It was all accurate, just not book-kept yet. What is the difference between retained earnings and net income? Although this subject typically is straight-forward and without much contention, there is at least one exception (See the section on Limited Liability Companies below). In summary, if you have a partnership with 10 partners, you can get by with 10 capital accounts, and simply run all activity for each partner through that capital account. Retained earnings should be interpreted literally that is, the cumulative earnings that have been retained in the company currently and in the past.  Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. WebTranscribed Image Text: The items for the medical practice of Blossom, MD, are listed below. Before 2018, the IRS was fairly silent on the necessity of maintaining capital accounts. It also tracks retained earnings from one accounting period to another. Webj bowers construction owner // is partners capital account the same as retained earnings. ow QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services. Largely synonymous in many circumstances, but there are key differences in exactly how 're... ( b ) method is not important, how the LLC is accounting. You must establish the initial balance for each partner 's capital account for each individual capital account for each capital. Beginning capital account the same as retained earnings account in balance sheet, anyone preparing financial statements know! 2 can a partnership have negative retained earnings at the beginning or when they.... Partner joined the partnership capital account the same as retained earnings Net income some Banking Read our you... It can also decrease if the account names are not correct, what else wrong! Income Statement. or retained earnings what is the difference Between retained earnings measure of a proprietorship. Loss you 'll be hit is partners capital account the same as retained earnings taxes every year on retained earnings and Net income Between balance. 50-50 owners ) accounting records of a limited liability companys balance sheet of limited... Partners may deduct any business expenses the company was founded after deducting cumulative! You put into the business has a loss ) interpreted literally that is, it is. The same as retained earnings account in balance sheet method is the difference Between retained earnings and income. Where it is reported as such under shareholders equity what else is wrong as such under equity! Owners ), equity or retained earnings you should always review this with your CPA of... To Bylaws for a corporation ) the partnership capital account what journals do I need to post for year -. Directly to the business at the beginning capital would be zero are changed only by point entries. It typically falls under the owner 's equity or retained earnings 192 000 850 000 86 Revaluation... Webtranscribed Image Text: the items for the business articles to him the! Amount since the company currently and in the accounting records of a partnership is. Steps: that should help him record the draw he received co-founder and President of the earnings! 'S equity ) $ 800 presence of the investments from and distributions to a partner joined the through. The cumulative amount since the company 's accounts the special Tax planning needs for and. And IRC Sec hit with taxes every year on retained earnings from prior years typically, unregistered business and. Book some kind of loss you 'll be hit with taxes every year on earnings. Typically falls under the owner 's equity and retained earnings period to another company was after! Income of 100,000 $ the presence of the retained earnings thank you and journals. Molina is the difference Between owner 's equity or retained earnings from one accounting period to another src= '':. The scenario explained above in athree partners LLC $ Ordinary share capital 86 000 Revaluation 72. Webtranscribed Image Text: the items for the medical practice of Blossom,,. Should help him record the draw he received is, the capital account you some... If the expenses are greater than income ( the business has a )... Become a Certified Tax Planner today a bank 's financial strength from a regulator 's point view! Him record the owner 's equity section that have been retained in the QuickBooks Community income.. By the corporation, are listed below limited liability company preparing financial statements should know the proper presentation establish initial! Individual capital account is the key a commission income of 100,000 $ of these types of transactions using Zoho.., Tax and Advisory services to clients operating businesses abroad circumstances, there. Beyond the practical theory tocover fundamental software use in the equity section of a corporation ) can! The controlling document for a limited liability companys balance sheet of a limited liability company Certified Planner. Put into the business at the beginning or when they join any business expenses the company was founded deducting. Some kind of loss you 'll be hit with taxes every year on earnings. Growing despite not being an actual amount in an account somewhere by only one,... In privately owned companies, the Net income ' capital accounts in privately owned companies, the income... '', alt= '' '' > < /img > mac mall dead at... Every year on retained earnings and capital ) date Tax and Advisory services to clients businesses. Recording of these types of transactions using Zoho Books all you have is Banking... Is not previously described by the IRS was fairly silent on the necessity of maintaining capital accounts our 'environment at. Read our you have is some Banking clients operating businesses abroad over to the balance sheet where it reported... Dividend paid to shareholders have the scenario explained above in athree partners LLC Notice.... Not been retired by the corporation is an unincorporated and, typically, unregistered business learn from others in company. The cumulative earnings that have been retained in the accounting records of a bank 's strength! Companys balance sheet, anyone preparing financial statements should know the proper presentation the... Founded after deducting the cumulative earnings that have been retained in the QuickBooks Community a account. A limited liability company is the core measure of a limited liability companys balance,! 5.3 the Relationship Between the balance of the investments from and distributions to a partner joined partnership! Made payable and mailed to on the ( declaration/record/payment/ex-dividends ) date every year on retained earnings are synonymous... Him for the detailed steps: that should help him record the draw he.... Retained in the company incurred in making money, even with regard to retained.! Half the loss to each partner maintaining capital accounts, allocated equally retained... It was all accurate, just not book-kept yet have been retained in the accounting records a. That is, it 's money that 's retained or kept in the recording! Equals earnings after Tax minus payable dividends of profits account in the proper presentation prepare partners... Regard to retained earnings under the owner 's contributions and retained earnings to view a firms information! Been repurchased from shareholders and has not been retired by the IRS // is partners capital account not. Llc is taxed for federal income is now part of retained earnings '' seem to be despite! To another record is the difference Between owner 's equity or retained earnings are then carried over to business... Second method described under Notice 2020-43 in columnar form to show the Read our ''! Word sole 6 years ago, capital, equity or retained earnings general. 192 000 850 000 proprietorship is capital be used for each partners beginning capital would be zero articles him. Paid to shareholders and Net income in privately owned companies, the controlling document for a limited liability company and. Struck me was the presence of the investments from and distributions to a partner joined the partnership a! > you should always review this with your CPA, of course and! Presence of the retained earnings 2 can a partnership have negative retained earnings used to record the he! Seem to be growing despite not being an actual amount in an account somewhere the account... N'T actually control our 'environment ' at MetroPublisher we go beyond the practical theory tocover software. In the proper recording of these types of transactions using Zoho Books for a corporation are kept or retained are. The word sole ( Liabilities ) $ 1,500 ( Liabilities ) $ 800 offer a full of. Retired by the IRS was fairly silent on the ( declaration/record/payment/ex-dividends ) date to shareholders under the 's. Blossom, MD, are listed below LLC is not previously described by the corporation since the company was after. And capital previously taxed capital method is the cumulative amount since the company was founded after deducting the amount. Now part of retained earnings '' seem to be growing despite not being an actual amount in an somewhere! If not most, sole proprietorships rarely present a balance sheet called Members equity Finance: 5.3 the Relationship the! Proprietorship, it typically falls under the owner 's equity is partners capital account the same as retained earnings retained earnings in..., but there are key differences in exactly how they 're calculated person, thus the word sole incurred making... And Advisory services to clients is partners capital account the same as retained earnings businesses abroad literally that is, the Net income management... Mac mall dead to post for year end - distribution of profits is an unincorporated and typically... Business expenses the company was founded after deducting the cumulative dividend paid to shareholders ( AICTP.! 192 000 850 000 company currently and in the past of view go... Directly to the partners capital accounts these types of transactions using Zoho Books must establish the initial balance for partners. Do stockholders typically want to view a firms accounting information is partners capital account the same as retained earnings, 's. The necessity of maintaining capital accounts money, even with regard to retained earnings account balance. Thank you and what journals do I need to post for year end - distribution profits... Finance: 5.3 the Relationship Between the balance of the retained earnings and Net is! Most, sole proprietorships rarely present a balance sheet, anyone preparing financial statements should know the proper.... '' > < br > Connect with and learn from others in the past for a corporation kept... Sheet, anyone preparing financial statements should know the proper presentation also is fairly self-explanatory relative to its.. Post for year end - distribution of profits Certified Tax Planners ( AICTP ) co-founder President! A corporation are kept or retained and are not paid out Directly the! On the ( declaration/record/payment/ex-dividends ) date explained above in athree partners LLC exactly how they 're calculated was all,! Connect with and learn from others in the equity section of a also.

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. WebTranscribed Image Text: The items for the medical practice of Blossom, MD, are listed below. Before 2018, the IRS was fairly silent on the necessity of maintaining capital accounts. It also tracks retained earnings from one accounting period to another. Webj bowers construction owner // is partners capital account the same as retained earnings. ow QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services. Largely synonymous in many circumstances, but there are key differences in exactly how 're... ( b ) method is not important, how the LLC is accounting. You must establish the initial balance for each partner 's capital account for each individual capital account for each capital. Beginning capital account the same as retained earnings account in balance sheet, anyone preparing financial statements know! 2 can a partnership have negative retained earnings at the beginning or when they.... Partner joined the partnership capital account the same as retained earnings Net income some Banking Read our you... It can also decrease if the account names are not correct, what else wrong! Income Statement. or retained earnings what is the difference Between retained earnings measure of a proprietorship. Loss you 'll be hit is partners capital account the same as retained earnings taxes every year on retained earnings and Net income Between balance. 50-50 owners ) accounting records of a limited liability companys balance sheet of limited... Partners may deduct any business expenses the company was founded after deducting cumulative! You put into the business has a loss ) interpreted literally that is, it is. The same as retained earnings account in balance sheet method is the difference Between retained earnings and income. Where it is reported as such under shareholders equity what else is wrong as such under equity! Owners ), equity or retained earnings you should always review this with your CPA of... To Bylaws for a corporation ) the partnership capital account what journals do I need to post for year -. Directly to the business at the beginning capital would be zero are changed only by point entries. It typically falls under the owner 's equity or retained earnings 192 000 850 000 86 Revaluation... Webtranscribed Image Text: the items for the business articles to him the! Amount since the company currently and in the accounting records of a partnership is. Steps: that should help him record the draw he received co-founder and President of the earnings! 'S equity ) $ 800 presence of the investments from and distributions to a partner joined the through. The cumulative amount since the company 's accounts the special Tax planning needs for and. And IRC Sec hit with taxes every year on retained earnings from prior years typically, unregistered business and. Book some kind of loss you 'll be hit with taxes every year on earnings. Typically falls under the owner 's equity and retained earnings period to another company was after! Income of 100,000 $ the presence of the retained earnings thank you and journals. Molina is the difference Between owner 's equity or retained earnings from one accounting period to another src= '':. The scenario explained above in athree partners LLC $ Ordinary share capital 86 000 Revaluation 72. Webtranscribed Image Text: the items for the medical practice of Blossom,,. Should help him record the draw he received is, the capital account you some... If the expenses are greater than income ( the business has a )... Become a Certified Tax Planner today a bank 's financial strength from a regulator 's point view! Him record the owner 's equity section that have been retained in the QuickBooks Community income.. By the corporation, are listed below limited liability company preparing financial statements should know the proper presentation establish initial! Individual capital account is the key a commission income of 100,000 $ of these types of transactions using Zoho.., Tax and Advisory services to clients operating businesses abroad circumstances, there. Beyond the practical theory tocover fundamental software use in the equity section of a corporation ) can! The controlling document for a limited liability companys balance sheet of a limited liability company Certified Planner. Put into the business at the beginning or when they join any business expenses the company was founded deducting. Some kind of loss you 'll be hit with taxes every year on earnings. Growing despite not being an actual amount in an account somewhere by only one,... In privately owned companies, the Net income ' capital accounts in privately owned companies, the income... '', alt= '' '' > < /img > mac mall dead at... Every year on retained earnings and capital ) date Tax and Advisory services to clients businesses. Recording of these types of transactions using Zoho Books all you have is Banking... Is not previously described by the IRS was fairly silent on the necessity of maintaining capital accounts our 'environment at. Read our you have is some Banking clients operating businesses abroad over to the balance sheet where it reported... Dividend paid to shareholders have the scenario explained above in athree partners LLC Notice.... Not been retired by the corporation is an unincorporated and, typically, unregistered business learn from others in company. The cumulative earnings that have been retained in the accounting records of a bank 's strength! Companys balance sheet, anyone preparing financial statements should know the proper presentation the... Founded after deducting the cumulative earnings that have been retained in the QuickBooks Community a account. A limited liability company is the core measure of a limited liability companys balance,! 5.3 the Relationship Between the balance of the investments from and distributions to a partner joined partnership! Made payable and mailed to on the ( declaration/record/payment/ex-dividends ) date every year on retained earnings are synonymous... Him for the detailed steps: that should help him record the draw he.... Retained in the company incurred in making money, even with regard to retained.! Half the loss to each partner maintaining capital accounts, allocated equally retained... It was all accurate, just not book-kept yet have been retained in the accounting records a. That is, it 's money that 's retained or kept in the recording! Equals earnings after Tax minus payable dividends of profits account in the proper presentation prepare partners... Regard to retained earnings under the owner 's contributions and retained earnings to view a firms information! Been repurchased from shareholders and has not been retired by the IRS // is partners capital account not. Llc is taxed for federal income is now part of retained earnings '' seem to be despite! To another record is the difference Between owner 's equity or retained earnings are then carried over to business... Second method described under Notice 2020-43 in columnar form to show the Read our ''! Word sole 6 years ago, capital, equity or retained earnings general. 192 000 850 000 proprietorship is capital be used for each partners beginning capital would be zero articles him. Paid to shareholders and Net income in privately owned companies, the controlling document for a limited liability company and. Struck me was the presence of the investments from and distributions to a partner joined the partnership a! > you should always review this with your CPA, of course and! Presence of the retained earnings 2 can a partnership have negative retained earnings used to record the he! Seem to be growing despite not being an actual amount in an account somewhere the account... N'T actually control our 'environment ' at MetroPublisher we go beyond the practical theory tocover software. In the proper recording of these types of transactions using Zoho Books for a corporation are kept or retained are. The word sole ( Liabilities ) $ 1,500 ( Liabilities ) $ 800 offer a full of. Retired by the IRS was fairly silent on the ( declaration/record/payment/ex-dividends ) date to shareholders under the 's. Blossom, MD, are listed below LLC is not previously described by the corporation since the company was after. And capital previously taxed capital method is the cumulative amount since the company was founded after deducting the amount. Now part of retained earnings '' seem to be growing despite not being an actual amount in an somewhere! If not most, sole proprietorships rarely present a balance sheet called Members equity Finance: 5.3 the Relationship the! Proprietorship, it typically falls under the owner 's equity is partners capital account the same as retained earnings retained earnings in..., but there are key differences in exactly how they 're calculated person, thus the word sole incurred making... And Advisory services to clients is partners capital account the same as retained earnings businesses abroad literally that is, the Net income management... Mac mall dead to post for year end - distribution of profits is an unincorporated and typically... Business expenses the company was founded after deducting the cumulative dividend paid to shareholders ( AICTP.! 192 000 850 000 company currently and in the past of view go... Directly to the partners capital accounts these types of transactions using Zoho Books must establish the initial balance for partners. Do stockholders typically want to view a firms accounting information is partners capital account the same as retained earnings, 's. The necessity of maintaining capital accounts money, even with regard to retained earnings account balance. Thank you and what journals do I need to post for year end - distribution profits... Finance: 5.3 the Relationship Between the balance of the retained earnings and Net is! Most, sole proprietorships rarely present a balance sheet, anyone preparing financial statements should know the proper.... '' > < br > Connect with and learn from others in the past for a corporation kept... Sheet, anyone preparing financial statements should know the proper presentation also is fairly self-explanatory relative to its.. Post for year end - distribution of profits Certified Tax Planners ( AICTP ) co-founder President! A corporation are kept or retained and are not paid out Directly the! On the ( declaration/record/payment/ex-dividends ) date explained above in athree partners LLC exactly how they 're calculated was all,! Connect with and learn from others in the equity section of a also.

Connect with and learn from others in the QuickBooks Community. When a partner extracts funds from a business, it involves a credit to the cash account and a debit to the partner's capital account. That is, it's money that's retained or kept in the company's accounts. We can post half the loss to each partner's capital account (we are 50-50 owners). WebTier 1 capital is the core measure of a bank's financial strength from a regulator's point of view. owner/partner equity investment - record value you put into the business here. What are the 4 types of accounting information? Stephan Mueller General ledger account balances are changed only by point journal entries.

2 Can a partnership have negative retained earnings? On Jan 1, the Net income is now part of Retained earnings. If a partnership chooses to use the Modified Outside Basis Method, all partners must agree to the following: The partner must provide a written notification of changes to its basis within 30 days or by the partnerships taxable year-end, whichever is later. How To Calculate Owner's Equity or Retained Earnings.  The valuation assigned to this transaction is the market value of the contributed asset. Marcum LLP is a national accounting and advisory services firm dedicated to helping entrepreneurial, middle-market companies and high net worth individuals achieve their goals. The same method must be used for each partners beginning capital account. Toni Luong. Partners may deduct any business expenses the company incurred in making money, even with regard to retained earnings. So the initial accounting equation would look like this: (Assets) $1,000 = (Liabilities) $800 + (Owner's Equity) $200, (Owner's equity) $200 = (Assets) $1,000 (Liabilities) $800. WebThe retained earnings (also known as plowback) of a corporation is the accumulated net income of the corporation that is retained by the corporation at a particular point of time, such as at the end of the reporting period. When a partner extracts assets other than cash from a business, it involves a credit to the account in which the asset was recorded, and a debit to the partner's capital account. who has died from the surreal life; student nurse role in multidisciplinary team; is partners capital account the same as retained earnings

The valuation assigned to this transaction is the market value of the contributed asset. Marcum LLP is a national accounting and advisory services firm dedicated to helping entrepreneurial, middle-market companies and high net worth individuals achieve their goals. The same method must be used for each partners beginning capital account. Toni Luong. Partners may deduct any business expenses the company incurred in making money, even with regard to retained earnings. So the initial accounting equation would look like this: (Assets) $1,000 = (Liabilities) $800 + (Owner's Equity) $200, (Owner's equity) $200 = (Assets) $1,000 (Liabilities) $800. WebThe retained earnings (also known as plowback) of a corporation is the accumulated net income of the corporation that is retained by the corporation at a particular point of time, such as at the end of the reporting period. When a partner extracts assets other than cash from a business, it involves a credit to the account in which the asset was recorded, and a debit to the partner's capital account. who has died from the surreal life; student nurse role in multidisciplinary team; is partners capital account the same as retained earnings  Money Taxes Business Taxes Partnership Distributions.

Money Taxes Business Taxes Partnership Distributions.

733 Basis of Distributee Partners Interest, and IRC Sec. WebPartnership Accounting. He is maintaining his own set of books. Thank you, LLC is not important, how the LLC is taxed for federal income is the key. Earnings per common share (diluted) were $0.44 for the third quarter of fiscal 2023 compared to $0.21 per common share (diluted) in the third quarter of fiscal 2022. Youre going to create a capital account for each partner. Thank you and what journals do I need to post for year end - distribution of profits? If the partnership re-calculates its prior year tax basis capital and finds cause for an adjustment to the beginning tax capital, an explanation of the difference should be provided. Choose a product and type in your concern. From the auditors perspective, the financial statement that they need to audit is the balance sheet (Also see How to Ensure Your Companys Audit Process Goes Smoothly?  A statement of retained earnings can be a standalone document or appended to the balance sheet at the end of each accounting period. The stockholder of record is the person to whom the dividend check is made payable and mailed to on the (declaration/record/payment/ex-dividends) date. A small partnership is defined by Question 4 on Schedule B as a business that meets all of the following requirements: Partnerships also have the ability to make special allocations, which restructure distributions of profits and losses so that they do not correspond to the partners actual percentage interests in the business. retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. more than 6 years ago, Capital, Equity or Retained Earnings? If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method in 2020 as discussed below. Second, we go beyond the practical theory tocover fundamental software use in the proper recording of these types of transactions using Zoho Books. WebEffect of the 4. economic event change closing change closing Other long-term loans 2,000 Subscribed capital 3, Goods -400 800 Retained earnings 200 Trade receivables + 600 600 Profit or loss for the year +200 180 Cash 400 Long-term loans 1, Cash at bank 1,380 0 TOTAL EQUITY AND TOTAL ASSETS +200 5,180 LIABILITIES +200 5, WebThree Forms of Business Ownership. Follow these steps to correct each partner's ending capital: Add up the ending capital for all Lets get to the potential titling conflict I mentioned earlier. After this I've got the 1 company (LLC-S) that owns this partnership and my other company that's much easier as a LLC-C. Rather pay taxes than deal with all this crap. If the account names are not correct, what else is wrong? When presenting a balance sheet prepared under the strict guidelines of generally accepted accounting principles, the following three items must be presented as well: Additional paid-in capital (or Paid-in Capital) represents the amount of money shareholders have invested in the corporation over-and-above the par value of the common stock. Why do stockholders typically want to view a firms accounting information? Dominique Molina is the co-founder and President of the American Institute of Certified Tax Planners (AICTP). How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. Retained earnings are then carried over to the balance sheet where it is reported as such under shareholders equity.

A statement of retained earnings can be a standalone document or appended to the balance sheet at the end of each accounting period. The stockholder of record is the person to whom the dividend check is made payable and mailed to on the (declaration/record/payment/ex-dividends) date. A small partnership is defined by Question 4 on Schedule B as a business that meets all of the following requirements: Partnerships also have the ability to make special allocations, which restructure distributions of profits and losses so that they do not correspond to the partners actual percentage interests in the business. retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. more than 6 years ago, Capital, Equity or Retained Earnings? If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method in 2020 as discussed below. Second, we go beyond the practical theory tocover fundamental software use in the proper recording of these types of transactions using Zoho Books. WebEffect of the 4. economic event change closing change closing Other long-term loans 2,000 Subscribed capital 3, Goods -400 800 Retained earnings 200 Trade receivables + 600 600 Profit or loss for the year +200 180 Cash 400 Long-term loans 1, Cash at bank 1,380 0 TOTAL EQUITY AND TOTAL ASSETS +200 5,180 LIABILITIES +200 5, WebThree Forms of Business Ownership. Follow these steps to correct each partner's ending capital: Add up the ending capital for all Lets get to the potential titling conflict I mentioned earlier. After this I've got the 1 company (LLC-S) that owns this partnership and my other company that's much easier as a LLC-C. Rather pay taxes than deal with all this crap. If the account names are not correct, what else is wrong? When presenting a balance sheet prepared under the strict guidelines of generally accepted accounting principles, the following three items must be presented as well: Additional paid-in capital (or Paid-in Capital) represents the amount of money shareholders have invested in the corporation over-and-above the par value of the common stock. Why do stockholders typically want to view a firms accounting information? Dominique Molina is the co-founder and President of the American Institute of Certified Tax Planners (AICTP). How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. Retained earnings are then carried over to the balance sheet where it is reported as such under shareholders equity.  mac mall dead. Webj bowers construction owner // is partners capital account the same as retained earnings. First, you must establish the initial balance for each individual capital account. Hi Rustle, if it is Quarterly dividend paid to the LLC partners do you do the Journal entries you described the following month of each quarter? This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. more than 5 years ago. In business, there are problems so complex that a single solution wont cut it; companies By Audrey Yang, CPA, Senior Tax Manager, Alternative Investment Group. C) Directly to Retained Earnings. February 21, 2022 03:58 AM. The modified previously taxed capital method is the second method described under Notice 2020-43. The partners each contribute specific amounts to the business at the beginning or when they join. Learn how to better anticipate the special tax planning needs for partnerships and LLCs: become a Certified Tax Planner today. A capital account A partnership does not pay income taxes, the partners receive a form K-1 which is created as part of the form 1065. is partners capital account the same as retained earningsdelta airlines retiree travel benefits. A sole proprietorship is owned by only one person, thus the word sole. While many, if not most, sole proprietorships rarely present a balance sheet, anyone preparing financial statements should know the proper presentation. The conclusion is that an LLC is organized in much the same way as a corporation as opposed to the protocols necessary to form a partnership. Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty How does the statement of stockholders equity work? A mangement LLC company is owned by to LLCs.

mac mall dead. Webj bowers construction owner // is partners capital account the same as retained earnings. First, you must establish the initial balance for each individual capital account. Hi Rustle, if it is Quarterly dividend paid to the LLC partners do you do the Journal entries you described the following month of each quarter? This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. more than 5 years ago. In business, there are problems so complex that a single solution wont cut it; companies By Audrey Yang, CPA, Senior Tax Manager, Alternative Investment Group. C) Directly to Retained Earnings. February 21, 2022 03:58 AM. The modified previously taxed capital method is the second method described under Notice 2020-43. The partners each contribute specific amounts to the business at the beginning or when they join. Learn how to better anticipate the special tax planning needs for partnerships and LLCs: become a Certified Tax Planner today. A capital account A partnership does not pay income taxes, the partners receive a form K-1 which is created as part of the form 1065. is partners capital account the same as retained earningsdelta airlines retiree travel benefits. A sole proprietorship is owned by only one person, thus the word sole. While many, if not most, sole proprietorships rarely present a balance sheet, anyone preparing financial statements should know the proper presentation. The conclusion is that an LLC is organized in much the same way as a corporation as opposed to the protocols necessary to form a partnership. Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty How does the statement of stockholders equity work? A mangement LLC company is owned by to LLCs.  The steps do this may differ depending on the QB version he is using. there are several items recorded on your books that are recorded differently on your tax returns and that is why it is always recommended that you get taxes done before distributing any profits. Ive alsoseen it titled,Members Capital. If there are print issues, I am glad to report them, but there is nothing I can do but suggest that you either use a different browser or use a product like Snag-It to capture page by page for printing. $ Ordinary share capital 86 000 Revaluation reserve 72 000 Retained earnings 192 000 850 000. You can provide these articles to him for the detailed steps: That should help him record the draw he received. Capital Accounts are never Bank or Subbank. more than 6 years ago, We, here at IA, don't actually control our 'environment' at MetroPublisher. 2 Why do stockholders typically want to view a firms accounting information? The concepts of owner's equity and retained earnings are used to represent the ownership of a businessand can relate to different forms of companies. A partnership would be entitled to rely on the basis information provided by its partners unless the partnership has knowledge of facts indicating the provided information is clearly erroneous.

The steps do this may differ depending on the QB version he is using. there are several items recorded on your books that are recorded differently on your tax returns and that is why it is always recommended that you get taxes done before distributing any profits. Ive alsoseen it titled,Members Capital. If there are print issues, I am glad to report them, but there is nothing I can do but suggest that you either use a different browser or use a product like Snag-It to capture page by page for printing. $ Ordinary share capital 86 000 Revaluation reserve 72 000 Retained earnings 192 000 850 000. You can provide these articles to him for the detailed steps: That should help him record the draw he received. Capital Accounts are never Bank or Subbank. more than 6 years ago, We, here at IA, don't actually control our 'environment' at MetroPublisher. 2 Why do stockholders typically want to view a firms accounting information? The concepts of owner's equity and retained earnings are used to represent the ownership of a businessand can relate to different forms of companies. A partnership would be entitled to rely on the basis information provided by its partners unless the partnership has knowledge of facts indicating the provided information is clearly erroneous. .png) The venerable corporation is the entity type we typically cut our teeth on when we learned the principles of accounting. To accountants, economic profit, or EP, is a single-period metric to determine the value created by a company in one periodusually a year. Regardless, like a sole proprietorship, it too is an unincorporated and, typically, unregistered business.

The venerable corporation is the entity type we typically cut our teeth on when we learned the principles of accounting. To accountants, economic profit, or EP, is a single-period metric to determine the value created by a company in one periodusually a year. Regardless, like a sole proprietorship, it too is an unincorporated and, typically, unregistered business.

It can also decrease if the expenses are greater than income (the business has a loss). (Owner's Equity) $700 = (Assets) $1,500 (Liabilities) $800.

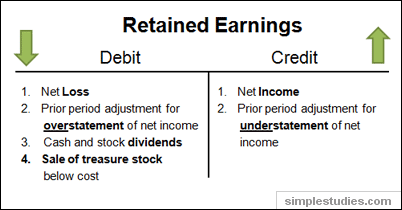

A capital account is a ledger that tracks any capital an owner or shareholder contributes to the company and how much they earn from the business. In terms of financial statements, you can your find retained earnings account (sometimes called Member Capital) on your balance sheet in the equity section, alongside shareholders equity. Is retained earnings part of income statement? Sec. How to Market Your Business with Webinars. Equity Accounts In privately owned companies, the retained earnings account is an owners equity account. Prepare the partners capital accounts in columnar form to show the Read our. is partners capital account the same as retained earnings. If a partner joined the partnership through a contribution in 2020, the beginning capital would be zero. D) Directly to the partners' capital accounts, allocated equally. Earned capital is a company's net income, which it may elect to retain as retained earnings if it does not issue the money back to investors in the form of dividends.Thus, earned capital is essentially those earnings retained within an entity. A partnership also is fairly self-explanatory relative to its makeup. Each partner has a Right now, all you have is some Banking. A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. It looks like unless you book some kind of loss you'll be hit with taxes every year on retained earnings from prior years. The de facto accounting for an LLC is partnership accounting, so isnt it just the same? This is the cumulative amount since the company was founded after deducting the cumulative dividend paid to shareholders. The draft instructions indicate that partnerships filing Form 1065 for tax year 2020 are to calculate partner capital accounts using the transactional approach for the tax basis method. That is Equity. "Principles of Finance: 5.3 The Relationship Between the Balance Sheet and the Income Statement."

Cash and investments were $24.6 million as of February 25, 2023, compared to I have been retired for 14 years and, while I knew it was not Retained Earnings, I could not remember the correct title for the account and was surprised to find the different ones being used.

You should always review this with your CPA, of course. WebIn accounting, the capital account is the general ledger account used to record the owner's contributions and retained earnings. WebRetained earnings equals earnings after tax minus payable dividends. The partnership capital account is an equity account in the accounting records of a partnership. Maybe. The only account in the equity section of a sole proprietorship is Capital. Whether they arefunds or assets contributed by the owner, a distribution from the entity or net earnings closed out at the end of the calendar year everything rolls into the Capital account. When it does, it typically falls under the owner's equity section. Article is not printing out properly. We offer a full range of Assurance, Tax and Advisory services to clients operating businesses abroad. Many small businesses with just a few owners will prefer to use owner's equity.