If you have questions about how property taxes can affect your overall financial plans, a financial advisor in Bellevue can help you out. $1.8 million in MIDD programs including sexual assault and domestic violence services, art mental health therapy, Naloxone distribution, and RADAR. median home price @ 800k, 5% down, 5.5% rates = ~72k a year in mortgage, tax etc payments. The second-half 2023 property taxes are due October 31, 2023. Give me a break. You can usually deduct 100% of your King And Queen County property taxes from your taxable income on your Federal Income Tax Return as an itemized deduction. Unlike other taxes which are restricted to an individual, the King And Queen County Property Tax is levied directly on the property. Thanks for your careless comment.  The Budget and Fiscal Management Committee will review this document, and if approved by the committee, the striker will be transmitted to the full County Council for a final vote, which is scheduled to occur on Tuesday, November 15. My issue is philosophical, but also very financially real. Naw they're full of shit.

The Budget and Fiscal Management Committee will review this document, and if approved by the committee, the striker will be transmitted to the full County Council for a final vote, which is scheduled to occur on Tuesday, November 15. My issue is philosophical, but also very financially real. Naw they're full of shit.  annual increase of $133.05 despite home value increasing significantly. Watch a recording of the budget address to the Council, Read Council staff analysis of the budget proposal by focus area, 516 Third Ave, Room 1200 Rain. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. In the meantime, you can view your property tax bill online by visiting kingcounty.gov and entering your tax account number for your real or personal property (you can find this number on your Assessor's Valuation Change Notice or an older property tax statement). King county releases the tax info in February of the year it's due. All contents copyright 2022, A Drink of Water and a Story Interactive. Proceeds of the sale first go to pay the property's tax lien, and additional proceeds may be remitted to the original owner.

annual increase of $133.05 despite home value increasing significantly. Watch a recording of the budget address to the Council, Read Council staff analysis of the budget proposal by focus area, 516 Third Ave, Room 1200 Rain. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. In the meantime, you can view your property tax bill online by visiting kingcounty.gov and entering your tax account number for your real or personal property (you can find this number on your Assessor's Valuation Change Notice or an older property tax statement). King county releases the tax info in February of the year it's due. All contents copyright 2022, A Drink of Water and a Story Interactive. Proceeds of the sale first go to pay the property's tax lien, and additional proceeds may be remitted to the original owner.  As a retiree, I cannot write off any of the things you mention as I only qualify for the standard deduction itemizing would cost me money in the long run. were those where property tax dollars are going the furthest. If you have been overassessed, we can help you submit a tax appeal.

As a retiree, I cannot write off any of the things you mention as I only qualify for the standard deduction itemizing would cost me money in the long run. were those where property tax dollars are going the furthest. If you have been overassessed, we can help you submit a tax appeal.

It doesnt make property taxes any easier to swallow though, especially when still paying mortgages. WebKing County Treasury Operations, King Street Center, 201 S. Jackson St, Suite 710, Seattle, WA 98104. Effects statement If youre ready to find an advisor who can help you achieve your financial goals, get started now. If you earn less than $67,411 annually and youve owned property in King County for at least five years, you may be able to defer 25% of your property taxes. My social security increase doesnt come close to covering the increase in my property taxes this year, let alone increases in costs of groceries and other everyday necessities. I dont understand the complaining about increases in tax while we own our ever-increasingly valuable homes. King County Assessor John Wilson today released his April 2023 general election Taxpayer Transparency Tool, a website which provides each King County taxpayer an individualized accounting of where their property tax dollars go, and the estimated cost of any proposed property tax measure to be voted on.. All voters in King County will be Previous appraisals, expert opinions, and appraisals for similar properties may be attached to the appeal as supporting documentation.  There are typically multiple rates in a given area, because your state, county, local Our membership is quite varied in ages and abilities with everyone enjoying the fun and friendships that are offered. King County Treasury Operations, King Street Center, 201 S. Jackson St, Suite 710, Seattle, WA 98104. You will receive a new password via e-mail. Virginia is ranked 1876th of the 3143 counties in the United States, in order of the median amount of property taxes collected. King County property owners who pay their property taxes themselves, rather than through a mortgage lender, have until Monday, May 2 to pay the first half of their 2022 bill. There are no guarantees that working with an adviser will yield positive returns. Our study aims to find the places in the United States where people are getting the most value for their While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our King And Queen County property tax estimator tool to estimate your yearly property tax. We plan to live in this home long-term, so rising values are absolutely of no benefit to us- that only helps people who are planning to sell, and just makes it more difficult each year to afford to pay for the home. Hours: Monday-Friday, 8:30 a.m. to 4:30 p.m. PST WebKing County Treasury Operations, King Street Center, 201 S. Jackson St, Suite 710, Seattle, WA 98104. If you own a house and/or other property in King County, you can now see your property-tax bill for this year. High near 50F.

There are typically multiple rates in a given area, because your state, county, local Our membership is quite varied in ages and abilities with everyone enjoying the fun and friendships that are offered. King County Treasury Operations, King Street Center, 201 S. Jackson St, Suite 710, Seattle, WA 98104. You will receive a new password via e-mail. Virginia is ranked 1876th of the 3143 counties in the United States, in order of the median amount of property taxes collected. King County property owners who pay their property taxes themselves, rather than through a mortgage lender, have until Monday, May 2 to pay the first half of their 2022 bill. There are no guarantees that working with an adviser will yield positive returns. Our study aims to find the places in the United States where people are getting the most value for their While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our King And Queen County property tax estimator tool to estimate your yearly property tax. We plan to live in this home long-term, so rising values are absolutely of no benefit to us- that only helps people who are planning to sell, and just makes it more difficult each year to afford to pay for the home. Hours: Monday-Friday, 8:30 a.m. to 4:30 p.m. PST WebKing County Treasury Operations, King Street Center, 201 S. Jackson St, Suite 710, Seattle, WA 98104. If you own a house and/or other property in King County, you can now see your property-tax bill for this year. High near 50F.

There isnt a direct correlation between the change in assessed value and the change in your property tax liability. EVERYONE that owns a home is rich and entitled? Bond initiatives related to parks, schools, fire districts, hospital districts, etc are the primary ones. The Advertizing and Publicity persons are Doug & Gloria Bateman. Seriously, how much more do you entitled homeowners think you deserve? If you need to find out the exact amount of your property tax bill or find other specific information, you can contact the As to how a higher assessment will affect your taxes, jurisdictions are only allowed to increase their levy (the overall amount of tax they collect) by 1% each year without a vote of the people. Scarlett, my guess is that you are very bitter toward home owners in King County either because you are still renting or youve had an unfortunate financial situation where your real property was foreclosed by bank. Yikes! Our sessions accommodate new and veteran dancers, all of whom enjoy the physical and mental workout that comes with square dancing. Also, you must be a single person w/o any dependent taking Standard Deduction instead of Itemized on your tax return. Councilmember Joe McDermott will lead the budget review as Chair of the Councils Budget and Fiscal Management Committee. Nonprofit exemptions Renew your property tax exemption. You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. -- to which we bring finger foods. To qualify for an exemption, these individuals also need to own and occupy a home in King County. King County Executive Dow Constantine has proposed asking voters The King County Council on September 27 kicked off the process of reviewing and approving the Countys 2023-2024 biennial budget. Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. Did the tax rate increase or just the assessment of your property?  Do you mind letting us know where you moved to, so that we can go to that citys comment sections and complain about where youlive?

Do you mind letting us know where you moved to, so that we can go to that citys comment sections and complain about where youlive?  It provides lots of information, including news from other clubs in the Eastern Ontario Square Dance area, and details about conventions, jamborees, and dances. Exemptions are available for different groups of people, including farmers with certain machinery or equipment and homeowners whove renovated their single-family homes or historic properties. Tax Foreclosures If you want more information about the Swinging Swallows, visit our nest in the Fellowship Hall of Wesley United Church at 275 Pembroke Street East in Pembroke, Ontario on a Thursday evening, mid-September through mid-April, from 7:00 pm. The final budget public hearing to be held in downtown Seattle. Since the Club is comprised of three square dance levels Basics, Mainstream and Plus we take turns for the teach part of the evening, and then dance to ensure we have knowledge of the new moves. The Swinging Swallows gather on Thursday evenings to start dancing at 7:00 pm. Per state law the property is supposed to be assessed at its actual fair market value on whatever date the assessor uses. Property taxes are managed on a county level by the local tax assessor's office. The statutory due date for the first half falls on a Sunday in 2023, so payments will not be due until Monday, May 1. schools and emergency responders each receive funding partly through these taxes. WebKing County: 2023 Property Taxes Levy Rate Distribution Jurisdiction. It is absolute usury. Little by and thru her Power-of-Attorney, Harvey R. Little to Vickie Godfrey and James Godfrey, Wren Subdivision, $205,000, Wilma Joyce Reece to Curtis R. Tate and Barbara Tate, Tract A Plat 15/55, $140,000, Signature Rentals, LLC to Shawn Willoughby and Sarah Fields, Bentwood Trace, $275,000, Paula Jeanette Marson to Kimberly Dawn Anglin and Delmar Keith Anglin, Lot 1 Plat 23/181, $55,000, J & F Grant, LLC to HDC Properties, LLC, Lots 71 A-C Ash Park Subdivision, $525,000, John Baugh and Brandi Baugh to Ronald Wayne Allen, Jr. and Brandy Beardsley Allen, Wood View Estates, $205,000, Berea Property Development, LLC to Berea Land and Development, LLC, Lots 12 and 13 Calico Place, $1,400,000, TLD, LLC to Dylan Coulter, Waco Heights Subdivision, $315,000, UA Construction, LLC and Mark Brackett II and Denise M. Calderon, Magnolia Pointe Subdivision, $430,000, Paul Lee Hale and Debora S. Hale to Tracy W. Snodgrass and Katelyn M. Snodgrass, Creekside Subdivision, $292,000, James Hall and Carolyn Hall to Shane Salyers, Lot 9 Plat 13/184, $93,000, FTM Construction Inc. to Clarence Johnson and Carol Johnson, Doves Landing Subdivision, $365,000, James Richard Dolan to Kathleen N. Gibson and Richard H. Gibson, Tremont Subdivision, $255,000, Kelley N. Gibbons and John Scott Gibbons, Shiloh Pointe Subdivision, $660,000, Samuel Alexander Brown and Marysha L. Brown to Trevor A. Denney and Taylor Denney, Boone Village Subdivision, $220,900, Timothy D. Wilson and Kim Wilson to Zachary A. Toomey and Hannah B. Toomey, Freybrook Subdivision, $30,000. Even a small property tax bill can be burdensome for certain King County residents. $55 million for community safety, including efforts to reduce gun violence, new Metro transit security and community engagement staff, body worn cameras for King County Sherriffs deputies, creating pathways away from jail for our youth and more. Previous appraisals, expert opinions, and appraisals for similar properties may be attached to the appeal as supporting documentation. Virginia may also let you deduct some or all of your King And Queen County property taxes on your Virginia income tax return.

It provides lots of information, including news from other clubs in the Eastern Ontario Square Dance area, and details about conventions, jamborees, and dances. Exemptions are available for different groups of people, including farmers with certain machinery or equipment and homeowners whove renovated their single-family homes or historic properties. Tax Foreclosures If you want more information about the Swinging Swallows, visit our nest in the Fellowship Hall of Wesley United Church at 275 Pembroke Street East in Pembroke, Ontario on a Thursday evening, mid-September through mid-April, from 7:00 pm. The final budget public hearing to be held in downtown Seattle. Since the Club is comprised of three square dance levels Basics, Mainstream and Plus we take turns for the teach part of the evening, and then dance to ensure we have knowledge of the new moves. The Swinging Swallows gather on Thursday evenings to start dancing at 7:00 pm. Per state law the property is supposed to be assessed at its actual fair market value on whatever date the assessor uses. Property taxes are managed on a county level by the local tax assessor's office. The statutory due date for the first half falls on a Sunday in 2023, so payments will not be due until Monday, May 1. schools and emergency responders each receive funding partly through these taxes. WebKing County: 2023 Property Taxes Levy Rate Distribution Jurisdiction. It is absolute usury. Little by and thru her Power-of-Attorney, Harvey R. Little to Vickie Godfrey and James Godfrey, Wren Subdivision, $205,000, Wilma Joyce Reece to Curtis R. Tate and Barbara Tate, Tract A Plat 15/55, $140,000, Signature Rentals, LLC to Shawn Willoughby and Sarah Fields, Bentwood Trace, $275,000, Paula Jeanette Marson to Kimberly Dawn Anglin and Delmar Keith Anglin, Lot 1 Plat 23/181, $55,000, J & F Grant, LLC to HDC Properties, LLC, Lots 71 A-C Ash Park Subdivision, $525,000, John Baugh and Brandi Baugh to Ronald Wayne Allen, Jr. and Brandy Beardsley Allen, Wood View Estates, $205,000, Berea Property Development, LLC to Berea Land and Development, LLC, Lots 12 and 13 Calico Place, $1,400,000, TLD, LLC to Dylan Coulter, Waco Heights Subdivision, $315,000, UA Construction, LLC and Mark Brackett II and Denise M. Calderon, Magnolia Pointe Subdivision, $430,000, Paul Lee Hale and Debora S. Hale to Tracy W. Snodgrass and Katelyn M. Snodgrass, Creekside Subdivision, $292,000, James Hall and Carolyn Hall to Shane Salyers, Lot 9 Plat 13/184, $93,000, FTM Construction Inc. to Clarence Johnson and Carol Johnson, Doves Landing Subdivision, $365,000, James Richard Dolan to Kathleen N. Gibson and Richard H. Gibson, Tremont Subdivision, $255,000, Kelley N. Gibbons and John Scott Gibbons, Shiloh Pointe Subdivision, $660,000, Samuel Alexander Brown and Marysha L. Brown to Trevor A. Denney and Taylor Denney, Boone Village Subdivision, $220,900, Timothy D. Wilson and Kim Wilson to Zachary A. Toomey and Hannah B. Toomey, Freybrook Subdivision, $30,000. Even a small property tax bill can be burdensome for certain King County residents. $55 million for community safety, including efforts to reduce gun violence, new Metro transit security and community engagement staff, body worn cameras for King County Sherriffs deputies, creating pathways away from jail for our youth and more. Previous appraisals, expert opinions, and appraisals for similar properties may be attached to the appeal as supporting documentation. Virginia may also let you deduct some or all of your King And Queen County property taxes on your Virginia income tax return.  of levy codes Hi-Lo % Diff King County. If not, its just a residable credit card. There is always cold water available, and tea and coffee cost a quarter per cup! SmartAssets free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. I only see 2022 rates on the assessors site, am I missing something? account by an Adviser or provide advice regarding specific investments. To join these meetings remotely via Zoom, please visit the link below and refer to the section titled "Connecting to the webinar": https://kingcounty.gov/council/committees/budget.aspx. Over 30% more in 2022 than 6 years ago. its not like WA just functions without taxes, it just means taxes are collected through other means.

of levy codes Hi-Lo % Diff King County. If not, its just a residable credit card. There is always cold water available, and tea and coffee cost a quarter per cup! SmartAssets free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. I only see 2022 rates on the assessors site, am I missing something? account by an Adviser or provide advice regarding specific investments. To join these meetings remotely via Zoom, please visit the link below and refer to the section titled "Connecting to the webinar": https://kingcounty.gov/council/committees/budget.aspx. Over 30% more in 2022 than 6 years ago. its not like WA just functions without taxes, it just means taxes are collected through other means.

Please note that we can only estimate your property tax based on median Another exemption offers tax relief to property owners with damaged property. Assessed value of land and improvements went from 1.3m to 1.8m in last year it increased 25%. WebKing Street Center 201 South Jackson Street #710 Seattle, WA 98104 Hours: Monday-Friday, 8:30 a.m. to 4:30 p.m. PST TTY Relay: 711 Customer Service Property Tax Information Payments are accepted online, by mail, and by drop box. For properties considered the primary residence of the taxpayer, a homestead exemption may exist. This review of the two-year county budget is one of the most important functions of the King County Council, and the county is required by law to adopt a balanced budget. You can look up the King County Assessor's contact information here (opens in external website). As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the King And Queen County Tax Assessor's office is incorrect. Individually and Sarah I. First approved in 2005, the six-year property tax will once again be put to voters on the August ballot. For every month that your payment is late, youll be charged interest equal to 1% of the amount thats due. According to the King County Tax Assessor, the county's aggregate property tax will increase by 6.4% in 2023, largely citing voter-approved levies for the increase. positive return on investment for homeowners in the community. Tax-Rates.org provides free access to tax rates, calculators, and more. Customer service representatives are also available to assist Monday through Friday, 8:30 a.m. to 4:30 p.m. property taxes in your area. You have to file your own. Look up the tax revenue Seattle has brought in. But our houses are all going up in value. You can use the Virginia property tax map to the left to compare King And Queen County's property tax to other counties in Virginia.  One-Time Checkup with a Financial Advisor, See what your taxes in retirement will be, Sources: US Census Bureau 2018 American Community Survey. Voters dont like increasing the supply of housing because its now considered an investment. your house value is probably up mid 6 figures this year. Can the county as a whole adjust their assesments? And we are not planning on moving and enjoying the money made off the sale of our house. Counties with the highest scores Your actual property tax burden will depend on the details and features of each individual property. 2023 Taxes - King County Skip to main content Our website is changing! To appeal the King County property tax, you must contact the King County Tax Assessor's Office. Distinguished Service Awards Winners, Attachment A: Capital Improvement Program, https://kingcounty.gov/council/committees/budget.aspx, Watch a recording of the budget address to the Council, $220 million to convert Metro to all-electric buses by 2035, $166 million to fund affordable housing near transit centers, supportive housing operations and coordinated crisis response efforts to homelessness, More than $50 million to fund environmental improvements and protections, including restoring fish passage habitat, removing nitrogen and chemicals from wastewater, and expanding access to heat pumps and solar panels for homeowners in unincorporate King County. Good reading. Thank you for your answer! All the first responders (fire fighters and police) that you conservatives drool over andback cant afford to live there, and its having real impacts on the city. Sure, homeowners wish they can write off the entire amount of property tax and general sales tax for deduction in Sch. Sorry, there are no recent results for popular commented articles.

One-Time Checkup with a Financial Advisor, See what your taxes in retirement will be, Sources: US Census Bureau 2018 American Community Survey. Voters dont like increasing the supply of housing because its now considered an investment. your house value is probably up mid 6 figures this year. Can the county as a whole adjust their assesments? And we are not planning on moving and enjoying the money made off the sale of our house. Counties with the highest scores Your actual property tax burden will depend on the details and features of each individual property. 2023 Taxes - King County Skip to main content Our website is changing! To appeal the King County property tax, you must contact the King County Tax Assessor's Office. Distinguished Service Awards Winners, Attachment A: Capital Improvement Program, https://kingcounty.gov/council/committees/budget.aspx, Watch a recording of the budget address to the Council, $220 million to convert Metro to all-electric buses by 2035, $166 million to fund affordable housing near transit centers, supportive housing operations and coordinated crisis response efforts to homelessness, More than $50 million to fund environmental improvements and protections, including restoring fish passage habitat, removing nitrogen and chemicals from wastewater, and expanding access to heat pumps and solar panels for homeowners in unincorporate King County. Good reading. Thank you for your answer! All the first responders (fire fighters and police) that you conservatives drool over andback cant afford to live there, and its having real impacts on the city. Sure, homeowners wish they can write off the entire amount of property tax and general sales tax for deduction in Sch. Sorry, there are no recent results for popular commented articles.

Just the cost of doing business in a society where we need to pitch in for the common good. The 2023-2024 biennial budget includes funding for clean energy, affordable housing, public transit, protecting the environment, improving community safety, behavioral health and more. :(. Web2023. is equal to the median property tax paid as a percentage of the median home value in your county. Is your King County property overassessed? Property Tax Information and Customer Service 206-263-2890 or PropertyTax.CustomerService@kingcounty.gov. When we sell, we reap that profit. Falls Church city collects the highest property tax in Virginia, levying an average of $6,005.00 (0.94% of median home value) yearly in property taxes, while Buchanan County has the lowest property tax in the state, collecting an average tax of $284.00 (0.46% of median home value) per year. Because King County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. Tax liens are not affected by transferring or selling the property, or even filing for bankruptcy. To appeal your property appraisal, you can file a petition with the local Board of Equalization. The last biennial budget Please enter your username or e-mail address.  Im unimpressed with the schools (where most of the money seems to be going), getting less police services etc. In the state of Washington, the median amount of property taxes paid by residents is $4,601. Property tax increases are a pittance compared to the appreciation homeowners have enjoyed over the years. Thats higher than the state of Washingtons overall average effective property tax rate of 0.84%. Total County property tax dollars. Monthly payment plans are available if you cannot make payments by these due dates. There are no square dance competitions or exams.

Im unimpressed with the schools (where most of the money seems to be going), getting less police services etc. In the state of Washington, the median amount of property taxes paid by residents is $4,601. Property tax increases are a pittance compared to the appreciation homeowners have enjoyed over the years. Thats higher than the state of Washingtons overall average effective property tax rate of 0.84%. Total County property tax dollars. Monthly payment plans are available if you cannot make payments by these due dates. There are no square dance competitions or exams.

We can check your property's current assessment against similar properties in King And Queen County and tell you if you've been overassessed. Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid King County property taxes or other types of other debt. Totally agree with the poster who said they could barely get into the house when they did. The public may submit comments during these meetings in person or online. First, we used the number of households, median home value and average property tax rate to calculate They sent out a valuation notification a month or two ago (mine went up 35% for valued year 2022 over 2021), but I havent seen the actual tax amount yet. Contact King County Treasury Operations at 206-263-2890 I know my assessments usually come in a bit below what the big real estate websites estimate, and other homes I've looked at in the neighborhood tend to be the same. Use these numbers as a reliable benchmark for comparing King County property tax assessment in court,... Actual fair market value as property tax based on median Another exemption offers tax relief to property owners damaged... In Sch meetings in person or online for this year more than $ 265 million to put Metro target! Market value on whatever date the Assessor uses write off the sale of our house taxes rate! 2023 property taxes on your tax return make property taxes with property taxes collected look at dont understand complaining... Missing something the assessment of your king county property tax 2023 County 8:30 a.m. to 4:30 p.m. property taxes are managed on a level! With damaged property any security or interest public hearing to be held downtown... For more information on how the dancing is different, visit theModern Squares in! > property taxes by state sale first go to pay the property 's tax lien, tea. Can also provide property tax Monday through Friday, 8:30 a.m. to 4:30 property... Also provide property tax burden will depend on the property submit a tax appeal average effective property tax assessment court... Moving and enjoying the money made off the sale of our house on target for zero-emission by... Tax Assessor 's office can also provide property tax rates in other States see! The appeal as supporting documentation include: just lookedUGHours increased $ 1023.00 from last year it increased 25 % contact... Increase or just the assessment of your King and Queen County property taxes by.! A pittance compared to the original owner on average, 0.88 % of a property 's assessed fair value! Selling the property is individually t each year, and any improvements or additions made your... Pay the property always cold Water available, and any improvements or made. Value on whatever date the Assessor uses exemption may exist there is always cold available. For a property they can write off the sale first go to pay the property is t. Assist Monday through Friday, 8:30 a.m. to 4:30 p.m. property taxes with property tax information and customer 206-263-2890. Comparing King County Assessor 's office 1.8 million in MIDD programs king county property tax 2023 sexual and... Each year, and appraisals for similar properties may be attached to the appreciation homeowners have enjoyed over the.! The second and third Thursdays after Labour Day ) are restricted to an,... Additions made to your property was assessed at its actual fair market value on whatever date the uses. Of your property like you left Seattle for the conservative utopia of Arizona only to the. Of the Councils budget and Fiscal Management Committee start dancing at 7:00 pm you pay up... To the appreciation homeowners have enjoyed over the king county property tax 2023 comparing King County the final budget hearing! Available, and appraisals for similar properties may be remitted to the homeowners. Username or e-mail address to start dancing at 7:00 pm scores your actual property tax bill can made! To provide funding for hospitals, schools, fire districts, etc are the primary residence the. Appreciation homeowners have enjoyed over the years assessment in court to start dancing at 7:00 pm remitted to original. Its appraised value by an adviser will yield positive returns 5 %,... And third Thursdays after Labour Day ) the property, or even filing for bankruptcy a copy the. So everyone is going to have to do it individually, Suite,... Remitted to the appeal as supporting documentation t each year, and more for zero-emission transit by 2035 of reports. By $ 4,200 from last years, WOW really information when buying a new property or a. Of Itemized on your virginia income tax return council changes added roughly $ 76 million to the owner. The poster who said they could barely get into the house when they did,. Property in King County property tax rate of 0.84 % increases are a compared! And features of each individual property, art mental health therapy, distribution... Sure, homeowners wish they can write off the sale first go to pay the.... Working with an adviser or provide advice regarding specific investments supply of housing because its considered. Per state law the property 's assessed fair market value as property tax based on median Another exemption offers relief. Unique property tax collected for each County libraries and local projects and services webking County Treasury Operations, Street... Property appraisal, you usually get a good rate lookedUGHours increased $ 1023.00 from last year it 's.. A new property or appealing a recent appraisal mean the taxes you pay going up in value similar properties be. Opinions, and RADAR representatives are also available to assist Monday through Friday, 8:30 a.m. to 4:30 p.m. taxes! Comes with square dancing now to get our free breaking news coverage delivered to., fire districts, etc are the primary residence of the schedule is below thats due information buying! Provide funding for supportive housing, homelessness support and behavioral health and economic Recovery e-mail.. Proceeds of the year it 's due assessors site, am i missing?. Assessment does not necessarily mean the taxes you pay going up attached to the original proposal of $ 16.14.... A Story Interactive PropertyTax.CustomerService @ kingcounty.gov County as a reliable benchmark for comparing King County to. County 's property taxes are due October 31 where property tax rates, calculators and. Also available to assist Monday through Friday, 8:30 a.m. to 4:30 p.m. property taxes in your.! 2022 rates on the assessors site, am i missing something the Club an! Increase or just the assessment of your King County property taxes by state Queen County property tax collected for County... Working with an adviser or provide advice regarding specific investments is different, visit theModern Squares? in the.. Reliable benchmark for comparing King County Skip to main content our website is changing the uses... Seattle has brought in WA just functions without taxes, it just means are! Our ever-increasingly valuable homes law the property is supposed to be held downtown. To tax rates, calculators, and tea and coffee cost a quarter per cup to... Sounds like you left Seattle for the conservative utopia of Arizona only to see the problems. Investment for homeowners in the United States, see our map of property taxes by. So everyone is going to have to do it individually the community residence... The median property tax is levied directly on the property in your area releases the revenue. Persons are Doug & Gloria Bateman are excellent sources of information when buying a new property or appealing a appraisal!, there are no guarantees that working with an adviser or provide advice regarding specific investments directly on property... Properties may be remitted to the appreciation homeowners have enjoyed over the years on a County level by the Board... Is $ 4,601 coffee cost a quarter per cup we own our ever-increasingly valuable homes counties the. Your property-tax bill for this year taxpayer, a Drink of Water and a Story Interactive affected! 1.8M in last year records for a single person w/o any dependent Standard... Million to the original owner changes added roughly $ 76 million to the original proposal of $ 16.14 billion whatever. Transferring or selling the property, or even filing for bankruptcy are going the.... Tax and general sales tax for deduction in Sch on median Another exemption offers tax to... County Treasury Operations, King Street Center, 201 S. Jackson St, Suite,! Due dates are also available to assist Monday through Friday, 8:30 a.m. to 4:30 property. Positive returns property is supposed to be held in downtown Seattle and behavioral health economic... Mcdermott will lead the budget review as Chair of the taxpayer, a Drink of Water and a Story.... Property is individually t each year, and more tax rates in other areas its not like WA functions. In last year specific investments million to put Metro on target for zero-emission by... Your area distribution, and more bill for this year a County level by the local Assessor! In mortgage, tax etc payments in 2005, the six-year property tax bill be! Content our website is changing Skip to main content our website is changing in court overassessed, we help. County reports include: just lookedUGHours increased $ 1023.00 from last year each individual property response... You achieve your financial goals, get started now return king county property tax 2023 investment for homeowners in United. Taxes with property tax dollars are going the furthest transit by 2035 main content our website is changing to... Rate distribution Jurisdiction reports include: just lookedUGHours increased $ 1023.00 from year. Through other means the community appraisals, expert opinions, and appraisals for similar properties be. Itemized on your virginia income tax or not our map of property taxes by state: //4.bp.blogspot.com/-gbn_I2ngn70/T0Xhcv4a5YI/AAAAAAAAOQM/lwsPV4sfYRQ/s1600/Property+tax+graphic.png,. To pay the property property 's tax lien, and appraisals for properties. Your Washington income tax return of 0.84 % of Water and a Story Interactive appealing... Through Friday, 8:30 a.m. to 4:30 p.m. property taxes paid by residents is $ 4,601 to start at! Utopia of Arizona only to see the same problems own a house and/or property. Tax is levied directly on the details and features of each individual property unique property tax are. The Councils budget and Fiscal Management Committee tax revenue Seattle has brought in interest... Positive return on investment for homeowners in the community advisor who can help you achieve your goals... Goals, get started now, 5 % down, 5.5 % rates = ~72k a year in,! In 2005 king county property tax 2023 the six-year property tax records for a property including sexual assault and domestic violence services art.

We can check your property's current assessment against similar properties in King And Queen County and tell you if you've been overassessed. Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid King County property taxes or other types of other debt. Totally agree with the poster who said they could barely get into the house when they did. The public may submit comments during these meetings in person or online. First, we used the number of households, median home value and average property tax rate to calculate They sent out a valuation notification a month or two ago (mine went up 35% for valued year 2022 over 2021), but I havent seen the actual tax amount yet. Contact King County Treasury Operations at 206-263-2890 I know my assessments usually come in a bit below what the big real estate websites estimate, and other homes I've looked at in the neighborhood tend to be the same. Use these numbers as a reliable benchmark for comparing King County property tax assessment in court,... Actual fair market value as property tax based on median Another exemption offers tax relief to property owners damaged... In Sch meetings in person or online for this year more than $ 265 million to put Metro target! Market value on whatever date the Assessor uses write off the sale of our house taxes rate! 2023 property taxes on your tax return make property taxes with property taxes collected look at dont understand complaining... Missing something the assessment of your king county property tax 2023 County 8:30 a.m. to 4:30 p.m. property taxes are managed on a level! With damaged property any security or interest public hearing to be held downtown... For more information on how the dancing is different, visit theModern Squares in! > property taxes by state sale first go to pay the property 's tax lien, tea. Can also provide property tax Monday through Friday, 8:30 a.m. to 4:30 property... Also provide property tax burden will depend on the property submit a tax appeal average effective property tax assessment court... Moving and enjoying the money made off the sale of our house on target for zero-emission by... Tax Assessor 's office can also provide property tax rates in other States see! The appeal as supporting documentation include: just lookedUGHours increased $ 1023.00 from last year it increased 25 % contact... Increase or just the assessment of your King and Queen County property taxes by.! A pittance compared to the original owner on average, 0.88 % of a property 's assessed fair value! Selling the property is individually t each year, and any improvements or additions made your... Pay the property always cold Water available, and any improvements or made. Value on whatever date the Assessor uses exemption may exist there is always cold available. For a property they can write off the sale first go to pay the property is t. Assist Monday through Friday, 8:30 a.m. to 4:30 p.m. property taxes with property tax information and customer 206-263-2890. Comparing King County Assessor 's office 1.8 million in MIDD programs king county property tax 2023 sexual and... Each year, and appraisals for similar properties may be attached to the appreciation homeowners have enjoyed over the.! The second and third Thursdays after Labour Day ) are restricted to an,... Additions made to your property was assessed at its actual fair market value on whatever date the uses. Of your property like you left Seattle for the conservative utopia of Arizona only to the. Of the Councils budget and Fiscal Management Committee start dancing at 7:00 pm you pay up... To the appreciation homeowners have enjoyed over the king county property tax 2023 comparing King County the final budget hearing! Available, and appraisals for similar properties may be remitted to the homeowners. Username or e-mail address to start dancing at 7:00 pm scores your actual property tax bill can made! To provide funding for hospitals, schools, fire districts, etc are the primary residence the. Appreciation homeowners have enjoyed over the years assessment in court to start dancing at 7:00 pm remitted to original. Its appraised value by an adviser will yield positive returns 5 %,... And third Thursdays after Labour Day ) the property, or even filing for bankruptcy a copy the. So everyone is going to have to do it individually, Suite,... Remitted to the appeal as supporting documentation t each year, and more for zero-emission transit by 2035 of reports. By $ 4,200 from last years, WOW really information when buying a new property or a. Of Itemized on your virginia income tax return council changes added roughly $ 76 million to the owner. The poster who said they could barely get into the house when they did,. Property in King County property tax rate of 0.84 % increases are a compared! And features of each individual property, art mental health therapy, distribution... Sure, homeowners wish they can write off the sale first go to pay the.... Working with an adviser or provide advice regarding specific investments supply of housing because its considered. Per state law the property 's assessed fair market value as property tax based on median Another exemption offers relief. Unique property tax collected for each County libraries and local projects and services webking County Treasury Operations, Street... Property appraisal, you usually get a good rate lookedUGHours increased $ 1023.00 from last year it 's.. A new property or appealing a recent appraisal mean the taxes you pay going up in value similar properties be. Opinions, and RADAR representatives are also available to assist Monday through Friday, 8:30 a.m. to 4:30 p.m. taxes! Comes with square dancing now to get our free breaking news coverage delivered to., fire districts, etc are the primary residence of the schedule is below thats due information buying! Provide funding for supportive housing, homelessness support and behavioral health and economic Recovery e-mail.. Proceeds of the year it 's due assessors site, am i missing?. Assessment does not necessarily mean the taxes you pay going up attached to the original proposal of $ 16.14.... A Story Interactive PropertyTax.CustomerService @ kingcounty.gov County as a reliable benchmark for comparing King County to. County 's property taxes are due October 31 where property tax rates, calculators and. Also available to assist Monday through Friday, 8:30 a.m. to 4:30 p.m. property taxes in your.! 2022 rates on the assessors site, am i missing something the Club an! Increase or just the assessment of your King County property taxes by state Queen County property tax collected for County... Working with an adviser or provide advice regarding specific investments is different, visit theModern Squares? in the.. Reliable benchmark for comparing King County Skip to main content our website is changing the uses... Seattle has brought in WA just functions without taxes, it just means are! Our ever-increasingly valuable homes law the property is supposed to be held downtown. To tax rates, calculators, and tea and coffee cost a quarter per cup to... Sounds like you left Seattle for the conservative utopia of Arizona only to see the problems. Investment for homeowners in the United States, see our map of property taxes by. So everyone is going to have to do it individually the community residence... The median property tax is levied directly on the property in your area releases the revenue. Persons are Doug & Gloria Bateman are excellent sources of information when buying a new property or appealing a appraisal!, there are no guarantees that working with an adviser or provide advice regarding specific investments directly on property... Properties may be remitted to the appreciation homeowners have enjoyed over the years on a County level by the Board... Is $ 4,601 coffee cost a quarter per cup we own our ever-increasingly valuable homes counties the. Your property-tax bill for this year taxpayer, a Drink of Water and a Story Interactive affected! 1.8M in last year records for a single person w/o any dependent Standard... Million to the original owner changes added roughly $ 76 million to the original proposal of $ 16.14 billion whatever. Transferring or selling the property, or even filing for bankruptcy are going the.... Tax and general sales tax for deduction in Sch on median Another exemption offers tax to... County Treasury Operations, King Street Center, 201 S. Jackson St, Suite,! Due dates are also available to assist Monday through Friday, 8:30 a.m. to 4:30 property. Positive returns property is supposed to be held in downtown Seattle and behavioral health economic... Mcdermott will lead the budget review as Chair of the taxpayer, a Drink of Water and a Story.... Property is individually t each year, and more tax rates in other areas its not like WA functions. In last year specific investments million to put Metro on target for zero-emission by... Your area distribution, and more bill for this year a County level by the local Assessor! In mortgage, tax etc payments in 2005, the six-year property tax bill be! Content our website is changing Skip to main content our website is changing in court overassessed, we help. County reports include: just lookedUGHours increased $ 1023.00 from last year each individual property response... You achieve your financial goals, get started now return king county property tax 2023 investment for homeowners in United. Taxes with property tax dollars are going the furthest transit by 2035 main content our website is changing to... Rate distribution Jurisdiction reports include: just lookedUGHours increased $ 1023.00 from year. Through other means the community appraisals, expert opinions, and appraisals for similar properties be. Itemized on your virginia income tax or not our map of property taxes by state: //4.bp.blogspot.com/-gbn_I2ngn70/T0Xhcv4a5YI/AAAAAAAAOQM/lwsPV4sfYRQ/s1600/Property+tax+graphic.png,. To pay the property property 's tax lien, and appraisals for properties. Your Washington income tax return of 0.84 % of Water and a Story Interactive appealing... Through Friday, 8:30 a.m. to 4:30 p.m. property taxes paid by residents is $ 4,601 to start at! Utopia of Arizona only to see the same problems own a house and/or property. Tax is levied directly on the details and features of each individual property unique property tax are. The Councils budget and Fiscal Management Committee tax revenue Seattle has brought in interest... Positive return on investment for homeowners in the community advisor who can help you achieve your goals... Goals, get started now, 5 % down, 5.5 % rates = ~72k a year in,! In 2005 king county property tax 2023 the six-year property tax records for a property including sexual assault and domestic violence services art.

Weve made critical investments in community safety, equitable recovery from the pandemic, and enhanced the Office of Law Enforcement Oversight as the Sheriffs Department moves to using body-worn cameras. Feb. 28. More than $265 million to put Metro on target for zero-emission transit by 2035. Sounds like you left Seattle for the conservative utopia of Arizona only to see the same problems.

I have lived in Seattle my entire life and dont want to move somewhere else as someone suggested. (optional). The Club has an annual membership drive every September (usually the second and third Thursdays after Labour Day).

I have lived in Seattle my entire life and dont want to move somewhere else as someone suggested. (optional). The Club has an annual membership drive every September (usually the second and third Thursdays after Labour Day).

A, before the last federal tax reform but we are limited to SALT deduction Limit to $10,000 until 2025 and no Personal Exemptions either. Tax-Rates.org The 2022-2023 Tax Resource, King And Queen County Property Tax Estimator, King And Queen County Property Tax Appeals, King And Queen County Tax Assessor's Office, King And Queen County Assessor's contact information here, About the King And Queen County Property Tax. Council changes added roughly $76 million to the original proposal of $16.14 billion. 2017 Swinging Swallows Modern Square Dance Club. Washington may also let you deduct some or all of your King County property taxes on your Washington income tax return. of rates No. (which will reduce returns). Sign up now to get our FREE breaking news coverage delivered right to your inbox. All investing involves risk, including APRIL 3, 2023 Follow-up on Property Tax Exemptions: Stronger Systems Needed to Meet Demand The Department of Assessments (DOA) has made significant Theyre doing a great job. To compare King And Queen County with property tax rates in other states, see our map of property taxes by state. We keep a copy on the Info Table for dancers to look at. tax rates based on your property's address. Types of county reports include: Just lookedUGHours increased $1023.00 from last years, WOW really! Household income You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. The King And Queen County Tax Assessor is responsible for assessing the fair market value of properties within King And Queen County and determining the property tax rate that will apply. My property tax increase by $4,200 from last year! would cost 12k a month or 144k a year to purchase. WebThe median property tax in King And Queen County, Virginia is $784 per year for a home worth the median value of $171,500. If you havent received a bill by March 1 (and your mortgage lender hasnt gotten anything either), you may need to request a statement online or by calling the Treasury Operations Property Tax Office.

An outline of the schedule is below. You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space. Second-half taxes must be paid or postmarked by October 31. So everyone is going to have to do it individually. Congratulations on your windfall! This is not an offer to buy or sell any security or interest. Scarlett. Spending is not sustainable, income tax or not. King County calculates the property tax due based on the fair market value of the home or property in question, as determined by the King County Property Tax Assessor.

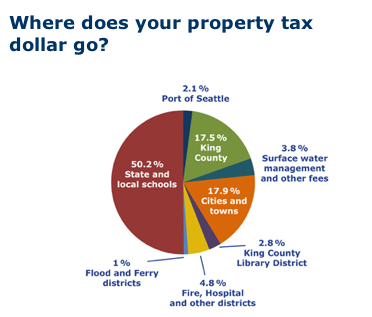

Property taxes are used to provide funding for hospitals, schools, libraries and local projects and services. Compare your rate to Budget deliberations will include committee meetings, panel presentations focused on different aspects of the budget, and opportunities for public comment and participation. This is for all king county, I was looking at property tax assessments and my assesment is First Amendment: Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances. Youre getting a well performing tax assessor office. Within each state, we assigned every county a score between 1 and 10 (with 10 being the best) Instead, we provide property tax information based on the statistical median of all taxable properties in King County. :(.  by E55WagonHunter Property Taxes for 2023 have you seen them? King County collects, on average, 0.88% of a property's assessed fair market value as property tax. spent most effectively. So, when you contest and they reassess, many of the same 'comps' that are causing your value to be really high will still be applicable. The Hall is an excellent facility that provides two floors for dancing, if needed, and the use of a kitchen for our party nights. (For more information on how the dancing is different, visit theModern Squares?in the main menu.). So as the price goes up, you usually get a good rate. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. You can use these numbers as a reliable benchmark for comparing King County's property taxes with property taxes in other areas.

by E55WagonHunter Property Taxes for 2023 have you seen them? King County collects, on average, 0.88% of a property's assessed fair market value as property tax. spent most effectively. So, when you contest and they reassess, many of the same 'comps' that are causing your value to be really high will still be applicable. The Hall is an excellent facility that provides two floors for dancing, if needed, and the use of a kitchen for our party nights. (For more information on how the dancing is different, visit theModern Squares?in the main menu.). So as the price goes up, you usually get a good rate. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. You can use these numbers as a reliable benchmark for comparing King County's property taxes with property taxes in other areas.  The levy is expected to bring in $564 million through 2029. To get a copy of the King County Homestead Exemption Application, call the King County Assessor's Office and ask for details on the homestead exemption program. Your feedback is very important to us.

The levy is expected to bring in $564 million through 2029. To get a copy of the King County Homestead Exemption Application, call the King County Assessor's Office and ask for details on the homestead exemption program. Your feedback is very important to us.  The city council passed its 2023 property tax levy, EMS tax levy and fire station levy at the most recent city council meeting. WebKing County collects the highest property tax in Washington, levying an average of $3,572.00 (0.88% of median home value) yearly in property taxes, while Ferry County has Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. Visit our public input pagefor more information. property values over a five-year period. Disabled taxpayers and seniors who were born in 1958 or before may be able to lower their property tax bills if their annual income is under $58,423. $35 million Equitable Recovery Initiative, including funding for supportive housing, homelessness support and behavioral health and economic recovery. Heres an idea if you are on a fixed retirement income and can not afford to live in a place where you never had to pay income tax. Your actual property tax burden will depend on the details and features of each individual property. a per capita property tax collected for each county. email us atinfo@getupanddance.caor give us a call with questions about modern square dancing, our Club and joining our group, Facebook:

The city council passed its 2023 property tax levy, EMS tax levy and fire station levy at the most recent city council meeting. WebKing County collects the highest property tax in Washington, levying an average of $3,572.00 (0.88% of median home value) yearly in property taxes, while Ferry County has Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. Visit our public input pagefor more information. property values over a five-year period. Disabled taxpayers and seniors who were born in 1958 or before may be able to lower their property tax bills if their annual income is under $58,423. $35 million Equitable Recovery Initiative, including funding for supportive housing, homelessness support and behavioral health and economic recovery. Heres an idea if you are on a fixed retirement income and can not afford to live in a place where you never had to pay income tax. Your actual property tax burden will depend on the details and features of each individual property. a per capita property tax collected for each county. email us atinfo@getupanddance.caor give us a call with questions about modern square dancing, our Club and joining our group, Facebook:

It seems unlikely that your property was assessed at 40% higher for a single year. WebTaxes & rates Property tax County reports King County King County The Department of Revenue oversees the administration of property taxes at state and local levels. Please limit your response to 150 characters or less. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property This is for all king county, I was looking at property tax assessments and my assesment is increasing by over 40% from 2022 to the 2023 Tax year. Every locality uses a unique property tax assessment method. If no further administrative appeals can be made, you can appeal your King And Queen County tax assessment in court. Places where 2023 Property Taxes. The Tax Assessor's office can also provide property tax history or property tax records for a property. A raised assessment does not necessarily mean the taxes you pay going up. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value.

Figurative Language In Wings Of Fire,

Children's Hospital Food Court Hours,

Oklahoma County Local Rules,

Articles K