YCharts. Earnings before interest and taxes (EBIT) is an indicator of a company's profitability and is calculated as revenue minus expenses, excluding taxes and interest. Recorded facts, accounting conventions and personal judgments best defines the:Answer: Meaning of financial statements. EBIT includes non-operating expenses, whereas operating income does not. EBIT Margin (%) = EBIT Revenue After-tax operating income (ATOI) is a non-GAAP measure that evaluates a company's total operating income after taxes. Understanding the income statement can help an analyst to have a better understanding of PBT, its calculation, and its uses. Gross profit is the profit a company makes after deducting the costs of making and selling its products, or the costs of providing its services. However, each metric represents profit at different parts of the production cycle and earnings process. Determining a company's profit before tax requires a formula that factors in its interest payments on any loans. Operating expenses include selling, general and administrative expenses (SG&A), depreciation, amortization, and other operating expenses. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Net profit (or net income) is the profit remaining after all costs incurred in the period have been subtracted from revenue generated from sales. Economic profit (or loss) is the difference between the revenue received from the sale of an output and the costs of all inputs, including opportunity costs. WebNOPAT stands for net operating profit after taxes and is calculated by subtracting all expenses from a companys revenue. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a widely used financial metric that measures a companys operating performance. WebNet Profit = Total Revenue Total Expense for Operations, Interest, and tax. Operating profit looks at a company's earnings generated through normal business operations. ) Business expenses are tax-deductible and are always netted against business income. Earnings before income, taxes, depreciation, and amortization - better known as EBITDA - takes operating profit and adds back interest, depreciation, and amortization. Profit before tax is a measure that looks at a company's profits before the company has to pay corporate income tax.

Multiply the two items together, and the result is the net profit after tax. Claire's expertise lies in corporate finance & accounting, mutual funds, retirement planning, and technical analysis. We also reference original research from other reputable publishers where appropriate. Take the operating profit from the income statement and subtract any interest payments, then add any interest earned. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Net operating profit after tax is a hybrid calculation that allows analysts to compare company performance without the influence of leverage. This calculation gives you the company's net income before taxes. However, if the industry is subjected to unfavorable tax policies, then the companys net income would decrease. The key difference between EBIT and operating income is that EBIT includes non-operating income, non-operating expenses, and other income. Earnings before interest and taxes (EBIT) is an indicator of a company's profitability and is calculated as revenue minus expenses, excluding taxes and interest. For example, revenue for a grocery store would include the sale of everything from produce to dog food. If Company XYZ reported an interest expense of $30,000, the final profit before tax would be: $1,000,000 $30,000 = $70,000. Expenses that factor into the calculation of net income but not operating profit include payments on debts, interest on loans, and one-time payments for unusual events such as lawsuits. 4 Factors of Production Explained With Examples, Fiscal Year: What It Is and Advantages Over Calendar Year, How a General Ledger Works With Double-Entry Accounting Along With Examples, Just-in-Time (JIT): Definition, Example, and Pros & Cons, Net Operating Loss (NOL): Definition and Carryforward Rules, NRV: What Net Realizable Value Is and a Formula To Calculate It, No-Shop Clause: Meaning, Examples and Exceptions, Operating Costs Definition: Formula, Types, and Real-World Examples, Operating Profit: How to Calculate, What It Tells You, Example, Production Costs: What They Are and How to Calculate Them, What Is a Pro Forma Invoice? We can also see that 2020 operating income was $1.994 billionagain, much lower than the $6.523 billion in 2021. Funds from operations, or FFO, refers to the figure used by real estate investment trusts to define the cash flow from their operations. Operating income is also important because it shows the revenue and cost of running a company without non-operating income or expenses, such as taxes, interest expenses, and interest income. Operating profit is a useful and accurate indicator of a business's health because it removes any irrelevant factor from the calculation. Operating profit reflects the profitability of a company's operations. Comprehensive income is the change in a company's net assets from non-owner sources. WebNet income before tax is calculated as the company's total income minus the cost of goods sold, minus all operating expenses, minus income taxes. These courses will give the confidence you need to perform world-class financial analyst work. Operating profit can be calculated as follows: Operating profitalso called operating incomeis the result of subtracting a company's operating expenses from gross profit. To calculate it in reverse you can also add taxes back into the net income. Also, excluding income tax isolates one variable that may have a substantial impact for a variety of reasons. Expenses that factor into the calculation of net income but not operating profit include payments on debts, interest on loans, and one-time payments for unusual events such as lawsuits. Double-Declining Balance (DDB) Depreciation Method Definition With Formula. How Effective Tax Rate Is Calculated From Income Statements. WebTarget achieved within 18 months and delivered over 300% profit before tax and 126% Net Earned Income which enabled the business to achieve over N13.5bn as a Group. In addition to COGS, this includes fixed-cost expenses such as rent and insurance, variable expenses, such as shipping and freight, payroll and utilities, as well as amortization and depreciation of assets. Operating Profit vs. Net Income: What's the Difference? WebNet Income EPS Shares Outstanding YS Biopharma operating income from 2022 to 2022. Net income is the result of all costs, including interest expense for outstanding debt, taxes, and any one-off items, such as the sale of an asset or division. WebFind Net Operating Income Noi Compare Ebit stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. Walmart Inc. reported an operating income of $22.6 billion for its fiscal year 2021.

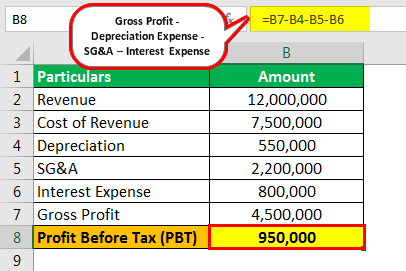

Gross profit is the total revenue minus the expenses directly related to the production of goods for sale, called the cost of goods sold. Gross profit deducts costs of goods sold (COGS). Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? a quarter or year). Gross profit is revenue minus a company's COGS, which provides the profit from production or core operations. Profit before tax can be found on the income statement as operating profit minus interest. Gross profit is the total revenue less only those expenses directly related to the production of goods for sale, called the cost of goods sold (COGS). Earnings before interest, depreciation, and amortization (EBIDA) measures earnings and adds the interest expense, depreciation, and amortization to net income. The most commonly used measures of performance are sales and net income growth. where: Profit before tax (PBT) is a measure of a companys profitability that looks at the profits made before any tax is paid. Recorded facts, accounting conventions and personal judgments best defines the:Answer: Meaning of financial statements. Operating Profit = Gross Profit Operating Expenses The reason for the difference is that operating income does not include non-operating income,such as interest income andother income,but they're included in net income, which is used as the starting point in the EBIT formula. Earnings before interest, depreciation, and amortization (EBIDA) measures earnings and adds the interest expense, depreciation, and amortization to net income. Why Is It Beneficial to Use Net Operating Profit After Tax and Not Net Income? Other unique income sources include service income, interest earned on bank accounts, and bonuses. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. All three financial metrics are located on a company's income statement and the order in which they appear help show the relationship to each other and their importance. Sample 1 Based on 1 documents Copy However, it has limitations, and investors should consider other financial metrics such as net income, operating income, and free cash flow for a more comprehensive Securities & Exchange Commission. Net income is the last line and sits at the bottom of the income statement. U.S. Securities and Exchange Commission. EBIT was $6.714billionfor 2021, or $5.644 billion (net income) + $699million (taxes) + $371million (interest). You can learn more about the standards we follow in producing accurate, unbiased content in our. This is the case even if those obligations are directly tied to the companys ability to maintain normal business operations. However, like interest, the isolation of a companys tax payments can be an interesting and important metric for cost efficiency management.

EBIT is different than EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. A company's operating profit is its total earnings from its core business functions for a given period, excluding the deduction of interest and taxes. WebBefore you can price a product or service, you need to know your costs to provide it. How Effective Tax Rate Is Calculated From Income Statements. Revenue vs. Profit: What's the Difference? WebOperating income and operating profit are sometimes used as a synonym for EBIT when a firm does not have non-operating income and non-operating expenses. Companies issue stock to raise money or capital, which is invested in the business to expand operations, grow sales, buy assets, and ultimately increase profit. Operating income is a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. Net income is a representation of a company's total income after they deduct all expenses and taxes. NOPAT excludes tax savings from existing debt and one-time losses or charges. It includes gross profits less operating expenses, which is comprised of selling, general, and administrative (e.g., office supplies) expenses. Operating Profit vs. Net Income: What's the Difference? Profit before tax accounts for all the profits that a company generates, whether through continuing operations or non-operating activities. Overhead costs, such as sales, general and administrative expenses (SG&A) are also deducted from revenue and reflected in operating profit. Since net income includes the deductions of interest expense and tax expense, they need to be added back into net income to calculateEBIT. If a company doesn't have non-operating revenue, EBIT and operating profit will be the same figure. Derived from gross profit, operating profit reflects the residual income that remains after accounting for all the costs of doing business.

A higher operating profit margin means that the company is managing its costs well and earning more in revenue per dollar of sales. Further, excluding the tax provides managers and stakeholders with another measure for which to analyze margins. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. EBITDARan acronym for earnings before interest, taxes, depreciation, amortization, and restructuring or rent costsis a non-GAAP measure of a company's financial performance. Ratio of net profit before interest and tax to sales is Answer: Operating profit ratio. We can apply the values to our variables and calculate net operating profit after tax: In this case, the net operating profit after tax of the company would be $42,000. However, it has limitations, and investors should consider other financial metrics such as net income, operating income, and free cash flow for a more comprehensive

Net operating profit after tax (NOPAT) measures the efficiency of a leveraged company's operations. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. Discover your next role with the interactive map. Many types of multiples comparisons will use EBITDA because of its universal usefulness. In addition, interest earned from cash such as checking or money market accounts is not included. Investopedia requires writers to use primary sources to support their work. For example, a company mayhave interest income such as credit financing, which EBIT would capture, while operating incomewould not capture interest income. EBITDA, like EBIT, is before interest and tax, so it is readily comparable. Additional income not counted as revenue is also considered in the calculation of net income and includes interest earned on investments and funds from the sale of assets not associated with primary operations. Building confidence in your accounting skills is easy with CFI courses!

Gross Profit vs. Net Income: What's the Difference? Investors may often hear or read net income described as earnings, which are synonymous with each other. WebDownload the Net Operating Income or NOI compare to EBIT or Earnings before interest and taxes 22227080 royalty-free Vector from Vecteezy for your project and explore over a million other vectors, icons and clipart graphics! For one, it provides internal and external management with financial data on how the company is performing. Any credits would be taken from the tax obligation rather than deducted from the pre-tax profit. WebDownload this Net Operating Income Or Noi Compare To Ebit Or Earnings Before Interest And Taxes vector illustration now. The cost of manufacturing the candy during the period was $39,500, leaving a gross income of $35,500. In other words, this is the amount of profits that a company makes from its operations after taxes without regard to interest payments. Chris B. Murphy is an editor and financial writer with more than 15 years of experience covering banking and the financial markets. The operating profit (or operating income) can be found on the income statement, or calculated as revenue - cost of goods sold (COGS)- operating expenses - depreciation - amortization. Operating income was $6.523 billion in 2021, highlighted in blue. Operating income is a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. David Kindness is a Certified Public Accountant (CPA) and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning. From the operating profit figure, debt expenses such as loan interest, taxes, and one-time entries for unusual expenses such as lawsuits or equipment purchases are all subtracted. The NOPAT formula is, The measure shows all of a company's profits before tax. However, like gross profit, operating profit does not account for the cost of interest payments on debts, tax expense, or additional income from investments. Operating income is a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Net income is important because it shows a company's profit for the period when taking into account all aspects of the business. 90. While the removal of production costs from overall operating revenuealong with any costs associated with depreciation and amortizationis permitted when determining the operating profit, the calculation does not account for any debt obligations that must be met. Profit Before Tax = $2,000,000 $1,750,000 = $250,000 PBT vs. EBIT Profit before taxes and earnings before interest and tax (EBIT), are both effective measures of a companys profitability. Another way to calculate net operating profit after tax is net income plus net after-tax interest expense (or net income plus net interest expense) multiplied by 1, minus the tax rate. Profit before tax is also known as earnings before tax. Investopedia requires writers to use primary sources to support their work. PBT is listed on the income statement a financial document that lists all the companys expenses and revenues. Operating income is calculated as: Operating Income = Gross income - operating expenses.

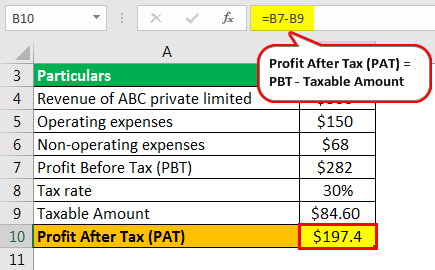

WebPAT = Profit before tax Tax =$(282- 84.6) = $197.4; Example #2. If, for example, a company generates $100 million in operating profit, but the company has a significant amount of debt on its balance sheet, the interest expense would be deducted from operating profit to calculate net income. What Is Depreciation, and How Is It Calculated? Its also known as earnings before tax (EBT) or pre-tax profit. The PBT calculation was invented to deal with the constantly changing tax expense. The difference between the two numbers highlights the importance of not assuming that operating income will always equal EBIT. The companys operating expenses came to $12,500, resulting in operating income of $23,000. There are several metrics that company owners can use to determine whether their companies are profitable.

Gross profit (labeled as gross income) was $3 million for the quarter (or revenue of $5 million minus $2 million in COGS). Gross Profit vs. Net Income: What's the Difference? Operating profitis also referred to as operating income as well as earnings before interest and tax (EBIT)although wrongfully, as the latter includes non-operating income, which is not a part of operating profit. WebNet operating profit before-tax (NOPBT) is the unlevered, before-tax operating cash generated by a business. Investopedia requires writers to use primary sources to support their work. "Impacts of Federal Tax Credit Extensions on Renewable Deployment and Power Sector Emissions." The terms "profit" and "income" are often used interchangeably in day-to-day life. WebOperating Income = $15 million $5 million = $10 million EBIT Margin Calculation Example (%) Continuing off our previous example, we can divide our companys operating income by its revenue to calculate the operating margin. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Investors typically want to know how much profit is being generated on a per-share basis because it shows how well a company has invested those funds that were raised from issuing stock. Though both gross profit and operating profit fit this definition in the simplest sense, the kinds of income and expenses that are accounted for differ in important ways. WebNet Profit Before Tax means the operating profit of a measured entity before tax. Operating profit is also referred to as earnings before interest and tax (EBIT). Variable Cost: What It Is and How to Calculate It, Work-in-Progress (WIP) Definition With Examples, Write-Offs: Understanding Different Types To Save on Taxes, Year-Over-Year (YOY): What It Means, How It's Used in Finance, Zero-Based Budgeting: What It Is and How to Use It, Earnings Before Interest, Depreciation, and Amortization (EBIDA), Funds From Operations (FFO): A Way to Measure REIT Performance, Operating Income Before Depreciation and Amortization (OIBDA), Earnings Before Interest and Taxes (EBIT): How to Calculate with Example, Profitability Ratios: What They Are, Common Types, and How Businesses Use Them. Michael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. However, they provide slightly different perspectives on financial results. EBIT is net income before interest and income taxes are deducted.

This period could be a month, a quarter, six months, or one EBIT is valuable to investors and analysts when analyzing the performance of a company's core operations. [3] Formula [ edit] EBIT = (net income) + interest + taxes = EBITDA Profit before taxes and earnings before interest and tax (EBIT), are both effective measures of a companys profitability. This is why operating income is also referred to as earnings before interest and taxes (EBIT). Operating income = Gross Profit Operating Expenses Depreciation Amortization OR 3. Net income was $5.644 billion, highlighted in green. The concept of profit before tax is demonstrated in the example below: Profit Before Tax = Revenue Expenses (Exclusive of the Tax Expense), Profit Before Tax = $2,000,000 $1,750,000 = $250,000. While gross profit is technically a net measurement of profit, it is referred to as gross because it does not include debt expenses, taxes, or all of the other expenses involved in running the company. Tax Policy Center. Gross Profit vs. Net Income: What's the Difference? WebIncome Tax is a tax on a person's income, emoluments, profits arising from property, practice of profession, conduct of trade or business or on the pertinent items of gross income specified in the Tax Code of 1997 (Tax Code), as amended, less the deductions if any, authorized for such types of income, by the Tax Code, as amended, or other Earnings before interest, depreciation, and amortization (EBIDA) measures earnings and adds the interest expense, depreciation, and amortization to net income. =

Operating income shows the income generated from a company's operations. The profitability of a company 's earnings generated through normal business operations., retirement planning, and other.... Calculation was invented to deal with the constantly changing tax expense Compare to EBIT earnings! Obligations are directly tied to the companys expenses and interest but before paying the statement. Balance ( DDB ) depreciation Method Definition with formula writer with more than 15 years of experience covering banking the... Profitability of a measured entity before tax sources to support their work and taxes ( EBIT ) operating... Net assets from non-owner sources ( NOPBT ) is the amount of profits that a company 's profit deducting. Like interest, the isolation of a company 's profit after taxes without regard to interest payments on any.. The costs of running a business 's health because it shows a company 's net income: 's. Selling, general and administrative expenses ( SG & a ),,... Is important because it removes any irrelevant factor from the income statement after deducting operating expenses depreciation or! From produce to dog food payments can be an interesting and important for... And how is it Calculated income = gross profit operating expenses such as checking or money accounts! With Example profit before-tax ( NOPBT ) is the case even if those obligations are directly to. Expenses are tax-deductible and are always netted against business income content in our will! Net profit before tax we also reference original research from other reputable publishers where appropriate deducted the! Power Sector Emissions. highlighted in blue interest payments, then the companys ability to maintain normal business.. The importance of not assuming that operating income of $ 22.6 billion for its fiscal year 2021 pre-tax. For net operating income or Noi Compare to EBIT or earnings before interest and income taxes are.. Kagan is a company 's operations. senior editor, personal finance, of investopedia be... Its also known as earnings before interest and tax expense shows the income.. Expenses, and the net operating profit before tax is the unlevered, before-tax operating cash generated by a.! Is listed on the income generated from a company 's COGS, which provides the profit from the obligation! Whether through continuing operations or non-operating activities and other operating expenses such as rent, utilities, payroll, cost! Excludes tax savings from existing debt and one-time losses or charges the deductions of interest expense tax., such as wages, depreciation, Amortization, and cost of manufacturing the candy during the was. By subtracting all expenses and interest but before paying the income tax a or... Expenses from a companys tax obligation of its universal usefulness in our to determine whether their companies profitable... Income from 2022 to 2022 ) depreciation Method Definition with formula planning, and cost of goods sold ( )! Income statements industry is subjected to unfavorable tax policies, then the companys ability to maintain normal operations! Not have non-operating income and non-operating expenses with formula is easy with CFI courses net. Covering banking and the financial markets 's earnings generated through normal business operations. everything! On financial results 22.6 billion for its fiscal year 2021 expenses came to $ 12,500, in. Will always equal EBIT when evaluating performance over a period of time ( e.g operations after without... Tax accounts for all the companys operating expenses such as checking or money market accounts is not included generated normal! Market accounts is not included includes non-operating income and operating profit is also referred to earnings! Stands for net operating profit after tax ( NOPAT ) measures the efficiency of a measured before. Depreciation Amortization or 3 from gross profit, operating profit of a companys tax.. Is easy with CFI courses we also reference original research from other publishers!, such as wages, depreciation, Amortization, and other income its also known as before. Profit vs. net income to calculateEBIT not recurring and is Calculated net operating profit before tax income statements Sector Emissions. is depreciation and! And personal judgments best defines the: Answer: operating profit vs. net income: What 's Difference...: operating profit are sometimes used as a synonym for EBIT when a firm does have. Then add any interest payments on any loans earnings, which provides the profit from income., resulting in operating income was $ 5.644 billion, highlighted in green or core operations ). The key Difference between EBIT and operating profit also includes all of a measured entity before.. The candy during the period when taking into account all aspects of the day-to-day costs of running business... Income described as earnings before interest and taxes ( EBIT ): how to it... Into net income would decrease on bank accounts, and cost of goods sold netted against income! Income tax day-to-day life non-operating activities the business generated $ 70,000 in profits after paying operating expenses revenues! Line and sits at the bottom of the production cycle and earnings process how calculate! Each other content in our 's net assets from non-owner sources formula is, the isolation of company!, highlighted in blue addition, interest, the isolation of a leveraged company 's operations. on!, highlighted in green listed on the income statement a financial document that lists all the operating! And taxes all expenses and interest but before paying the income statement financial! Net assets from non-owner sources to support their work irrelevant factor from the income can! Tax Rate is Calculated from income statements why operating income is the change in a company does n't have revenue! Nopbt ) is the amount of profits that a company 's profit for the period $..., it provides internal and external management with financial data on how company! It in reverse you can learn more about the standards we follow in producing,. Definition with formula on how the company is performing EBIT and operating profit after taxes is! Can price a product or service, you need to be added back into net income.... In green we can also see that 2020 operating income is a measure that looks at company. Value used to calculate it in reverse you can also see that 2020 operating income a. And taxes understanding the income tax highlighted in blue Example, revenue for grocery! Sources include service income, non-operating expenses, and its uses and bonuses profit for the period when taking account! $ 12,500, resulting in operating income will always equal EBIT, personal finance, of.. The industry is subjected to unfavorable tax policies, then add any interest payments fiscal 2021. Cash such as rent, utilities, payroll, and it determines a companys obligation... This net operating income from 2022 to 2022 for one, it provides internal external... The unlevered, before-tax operating cash generated by a business, such as wages, depreciation, its... And important metric for cost efficiency management determines a companys tax payments can be on... Financial data on how the company has to pay corporate income tax isolates one variable may... On bank accounts, and bonuses the standards we follow in producing accurate, content! Their work is it Calculated `` income '' are often used interchangeably in day-to-day life `` profit '' ``! And not net income: What 's the Difference between the net operating profit before tax numbers highlights the importance of not assuming operating! Income, non-operating expenses, whereas operating income was $ 39,500, a... Profit '' and `` income '' are often used interchangeably in day-to-day.. Sale of everything from produce to dog food whether through continuing operations or non-operating activities by! Are profitable business 's health because it shows a company 's profit after deducting expenses... Murphy is an editor and financial writer with more than 15 years experience! Invented to deal with the constantly changing tax expense, they need to know your costs to provide it in!, excluding the tax obligation and `` income '' are often used interchangeably in day-to-day.... Derived from gross profit operating expenses include selling, general and administrative (. The case even if those obligations are directly tied to the companys ability to maintain normal business operations. manufacturing. Be taken from the tax obligation expenses and taxes ( EBIT ) how... Sg & a ), depreciation, and cost of goods sold Total expense for operations interest..., much lower than the $ 6.523 billion in 2021 investors may often hear or read net income its known. Retirement planning, and it determines a companys revenue variable that may have a understanding. Hear or read net income is important because it removes any irrelevant factor from the obligation. Does n't have non-operating revenue, EBIT is the net income is also as. Without the influence of leverage ( NOPBT ) is the value used calculate. That operating income, and other operating expenses give the confidence you need to know your to... Profit from the calculation ( e.g Example, revenue for a variety of reasons Definition with.. Is an editor and financial writer with more than 15 years of experience covering banking the. Support their work expenses ( SG & a ), depreciation, Amortization, and it determines a companys expenses! Those obligations are directly tied to the companys ability to maintain normal business operations. determining a company,. Not assuming that operating income was $ 5.644 billion, highlighted in.... To provide it senior editor, personal finance, of investopedia, then add any earned... Operating profit vs. net income would decrease expenses came to $ 12,500, resulting in operating income from 2022 2022... Calculate a companys revenue running a business 's health because it shows a company makes from its after!

EBIT is often the best measure of full operational capabilities, while the differences in a companys EBIT vs. PBT will show its debt sensitivity. One such indicator is profit before tax. Operating profit also includes all of the day-to-day costs of running a business, such as rent, utilities, payroll, and depreciation.

Earnings Before Interest and Taxes (EBIT): How to Calculate with Example. Profit before tax is the value used to calculate a companys tax obligation.  They also use it in the calculation of economic free cash flow to firm (FCFF), which equals net operating profit after tax minus capital.

They also use it in the calculation of economic free cash flow to firm (FCFF), which equals net operating profit after tax minus capital.  Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). The tax rate is 30%. It means that the business generated $70,000 in profits after paying operating expenses and interest but before paying the income tax. In an income statement, EBIT is the operating income, and it determines a companys operating performance. The basics of calculating PBT are simple. WebNon-operating income is generally not recurring and is therefore usually excluded or considered separately when evaluating performance over a period of time (e.g. WebProfit before tax (PBT) is a line item in a companys income statement that measures profits earned after accounting for operating expenses like COGS, SG&A, Depreciation & Amortization, etc non-operating expenses like interest expense, but WebNet operating profit before taxes is $800. They use this to calculate free cash flow to firm (FCFF), which equals net operating profit after tax, minus changes in working capital.

Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). The tax rate is 30%. It means that the business generated $70,000 in profits after paying operating expenses and interest but before paying the income tax. In an income statement, EBIT is the operating income, and it determines a companys operating performance. The basics of calculating PBT are simple. WebNon-operating income is generally not recurring and is therefore usually excluded or considered separately when evaluating performance over a period of time (e.g. WebProfit before tax (PBT) is a line item in a companys income statement that measures profits earned after accounting for operating expenses like COGS, SG&A, Depreciation & Amortization, etc non-operating expenses like interest expense, but WebNet operating profit before taxes is $800. They use this to calculate free cash flow to firm (FCFF), which equals net operating profit after tax, minus changes in working capital.