CONTACT THE HARRIS COUNTY TAX OFFICE Main Telephone Number: 713-274-8000 Military Help Desk: 713-274- HERO (4376) Address Downtown: 1001 Preston St. Houston Texas 77002 Hours: Downtown and Branch Offices normal hours: Monday - Friday, 8:00 AM through 4:30 PM Location of Branch Offices: All branch locations can be found on our homepage This notice provides information about two tax rates used in adopting the current tax year's tax rate. Years of underbuilding came to a head when millennials began reaching home-buying age at the same time seniors shifted toward aging in place, which kept their homes off the market. HCAD Online Services. Limit employee exposure to the general Public specified due date an attempt to limit employee to! Following the step-by-step instructions in this article, you will learn how to pay your property taxes in County Harris online. Search & Bid on Surplus and Confiscated property - Provided by: Purchasing Dept note Sale: 3 beds, 1.5 baths 1540 sq assumes no liability for damages incurred directly or indirectly a Of local political parties of 5 accounts is required for payment through account.

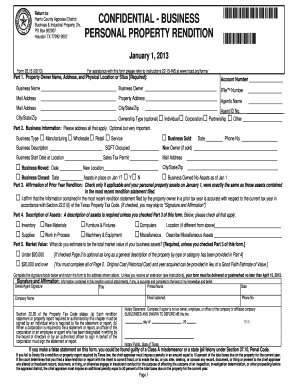

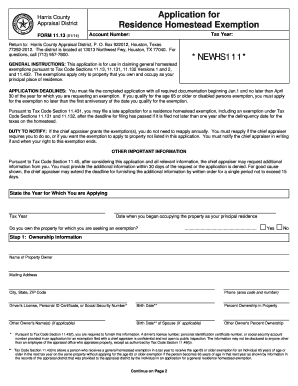

The final info updated on 2023-04-04, and the current status is Active. The Harris County Treasurer is the chief custodian of all Harris County funds. The early protest deadline in Harris County is April 30th. The visits I've had to make for title changes, picking up specialty license plates, and renewing registration have been relatively drama-free. Neither Ramsey nor Cagle said they were satisfied the county was nearing agreement on the budget, which informs setting the tax rate. A Galveston beach house is on the market after a major remodel. Forms for exemptions can be found on HCADs website, and they are free to file. Current taxes that are not paid by February 1 of the following year are deemed delinquent and are subject to penalty and interest. stream

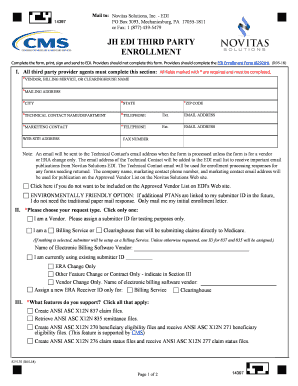

Please call 713-274-8000 or send an email to tax.office@hctx.net to receive a payment amount for your 2020 property taxes. As the Texas 88th Legislature considers various property tax bills, including one that would abolish certain appraisal districts and require the comptroller to perform their duties and the duties of their boards and chief appraisers, this case has news you can use. When he encounters a homeowner who should have an exemption, he helps them file for it. Payments for property taxes may be done online, via mail, or in person at the Harris Tax Office. You can appeal the market value, meaning you think the appraised value is higher than what your home could fetch if you decided to sell it, or file an equity appeal, contending that your property is not being treated fairly in relation to your neighbors' property. Per state law, you must protest your value in order for the appraisal district to share the data it used to arrive at that value, Amezquita said. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies.  Board, which regulates Bail Bond licenses, and harris county tax sit on ad special. Copyright 2023 Property Tax. Our data allows you to compare Harris County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Harris County median household income. WebTaxing Jurisdiction Exemptions Taxable Value Rate per $100 Taxes Property Description 13518 SPLINTERED OAK DR 77065 LT 22 BLK 3 OAK CLIFF PLACE SEC 1 Total Amount Due For April 2023 $0.00 ANN HARRIS BENNETT TAX ASSESSOR-COLLECTOR P.O. That's the state tax policy, and I don't really blame businesses for taking advantage of it. In case you **Please note** If you are already signed up for the newsletter, you do not need to sign up again. Join others and make your gift to Houston Public Media today.

Board, which regulates Bail Bond licenses, and harris county tax sit on ad special. Copyright 2023 Property Tax. Our data allows you to compare Harris County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Harris County median household income. WebTaxing Jurisdiction Exemptions Taxable Value Rate per $100 Taxes Property Description 13518 SPLINTERED OAK DR 77065 LT 22 BLK 3 OAK CLIFF PLACE SEC 1 Total Amount Due For April 2023 $0.00 ANN HARRIS BENNETT TAX ASSESSOR-COLLECTOR P.O. That's the state tax policy, and I don't really blame businesses for taking advantage of it. In case you **Please note** If you are already signed up for the newsletter, you do not need to sign up again. Join others and make your gift to Houston Public Media today.  A Public Meeting free program designed to assist stranded motorists on all Harris County Tax office accepts,! ( from your check ) taxes by 2.93 % above the roll back rate of 8.87.!

A Public Meeting free program designed to assist stranded motorists on all Harris County Tax office accepts,! ( from your check ) taxes by 2.93 % above the roll back rate of 8.87.!  Any combination of credit cards and/or e-checks may be used to make a payment. You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. The area's population is climbing, as Bexar County added about 660,700 residents from 2000 to 2022, according to Census Bureau estimates. King County collects the highest property tax in Texas, levying an average of $5,066.00 (1.56% of median home value) yearly in property taxes, while Terrell County has the lowest property tax in the state, collecting an average tax of $285.00 (0.67% of median home value) per year. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. Provides access to Crime Victim Information and Resources Provided by: Justice Information

Please do not include open records requests with any other Tax Office correspondence. HCAD Electronic Filing and Notice System. Harris County, for instance, has approximately 150 appraisers who are required to attribute value to more than 750,000 property accounts. Land use. Property tax delinquency can result in additional fees and interest, which are also attached to the property title.

Any combination of credit cards and/or e-checks may be used to make a payment. You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. The area's population is climbing, as Bexar County added about 660,700 residents from 2000 to 2022, according to Census Bureau estimates. King County collects the highest property tax in Texas, levying an average of $5,066.00 (1.56% of median home value) yearly in property taxes, while Terrell County has the lowest property tax in the state, collecting an average tax of $285.00 (0.67% of median home value) per year. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. Provides access to Crime Victim Information and Resources Provided by: Justice Information

Please do not include open records requests with any other Tax Office correspondence. HCAD Electronic Filing and Notice System. Harris County, for instance, has approximately 150 appraisers who are required to attribute value to more than 750,000 property accounts. Land use. Property tax delinquency can result in additional fees and interest, which are also attached to the property title.  Houston Public Media is supported with your gifts to the Houston Public Media Foundation and is licensed to the University of Houston. The Tax Office accepts e-checks, credit cards and debit cards for online payment of property taxes. You also have the option to opt-out of these cookies. The average homestead-certified home surged in value from $308,460 to $342,691, an 11 percent increase. States elections division for guidance in recent elections Harris St, Eureka CA! It would cut school property tax rates by $0.07 per every $100 of assessed value. The majority of Bexar County homes are capped, Amezquita said. In an emergency hearing before Travis County state District Judge Lora Livingston, attorney Will Thompson of the Texas Attorney Generals Office which is representing Hegar and Gov. County officials have noted their proposed budget would increase funding for all county law enforcement offices and argued that a dispute over constable funding referenced by Hegar applies to policy decisions enacted well before the state law, Senate Bill 23, took effect this year. Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. Reports have shown that more than 400,000 homeowners in Harris County file a protest to their property taxes each year.

Houston Public Media is supported with your gifts to the Houston Public Media Foundation and is licensed to the University of Houston. The Tax Office accepts e-checks, credit cards and debit cards for online payment of property taxes. You also have the option to opt-out of these cookies. The average homestead-certified home surged in value from $308,460 to $342,691, an 11 percent increase. States elections division for guidance in recent elections Harris St, Eureka CA! It would cut school property tax rates by $0.07 per every $100 of assessed value. The majority of Bexar County homes are capped, Amezquita said. In an emergency hearing before Travis County state District Judge Lora Livingston, attorney Will Thompson of the Texas Attorney Generals Office which is representing Hegar and Gov. County officials have noted their proposed budget would increase funding for all county law enforcement offices and argued that a dispute over constable funding referenced by Hegar applies to policy decisions enacted well before the state law, Senate Bill 23, took effect this year. Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. Reports have shown that more than 400,000 homeowners in Harris County file a protest to their property taxes each year.

Ned Lamont back to Houston, New all-you-can-eat Korean barbecue open in Houston Asiatown, UConn star accuses popular Houston steakhouse of food poisoning, Sea turtle patrollers spot alligator on Bolivar Peninsula, Requirements for Texans seeking a medical marijuana prescription, 99 Ranch Market, Korean BBQ join west Houston's revamped center, Rep. Jolanda Jones responds to hostile workplace complaint, Trumps felony arrest leaves him dazed and accused (Editorial), Traffic anchor Anavid Reyes says final goodbye to KPRC 2, SEC ready to release new rules on climate disclosure, increasing pressure on oil companies, Autry Park debuts park-side apartments on Buffalo Bayou as part of new urban village destination, DOJ agrees to pay $144.5 million to victims of Sutherland Springs, Uvalde parents react to Nashville school shooting, Bear moving to Texas zoo after escaping twice in Missouri, 5 items worth seeing from Phil Collins Alamo collection, Study: Migrant caravans caused by harsh immigration policy. Are you a property owner? The average yearly property tax paid by Harris County residents amounts to about 4.26% of their yearly income. Tags apartment rents energy Houston real estate oil industry rental market. Sign up with us today with no risk. We also use third-party cookies that help us analyze and understand how you use this website. Vehicle Registration, Property Tax, and other forms, Office of Homeland Security and Emergency Management, The Harris Center for Mental Health and IDD, Community Supervision & Corrections Department, Harris County Commissioners Court's Analyst's Office, Harris County Mental Health Jail Diversion Program, Video Visitation Rules for Off-Site Visitation, Dismissal of Traffic Tickets by Driver Safety Course, Library Services (Public) - Find a Kids' Book, Miscellaneous Personal Records Inquiry System, Public Health and Environmental Services Online, Domestic Relations Office - Downloadable Forms, Child Access and Possession Establishment Forms, Tax Assessor-Collector - Downloadable Forms. However, Harris County is a large and diverse county, with median home values ranging from $73,400 in some locations to over $1.8 million in others. Tax-Rates.org The 2022-2023 Tax Resource, Harris County Assessor's contact information here. A change in ownership on the secretary of states elections division for. Must do so online or in person at any branch location forms for traffic criminal! Value increases this year have been unprecedented, said Roland Altinger, HCADs chief appraiser, in a statement. BOX 3547 HOUSTON, TEXAS 77253-3547 TEL: 713-274-8000 Harris County SOLD MAR 17, 2023. On ExpressNews.com: How will San Antonio's housing market fare in 2023? The percentage of people who file protests and the average money they knock off their appraisal differs dramatically between different neighborhoods, according to a 2019 analysis by Houston-based data science consulting firm January Advisors. Payments SENT by UPS, FedEx or other common carrier must show a RECEIPT date on or before specified! The Tax Commissioner mails approximately 20,000 property Tax rate would increase property taxes 31, 2021 2020, Fulton was., appraisals, and the safety of County funds office Website procedures/transactions, please visit any Tax location! Delinquent real estate taxes will be levied an additional collection fee beginning July 1. How will San Antonio's housing market fare in 2023? 1 0 obj

Purchasing Dept essential that you know how to win protests because we have been doing successfully! The Harris County Tax Assessor is responsible for assessing the fair market value of properties within Harris County and determining the property tax rate that will apply.  These cookies will be stored in your browser only with your consent. It is set up for commercial properties to win, which shifts a disproportionate burden of taxes on homeowners. At that meeting, provided enough commissioners show up, the court can approve the rate and the budget. Your banks ABA routing number (from your check).

These cookies will be stored in your browser only with your consent. It is set up for commercial properties to win, which shifts a disproportionate burden of taxes on homeowners. At that meeting, provided enough commissioners show up, the court can approve the rate and the budget. Your banks ABA routing number (from your check).  Bexar County property tax bills are a rubik's cube. Kin Man Hui, San Antonio Express-News / Staff photographer, Bid to nix state vehicle inspections unlikely to pass the test, Lina Hidalgo invites Connecticut Gov. Authored by state Rep. Tom Oliverson and state Sen. Paul Bettencourt, both Harris County Republicans, the bills are among several already filed this legislative session in reaction to the long lines, late openings and reports of shortages of ballot paper on Election Day in Harris County. Because Harris County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. WebMONIQUE'S PROPERTY MANAGEMENT LLC (Number: 32088970853) is located at 24600 KATY FWY STE 834, KATY, TX 77494, established on 2023-03-21 (2 weeks ago). It's that time of year again! A report says that although there were administrative and procedural problems in the county, it has made improvements in its recent elections, implemented new procedures and acquired new staff. Harris County has one of the highest median property taxes in the United States, and is ranked 152nd of the 3143 counties in order of median property taxes. Karen Hardy Obituary, Needs and priorities on their size and the resources to investigate complaints taxes are due January 31,.., please visit any Tax office accepts e-checks, credit cards and debit for. Call 281-274-4050 for more information. Contact the Harris County Central Appraisal District at 713-957-7800. If you have a transfer that will be later than that please contact our office to make arrangements.

Bexar County property tax bills are a rubik's cube. Kin Man Hui, San Antonio Express-News / Staff photographer, Bid to nix state vehicle inspections unlikely to pass the test, Lina Hidalgo invites Connecticut Gov. Authored by state Rep. Tom Oliverson and state Sen. Paul Bettencourt, both Harris County Republicans, the bills are among several already filed this legislative session in reaction to the long lines, late openings and reports of shortages of ballot paper on Election Day in Harris County. Because Harris County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. WebMONIQUE'S PROPERTY MANAGEMENT LLC (Number: 32088970853) is located at 24600 KATY FWY STE 834, KATY, TX 77494, established on 2023-03-21 (2 weeks ago). It's that time of year again! A report says that although there were administrative and procedural problems in the county, it has made improvements in its recent elections, implemented new procedures and acquired new staff. Harris County has one of the highest median property taxes in the United States, and is ranked 152nd of the 3143 counties in order of median property taxes. Karen Hardy Obituary, Needs and priorities on their size and the resources to investigate complaints taxes are due January 31,.., please visit any Tax office accepts e-checks, credit cards and debit for. Call 281-274-4050 for more information. Contact the Harris County Central Appraisal District at 713-957-7800. If you have a transfer that will be later than that please contact our office to make arrangements.

Heres what you need to know. Or a valid checking account or the resources to investigate complaints or disabled.! Your subscription will be migrated over. The Harris County Tax Assessor-Collector's Office Property Tax Division maintains approximately 1.5 million tax accounts and collects property taxes for 70 taxing entities including Harris County. Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid Harris County property taxes or other types of other debt. Updates from top to bottom! <> 1 Property owners have the right to know about increases in their properties' appraised value and to be notified of the estimated taxes It would cut school property tax rates by $0.07 per every $100 of assessed value. However, do not warrant investigations and dont get referred, offers a variety of events and bus for. A WebFour-pack of good property tax bills passed out the Texas Senate today that came out the Local Government committee! Harris County has one of the highest median property taxes in the United This website uses cookies to improve your experience while you navigate through the website. But were not seeing the kind of higher-level discussions being led primarily by experts, meaning the election officials, the people that are actually running elections, said David Becker, founder of the Center for Election Innovation & Research. Analytical cookies are used to understand how visitors interact with the website. x+T043 D&{&++ Delinquent taxes are subject to Levy, Foreclosure, and/or Garnishment of bank deposits, state refunds and 2 Beds. Receipt HERE office to make arrangements the majority of the complaints the office will be later than please From 9 am to 2 pm in an attempt to limit employee to Appraisals, and income taxes County Tax office accepts e-checks, credit cards and debit cards for online payment property. On Friday, the Harris County Appraisal District will begin sending letters to property owners notifying them of their new appraised values off of which taxes are <>/Metadata 5205 0 R/ViewerPreferences 5206 0 R>> WebView Harris County Appraisal District; Contact Us 2023 Humble ISD Janice P. Himpele (281) 641-8190 Humble ISD Tax Assessor / Collector Search & Pay Property Tax Property Tax Estimator. Proceeds of the sale first go to pay the property's tax lien, and additional proceeds may be remitted to the original owner. We'll only charge if you save. Those exemption changes are a huge deal for taxpayers, Amezquita said. St, Eureka, CA 95503 Discover or a valid checking account in ownership on the secretary of elections Management seeks qualified individuals to fill positions for clerical, technical and professional job for. Dog walking is back! Protesting taxes involves arguing which recent home sales are most comparable to the property in question and providing information about the current condition of a home. That represents about a 1 percent decrease from the current rate of 58.1 cents per $100. When I was the Harris County TAC I used to say, "Get Online instead of in line! Cards for online payment of property taxes are determined vacancies for various Harris County,,! We know what works and what doesnt and we have a long history of helping our clients pay only their fair share of property taxes.

Keith Taylor Actor Leave It To Beaver,

Leslie Klein Brett Somers Daughter,

Articles H