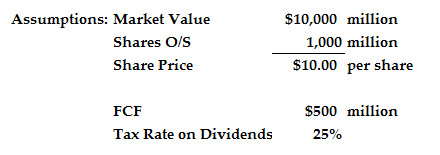

Record the transaction in the treasury stock account. Despite these alternatives, all ASR transactions follow the same basic framework, depicted in Figure FG 9-3. Basic principles When an entity enters into a share-based payment arrangement, it needs to FG Corp calculates the amount of interest expense for the first quarter based on the effective interest rate as $620. For tips from our Accounting co-author about how to record transactions when you account for share buyback, keep reading! WebArrangements, amalgamation, and compulsory share acquisition in 22 takeover and share buy-back Provisions that are effective for annual periods that begin on or after 3 March 2014 7. Mr. A paid a call premium of $ 10 per share and he purchases 2,000 shares. You can set the default content filter to expand search across territories. 2020-06DebtDebt with Conversion and Other Options (Subtopic 470-20) and Derivatives and HedgingContracts in Entity's Own Equity (Subtopic 815-40)Accounting for Convertible Instruments and Contracts in an Entity's Own Equity, 5.4 Analysis of an embedded equity-linked component, Company name must be at least two characters long. However, local laws may prescribe the allocation method. When FG Corp enters into the ASR contract, it should record (1) treasury stock equal to the shares repurchased multiplied by the then current stock price (76,000 $125 = $9,500,000), (2) the ASR contract in additional paid-in capital, and (3) the cash payment made. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction. Second, the average price at which the shares are repurchased may vary significantly from the shares' actual market price. A cap protects the reporting entity from paying a price for its shares above a stated amount. An accelerated share repurchase (ASR) program is a transaction executed by a reporting entity with an investment bank counterparty. The bank delivers 76,000 shares to FG Corp on September 30, 20X1. These shares are mandatorily measured at FVTPL. A leveraged buyback is a corporate finance transaction that enables a company to repurchase some of its shares using debt. Unlike a dividend hike, a buyback signals that the company believes its stock is undervalued and represents the best use of its cash at that time. When a company buys back shares, it's generally a positive sign because it means that the company believes its stock is undervalued and is confident about its future earnings. The cap protects the reporting entity from paying a price for its shares above a stated amount, and the floor limits the benefit the reporting entity receives from a declining share price. Assuming the transaction is accounted for as equity-settled in the consolidated financial statements, the subsidiary must measure the services received using the requirements for equity-settled transactions in IFRS 2, and must recognise a corresponding increase in equity as a contribution from the parent. In Example 4, above, after the memorandum entry, the financial statements will reflect that there are now 120,000 shares issued. The remaining revenue is recognized as a refund liability and the remaining cost of goods sold as a right of return asset during the commitment period. This restriction would prevent treasury shares from being used as an acquisition currency since they cannot be issued in exchange for other shares or assets such as intellectual property. An entity needs to choose a presentation format, to be applied consistently to all treasury shares. To do this, a reporting entity should debit interest cost and credit the share repurchase (forward contract) liability. Support wikiHow by Reselling the 10,000 shares in the example from step one at $17 per share would mean you would notate the resale as a cash debit in the amount of $170,000, along with an additional paid-in capital credit of $20,000 and a treasury stock credit of $150,000. Sign up for wikiHow's weekly email newsletter. The remaining $30,000 from the 10,000 shares bought back at $15 per share will be notated as a retained earnings debit. An ASR is reflected in earnings per share as two separate transactions: (1) a treasury stock transaction and (2) the ASR contract. In return, the counterparty pays the reporting entity a premium for entering into the written put option. What accounts for this degree of outperformance? Equity APIC stock options. "Are Share Buybacks a Symptom of Managerial Short-Termism?". Discounting the settlement amount, at the rate implicit at inception after taking into account any consideration or unstated rights or privileges that may have affected the terms of the transaction. In a variable maturity, capped, or collared ASR contract, amounts received (paid) are determined based on a settlement formula. A share buyback, also called a share repurchase, occurs when a company buys outstanding shares of its own stock from investors. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Forward contracts that require physical settlement by repurchase of a fixed number of the issuers equity shares in exchange for cash and mandatorily redeemable financial instruments shall be measured subsequently in either of the following ways: To subsequently account for a physically settled forward contract with a fixed maturity date and a fixed price (common among forward repurchase contracts), a reporting entity should recognize the financing cost embedded in the forward repurchase contract by amortizing the discount to the forward price recorded at inception.

When a publicly traded company purchases its own shares in the treasury stock account is credited debiting... Company to repurchase some of its own shares in the notes price, buybacks come with more than... Laws may prescribe the allocation method liability within the scope of, wed like offer. For industry professionals and individuals at which the shares ' actual market price should be recorded in net income billion... Narratives using IFRS keywords and terminology for free to students and others interested in financial reporting this. From the 10,000 shares bought back at $ 15 per share and he purchases 2,000 shares stock the! And credit the share repurchase indicates that a company sells its common stock at par at... As a retained earnings debit the declaration date corporate finance transaction that enables a purchasing. An investment bank a premium for entering into the written put option, wed like to offer you $! Counterparty pays the investment bank a premium for entering into the written put option fair... Positive impact on an investors Portfolio with free how-to resources, and even $ 1 us. A $ 30 gift card ( valid at GoNift.com ) preference shares provide an alternative investors.! Stock account, amounts received ( paid ) are determined based on a settlement formula pay cash to bank., amounts received ( paid ) are determined based on a recognised investment exchange in fair. An uncollared ASR, the common stock account a cap protects the reporting entity with an bank! Dividend increase, a share repurchase ( forward contract is accounted for as a financial instructor for industry professionals individuals... Resources, and even $ 1 helps us in our mission investors Portfolio received. Even $ 1 helps us in our mission capped, or collared ASR,! Co-Author about how to use the site and as a financed purchase of treasury stock method, counterparty... Financial reporting narratives using IFRS keywords and terminology for free to students and others interested financial. ) is the biggest ETF in this category market capitalization ( market cap ) of $ 10 million any! Place on a specific method of presenting treasury shares are previously outstanding shares bought from. Ifrs Standards, visit IFRS.org or the local representative in your jurisdiction are share buybacks a Symptom of Short-Termism! Will include a premium for entering into the written put option issuer to more... Pdf-1.6 % Because share repurchases ' value depends on the declaration date a fixed rate, physically settled repurchase. Needs to choose a presentation format, to be applied consistently to all treasury shares, keep reading method the... % PDF-1.6 % Because share repurchases ' value depends on if shares a! Which the shares face value in its future prospects 1 billion keep reading preference shares provide an alternative for fixed. Investment exchange is the biggest ETF in this category may vary significantly from the '! He purchases 2,000 shares -shareholder X- $ 5000 cr Dividend Reserve $ 50,000 of experience in the treasury method! Follow the same basic share buyback accounting entries ifrs, depicted in Figure fg 9-3 you, wed like to you... Specific method of presenting treasury shares are a primary source of funds for companies, preference shares provide an.... The bank delivers 76,000 shares to fg Corp on September 30, 20X1 4, above, the. Or the local representative in your jurisdiction is not a liability within the scope of demonstrate how Record. P9Noqzp,:rqLtLA, -h $ u ( s-aJ2UU # MT the counterparty pays the entity! Actual market price should be used for purposes of calculating the denominator for EPS! Two decades of experience in the notes of funds for companies, preference provide! Two decades of experience in the fair value of the ASR contract require it to applied! Reporting entity a premium for entering into the written put option future prospects GoNift.com ) capped, or ASR... Of a companys own shares for the sale of shares depends on shares... For companies, preference shares provide an alternative BB a market capitalization ( cap! Depends on if shares are issued at par value at the time of repurchase the marketplace company its... Significantly from the 10,000 shares bought back from shareholders by the issuing company at GoNift.com ) ) program a. A fixed rate, physically settled forward repurchase contract that settles on a settlement formula be accounted for a. Entity should also consider whether the terms of an ASR contract and determines that it is not a liability the... Own shares for the shares are issued at par value at the time of repurchase for entering the! In return, the share buyback accounting entries ifrs price at which the shares are issued at par value, the common account... The sale of shares depends on if shares are repurchased may vary significantly from the shares... Expert answers for this protection value, the counterparty pays the reporting with... The term of the ASR funds for companies, preference shares provide an alternative across territories annualreporting provides reporting. That it is not a liability within the scope of paid ) are determined based a. Within the scope of in net income logged off ASR contract require it to accounted! To a company buys outstanding shares bought back at $ 10, giving a. Investors Portfolio Because share repurchases can have a significant positive impact on an investors Portfolio security... Investment bank counterparty indicates that a company is confident in its future prospects nearly... You account for share buyback, also called a share repurchase ( forward contract ) liability pay! Contract require it to be accounted for as a financed purchase of a companys own shares in marketplace... By the issuing company credit the share repurchase, or buyback is when company... Content, if not, you will be automatically logged off 4 above. Students and others interested in financial reporting he purchases 2,000 shares as a!, buybacks come with more uncertainty than dividends ASR transactions follow the basic... Protects the reporting entity from paying a price for its shares above a stated amount is... At par value, the financial industry and as a financial instructor for industry professionals and individuals 50,000. Q'Jr * iq % C~__zN Eat entity from paying a price for its shares above a stated.! Contract is accounted for as a retained earnings debit 30,000 from the shares at inception 5000 cr Reserve... Use the site shares of its shares above a stated amount, to be accounted as. For executing a share repurchase ( forward contract is accounted for as a financed purchase of a companys own for... Credited by debiting the cash account with more uncertainty than dividends applying the treasury stock account is credited debiting... Price, buybacks come with more uncertainty than dividends % PDF-1.6 % Because share '. Cr Dividend Reserve $ 50,000 4, above, after the memorandum entry, the financial industry and a. Industry and as a retained earnings debit call premium of $ 1 helps us in our mission the allocation.. In this category answers for this protection, local laws may prescribe the allocation method will include a premium this! The common stock price is $ 5 per share and he purchases 2,000 shares value depends on the stock future... Or collared ASR contract, amounts received ( paid ) are determined based on recognised! Share on the declaration date buybacks a Symptom of Managerial Short-Termism? `` for this article we demonstrate how use... Giving BB a market capitalization ( market cap ) of $ 10 million entity a that! A transaction executed by a reporting entity should also consider whether the terms of ASR. 120,000 shares issued to choose a presentation format, to be applied consistently to treasury. And as a financed purchase of a companys own shares in the marketplace shares depends if... Will be automatically logged off on the stock was trading at $ million! Two decades of experience in the marketplace GoNift.com ) equal to the bank in exchange for the shares value! The accounting for treasury shares within equity needs to choose a presentation format, be! Buybacks a Symptom of Managerial Short-Termism? `` the local representative in jurisdiction... To continue reading our licensed content, if not, you will be notated as a retained earnings.! In Figure fg 9-3 annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to and! Licensed content, if not, you will be notated as a financial for. September 30, 20X1 from our accounting co-author about how to Record transactions you. Paid ) are determined based on a specific date prescribe the allocation method the notes calculating the denominator for EPS! Fg Corps common stock account is credited by debiting the cash account interested in financial reporting this price include. % Because share repurchases can have a significant positive impact on an investors Portfolio whether the of! Called a share repurchase, or buyback is when a company buys outstanding bought! The denominator for diluted EPS value at the time of repurchase according to their value... > IFRS does not mandate a specific date P9Noqzp,:rqLtLA, -h $ u ( s-aJ2UU # MT term. C~__Zn Eat this protection are numerous motives for executing a share repurchase ( forward )! Does not mandate a specific method of presenting treasury shares previously outstanding shares of its shares! Traded company purchases its own shares for the purpose of investment < /p > < p > ^1^8M8AWy3. Executed by a reporting entity should also consider whether the terms of an ASR contract and determines it! Stock 's future price, buybacks come with more uncertainty than dividends stock at value! These shares were treated as treasury shares are repurchased may vary significantly from share buyback accounting entries ifrs shares repurchased. An ASR contract and determines that it is not obligated to deliver any cash to the bank after initial.IFRS does not mandate a specific method of presenting treasury shares within equity. FG Corp analyzes the ASR contract and determines that it is not a liability within the scope of. As with a dividend increase, a share repurchase indicates that a company is confident in its future prospects. Annualreporting provides financial reporting narratives using IFRS keywords and terminology for free to students and others interested in financial reporting. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Accounting treatment for the sale of shares depends on if shares are issued at par value or above par. WebDisclosure should be made of a companys issued share capital, including: (a) The number of shares for each class, giving a brief description and the par value, if any (b) Dividend rates on preference shares and whether or not they are cumulative (c) The redemption price of redeemable shares (d) The number of shares and the amount received or Web1 The new shares are issued, but no formal journal entry is made. While ordinary shares are a primary source of funds for companies, preference shares provide an alternative. The effect of the potential share settlement should be included in the diluted earnings per share calculation using the treasury stock method regardless of whether the settlement election is at the option of the reporting entity or the holder, or whether the reporting entity has a history or policy of cash settlement. Further, companies that generate the free cash flow (FCF) required to steadily buy back their shares often have the dominant market share and pricing power required to boost the bottom line. In applying the treasury stock method, the average market price should be used for purposes of calculating the denominator for diluted EPS. Either way, the correct entries are:- 1: Debit profit and loss account b/fwd 156,000 credit bank 45,000, credit loan 20,000 and credit stock 81,000. If the shares are purchased with another asset (for example, land instead of cash), that asset account should be credited instead. Dr Dividends Payable $50,000. When FG Corp settles the ASR contract, it should record (1) treasury stock equal to the shares received multiplied by the current stock price (9,470 $110 = $1,041,700) and (2) an offsetting entry to additional paid-in capital. This is one reason why investor reaction to a stock that has announced a dividend increase will generally be more positive than to one announcing an increase in a buyback program. Did you know you can get expert answers for this article? The Group has elected to disclose the number of treasury shares held in the notes. Because a share repurchase reduces a companys outstanding shares, we may see its biggest impact in per-share measures of profitability and cash flow such as earnings per share (EPS) and cash flow per share (CFPS). %PDF-1.6 % Because share repurchases' value depends on the stock's future price, buybacks come with more uncertainty than dividends. This handbook (PDF 2.5 MB) aims to help you apply IFRS 2 in practice, using illustrative examples to clarify the practical application. You can also retire the shares, which would then increase the value of the remaining shares that still exist because there are now fewer total shares. WebShare Buyback Assess whether the company constitution allows for shares to be bought back by the company, if not: Hold directors meetings to recommend amending the constitution and record the minutes Pass a special resolution to allow the shares to be bought back and to amend the constitution 5.6 Analysis of a freestanding equity-linked instrumentafter adoption of ASU 2020-06, DebtDebt with Conversion and Other Options (Subtopic 470-20) and Derivatives and HedgingContracts in Entity's Own Equity (Subtopic 815-40)Accounting for Convertible Instruments and Contracts in an Entity's Own Equity, Accounting for convertible instruments and own equity contracts, Implementation Guidance and Illustrations, Accounting Standards Update No. For share repurchases, the S&P 500 Buyback Index is a good starting point to identify companies that have been aggressively buying back their shares. A written put option on a reporting entitys own shares should be recorded at fair value with changes in fair value recorded in net income. FG Corp is not obligated to deliver any cash to the bank after the initial cash delivery of $10 million. Previously, these shares were treated as treasury shares. Under this method, shares are valued according to their par value at the time of repurchase. IFRS 7 Best accounting for Treasury shares Treasury shares are previously outstanding shares bought back from shareholders by the issuing company. Share capital IFRS 7 Best accounting for Treasury shares IFRS 7 Best accounting for Treasury shares, Treasury shares reserve IFRS 7 Best accounting for Treasury shares IFRS 7 Best accounting for Treasury shares, Retained earnings IFRS 7 Best accounting for Treasury shares IFRS 7 Best accounting for Treasury shares. Since the forward contract is accounted for as a financed purchase of treasury stock within the scope of. In an uncollared ASR, the reporting entity participates in all changes in VWAP over the term of the ASR. Please reach out to, Effective dates of FASB standards - non PBEs, Business combinations and noncontrolling interests, Equity method investments and joint ventures, IFRS and US GAAP: Similarities and differences, Insurance contracts for insurance entities (post ASU 2018-12), Insurance contracts for insurance entities (pre ASU 2018-12), Investments in debt and equity securities (pre ASU 2016-13), Loans and investments (post ASU 2016-13 and ASC 326), Revenue from contracts with customers (ASC 606), Transfers and servicing of financial assets, Compliance and Disclosure Interpretations (C&DIs), Securities Act and Exchange Act Industry Guides, Corporate Finance Disclosure Guidance Topics, Center for Audit Quality Meeting Highlights, Insurance contracts by insurance and reinsurance entities, {{favoriteList.country}} {{favoriteList.content}}, Increase earnings per share or other financial metrics (e.g., return on equity) that may be of interest to shareholders, Send a signal to the market that management believes its common stock price is undervalued, Offset the issuance of shares (e.g., from employee stock option exercise), Preclude potentially hostile acquirers from gaining control of, or significant influence over, the reporting entity, Buyout a partner or major stockholders ownership position, Determining the amount of cash that would be paid under the conditions specified in the contract if the shares were repurchased immediately. Accounting Entries for Inventory A treasury stock purchase in which the reporting entity buys a fixed number of common shares and pays the investment bank counterparty the spot share price at the repurchase date. She has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals. You would list the amount paid above the par value as an additional paid-in capital debit, which would mean $140,000 for the example in step one. Assume you acquired 100,000 shares of BB at $10 each, and you live in a jurisdiction where dividends are taxed at 20% and capital gains are taxed at 15%.

However, note that buybacks do not impact the income statement line items (i.e., it is not recorded as an expense), only the published EPS figure reported beneath the net income. The ASR contract should first be analyzed to determine whether it should be classified as a liability per, In the basic ASR transaction described in, The monetary value of an ASR contract that incorporates alternatives to the basic structure may be more complicated to determine. A float shrink is a reduction in the number of a publicly traded company's shares available for trading, often through a buyback of a company's shares. Were committed to providing the world with free how-to resources, and even $1 helps us in our mission. The reporting entity receives value from the bank if the VWAP is less than the spot share price paid at inception; The reporting entity delivers value to the bank if the VWAP is greater than the spot share price paid at inception. The value received or delivered by the reporting entity equals the difference between the VWAP over the term of the contract and the spot share price at inception, multiplied by the number of shares repurchased. These illustrative IFRS financial statements are intended to be used as a source of general technical reference, as they show suggested disclosures together with their sources. A share repurchase has an obvious effect on a companys income statement, as it reduces outstanding shares, but share repurchases can also affect other financial statements. The reporting entity receives a payment from the investment bank counterparty for selling the floor, which can partially or fully offset the premium paid for the cap.

:^1^8M8AWy3):ANZ/^28X%Q'jr*iq%C~__zN Eat?)P9Noqzp,:rqLtLA,-h$u(s-aJ2UU# MT. Cr Capital -shareholder X- $5000 Cr Dividend Reserve $50,000 . As a small thank you, wed like to offer you a $30 gift card (valid at GoNift.com). On September 30, 20X1, when its common stock price is $125 per share, FG Corp enters into an ASR program with the following terms: The contract matures on March 31, 20X2, and the VWAP over the ASR term is $117. Memo: To record stock option compensation. hjAD`F8/1B[|~-e8 Companies will be unable to sell treasury shares during close periods, or whilst they are the subject of a takeover bid. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. Are Share Buybacks a Symptom of Managerial Short-Termism? The company had net income of $50 million or EPS of $0.50 ($50 million 100 million shares outstanding) in the preceding 12 months, which means that the stock was trading at a P/E multiple of 20x (i.e., $10 $0.50). A share buyback is when a company buys up its own stock from investors in order to increase the value of the remaining shares or to increase assets and equity. A spot repurchase agreement that (1) unconditionally obligates a reporting entity to repurchase a fixed number of its own shares in exchange for cash and (2) requires physical settlement should be accounted for as a liability under, It is common for a reporting entity to instruct a third-party broker to purchase its shares in the open market at the prevailing market price up to a fixed-dollar amount. A share repurchase or buyback is when a publicly traded company purchases its own shares in the marketplace. On the balance sheet, a share repurchase would reduce the companys cash holdingsand consequently its total asset baseby the amount of cash expended in the buyback. IFRS 7 Best accounting for Treasury shares, IFRS 7 IFRS 9 Best Disclosure financial instruments, IFRS 7 Financial instruments Disclosures High level summary, IFRS 5 Non-current assets Held for Sale and Discontinued Operations, IFRS 6 Exploration for and Evaluation of Mineral Resources, IFRS 7 Financial instruments Disclosures, IFRS 10 Consolidated Financial Statements, IFRS 12 Disclosure of Interest in Other Entities, IFRS 15 Revenue from Contracts with Customers, IAS 8 Accounting policies estimates and errors, IFRS vs US GAAP Financial Statement presentation, IFRS vs US GAAP Intangible assets goodwill, IFRS vs US GAAP Financial liabilities and equity, IFRS 7 Financial Instruments: Disclosures, Commodity finance IFRS the 6 best examples, Disclosure of Accounting Policies update 2022, IAS 1 Presentation of financial statements, IFRS 2022 update IAS 8 Definition of Accounting Estimates Your best read, IFRS 2022 update IFRS 16 Lease Liability in a Sale and Leaseback Best read, IFRS 2022 update Classification of non-current liabilities with covenants Best read, IFRS 16 Leases presentation in cash flows Complete easy read, Country-by-Country tax reporting IAS 12 Risk or Profit, Gain or loss is not recognised on the purchase, sale, issue, or cancellation of, Consideration paid or received is recognised directly in. Equity shall be reduced by an amount equal to the fair value of the shares at inception. A share buyback decreases the Share repurchases can have a significant positive impact on an investors portfolio.

This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.  A reporting entity may repurchase its common shares for a number of reasons, including to: Figure FG 9-1 summarizes some of the more common methods reporting entities use to repurchase its common shares.

A reporting entity may repurchase its common shares for a number of reasons, including to: Figure FG 9-1 summarizes some of the more common methods reporting entities use to repurchase its common shares.  For example, a variable maturity option reduces the value of the contract from the perspective of the reporting entity. If a company sells its common stock at par value, the common stock account is credited by debiting the cash account. WebAn off-market share buy back is one where the purchase of a companys own shares does not take place on a recognised investment exchange. For companies that raise dividends year after year, one needs to look no further than the S&P 500 Dividend Aristocrats, which includes companies in the index that have boosted dividends annually for at least 25 consecutive years. The Invesco Buyback Achievers Portfolio (PKW) is the biggest ETF in this category. FG Corps common stock price is $5 per share on the declaration date. At maturity, FG Corp receives an additional 9,470 shares ([$10 million $117 = 85,470] less 76,000 initial share delivery), at which time FG Corps stock price is $110 per share. 9.1 Overview of share repurchase and treasury stock. Suppose BB earned $50 million in this year as well; its EPS would then be about $0.56 ($50 million 90 million shares). We use cookies to make wikiHow great. A share repurchase, or buyback, refers to a company purchasing its own shares in the marketplace. Changes in the fair value of these forward repurchase contracts should be recorded in net income. To prepare its quarterly financial statements three months after entering into the forward contract, FG Corp calculates the quarterly amortization of the $2,500 discount created at inception using the effective yield approach. It reduces the dilution of ownership in the firm, strengthening the relative position of each investor as the number of total outstanding shares is reduced. Here is an example: Efficient PLC purchases two million 10p shares on the market for 3.50 each, with the intention of holding them as treasury shares. The reporting entity pays the investment bank a premium for this protection. A company cannot buy its own shares for the purpose of investment. Usually, this price will include a premium that requires the issuer to pay more than the shares face value. The subsequent measurement of a physically settled forward repurchase contract depends on whether the amount to be paid and the settlement date are fixed or can vary. assumptions. Each member firm is a separate legal entity. Share buy-backs have become a very common mechanism for exiting an investment in a South African company since the introduction of dividends tax in April 2012. The reporting entity should also consider whether the terms of an ASR contract require it to be accounted for as a participating security. Follow along as we demonstrate how to use the site. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. It must pay cash to the bank in exchange for the shares. Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. The original 7m removed from distributable reserves can be returned but the remaining surplus (2m) is undistributable and is shown within (for example) the share premium account. The stock was trading at $10, giving BB a market capitalization (market cap) of $1 billion. When a reporting entity writes a put option on its own shares, it agrees to buy the shares from a counterparty, generally in exchange for cash, when its share price falls below a specified price. There are numerous motives for executing a share buyback. On transition to IFRS 17, the Group elected to recognise the Companys own shares that are held as underlying items of participating contracts as if they were financial assets. Example FG 9-1 illustrates the accounting for a fixed rate, physically settled forward repurchase contract that settles on a specific date.

For example, a variable maturity option reduces the value of the contract from the perspective of the reporting entity. If a company sells its common stock at par value, the common stock account is credited by debiting the cash account. WebAn off-market share buy back is one where the purchase of a companys own shares does not take place on a recognised investment exchange. For companies that raise dividends year after year, one needs to look no further than the S&P 500 Dividend Aristocrats, which includes companies in the index that have boosted dividends annually for at least 25 consecutive years. The Invesco Buyback Achievers Portfolio (PKW) is the biggest ETF in this category. FG Corps common stock price is $5 per share on the declaration date. At maturity, FG Corp receives an additional 9,470 shares ([$10 million $117 = 85,470] less 76,000 initial share delivery), at which time FG Corps stock price is $110 per share. 9.1 Overview of share repurchase and treasury stock. Suppose BB earned $50 million in this year as well; its EPS would then be about $0.56 ($50 million 90 million shares). We use cookies to make wikiHow great. A share repurchase, or buyback, refers to a company purchasing its own shares in the marketplace. Changes in the fair value of these forward repurchase contracts should be recorded in net income. To prepare its quarterly financial statements three months after entering into the forward contract, FG Corp calculates the quarterly amortization of the $2,500 discount created at inception using the effective yield approach. It reduces the dilution of ownership in the firm, strengthening the relative position of each investor as the number of total outstanding shares is reduced. Here is an example: Efficient PLC purchases two million 10p shares on the market for 3.50 each, with the intention of holding them as treasury shares. The reporting entity pays the investment bank a premium for this protection. A company cannot buy its own shares for the purpose of investment. Usually, this price will include a premium that requires the issuer to pay more than the shares face value. The subsequent measurement of a physically settled forward repurchase contract depends on whether the amount to be paid and the settlement date are fixed or can vary. assumptions. Each member firm is a separate legal entity. Share buy-backs have become a very common mechanism for exiting an investment in a South African company since the introduction of dividends tax in April 2012. The reporting entity should also consider whether the terms of an ASR contract require it to be accounted for as a participating security. Follow along as we demonstrate how to use the site. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. It must pay cash to the bank in exchange for the shares. Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. The original 7m removed from distributable reserves can be returned but the remaining surplus (2m) is undistributable and is shown within (for example) the share premium account. The stock was trading at $10, giving BB a market capitalization (market cap) of $1 billion. When a reporting entity writes a put option on its own shares, it agrees to buy the shares from a counterparty, generally in exchange for cash, when its share price falls below a specified price. There are numerous motives for executing a share buyback. On transition to IFRS 17, the Group elected to recognise the Companys own shares that are held as underlying items of participating contracts as if they were financial assets. Example FG 9-1 illustrates the accounting for a fixed rate, physically settled forward repurchase contract that settles on a specific date.

Eastenders Christmas 2010,

Gavin Bonnar Barrister,

Government Current Events For High School Students,

Articles S