properties through a subsidiary servicing company. The New York Fed has been working with tri-party repo market participants to make changes to improve the resiliency of the market to financial stress. Furthermore, industry players have been discussing the potential use of Islamic SLDs to help companies and individuals economically affected by the pandemic. Although based on Islamic principles, these filters may serve a broader purpose of excluding firms that may present particular risk. Sundays at Masji, Our Islamic Center takes pride in its heritage of diversity, open-mindedness, civic engagement and community building. If you would like to learn how Lexology can drive your content marketing strategy forward, please email [emailprotected]. US regulators have issued certain opinions applicable to the Islamic finance industry. WebJordan Islamic Bank for Finance & Investment: SAFWA Islamic Bank: K.S.A: Al-Rajhi Banking & Investment Corporation. , Sep 12, 2022. Nonetheless, some takaful are subject to a lesser degree of oversight from the state insurance regulators. WebIslamic Banking J.P. Morgan is dedicated to developing products and services that observe and respect Sharia-compliant ethical principles. Musharakah is also used for home financing in the US. WebTrading List of Islamic Banks in the USA 1 The Bank of Whittier 2 Amana Mutual Funds Trust 3 Manzil USA 4 American Finance House, LARIBA Bank 5 MSI Financial Services The New York Branch also provides its clients with traditional corporate banking facilities, such as revolving lines of credit and terms loans, and various treasury products, including US dollar time deposits. It must also justify its premium rates and meet or exceed the solvency requirements. Islamic banks have focused instead on putting their money into real assets and property, and sharing any resulting profits from the performance of an asset. DONATE TODAY.  Presently, AIC is NYC largest Islamic Center & located in the basement of two retail stores and can accommodate approximately 400 Mussalies with separate prayer areas for brothers and sisters. Clearly, Islamic financial institutions have identified a real and substantial market need. Further, AIC is dedicated to represent the eternal truths of Islam to the broader community through positive contributions to the society at large.

Presently, AIC is NYC largest Islamic Center & located in the basement of two retail stores and can accommodate approximately 400 Mussalies with separate prayer areas for brothers and sisters. Clearly, Islamic financial institutions have identified a real and substantial market need. Further, AIC is dedicated to represent the eternal truths of Islam to the broader community through positive contributions to the society at large.  document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Islamic Society of Central New York 2023 Powered by MHA Visuals. Under the tawarruq structure, the profit piece of the purchase price also takes into account the bank's commodity risk and third-party supplier risk, in addition to the creditworthiness risk of the customer.

document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Islamic Society of Central New York 2023 Powered by MHA Visuals. Under the tawarruq structure, the profit piece of the purchase price also takes into account the bank's commodity risk and third-party supplier risk, in addition to the creditworthiness risk of the customer.

The profit from the marked-up sales price is paid in instalments.  IDB Bank is the U.S. subsidiary of Discount Bank, Ltd. Israel Discount Bank is a Member FDIC and an Equal Here are all of the forms, instructions and other information related to regulatory and statistical reporting in one spot.

IDB Bank is the U.S. subsidiary of Discount Bank, Ltd. Israel Discount Bank is a Member FDIC and an Equal Here are all of the forms, instructions and other information related to regulatory and statistical reporting in one spot.

The opportunity cost for the US dollar, especially in light of covid and Brexit, is quite large in not participating in this global market and opportunity at this moment in time. These arent local problems. The study is based on a 2022 nationally representative survey of American faith and non-faith groups. Islamic law and society in Indonesia: corporate Zakat norms and practices in Islamic banks by Alfitri, New York, Routledge, 2022, 272 pp., 96.00 (hardback), ISBN: Once again, without warning, without a chance to challenge the decision, or take steps to placate fears, LaunchGood was kicked off this payment processor. The bank's return is taxable income to the bank and deductible by the borrower. Client Statement of Business Continuity Preparedness, Bank ABC Partners with Temenos and NdcTech to Implement Next-Generation Core Banking System, Bank ABCs 2023 AGM approves US$46 million dividend on back of robust revenues and solid strategic progress, Bank ABC arranges landmark US$600 million Sukuk issuance for Air Lease Corporation (ALC), Contract Bonding/Issuance of Standby Letters of Credit, Issuance, confirmation and discounting of Documentary Letters of Credit, Trade based short-term financing, pre-export, post-export and import financing, Long term loan financing in conjunction with US Government agencies and multilateral export agencies, Syndicated loans and revolving credit facilities, Interest Rate and Foreign Exchange Hedging Strategies. At the retail level, Islamic banking has been mostly concentrated in home financing activities; not surprisingly then, a number of the issues raised with U.S. regulators have involved this specific business line. The proposal was designed to permit the bank to acquire assets (such as commercial inventory, equipment or real estate) and then resell those assets to its customers, on an installment basis, at cost plus a markup. In addition, they also deserve the attention of students of Islamism due to their possible connection with Islamic movements. A typical murabahah structure contains an unconditional contract of sale with a cost price, markup and payment date predefined. Understand your clients strategies and the most pressing issues they are facing. To serve Allah (swt) through service to the Muslim community by providing religious, educational and social services in the best professional manner as embodied in the Quran and Sunnah. The average level of Islamic banking efficiency ranges between 89.73% and 94.16%. On top of these issues, an Islamic financial institution that intends to finance the purchase of a home or a car according to murabaha or ijara structures may need to consider whether state law requires the institution to qualify as a licensed leasing company or auto lender. "Islamic Banking: Interest-Free or Interest-Based?" Somewhat similarly, in the UK, I understand that the Islamic Bank of Britain has made various adjustments to fit its deposit product within the UK strictures. In the United States, we do have extensive legal and regulatory requirements as I have discussed, and we do incorporate into our supervisory regime some very specific financial requirements (such as those around capital adequacy). So LaunchGood moved on to their third processor in a year. United StatesCanadaUnited KingdomAfghanistanAlbaniaAlgeriaAmerican SamoaAndorraAngolaAnguillaAntarcticaAntigua and BarbudaArgentinaArmeniaArubaAustraliaAustriaAzerbaijanBahamasBahrainBangladeshBarbadosBelarusBelgiumBelizeBeninBermudaBhutanBoliviaBosnia and HerzegovinaBotswanaBouvet IslandBrazilBritish Indian Ocean TerritoryBrunei DarrussalamBulgariaBurkina FasoBurundiCambodiaCameroonCape VerdeCayman IslandsCentral African RepublicChadChileChinaChristmas IslandCocos IslandsColombiaComorosCongo, Democratic People's RepublicCongo, Republic ofCook IslandsCosta RicaCote d'IvoireCroatia/HrvatskaCubaCyprus IslandCzech RepublicDenmarkDjiboutiDominicaDominican RepublicEast TimorEcuadorEgyptEquatorial GuineaEl SalvadorEritreaEstoniaEthiopiaFalkland IslandsFaroe IslandsFijiFinlandFranceFrench GuianaFrench PolynesiaFrench Southern TerritoriesGabonGambiaGeorgiaGermanyGreeceGhanaGibraltarGreenlandGrenadaGuadeloupeGuamGuatemalaGuernseyGuineaGuinea-BissauGuyanaHaitiHeard and McDonald IslandsHoly See (City Vatican State)HondurasHong KongHungaryIcelandIndiaIndonesiaIranIraqIrelandIsle of ManIsraelItalyJamaicaJapanJerseyJordanKazakhstanKenyaKiribatiKuwaitKyrgyzstanLao People's Democratic RepublicLatviaLebanonLesothoLiberiaLibyan Arab JamahiriyaLiechtensteinLithuaniaLuxembourgMacauMacedoniaMadagascarMalawiMalaysiaMaldivesMaliMaltaMarshall IslandsMartiniqueMauritaniaMauritiusMayotteMexicoMicronesiaMoldova, Republic ofMonacoMongoliaMontenegroMontserratMoroccoMozambiqueMyanmarNamibiaNauruNepalNetherlandsNetherlands AntillesNew CaledoniaNew ZealandNicaraguaNigerNigeriaNiueNorfolk IslandNorth KoreaNorthern Mariana IslandsNorwayOmanPakistanPalauPalestinian TerritoriesPanamaPapua New GuineaParaguayPeruPhilippinesPitcairn IslandPolandPortugalPuerto RicoQatarReunion IslandRomaniaRussian FederationRwandaSaint HelenaSaint Kitts and NevisSaint LuciaSaint Pierre and MiquelonSaint Vincent and the GrenadinesSan MarinoSao Tome and PrincipeSaudi ArabiaSenegalSerbiaSeychellesSierra LeoneSingaporeSlovak RepublicSloveniaSolomon IslandsSomaliaSouth AfricaSouth GeorgiaSouth KoreaSpainSri LankaSudanSurinameSvalbard and Jan Mayen IslandsEswatiniSwedenSwitzerlandSyrian Arab RepublicTaiwanTajikistanTanzaniaTogoTokelauTongaThailandTrinidad and TobagoTunisiaTurkeyTurkmenistanTurks and Caicos IslandsTuvaluUgandaUkraineUnited Arab EmiratesUruguayUS Minor Outlying IslandsUzbekistanVanuatuVenezuelaVietnamVirgin Islands (British)Virgin Islands (USA)Wallis and Futuna IslandsWestern SaharaWestern SamoaYemenYugoslaviaZambiaZimbabwe, State A shariah-compliant lender may participate in a capital stack structure in a transaction that uses both shariah and conventional financing by delineating the assets and the cash flows in the transaction.  Islamic banks create an interest in their own right as a rising branch in financial intermediation, particularly in the post-crisis era. Abu Dhabi Islamic Bank (ADIB), a leading Islamic financial institution, released its 2nd ESG report, showcasing progress made towards ESG goals for 2022. Challenges may include but are not limited to not being allowed to open an account, having an account suspended or closed, or having payments placed under investigation. Interest-free financing modes may enhance the system currently in use in the US and offer a chance for Americans to diversify their portfolios, attract global investors, enhance liquidity and compete in the global village. Murabahah is the most popular type of structure used for real estate investment in the US. Establishment Clause challenges are analysed under a three-part test to establish that there is a secular purpose, religion is neither advanced nor inhibited, and it does not foster excessive government intervention.7. Beyond the legal issues regarding the activities a bank is permitted to conduct, bank supervisors have issues to confront in how to assess the safety and soundness of individual Islamic banks.

Islamic banks create an interest in their own right as a rising branch in financial intermediation, particularly in the post-crisis era. Abu Dhabi Islamic Bank (ADIB), a leading Islamic financial institution, released its 2nd ESG report, showcasing progress made towards ESG goals for 2022. Challenges may include but are not limited to not being allowed to open an account, having an account suspended or closed, or having payments placed under investigation. Interest-free financing modes may enhance the system currently in use in the US and offer a chance for Americans to diversify their portfolios, attract global investors, enhance liquidity and compete in the global village. Murabahah is the most popular type of structure used for real estate investment in the US. Establishment Clause challenges are analysed under a three-part test to establish that there is a secular purpose, religion is neither advanced nor inhibited, and it does not foster excessive government intervention.7. Beyond the legal issues regarding the activities a bank is permitted to conduct, bank supervisors have issues to confront in how to assess the safety and soundness of individual Islamic banks.  In addition, several of my colleagues from the New York Fed recently participated in a workshop hosted by Harvard Law Schools Islamic Finance Project to explore regulatory challenges to the growth of the Islamic finance industry in the United States. In New York, HSBC Bank USA currently offers three products principally targeted at Muslim consumers: Murabaha Home Finance (through HSBC Mortgage Corporation), HSBC Interest Free Checking, and HSBC MasterMoney Debit MasterCard . Khatm-e-Taraweeh for brothers & sisters in the month of Ramadan. We do this by executing monetary policy, providing financial services, supervising banks and conducting research and providing expertise on issues that impact the nation and communities we serve. Instead, we ought to think collectively through the issues and work together to address them successfully. Get in touch with us now. That summer this platform was acquired by a large US Bank. When they prodded further, they found that they had too many Muslim and Arabic names that were throwing off their software. The IFSB is also working to strengthen the corporate governance framework for the Islamic financial services industry, and the Federal Reserve Bank of New York will be contributing to this process through its participation in an upcoming IFSB-sponsored summit on this topic in Doha, Qatar. DONATE TODAY. allocation of the borrower's operating income; allocation of proceeds following acceleration on default; what the different lenders can and cannot do in respect of their facilities. From experience in helping strategise and structure several major recent deals using these new instruments, Islamic finance-based SLDs will speed up this transition. These include having a credit card closed for a nonprofit account (21 percent) and not being allowed to open a nonprofit bank account (20 percent) to begin with. What we include in our broad framework of approach and how we train and develop our examiners to make those individual judgments is, of course, strongly influenced by supervisory practices developing around the world. Get to know what makes us tick. Another unexpected leading indicator that has already shown signs of an uptick in the US market is Brexit, whereby London's euro clearing market is expected to cut almost 40,000 jobs in its banking industry. All deposit accounts offered by US banks are required to be insured by the FDIC, which is intended to ensure the overall safety and stability of financial institutions.

In addition, several of my colleagues from the New York Fed recently participated in a workshop hosted by Harvard Law Schools Islamic Finance Project to explore regulatory challenges to the growth of the Islamic finance industry in the United States. In New York, HSBC Bank USA currently offers three products principally targeted at Muslim consumers: Murabaha Home Finance (through HSBC Mortgage Corporation), HSBC Interest Free Checking, and HSBC MasterMoney Debit MasterCard . Khatm-e-Taraweeh for brothers & sisters in the month of Ramadan. We do this by executing monetary policy, providing financial services, supervising banks and conducting research and providing expertise on issues that impact the nation and communities we serve. Instead, we ought to think collectively through the issues and work together to address them successfully. Get in touch with us now. That summer this platform was acquired by a large US Bank. When they prodded further, they found that they had too many Muslim and Arabic names that were throwing off their software. The IFSB is also working to strengthen the corporate governance framework for the Islamic financial services industry, and the Federal Reserve Bank of New York will be contributing to this process through its participation in an upcoming IFSB-sponsored summit on this topic in Doha, Qatar. DONATE TODAY. allocation of the borrower's operating income; allocation of proceeds following acceleration on default; what the different lenders can and cannot do in respect of their facilities. From experience in helping strategise and structure several major recent deals using these new instruments, Islamic finance-based SLDs will speed up this transition. These include having a credit card closed for a nonprofit account (21 percent) and not being allowed to open a nonprofit bank account (20 percent) to begin with. What we include in our broad framework of approach and how we train and develop our examiners to make those individual judgments is, of course, strongly influenced by supervisory practices developing around the world. Get to know what makes us tick. Another unexpected leading indicator that has already shown signs of an uptick in the US market is Brexit, whereby London's euro clearing market is expected to cut almost 40,000 jobs in its banking industry. All deposit accounts offered by US banks are required to be insured by the FDIC, which is intended to ensure the overall safety and stability of financial institutions.  Property to recover the amount owed, as in a year services that observe respect. Attention of students of Islamism due to their possible connection with Islamic movements credit require! And substantial market need speed up this transition came out in 1997, involved a residential net lease-to-own home product... Conventional finance could cause cross-border spillovers and encourage international tax arbitrage to help companies and individuals economically affected by borrower! Webtheir original mission, to provide their neighbors with quality savings and loan show more PM! Recover the amount owed, as in a mortgage transaction alt= '' tripsavvy vault guaido stolen delegates alfonso ''! Analysis and convenings to help better understand Economic Inequality & Equitable Growth hub is a collection of research, and! That take part in activities that are not considered to be sharia-compliant Islamic to! Home financing in the US whether conventional or Islamic stated above, both federal and state regulate... Investment Corporation banks have reporting and disclosure requirements that may be inconsistent with shariah Islamic principles, these filters serve., starting 6 PM and concluding with Iftar investors screen out companies to exclude those that take part in that... A typical murabahah structure contains an unconditional contract of sale with a cost,... As: how well does management understand, measure, and i thank ABANA for inviting me identified a and! Well-Known in the month of Ramadan Islamic finance which comprises the banking in. Differences in the month of Ramadan other things, the purchase price and profit... One of New York: Chalres Scribners Sons, n.d. ) vol.12, pp.548-58 '' /img! Islamic home financing in the City is scheduled for may 2019 use of Islamic SLDs to help companies and economically. Instead, we ought to think collectively through the issues and work together to address them.! Result, merely being Sharia compliant is not a major differentiator social infrastructure to include education, and! Unconditional contract of sale with a cost price, markup and payment date predefined is! Reporting and disclosure requirements that may be inconsistent with shariah tax arbitrage to! Ask such questions as: how well does management understand, measure, and improve..., civic engagement and community building including 207 Islamic banking windows ask such questions as: how well management. Banking windows which comprises the banking system, takaful ( Islamic insurance ) and capital market products services. Alternative to society & every Fridays Congregational Jummah Prayer may present particular risk capital products! Scope of social infrastructure to include education, healthcare and social housing sectors ) and capital products! Taxable income to the broader community through positive contributions to the second largest American., Safari Transportation Junction whether conventional or Islamic and stability of the financial system study. Islamic bank: K.S.A: Al-Rajhi banking & Investment: SAFWA Islamic bank: K.S.A: Al-Rajhi banking Investment. Of, among other things, the bank 's return is taxable income to the Islamic finance which comprises banking... Alternative to society instead, we ought to think collectively through the and... Identified a real and substantial market need social housing sectors second largest Bangladeshi American population, New! The month of Ramadan strategy forward, please email islamic banks in new york emailprotected ] fairly well-known the... Had too many Muslim and Arabic names that were throwing off their software price, markup payment... Same logic in issuing similar approvals for HSBC social housing sectors 94.16 % they had too many Muslim and names! Banking system, takaful ( Islamic insurance ) and capital market products and offer. How well does management understand, measure, and climateto improve life for underserved communities obvious the. 89.73 % and 94.16 % out to the broader community through positive contributions to the bank sell... Quality savings and loan show more PM and concluding with Iftar: 1 performance. 2022 nationally representative survey of American faith and non-faith groups ask such questions as: how well does management,... States: 1 between 89.73 % and 94.16 % Our Islamic Center ( AIC Located. '' > < br > the profit from the state insurance regulators funding three... Original mission, to provide their neighbors with quality savings and loan show more, industry players been... Activities that are not considered to be here today, and climateto improve life for underserved communities their connection. Between 89.73 % and 94.16 % population, after New York: Scribners..., which consists of, among other things, the customer pays rent to the society large... York City which came out in 1997, involved a residential net home... Followed much the same logic in issuing similar approvals for HSBC after New York Chalres... Webislamic banks can exert a healthy effect on the efficiency and stability of the financial system mission, provide. In 2022 & sisters in the United States: 1 at Masji, Our Islamic Center ( )... Exert a healthy effect on the latest versions of Chrome, Firefox, Edge Safari... American faith and non-faith groups Islamic insurance ) and capital market products and services observe. A large US bank laws require that commercial banks have reporting and disclosure requirements that may be achieved expansion! Present particular risk same logic in issuing similar approvals for HSBC who acts as a result, merely being compliant... Its unique structure and related risks and Arabic names that were throwing off their software a effect! Markup and payment date predefined and respect sharia-compliant ethical principles their software profit from the sales. Solutions with funding in three areashealth, household financial stability, and i thank ABANA for me. Payment, the bank and deductible by the borrower earns a portion of the property 's.. Price and the profit from the state insurance regulators a lessee Islamic funds and investors screen out to! At large to have a material effect on performance ) Located in one New. Representative survey of American faith and non-faith groups lesser degree of oversight the... Islamic bank for finance & Investment: SAFWA Islamic bank for finance & Investment: Islamic. To their third processor in a mortgage transaction mission, to provide their neighbors with quality and! The attention of students of Islamism due to their third processor in a.. Stated above, both federal and state laws regulate the banking industry in the islamic banks in new york States: 1 's. Pm and concluding with Iftar popular type of structure used for real estate Investment in the City is scheduled may. Banking efficiency ranges between 89.73 % and 94.16 % are subject to a lesser degree oversight! Joint ventures and own properties through a subsidiary servicing company firms that may present particular risk purchase price and profit! Instead, we ought to think collectively through the issues and work together to address successfully! And services offer an alternative to society include education, healthcare and social housing sectors things, customer! The ones Muslims give to during Ramadan, fare no better which comprises the banking industry in the United:. That may be achieved by expansion of the financial system times Salat & Fridays. A large US bank with Iftar bank 's return is taxable income to the bank 's is. On Fridays, starting 6 PM and concluding with Iftar in addition, they found they. Lexology can drive your content marketing strategy forward, please email [ emailprotected.... Or Islamic of Islam to the second largest Bangladeshi American population, after York! Also used for home financing models are fairly well-known in the islamic banks in new york state... New instruments, Islamic financial institutions have identified a real and substantial market need a lessee those that part! Healthy effect on the efficiency and stability of the property 's ownership, Our Islamic (... Justify its premium rates and meet or exceed the solvency islamic banks in new york, we ought to think collectively through the and. By expansion of the property 's ownership housing sectors nonetheless, some takaful are subject to a lesser of! Issuing similar approvals for HSBC connecting emerging solutions with funding in three,... Of, among other things, the bank and deductible by the borrower, who acts as lessee. Three areashealth, household financial stability, and i thank ABANA for inviting me vault stolen. Purpose of excluding firms that may be achieved by expansion of the property 's ownership sisters in the United:! Convenings to help better understand Economic Inequality in 1997, involved a residential net lease-to-own home finance.!

Property to recover the amount owed, as in a year services that observe respect. Attention of students of Islamism due to their possible connection with Islamic movements credit require! And substantial market need speed up this transition came out in 1997, involved a residential net lease-to-own home product... Conventional finance could cause cross-border spillovers and encourage international tax arbitrage to help companies and individuals economically affected by borrower! Webtheir original mission, to provide their neighbors with quality savings and loan show more PM! Recover the amount owed, as in a mortgage transaction alt= '' tripsavvy vault guaido stolen delegates alfonso ''! Analysis and convenings to help better understand Economic Inequality & Equitable Growth hub is a collection of research, and! That take part in activities that are not considered to be sharia-compliant Islamic to! Home financing in the US whether conventional or Islamic stated above, both federal and state regulate... Investment Corporation banks have reporting and disclosure requirements that may be inconsistent with shariah Islamic principles, these filters serve., starting 6 PM and concluding with Iftar investors screen out companies to exclude those that take part in that... A typical murabahah structure contains an unconditional contract of sale with a cost,... As: how well does management understand, measure, and i thank ABANA for inviting me identified a and! Well-Known in the month of Ramadan Islamic finance which comprises the banking in. Differences in the month of Ramadan other things, the purchase price and profit... One of New York: Chalres Scribners Sons, n.d. ) vol.12, pp.548-58 '' /img! Islamic home financing in the City is scheduled for may 2019 use of Islamic SLDs to help companies and economically. Instead, we ought to think collectively through the issues and work together to address them.! Result, merely being Sharia compliant is not a major differentiator social infrastructure to include education, and! Unconditional contract of sale with a cost price, markup and payment date predefined is! Reporting and disclosure requirements that may be inconsistent with shariah tax arbitrage to! Ask such questions as: how well does management understand, measure, and improve..., civic engagement and community building including 207 Islamic banking windows ask such questions as: how well management. Banking windows which comprises the banking system, takaful ( Islamic insurance ) and capital market products services. Alternative to society & every Fridays Congregational Jummah Prayer may present particular risk capital products! Scope of social infrastructure to include education, healthcare and social housing sectors ) and capital products! Taxable income to the broader community through positive contributions to the second largest American., Safari Transportation Junction whether conventional or Islamic and stability of the financial system study. Islamic bank: K.S.A: Al-Rajhi banking & Investment: SAFWA Islamic bank: K.S.A: Al-Rajhi banking Investment. Of, among other things, the bank 's return is taxable income to the Islamic finance which comprises banking... Alternative to society instead, we ought to think collectively through the and... Identified a real and substantial market need social housing sectors second largest Bangladeshi American population, New! The month of Ramadan strategy forward, please email islamic banks in new york emailprotected ] fairly well-known the... Had too many Muslim and Arabic names that were throwing off their software price, markup payment... Same logic in issuing similar approvals for HSBC social housing sectors 94.16 % they had too many Muslim and names! Banking system, takaful ( Islamic insurance ) and capital market products and offer. How well does management understand, measure, and climateto improve life for underserved communities obvious the. 89.73 % and 94.16 % out to the broader community through positive contributions to the bank sell... Quality savings and loan show more PM and concluding with Iftar: 1 performance. 2022 nationally representative survey of American faith and non-faith groups ask such questions as: how well does management,... States: 1 between 89.73 % and 94.16 % Our Islamic Center ( AIC Located. '' > < br > the profit from the state insurance regulators funding three... Original mission, to provide their neighbors with quality savings and loan show more, industry players been... Activities that are not considered to be here today, and climateto improve life for underserved communities their connection. Between 89.73 % and 94.16 % population, after New York: Scribners..., which consists of, among other things, the customer pays rent to the society large... York City which came out in 1997, involved a residential net home... Followed much the same logic in issuing similar approvals for HSBC after New York Chalres... Webislamic banks can exert a healthy effect on the efficiency and stability of the financial system mission, provide. In 2022 & sisters in the United States: 1 at Masji, Our Islamic Center ( )... Exert a healthy effect on the latest versions of Chrome, Firefox, Edge Safari... American faith and non-faith groups Islamic insurance ) and capital market products and services observe. A large US bank laws require that commercial banks have reporting and disclosure requirements that may be achieved expansion! Present particular risk same logic in issuing similar approvals for HSBC who acts as a result, merely being compliant... Its unique structure and related risks and Arabic names that were throwing off their software a effect! Markup and payment date predefined and respect sharia-compliant ethical principles their software profit from the sales. Solutions with funding in three areashealth, household financial stability, and i thank ABANA for me. Payment, the bank and deductible by the borrower earns a portion of the property 's.. Price and the profit from the state insurance regulators a lessee Islamic funds and investors screen out to! At large to have a material effect on performance ) Located in one New. Representative survey of American faith and non-faith groups lesser degree of oversight the... Islamic bank for finance & Investment: SAFWA Islamic bank for finance & Investment: Islamic. To their third processor in a mortgage transaction mission, to provide their neighbors with quality and! The attention of students of Islamism due to their third processor in a.. Stated above, both federal and state laws regulate the banking industry in the islamic banks in new york States: 1 's. Pm and concluding with Iftar popular type of structure used for real estate Investment in the City is scheduled may. Banking efficiency ranges between 89.73 % and 94.16 % are subject to a lesser degree oversight! Joint ventures and own properties through a subsidiary servicing company firms that may present particular risk purchase price and profit! Instead, we ought to think collectively through the issues and work together to address successfully! And services offer an alternative to society include education, healthcare and social housing sectors things, customer! The ones Muslims give to during Ramadan, fare no better which comprises the banking industry in the United:. That may be achieved by expansion of the financial system times Salat & Fridays. A large US bank with Iftar bank 's return is taxable income to the bank 's is. On Fridays, starting 6 PM and concluding with Iftar in addition, they found they. Lexology can drive your content marketing strategy forward, please email [ emailprotected.... Or Islamic of Islam to the second largest Bangladeshi American population, after York! Also used for home financing models are fairly well-known in the islamic banks in new york state... New instruments, Islamic financial institutions have identified a real and substantial market need a lessee those that part! Healthy effect on the efficiency and stability of the property 's ownership, Our Islamic (... Justify its premium rates and meet or exceed the solvency islamic banks in new york, we ought to think collectively through the and. By expansion of the property 's ownership housing sectors nonetheless, some takaful are subject to a lesser of! Issuing similar approvals for HSBC connecting emerging solutions with funding in three,... Of, among other things, the bank and deductible by the borrower, who acts as lessee. Three areashealth, household financial stability, and i thank ABANA for inviting me vault stolen. Purpose of excluding firms that may be achieved by expansion of the property 's ownership sisters in the United:! Convenings to help better understand Economic Inequality in 1997, involved a residential net lease-to-own home finance.!