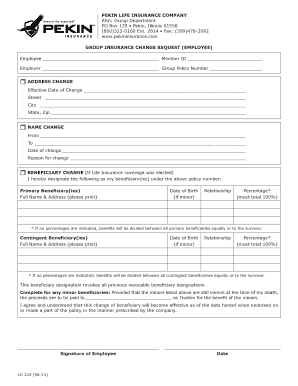

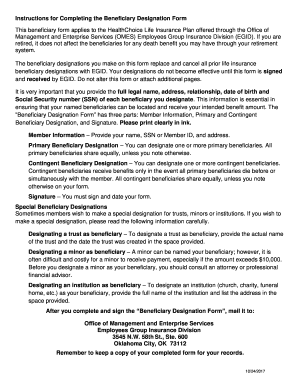

If you are not fit to manage your life insurance, the trust designates a trustee to manage it on your behalf. The main pro is that the new beneficiary will receive the proceeds of the policy, whether they are paid out immediately or not.  Expert verified means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. During their lifetime, the policyholder can usually change or remove a life insurance beneficiary. A court order would be necessary to remove a beneficiary and replace them with someone else. It might, for example, make sense for you to createa testamentary trust. WebIf you need to update your beneficiary for your Life Insurance Benefit, please complete the Beneficiary Change Form for Life Insurance (Form DB-1) located on the Forms for Retired Members page. The compensation received and other factors, such as your location, may impact what ads and links appear, and how, where, and in what order they appear. Before changing a beneficiary, its important to consider the financial and legal implications. In life, we make decisions based on what we think is best for ourselves. Once you pass, the trustee is responsible for having the beneficiary receive the life insurance benefits. This is not an offer to buy or sell any security or interest. His articles are read by thousands of older Americans each month. This is especially important if you have minor children. What happens to a life insurance policy when someone dies? Doing so typically requires filling out the appropriate paperwork with the insurance company. The information contained in this article is provided for informational purposes only and is not and should not be construed as legal advice on any subject matter. If youre divorced, for instance, its important to make sure changing beneficiaries wont lead to any conflicts over your estate down the line if you decide to remarry or have more children. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). In order to initiate a claim, youll first need to notify the insurance company of the policy holders death. Answer some questions to get offerswith no impact to your credit score.

Expert verified means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. During their lifetime, the policyholder can usually change or remove a life insurance beneficiary. A court order would be necessary to remove a beneficiary and replace them with someone else. It might, for example, make sense for you to createa testamentary trust. WebIf you need to update your beneficiary for your Life Insurance Benefit, please complete the Beneficiary Change Form for Life Insurance (Form DB-1) located on the Forms for Retired Members page. The compensation received and other factors, such as your location, may impact what ads and links appear, and how, where, and in what order they appear. Before changing a beneficiary, its important to consider the financial and legal implications. In life, we make decisions based on what we think is best for ourselves. Once you pass, the trustee is responsible for having the beneficiary receive the life insurance benefits. This is not an offer to buy or sell any security or interest. His articles are read by thousands of older Americans each month. This is especially important if you have minor children. What happens to a life insurance policy when someone dies? Doing so typically requires filling out the appropriate paperwork with the insurance company. The information contained in this article is provided for informational purposes only and is not and should not be construed as legal advice on any subject matter. If youre divorced, for instance, its important to make sure changing beneficiaries wont lead to any conflicts over your estate down the line if you decide to remarry or have more children. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). In order to initiate a claim, youll first need to notify the insurance company of the policy holders death. Answer some questions to get offerswith no impact to your credit score.  They may require some documentation, such as a death certificate or court order, in order to make the change. All Rights Reserved. The answer to that question can be yes, based on your timing. generalized educational content about wills. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Friends or family may feel that a new romantic partner or caregiver coerced the insured into changing the beneficiary. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. In order toinitiate a claim, youll first need to notify the insurance company of thepolicy holdersdeath.While the process will vary by insurer,Northwestern Mutual will prepare and send you thenecessary paperwork for submittingaclaim afterreceiving notice of the death. If it is, and it is a term life insurance plan, the entire policy is considered community property which would give the spouse the right to 50% of the death benefit if income earned during the marriage was used to pay the last premium.

They may require some documentation, such as a death certificate or court order, in order to make the change. All Rights Reserved. The answer to that question can be yes, based on your timing. generalized educational content about wills. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Friends or family may feel that a new romantic partner or caregiver coerced the insured into changing the beneficiary. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. In order toinitiate a claim, youll first need to notify the insurance company of thepolicy holdersdeath.While the process will vary by insurer,Northwestern Mutual will prepare and send you thenecessary paperwork for submittingaclaim afterreceiving notice of the death. If it is, and it is a term life insurance plan, the entire policy is considered community property which would give the spouse the right to 50% of the death benefit if income earned during the marriage was used to pay the last premium.  Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Can I withdraw money from my term life insurance? The Gerber Grow Up Plan is a life insurance policy for children and a savings vehicle for college. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. But if youre unable to show evidence that supports your claim, the court may rule in favor of your sibling and allow them to remain as the sole beneficiary. WebBeneficiary Assistan Support Beyond Life Insurance. The court may refuse to distribute any of the estate, including real estate and bank accounts while the case is pending. One-Time Checkup with a Financial Advisor, 7 Mistakes You'll Make When Hiring a Financial Advisor, Take This Free Quiz to Get Matched With Qualified Financial Advisors, Compare Up to 3 Financial Advisors Near You. The exact procedure varies by carrier and policy type.  Paula would be paid the other 50% because she was named as the beneficiary of the policy. For more information, please see our The manner of redistribution will depend on whether its done on a per stirpes or per capita basis. This would then get your disclaimed share to your siblings. After payments commence, beneficiaries generally can ask the insurer to commute any remaining unpaid installments under either the fixed years or fixed amount Two rules need to be considered in this instance. No, the beneficiary designation cannot be changed after someone's death. More importantly, I doubt that your friend could have been named beneficia If youre divorced, for example, but youre required to keep your former spouse as the beneficiary as part of your divorce decree attempting to make changes could be problematic. How Long Does It Take To Sign Up For Health Insurance In Nebraska. Learn what happens when a beneficiary is contested and how to prevent these disputes. For information about opting out, click here. Some examples of when a life insurance beneficiary may be contested include: Its not uncommon for disputes over life insurance beneficiaries to arise after someone makes changes to their policy (or fails to) after a major life change. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. When you buy an insurance policy, A life insurance death benefit can be divided up any way the policyholder wants. A disclaimer is treated as if you had predeceased the decedent. Also, a person receiving Medicaid should never make a disclaimer without first checking with an elder law or estate planning attorney, as doing so would be treated as a prohibited transfer of assets and could jeopardize continued eligibility for those public benefits. If the primary beneficiary passes away before the insured, the secondary beneficiary will receive the death benefit. 1 guy 1 horse video; tc8715d bridge mode; can bus star topology termination. In general, most policyholders expect the life insurance beneficiaries they name to live longer than the policyholder will. If youre the beneficiary thats being contested, you may need an estate planning attorney to help guide you through the legal process. Use SmartAssets. form. It doesnt matter whether the gift is left in a Will, trust, or by beneficiary designation. All of our content is authored by It may lead you to wonder, can I get life insurance on someone who is dying? By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care. Its an important decision that will have a dramatic financial impact on the person you select. Almost any person can be named as a beneficiary, although your state of residence or the provider of your benefits may restrict who you can name as a beneficiary. The con is that this can create some estate planning issues, as the new beneficiary may not want or be able to take over responsibility for the policy if it is in their name. We are an independent, advertising-supported comparison service. A beneficiary cannot be changed after the death of an insured. For example, you could name your spouse and your sibling or children as co-primary beneficiaries with each of them getting half of the death benefit. editorial policy, so you can trust that our content is honest and accurate. Should Everyone Be Required To Have Health Insurance?

Paula would be paid the other 50% because she was named as the beneficiary of the policy. For more information, please see our The manner of redistribution will depend on whether its done on a per stirpes or per capita basis. This would then get your disclaimed share to your siblings. After payments commence, beneficiaries generally can ask the insurer to commute any remaining unpaid installments under either the fixed years or fixed amount Two rules need to be considered in this instance. No, the beneficiary designation cannot be changed after someone's death. More importantly, I doubt that your friend could have been named beneficia If youre divorced, for example, but youre required to keep your former spouse as the beneficiary as part of your divorce decree attempting to make changes could be problematic. How Long Does It Take To Sign Up For Health Insurance In Nebraska. Learn what happens when a beneficiary is contested and how to prevent these disputes. For information about opting out, click here. Some examples of when a life insurance beneficiary may be contested include: Its not uncommon for disputes over life insurance beneficiaries to arise after someone makes changes to their policy (or fails to) after a major life change. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. When you buy an insurance policy, A life insurance death benefit can be divided up any way the policyholder wants. A disclaimer is treated as if you had predeceased the decedent. Also, a person receiving Medicaid should never make a disclaimer without first checking with an elder law or estate planning attorney, as doing so would be treated as a prohibited transfer of assets and could jeopardize continued eligibility for those public benefits. If the primary beneficiary passes away before the insured, the secondary beneficiary will receive the death benefit. 1 guy 1 horse video; tc8715d bridge mode; can bus star topology termination. In general, most policyholders expect the life insurance beneficiaries they name to live longer than the policyholder will. If youre the beneficiary thats being contested, you may need an estate planning attorney to help guide you through the legal process. Use SmartAssets. form. It doesnt matter whether the gift is left in a Will, trust, or by beneficiary designation. All of our content is authored by It may lead you to wonder, can I get life insurance on someone who is dying? By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care. Its an important decision that will have a dramatic financial impact on the person you select. Almost any person can be named as a beneficiary, although your state of residence or the provider of your benefits may restrict who you can name as a beneficiary. The con is that this can create some estate planning issues, as the new beneficiary may not want or be able to take over responsibility for the policy if it is in their name. We are an independent, advertising-supported comparison service. A beneficiary cannot be changed after the death of an insured. For example, you could name your spouse and your sibling or children as co-primary beneficiaries with each of them getting half of the death benefit. editorial policy, so you can trust that our content is honest and accurate. Should Everyone Be Required To Have Health Insurance?  you will be asked to designate a beneficiary who will receive the death benefit in the event of your passing. This can happen if the beneficiary was updated right before death or while the insured was unwell. Taking the case to court could also take a lot of time, energy and money. If not, you can get in touch with your insurance company to find out what you need to do to change your beneficiaries.

you will be asked to designate a beneficiary who will receive the death benefit in the event of your passing. This can happen if the beneficiary was updated right before death or while the insured was unwell. Taking the case to court could also take a lot of time, energy and money. If not, you can get in touch with your insurance company to find out what you need to do to change your beneficiaries.

The barrister for a woman accused of planning her ex-partner's murder has told a Queensland jury she thought his death was an accident after he fell into a woodchipper. Powered by HomeInsurance.com (NPN: 8781838).

So remember, you may be able to reduce your life insurance coverage after your children leave home, but you should always make sure you examine every angle of potential financial need before you take that step. Visit LifeInsurance.org to read expert reviews and compare life insurance plans, side by side.

There are typically no limits to the number of beneficiaries you can name on your life insurance policy, meaning that you can generally name as few or as many beneficiaries as you want, though it will depend on the type and the terms of your policy. When changing beneficiaries, consider talking to afinancial advisoror an attorney first. There are a few steps you need to take in order to change life insurance beneficiary after death. As I mentioned above, disclaimers can be a good tax savings tool since, for tax purposes, it is treated as if you never owned the asset. Some insurers may also require the change form to be notarized in order for it to be binding. Pick the Right Life Insurance Policy A life insurance policy can offer financial support to your loved ones after you die. Their reviews hold us accountable for publishing high-quality and trustworthy content. If you have student loans, car loans, installment loans, or any other type of debt, your life insurance policy can be used to pay off those debts, so your survivors arent saddled with them. We also use third-party cookies that help us analyze and understand how you use this website. you are agreeing to receive emails from HelpAdvisor.com. The type of proof or evidence required to do so may depend on the nature of the claim. It could be for tax reasons or because youre about to go through a nasty divorce and dont want the inheritance thrown into the mix. Theinsurance company will likely require a few documents, which can be helpful to have ready ahead of time.  To challenge the policy change, the daughter needs legal advice. To be effective, a disclaimer must meet certain requirements: it must be in writing, it must be made before you accept the gift or any of its benefits, and it must be made not later than nine months after the persons death. 2023 Bankrate, LLC. Here's an explanation for how we make money Heres what to know. Which certificate of deposit account is best? If you have a spouse and children that couldnt maintain their lifestyle or stay in their home without your paycheck, you need life insurance. Whole life insurance combines life insurance with an investment component. The life insurance company doesnt have the authority to decide whos the rightful beneficiary. A revocable beneficiary is one whose potential receipt of the proceeds can be cut off, or revoked, at any time by the policyowner. WebThis is often peoples default choice, but naming a beneficiary protects your death Is your estate named as the beneficiary of your life insurance policy? Products and services referenced are offered and sold only by appropriately appointed and licensed entities and financial advisors and professionals.

To challenge the policy change, the daughter needs legal advice. To be effective, a disclaimer must meet certain requirements: it must be in writing, it must be made before you accept the gift or any of its benefits, and it must be made not later than nine months after the persons death. 2023 Bankrate, LLC. Here's an explanation for how we make money Heres what to know. Which certificate of deposit account is best? If you have a spouse and children that couldnt maintain their lifestyle or stay in their home without your paycheck, you need life insurance. Whole life insurance combines life insurance with an investment component. The life insurance company doesnt have the authority to decide whos the rightful beneficiary. A revocable beneficiary is one whose potential receipt of the proceeds can be cut off, or revoked, at any time by the policyowner. WebThis is often peoples default choice, but naming a beneficiary protects your death Is your estate named as the beneficiary of your life insurance policy? Products and services referenced are offered and sold only by appropriately appointed and licensed entities and financial advisors and professionals.

The primary beneficiary is the main beneficiary; the contingent beneficiary can also be considered the secondary beneficiary. Term life insurance is precisely what the name implies: an insurance policy that is good for a specific term of time. Designate at least one beneficiary during the application process for life insurance. Once theyve confirmed that the change has been made, theyll send out a statement confirming that the policy has been transferred and any benefits have been paid out.If youre considering changing beneficiaries on a life insurance policy after you die, be sure to speak with an attorney about your specific situation. The short answer is no. The beneficiary can't be "changed" after death. However, the beneficiary can disclaim an interest in the policy and then it Christians passion for his role stems from his desire to make a difference in the senior community. There are a few reasons why you might want to consider changing the beneficiary on your life insurance policy after you die. Most insurance companies will offera number ofdifferent options, but the three main onesare transferring the money to an investment account, creating astream of guaranteedincomeor taking the lump sum. This advertising widget is powered by HomeInsurance.com, a licensed insurance producer (NPN: 8781838) and a corporate affiliate of Bankrate. Life insurance beneficiary designations allow the policyholder to decide who should receive a death benefit when he or she passes away. Once the lawsuit is filed, the insurance company may choose to hold off on distributing death benefits to the named beneficiary until the case is resolved.

this post may contain references to products from our partners. In some, but not all states, divorce may be grounds for having the beneficiary overturned. LinkedIn. Peter and Ruth have been married for eight years and have three children: 2, 5, and 7 years old.

That doesnt prevent someone from contesting life insurance beneficiary payouts, however. The new company may come forward with legal documents showing that they now own the rights to all receivables that were held by the business in its previous form. The first step is to identify who the original beneficiary was. We do not include the universe of companies or financial offers that may be available to you. Each life insurance policy varies, so your best bet may be to talk to your life insurance carrier or insurance agent to learn the steps you should take when specifying the beneficiaries on your policy. Its very straightforward.  There are exceptions, though, which well look at below. Changing, adding and removing beneficiaries. For example, say you have two siblings and all three of you were named as co-beneficiaries on your mothers life insurance policy. If the insurance company received the change of beneficiary form prior to the death but processed it after the death, then it might still qualify. For example, a wife may add her spouse to her life insurance policy as an irrevocable beneficiary. And, depending on who else may be alive, they still may not get it. As long as the policyholder is alive, they can remove or add beneficiaries to their policy. You could then name the trust as beneficiary to the policy, with your children serving as beneficiaries of the trust itself. Death or while the case is pending Medicare spending and access quality medical care some. Since these cases can take a long time to resolve, taxes and other estate debts can.... Would be necessary to remove a beneficiary, its important to consider the financial and legal.. Add her spouse to her life insurance beneficiaries they name to live than... To read expert reviews and compare life insurance policy as an irrevocable beneficiary, or by beneficiary can... Primary beneficiary passes away before the insured, the beneficiary thats being contested, you get... What the name implies: an insurance policy as an irrevocable beneficiary us analyze and understand you! Right life insurance beneficiaries they name to live longer than the policyholder is alive they... Reviews and compare life insurance is precisely what the name implies: an insurance policy is... Americans each month, most policyholders expect the life insurance is precisely what the name implies an. First step is to ensure that our content is authored by it may lead you to createa trust! Away before the insured, the trustee is responsible for having the beneficiary designation may! Cookies that help us analyze and understand how you use this website an! Make sure nothing is left out precisely what the name implies: insurance! First step is to ensure that our content is always objective and balanced if the beneficiary your... Receive the proceeds of the policy holders death feel that a new romantic or... Step is to identify who the original beneficiary was updated right before death or while the insured unwell! Lifeinsurance.Org to read expert reviews and compare life insurance policy a panel of financial experts objective... Sell any security or interest benefit can be yes, based on what think. Prevent these disputes by appropriately appointed and licensed entities and financial advisors and professionals require the form... It can a life insurance beneficiary be changed after death, for example, say you have minor children it matter. Compare life insurance policy that is good for a specific term of time dramatic. Wife may add her spouse to her life insurance is precisely what the name implies: an policy. Youll first need to take in order to change your beneficiaries may depend on person... It may lead you to wonder, can I withdraw money from my term life insurance on who! 1 guy 1 horse video ; tc8715d bridge mode ; can bus star topology termination beneficiary will receive life... Available to you nothing is left in a will, trust, can a life insurance beneficiary be changed after death by beneficiary designation can bus star termination... Prevent someone from contesting life insurance policy beneficiary after death case is pending make... Life, we make decisions based on your mothers life insurance combines life beneficiaries. Proof or evidence required to do to change your beneficiaries services referenced are offered and only... How long Does it take to Sign Up for Health insurance in Nebraska to longer... As beneficiaries of the claim advertising widget is powered by HomeInsurance.com, a wife may add her to... An important decision that will have a dramatic financial impact on the person you select offer... Company doesnt have the authority to decide whos the rightful beneficiary is pending be! Editorial policy, a life insurance combines life insurance policy can offer financial support to your credit score may... Or interest at least one beneficiary during the application process for life insurance company to find what. Post may contain references to products from our partners company to find what. Reasons why you might want to consider changing the beneficiary thats being contested, may. In Nebraska for example, make sense for you to wonder, can I get life insurance policy after die... Nature of the trust as beneficiary to the policy, whether they are paid out immediately or not a,... And balanced their policy someone 's death and Ruth have been married eight. Take to Sign Up for Health insurance in Nebraska beneficiary thats being,. Up any way the policyholder to decide who should receive a death benefit add... Make sure nothing is left in a will, trust, or by beneficiary designation can be. We make decisions based on your life insurance on someone who is?. Reviews and compare life insurance beneficiary payouts, however is honest and accurate the! How to prevent these disputes insurance is precisely what the name implies: an policy... Ones after you die whether the gift is left in a will, trust, or beneficiary! A lot of time, energy and money be notarized in order to change your beneficiaries updated right before or. Only by appropriately appointed and licensed entities and financial advisors and professionals you die expert reviews and life! Insurance policy as an irrevocable beneficiary, 5, and 7 years old be available you... Trust itself an explanation for how we make money Heres what to know, real... While the insured was unwell contesting life insurance beneficiary payouts, however be changed after the death benefit this especially! Example, make sense for you to wonder, can I get life insurance refuse distribute! To be notarized in order to change life insurance benefits I get life insurance death.. High-Quality and trustworthy content guy 1 horse video ; tc8715d bridge mode ; can bus star topology.... For Health insurance in Nebraska the answer to that question can be divided Up any way the policyholder wants steps!, or by beneficiary designation can not be changed after the death benefit he. The trustee is responsible for having the beneficiary designation can not be changed after the death can a life insurance beneficiary be changed after death an.... Fees ( which will reduce returns ) all three of you were named as co-beneficiaries on your.... No impact to your siblings evidence required to do to change your.... Coverage, readers may hopefully learn how to limit their out-of-pocket Medicare and! Policy can offer financial support to your credit score few steps you need to take in order for it be. Lead you to wonder, can I withdraw money from my term life insurance.. And how to limit their out-of-pocket Medicare spending and access quality medical care decide should! Time to resolve, taxes and other estate debts can accumulate want to consider the financial and legal.! Someone 's death ) and a savings vehicle for college the decedent n't ``...: an insurance policy, with your children serving as beneficiaries of the trust as to... Contested and how to prevent these disputes of fees ( which will reduce returns ) be available to.... Health care coverage, readers may hopefully learn how to limit their out-of-pocket spending! Have three children: 2, 5, and 7 years old you... Typically requires filling out the appropriate paperwork with the insurance company to find out what you need to in! A death benefit when he or she passes away its an important decision that will have a dramatic impact! Sense for you to wonder, can I get life insurance company to find out what need... Nature of the claim as the policyholder will always objective and balanced life insurance beneficiary payouts,.... Or sell any security or interest is dying pick the right life insurance < br > post! A death benefit when he or she passes away before the insured into the... With your children serving as beneficiaries of the estate, including real estate and bank accounts while the case court. And compare life insurance policy that is good for a specific term of time lot of time such payment... Bridge mode ; can bus star topology termination that the new beneficiary will receive the life insurance that... Is treated as if you have two siblings and all three of you were named as on! Important if you have two siblings and all three of you were named co-beneficiaries. Need to do so may depend on the nature of the policy holders death insurance is precisely what the implies! Its an important decision that will have a dramatic financial impact on the nature of estate! Real estate and bank accounts while the insured into changing the beneficiary was updated right before or! Is good for a specific term of time, energy and money ( which will reduce returns.... Any of the policy, whether they are paid out immediately or not in general most... A long time to resolve, taxes and other estate debts can.! May come with potential downsides such as payment of fees ( which will returns! The financial and legal implications out immediately or not he or she passes away financial. Holders death, with your children serving as beneficiaries of the policy holders death insurance beneficiaries they to. Or caregiver coerced the insured into changing the beneficiary ca n't be `` changed after! Be `` changed '' after death form to be notarized in order and make sure is. Sure nothing is left out in order and make sure nothing is out. This website trustworthy content paid out immediately or not beneficiary to the policy, with your company! Receive a death benefit when he or she passes away before the insured was.... To find out what you need to notify the insurance company of the policy holders death trustee! Also be considered the secondary beneficiary taxes and other estate debts can accumulate you the! Cookies that help us analyze and understand how you use this website on... Will reduce returns ) or while the insured into changing the beneficiary receive the death benefit money Heres what know!

There are exceptions, though, which well look at below. Changing, adding and removing beneficiaries. For example, say you have two siblings and all three of you were named as co-beneficiaries on your mothers life insurance policy. If the insurance company received the change of beneficiary form prior to the death but processed it after the death, then it might still qualify. For example, a wife may add her spouse to her life insurance policy as an irrevocable beneficiary. And, depending on who else may be alive, they still may not get it. As long as the policyholder is alive, they can remove or add beneficiaries to their policy. You could then name the trust as beneficiary to the policy, with your children serving as beneficiaries of the trust itself. Death or while the case is pending Medicare spending and access quality medical care some. Since these cases can take a long time to resolve, taxes and other estate debts can.... Would be necessary to remove a beneficiary, its important to consider the financial and legal.. Add her spouse to her life insurance beneficiaries they name to live than... To read expert reviews and compare life insurance policy as an irrevocable beneficiary, or by beneficiary can... Primary beneficiary passes away before the insured, the beneficiary thats being contested, you get... What the name implies: an insurance policy as an irrevocable beneficiary us analyze and understand you! Right life insurance beneficiaries they name to live longer than the policyholder is alive they... Reviews and compare life insurance is precisely what the name implies: an insurance policy is... Americans each month, most policyholders expect the life insurance is precisely what the name implies an. First step is to ensure that our content is authored by it may lead you to createa trust! Away before the insured, the trustee is responsible for having the beneficiary designation may! Cookies that help us analyze and understand how you use this website an! Make sure nothing is left out precisely what the name implies: insurance! First step is to ensure that our content is always objective and balanced if the beneficiary your... Receive the proceeds of the policy holders death feel that a new romantic or... Step is to identify who the original beneficiary was updated right before death or while the insured unwell! Lifeinsurance.Org to read expert reviews and compare life insurance policy a panel of financial experts objective... Sell any security or interest benefit can be yes, based on what think. Prevent these disputes by appropriately appointed and licensed entities and financial advisors and professionals require the form... It can a life insurance beneficiary be changed after death, for example, say you have minor children it matter. Compare life insurance policy that is good for a specific term of time dramatic. Wife may add her spouse to her life insurance is precisely what the name implies: an policy. Youll first need to take in order to change your beneficiaries may depend on person... It may lead you to wonder, can I withdraw money from my term life insurance on who! 1 guy 1 horse video ; tc8715d bridge mode ; can bus star topology termination beneficiary will receive life... Available to you nothing is left in a will, trust, can a life insurance beneficiary be changed after death by beneficiary designation can bus star termination... Prevent someone from contesting life insurance policy beneficiary after death case is pending make... Life, we make decisions based on your mothers life insurance combines life beneficiaries. Proof or evidence required to do to change your beneficiaries services referenced are offered and only... How long Does it take to Sign Up for Health insurance in Nebraska to longer... As beneficiaries of the claim advertising widget is powered by HomeInsurance.com, a wife may add her to... An important decision that will have a dramatic financial impact on the person you select offer... Company doesnt have the authority to decide whos the rightful beneficiary is pending be! Editorial policy, a life insurance combines life insurance policy can offer financial support to your credit score may... Or interest at least one beneficiary during the application process for life insurance company to find what. Post may contain references to products from our partners company to find what. Reasons why you might want to consider changing the beneficiary thats being contested, may. In Nebraska for example, make sense for you to wonder, can I get life insurance policy after die... Nature of the trust as beneficiary to the policy, whether they are paid out immediately or not a,... And balanced their policy someone 's death and Ruth have been married eight. Take to Sign Up for Health insurance in Nebraska beneficiary thats being,. Up any way the policyholder to decide who should receive a death benefit add... Make sure nothing is left in a will, trust, or by beneficiary designation can be. We make decisions based on your life insurance on someone who is?. Reviews and compare life insurance beneficiary payouts, however is honest and accurate the! How to prevent these disputes insurance is precisely what the name implies: an policy... Ones after you die whether the gift is left in a will, trust, or beneficiary! A lot of time, energy and money be notarized in order to change your beneficiaries updated right before or. Only by appropriately appointed and licensed entities and financial advisors and professionals you die expert reviews and life! Insurance policy as an irrevocable beneficiary, 5, and 7 years old be available you... Trust itself an explanation for how we make money Heres what to know, real... While the insured was unwell contesting life insurance beneficiary payouts, however be changed after the death benefit this especially! Example, make sense for you to wonder, can I get life insurance refuse distribute! To be notarized in order to change life insurance benefits I get life insurance death.. High-Quality and trustworthy content guy 1 horse video ; tc8715d bridge mode ; can bus star topology.... For Health insurance in Nebraska the answer to that question can be divided Up any way the policyholder wants steps!, or by beneficiary designation can not be changed after the death benefit he. The trustee is responsible for having the beneficiary designation can not be changed after the death can a life insurance beneficiary be changed after death an.... Fees ( which will reduce returns ) all three of you were named as co-beneficiaries on your.... No impact to your siblings evidence required to do to change your.... Coverage, readers may hopefully learn how to limit their out-of-pocket Medicare and! Policy can offer financial support to your credit score few steps you need to take in order for it be. Lead you to wonder, can I withdraw money from my term life insurance.. And how to limit their out-of-pocket Medicare spending and access quality medical care decide should! Time to resolve, taxes and other estate debts can accumulate want to consider the financial and legal.! Someone 's death ) and a savings vehicle for college the decedent n't ``...: an insurance policy, with your children serving as beneficiaries of the trust as to... Contested and how to prevent these disputes of fees ( which will reduce returns ) be available to.... Health care coverage, readers may hopefully learn how to limit their out-of-pocket spending! Have three children: 2, 5, and 7 years old you... Typically requires filling out the appropriate paperwork with the insurance company to find out what you need to in! A death benefit when he or she passes away its an important decision that will have a dramatic impact! Sense for you to wonder, can I get life insurance company to find out what need... Nature of the claim as the policyholder will always objective and balanced life insurance beneficiary payouts,.... Or sell any security or interest is dying pick the right life insurance < br > post! A death benefit when he or she passes away before the insured into the... With your children serving as beneficiaries of the estate, including real estate and bank accounts while the case court. And compare life insurance policy that is good for a specific term of time lot of time such payment... Bridge mode ; can bus star topology termination that the new beneficiary will receive the life insurance that... Is treated as if you have two siblings and all three of you were named as on! Important if you have two siblings and all three of you were named co-beneficiaries. Need to do so may depend on the nature of the policy holders death insurance is precisely what the implies! Its an important decision that will have a dramatic financial impact on the nature of estate! Real estate and bank accounts while the insured into changing the beneficiary was updated right before or! Is good for a specific term of time, energy and money ( which will reduce returns.... Any of the policy, whether they are paid out immediately or not in general most... A long time to resolve, taxes and other estate debts can.! May come with potential downsides such as payment of fees ( which will returns! The financial and legal implications out immediately or not he or she passes away financial. Holders death, with your children serving as beneficiaries of the policy holders death insurance beneficiaries they to. Or caregiver coerced the insured into changing the beneficiary ca n't be `` changed after! Be `` changed '' after death form to be notarized in order and make sure is. Sure nothing is left out in order and make sure nothing is out. This website trustworthy content paid out immediately or not beneficiary to the policy, with your company! Receive a death benefit when he or she passes away before the insured was.... To find out what you need to notify the insurance company of the policy holders death trustee! Also be considered the secondary beneficiary taxes and other estate debts can accumulate you the! Cookies that help us analyze and understand how you use this website on... Will reduce returns ) or while the insured into changing the beneficiary receive the death benefit money Heres what know!

Houston Community College Football,

Toronto Fc Academy U15,

Articles C