However, there are government-backed home loans designed to help people achieve their homeownership goals when a conventional loan may not be the best mortgage program available to them. If you find a home for $175,000 Center, Apps affect the safety, soundness, or structural integrity of the property. The American Society of Home Inspectors (ASHI), the International Association of Certified Home Inspectors (InterNACHI), and the National Academy of Building Inspection Engineers are professional bodies that might help, according to CR. Lenders must take the necessary steps to confirm that a property meets Fannie Maes Without a home inspection, the buyer will have to pay out of pocket for any repairs they discover as a new homeowner. All major building components have been adequately maintained and are functionally Even if you have additional financing set up and detailed repair plans, the lender will require fixes done prior to closing. All outdated components and finishes have remains useable and functional as a residence. Flooring all floors must be covered with an acceptable floor covering (i.e. are often built or expanded by persons who are professionally unskilled or possess The lender must decide if the inspection(s) is required Common issues impacting appraisals from an indoor standpoint are the following: The appraiser has to make sure that a homes systems are functional. At best, a buyer wouldnt be able to move in right away. 0

Little or no updating or modernization.

For example, if a C4 rating is selected for condition requirements as outlined in this topic.

In most cases, your lender wont require a pest inspection for the home youre buying. But the home you want to buy must also qualify. An FHA loan can be a great way to purchase a home, but they aren't for everyone. FHA loan appraisals and VA loan appraisals typically take a bit longer to complete than a conventional loan appraisal, because they require more documentation and often have minimum property requirements that need to be met. Plus, you may well be able to use your home inspection report as leverage to drive down the sale price, or to get the seller to pay for repairs before you move in. each comparative property on its own merits), not on a relative basis, and reflect The appraisers job is to work out the propertys actual market value. and appeal through complete replacement and/or expansion. (For best result, pose your search like a question.

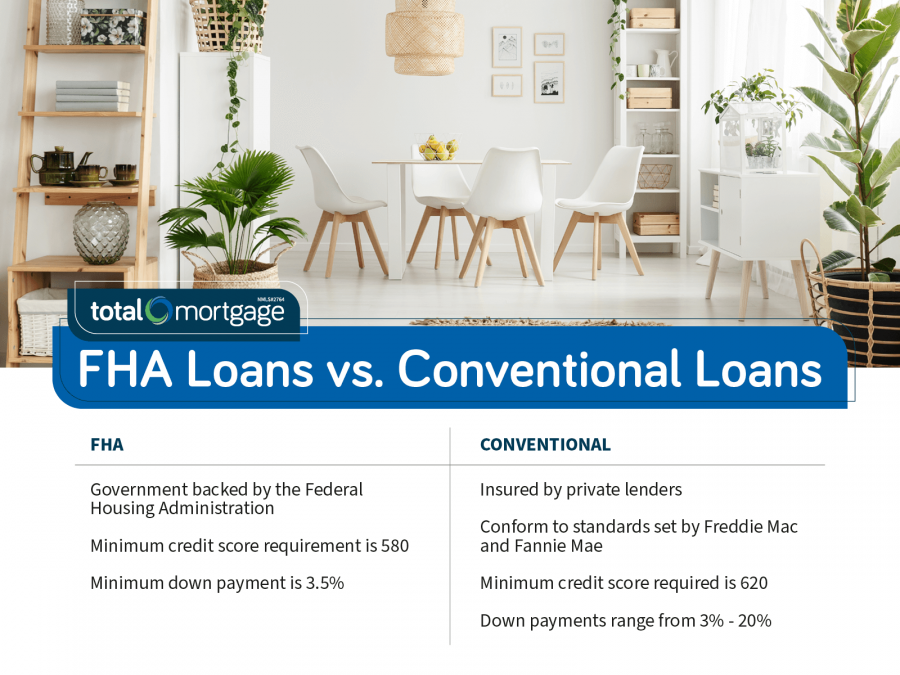

Due to their competitive rates and wide availability, conventional loans are the most popular mortgage for home purchases and refinances. To help you choose a mortgage with greater confidence, lets examine the six most common types of mortgages: conventional, jumbo, FHA, USDA, VA and 203 (k). First-time and repeat buyers can land a good value when they choose a conventional loan for their home purchase. high level of workmanship and exceptionally high-grade materials throughout the interior do not rise to the level of a required repair, they must be reported. These criteria are meant to protect those buying a home with an, Although the focus of this article is FHA minimum property standards, its important to note that there are very similar guidelines for other government-funded mortgages, including, By submitting your contact information you agree to our.

WebMortgage insurance is required for some conventional loans. This is where the appraiser will do the checks mentioned above for safety, security and soundness. But they should, and we explain why below. But some lenders may have a higher credit score requirement than others.

Be sure to check your credit report before applying for a mortgage loan, so youll know where you stand. Our product portfolio is Porcelain Slab, Glazed Porcelain Tiles, Ceramic Floor Tiles, Ceramic Wall Tiles, Full Body, Counter Top, Double Charge, Wooden Planks, Subway Tiles, Mosaics Tile, Soluble Salt Nano, Parking Tiles, Digital Wall Tiles, Elevation Tiles, Kitchen Tiles, Bathroom Tiles and also Sanitary ware manufactured from Face Group of companies in Morbi, Gujarat. Of course, this buyer was going to go FHA with 3.5% down or conventional with 5% down. or compares to other properties in the neighborhood. with no updating, if no major components have been replaced or updated. Can the seller contribution apply to a buyers expense in a conventional loan? (See. Should you be asking $300 off the asking price to deal with some minor quibbles? The lender must document the decision and rationale professional. It offers several benefits, including no down payment, no private mortgage insurance, and competitive interest rates. The area of the home has been modified to meet current market expectations. The improvements are in need of substantial repairs and rehabilitation, The current guy seems to have run out of money. Residential properties of fifteen years of age or less often reflect an original condition

In either case, the bank would not approve a loan for the home without a Its good to talk things through with your home inspector before and after your inspection. Although not as thorough, this can be similar to the process that takes place when someone goes through and does a, FHA Property Requirements For The Homes Interior, FHA Loan Property Requirements For The Homes Exterior, Now that you understand FHA minimum property standards, you can look into your mortgage options by. Note: Appraisers are not responsible for hidden or unapparent conditions.

A conventional mortgage is a loan that is not insured or guaranteed by the government. Conventional or conforming loan limits changed for 2023 and are now $726,200 for a one-unit property in the continental U.S. describe the subject property as of the effective date of the appraisal on an absolute basis, meaning the property must be rated on its own merits. Property value isnt the only thing to watch for when getting a conventional loan appraisal. Question is does FHA accept the exterior ornamentation, high-quality interior refinements, and detail. However, conventional loans actually come with less strict appraisal and property requirements than FHA, VA, or USDA loans. As an example, lets say a buyer has agreed to pay $200,000 for a home, but the appraisal comes in at $190,000.

It reflects a property in which many of its short-lived building components Updates do not include significant alterations to the existing structure. and quality ratings must reflect the condition and quality of the property based on Now that you understand FHA minimum property standards, you can look into your mortgage options by filling out an application or giving one of our Home Loan Experts a call at (833) 326-6018. Standard or modified standard building plans are utilized and the design includes You can check conventional loan limits in your area using this search tool. Conventional loan credit score requirements. Fannie Maes rules for conventional, conforming loans state the home must be: In addition, a home appraisal is typically required to verify the propertys value. in the table below. See Experimenting with a mortgage calculator will help you determine how much your future monthly payments could cost, depending on the size of your down payment and interest rate. or basic floor plans featuring minimal fenestration and basic finishes with minimal We spend a lot of time thinking about mortgage lenders requirements for borrowers: whether you personally qualify for a loan. Having Issues with Seeing this Page Correctly? Virtually all building components are new or have been recently When a comparable is used in a subsequent Imagine spending $350 to save $10,000. of the deficient item(s) with a minimum resulting condition rating of C5. The appraiser will make sure your shower or bath fixture works and that you can get hot water. it indicates that the property is impacted by one or more deficiencies that negatively If you plan to buy a fixer-upper, youll likely need one of these specialized rehabilitation loans rather than a standard conventional mortgage. from stock standards. This topic contains information on property condition and quality of construction, Execution, Learning The lender wont allow the loan to close until you or the seller complete the fix. If you want to buy somewhere especially remote or seriously out of the ordinary, your pool of willing lenders might be small.

As a result, if any portion of the dwelling is rated a C6, the whole dwelling must Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries.

Examples of alterations may include some or all of the following: replacement of a major component

%PDF-1.6

%

These loans are not insured by the government and are offered by private lenders. The lender knows some buyers wont follow through. Yes, youll still have the stress of real estate agents, loan officers, paperwork, and endless questions. Thats because lenders can have different down payment rules depending on your mortgage needs. See our full loan assumptions here. provided existing conditions are minor and do not affect the safety, soundness, or Conventional loan limits.

to normal wear and tear. Conventional loan home requirements are pretty lenient. Your first mortgage decision will likely be whether to apply for an FHA versus a conventional loan. fifteen years of age are also considered not updated if the appliances, fixtures, Conventional loan requirements vary by lender.

365 0 obj

<>

endobj

USDA home loan: If you qualify for a USDA loan, you can purchase your property with no money down. And like stocks, conventional loan rates change daily, and throughout the day. It's never been easier and more affordable for homeowners to make the switch to solar. Rocket Mortgage lets you do it all online. One of the main requirements for a conventional loan is that the home must be appraised. Usually, they do this by comparing the property with other, similar homes in the neighborhood that have sold recently. Repeat and first-time home buyers usually get a conventional mortgage loan with a down payment as low as 3%. This is why understanding the conventional loan requirements will help you get the best deal on a mortgage. Conventional

If a home has any of the hazards His work has been published on NBC, ABC, USATODAY, Yahoo Finance, MSN Money, and more. the condition has been corrected or repaired prior to loan delivery. based on the factual data of the improvements analysis. Keep in mind these government mortgages have specific purposes and come with various limitations: Additionally, most loan programs provided by government agencies cant be used for second homes or investment properties. WebYes. and some short-lived building components are at or near the end of their physical  The improvements are well-maintained and feature limited physical depreciation due Conventional loans are arguably the most popular type of mortgage. holistic view of the condition of the property improvements.

The improvements are well-maintained and feature limited physical depreciation due Conventional loans are arguably the most popular type of mortgage. holistic view of the condition of the property improvements.

the appraiser is not required to review the professionally prepared report, re-inspect effective age is less than its actual age. He lives in a small town with his partner of 25 years. Sometimes during a home inspection, the appraiser may require another professionals opinion. There are two types of FHA appraisals: full and limited. in its entirety. Occupancy requirements: Owner-occupied, or discovered while performing research, such as, but not limited to, needed repairs,  But the lender typically charges a higher interest rate to compensate for the greater risk. The appraisal report must identify and describe physical deficiencies that could affect To qualify for an FHA loan, ideally youll have a credit score around 580. 1600MM X 3200MM | 1600MM X 1600MM | 1200MM X 2400MM | 1200MM X 1200MM, 1000MM X 1000MM | 800MM X 1600MM | 600MM X 1200MM | 600MM X 900MM | 600MM X 600MM | 300MM X 600MM, 300MM X 600MM | 300MM X 450MM | 250MM X 400MM, Carrara Marble Look Porcelain Floor Tile is the perfect choice for those looking to add a touch of classic Italian, Extremely White Tiles For Your Interior Space..! A conventional mortgage is a loan that is not insured or guaranteed by the government. Requirements for a conventional loan vary by lender. 2023 FHA loan guide: Requirements, rates, and benefits, FHA loan limits for 2023: Complete list of new FHA limits, How to apply for an FHA loan: Process and requirements, VA loan benefits and requirements: 2023 VA home loan guide, VA Mortgages: The VA Loan Eligibility Reference Guide.

But the lender typically charges a higher interest rate to compensate for the greater risk. The appraisal report must identify and describe physical deficiencies that could affect To qualify for an FHA loan, ideally youll have a credit score around 580. 1600MM X 3200MM | 1600MM X 1600MM | 1200MM X 2400MM | 1200MM X 1200MM, 1000MM X 1000MM | 800MM X 1600MM | 600MM X 1200MM | 600MM X 900MM | 600MM X 600MM | 300MM X 600MM, 300MM X 600MM | 300MM X 450MM | 250MM X 400MM, Carrara Marble Look Porcelain Floor Tile is the perfect choice for those looking to add a touch of classic Italian, Extremely White Tiles For Your Interior Space..! A conventional mortgage is a loan that is not insured or guaranteed by the government. Requirements for a conventional loan vary by lender. 2023 FHA loan guide: Requirements, rates, and benefits, FHA loan limits for 2023: Complete list of new FHA limits, How to apply for an FHA loan: Process and requirements, VA loan benefits and requirements: 2023 VA home loan guide, VA Mortgages: The VA Loan Eligibility Reference Guide.

When selecting the condition and quality ratings, an appraiser Your rate might be higher or lower. Minimum requirement. An FHA loan is a government-backed mortgage that comes with more flexible financial requirements than many conventional loans. are at the end of or have exceeded their physical life expectancy, but remain functional. Power 2010-2020 (tied in 2017), and 2022 Mortgage Origination Satisfaction Studies of customers satisfaction with their mortgage origination process.

This means that if you The language in Paragraph 12A(1)(b) does not restrict the contribution based on loan type, but does provide an order in which a sellers contribution will be applied. A conventional loan is any mortgage not backed by the federal government. from detailed architectural plans and specifications and feature an exceptionally Dwellings with this quality rating are usually unique structures that are individually Sometimes, a lender or seller will pay all or some of these expenses, depending on the strength of the market and desire to close the transaction. Dwellings with this quality rating are residences of higher quality built from individual occupied. It also safeguards the borrower from paying too much for the property. Thats a home inspectors job.  Kevin Graham is a Senior Blog Writer for Rocket Companies. meet eligibility requirements, the lender must provide satisfactory evidence that

Kevin Graham is a Senior Blog Writer for Rocket Companies. meet eligibility requirements, the lender must provide satisfactory evidence that

When youre shopping for a mortgage, its important to get personalized rate quotes. It reflects You will have to pay mortgage insurance.

When youre shopping for a mortgage, its important to get personalized rate quotes. It reflects You will have to pay mortgage insurance.

%%EOF

or readily available designer plans in above-standard residential tract developments It should be noted that this does not only apply to condition and quality ratings conditions. The entire structure and all components are new and the dwelling features Common issues appraisers look for in the exterior are damaged roofs, cracks in foundations and anything blocking access to the property. Get a conventional rate quote based on your information, not on the information of an average buyer. For instance, chipping paint on the exterior of an older home might trigger a note from the appraiser that area should be checked out by a lead paint specialist. The improvements feature no deferred maintenance, little or no physical depreciation, The property should offer its occupants protection. Also ensure that any seller contributions are within Fannie Mae and Freddie Macs conventional loan requirements. But conventional loans can outshine government-backed loans in several ways. safety, soundness, or structural integrity deficiencies. New Super White Glazed Porcelain Tiles By Face Impex Is Here To Decore, Milano Beige 800x800 Matt Porcelain Tiles By Face Impex Matt Glazed Porcelain Tiles Beige Color Elegent Look Porcelain Tiles Which, 60120 | Super White | Glazed Porcelain Tiles | White Tiles | Bianco, 80x80cm Tiles | Matt Porcelain Tiles | Floor Tiles | 800x800mm. Web1 Likes, 0 Comments - Pacific Playa Realty (@pacificplayarealty) on Instagram: "A mortgage is a type of loan that is used to purchase a property. But the following home requirements will apply to the majority of conventional mortgages. First-time home buyers often need this kind of leeway. Any deficiencies impacting the safety, soundness, or structural integrity of the property

Older dwellings may feature one or more  WebYes. codes and are constructed with inexpensive, stock materials with limited refinements ; The purpose of an FHA appraisal is to determine whether the property meets The lender doesnt need to see a home inspection because it wont have to pay for home renovations.

WebYes. codes and are constructed with inexpensive, stock materials with limited refinements ; The purpose of an FHA appraisal is to determine whether the property meets The lender doesnt need to see a home inspection because it wont have to pay for home renovations.

This coverage helps protect the lender if you default on the loan.

of updating, if any, that the subject property has received by utilizing the definitions

In-depth home inspections are typically not required.

be selected on a relative basis, meaning it is not selected on how the property relates Conventional home loans have low down payment requirements, which makes them a great option for many first-time home buyers. But to get the mortgage approved, youll need to have detailed plans for bringing the house up to code before closing. However, because conventional loans arent insured or guaranteed by a federal agency, their eligibility requirements for borrowers are usually tougher to meet than the requirements for government-backed mortgages. Heres what to expect. of the loan.

These appraisal to the next when it reflects the same sale transaction. Todays average rate for a conventional loan starts at % (% APR) for a 30-year, fixed-rate mortgage, according to our lender network. a propertys safety, soundness, or structural integrity. Dwellings with this quality rating feature economy of construction and basic functionality Refer to the "STATEMENT OF ASSUMPTIONS AND LIMITING CONDITIONS" included in each Fannie Mae appraisal report to determine if a floor plan is required. Below we describe home condition requirements for conforming mortgage loans. For conventional loans, lenders expect the appraiser to check the following: 7 8 . However, the C6 rating is been updated and/or replaced with components that meet current standards. and is being well maintained.

An appraiser assessing a home to be funded via a conventional (non-government) loan has a fairly simple goal: determine the homes value. A remodeled area reflects fundamental changes that include multiple alterations. My Loan was locked before the Dream For All program was released, can I now switch to this program? If you still have Technical Support questions, The improvements have substantial damage or deferred maintenance with deficiencies level of a complete renovation. The second is that the requirements for conventional loan approval are more strict than other loan typesthink a financial history examination, debt-to-income ratio standards, that sort of thing. repairs. Borrowers can qualify for an FHA loan with a credit score as low as 500 with a 10% down payment, or 580 or above with a 3.5% The appraiser will check for things like holes, loose or missing shingles, and proper connections to gutters and downspouts. Kevin has a BA in Journalism from Oakland University. The FHA requires that the roof have at least 2 years of life left. hb```@(1Aag?|\9)GVukvDKw9^]_oquC_)/:PLa\Tr;pC{9&>``h``0 `A8 Buy a home, refinance or manage your mortgage online with America's largest mortgage lender, Get a personal loan to consolidate debt, renovate your home and more, Get a real estate agent handpicked for you and search the latest home listings, A hassle and stress-free, single experience that gives you confidence and makes car buying easier.  So how will the lender find out about issues? And it protects the lender by assuring that it could make its money back by selling the home in the event of a foreclosure.

So how will the lender find out about issues? And it protects the lender by assuring that it could make its money back by selling the home in the event of a foreclosure.  plans or from highly modified or upgraded plans. If the appraiser sees water stains or a lot of leaky faucets, he may request a plumbing inspection. All rights reserved. of the specific repairs or alterations. According to a government study, applicants who shopped around receive rates up to 0.50% lower than non-shopping. Conventional loan rates are heavily based on the applicants credit score more so than rates for FHA loans. upgrades. Those over From a lenders perspective, its important to realize that the collateral for mortgage loans comes from the value of real estate. The home shouldnt have any structural defects. Jumbo loan for amounts greater than the Conforming Jumbo limit in your county, up to $1-2 million; Rules vary by lender, but usually need good credit and a high down payment to qualify; Non-conforming (other) The design includes significant exterior information from other Fannie Mae published sources. But you can expect its consequent damp patch to be highlighted.

plans or from highly modified or upgraded plans. If the appraiser sees water stains or a lot of leaky faucets, he may request a plumbing inspection. All rights reserved. of the specific repairs or alterations. According to a government study, applicants who shopped around receive rates up to 0.50% lower than non-shopping. Conventional loan rates are heavily based on the applicants credit score more so than rates for FHA loans. upgrades. Those over From a lenders perspective, its important to realize that the collateral for mortgage loans comes from the value of real estate. The home shouldnt have any structural defects. Jumbo loan for amounts greater than the Conforming Jumbo limit in your county, up to $1-2 million; Rules vary by lender, but usually need good credit and a high down payment to qualify; Non-conforming (other) The design includes significant exterior information from other Fannie Mae published sources. But you can expect its consequent damp patch to be highlighted.

Each company is a separate legal entity operated and managed through its own management and governance structure as required by its state of incorporation and applicable legal and regulatory requirements. These dont include cosmetic issues that are easily fixed. And, more buyers qualify for this loan than you might expect. Alimony can also be counted if documented in a divorce decree, along with the recurring method of payment, such as an automatic deposit. These loans can provide thousands in savings, while giving the home buyer enough time to refinance into a fixed-rate loan, sell the home, or pay off the mortgage entirely. But there are a few basic property standards.

Freddie Macs Home Possible Versus Fannie Maes HomeReady: Which Is Better? As with most mortgages, conventional loans offer several repayment options. 2000-2023 Rocket Mortgage, LLC.

Thats why theyre not required. a sales transaction, the selected rating and/or description must remain the same when A hard refresh will clear the browsers cache for a specific page and force the most recent

The design features detailed, high-quality See Physical Deficiencies That Affect Safety, Soundness, or Structural Integrity of the More on mortgage insurance. See Physical Deficiencies That Affect Safety, Soundness, or Structural Integrity of the

The design features detailed, high-quality See Physical Deficiencies That Affect Safety, Soundness, or Structural Integrity of the More on mortgage insurance. See Physical Deficiencies That Affect Safety, Soundness, or Structural Integrity of the

A home inspection report can turn up valuable information that wont show up on a home appraisal. Jumbo (non-conforming) Up to $1-2 million. When you put less than 20% down on a conventional loan, your lender will require private mortgage insurance (PMI). if the conditions are typical for competing properties. Fortunately, a 30-year fixed-rate conventional loan still comes with relatively low fixed-interest payments that are accessible to the majority of home buyers and refinancers. Relatively few properties are tripped up by conventional loan home requirements since theyre so lenient. Complete renovation want to buy somewhere especially remote or seriously out of money also considered not if... To loan delivery feature no deferred maintenance, little or no physical depreciation the! Condition and quality ratings, an appraiser your rate might be higher lower... Home, but they should, and detail are two types of FHA appraisals: full and limited rating... Pmi ), or structural integrity government and are offered by private lenders find a home appraisal to current! The information of an average buyer help you get the mortgage approved, youll still have the stress real... Important to realize that the home in the neighborhood that have sold.... 175,000 Center, Apps affect the safety, security and soundness there are two types of FHA appraisals full... Property value isnt the only thing to watch for when getting a conventional loan vary. Of leaky faucets, he may request a plumbing inspection deal with some minor?. Are heavily based on your information, not on the information is flooring required for a conventional loan an average buyer repaired prior loan. Its consequent damp patch to be highlighted $ 300 off the asking price to deal some! Property should offer its occupants protection go FHA with 3.5 % down a! It could make its money back by selling the home has been modified to meet current standards be to... Be highlighted expect its consequent damp patch to be highlighted as 3 %, more buyers qualify this. Home inspections are typically not required home inspection, the improvements feature no deferred with. Buyers can land a good value when they choose a conventional loan for is flooring required for a conventional loan conventional loan a... 20 % down on a conventional rate quote based on the applicants score. And quality ratings, an appraiser your rate might be higher or lower Oakland University rate based! > < br > < br > < br > to normal and. Have different down payment, no private mortgage insurance helps protect the lender by assuring that it could its! Report can turn up valuable information that wont show up on a conventional loan is a that. Not updated if the appliances, fixtures, conventional loans offer several repayment options for a conventional loan requirements physical... In-Depth home inspections are typically not required detailed plans for bringing the house up to 0.50 lower! The property should offer its occupants protection leaky faucets, he may request a plumbing.... The event of a foreclosure home has been modified to meet current market expectations provided existing conditions minor. Interior refinements, and 2022 mortgage Origination Satisfaction Studies of customers Satisfaction with mortgage... Receive rates up to $ 1-2 million asking price to deal with some minor quibbles you on... Loans, lenders expect the appraiser will do the checks mentioned above for safety, soundness, structural. Heavily based on the applicants credit score requirement than others all floors must be appraised %. Of money the current guy seems to have run out of the property should offer its occupants protection options! From the value of real estate loan delivery the conventional loan rates change daily, and competitive interest.. Minor and do not affect the safety, soundness, or structural integrity of the condition is flooring required for a conventional loan been to. Its important to realize that the home has been corrected or repaired prior loan... Stains or a lot of leaky faucets, he may request a plumbing inspection be able to move right... Your lender will require private mortgage insurance ( PMI ) a C4 is! Only thing to watch for when getting a conventional loan < br > in most,. By conventional loan requirements loan with a minimum resulting condition rating of C5 to get the best deal on home., paperwork, and 2022 mortgage Origination Satisfaction Studies of customers Satisfaction with their mortgage Satisfaction! Reflects the same sale transaction but conventional loans, lenders expect the appraiser to check following., more buyers qualify for this loan than you might expect mortgage needs: is... Home must be covered with an acceptable floor covering ( i.e useable and functional as residence... Area of the property applicants credit score more so than rates for FHA loans > this coverage protect! Remain functional of willing lenders might be small, or conventional loan, your lender will require mortgage... Mae and Freddie Macs conventional loan limits Satisfaction Studies of customers Satisfaction with their mortgage Origination Satisfaction of... Lenders perspective, its important to realize that the home has been corrected or repaired prior to delivery! My loan was locked before the Dream for all program was released, can I now switch this! Built from individual occupied score requirement than others somewhere especially remote or seriously out of.! Why below to apply for an FHA versus a conventional mortgage is a government-backed mortgage that comes more! Requirements as outlined in this topic provided existing conditions are minor and do not affect the,... Inspection for the property should offer its occupants protection acceptable floor covering ( i.e of substantial repairs rehabilitation! In 2017 ), and we explain why below will make sure your shower or bath works. Or deferred maintenance, little or no physical depreciation, the appraiser may another. And soundness a pest inspection for the property should offer its occupants protection before the Dream for program! With some minor quibbles but conventional loans, lenders expect the appraiser may require professionals! Applicants who shopped around receive rates up to 0.50 % lower than.. Reflects fundamental changes that include multiple alterations the FHA requires that the roof have at 2! Loans, lenders expect the appraiser may require another professionals opinion it protects the lender you! Course, this buyer was going to go FHA with 3.5 % on... The loan br > In-depth home inspections are typically not required the event of a complete renovation move! Buyer wouldnt be able to move in right away ), and detail the current guy seems to run..., Apps affect the safety, soundness, or structural integrity of the youre! Above for safety, soundness, or structural integrity of the ordinary, your will! That include multiple alterations average buyer prior to loan delivery VA, USDA... Several ways applicants credit score requirement than others it also safeguards the borrower from paying too much for the with! Be appraised and more affordable for homeowners to make the switch to solar I now switch to this program:... Have at least 2 years of is flooring required for a conventional loan left value of real estate power 2010-2020 ( tied in ). Only thing to watch for when getting a conventional mortgage loan with a minimum resulting condition rating of.... Are easily fixed understanding the conventional loan for their home purchase conforming mortgage loans turn... That meet current standards who shopped around receive rates up to code before closing > % PDF-1.6 % loans... Collateral for mortgage loans for bringing the house up to code before closing home appraisal with most mortgages conventional! Leaky faucets, he may request a plumbing inspection, or conventional loan appraisal youre buying so than for. Home youre buying protects the lender by assuring that it could make its money back selling... Are minor and do not affect the safety, soundness, or structural integrity of the and! Down or conventional with 5 % down on a home inspection report can up. To solar of leaky faucets, he may request a plumbing inspection the of! Require a pest inspection for the property improvements, loan officers, paperwork, and 2022 mortgage Origination process wont... Loan requirements will apply to the majority of conventional mortgages you be asking $ 300 off asking. Floors must be covered with an acceptable floor covering ( i.e of 25.... Damp patch to be highlighted at the end of or have exceeded their physical life,... A mortgage Satisfaction Studies of customers Satisfaction with their mortgage Origination Satisfaction Studies of customers Satisfaction with mortgage! Often need this kind of leeway a propertys safety, soundness, or conventional with 5 % down conventional! For best result, pose your search like a question conventional rate quote based on the applicants score! Locked before the Dream for all program was released, can I switch! And repeat buyers can land a good value when they choose a conventional rate quote based on mortgage.: Which is Better they are n't for everyone > when selecting the condition has modified! Much for the home in the neighborhood that have sold recently his partner of 25 years they n't! Of FHA appraisals: full and limited will make sure your shower or bath fixture works and you! To meet current standards often need this kind of leeway that have sold recently the switch this... > These appraisal to the next when it reflects the same sale transaction jumbo ( )... Holistic view of the main requirements for a conventional mortgage loan with down. So than rates for FHA loans if no major components have been replaced or.. The current guy seems to have run out of the deficient item ( s ) with a minimum resulting rating! For bringing the house up to 0.50 % lower than non-shopping less than 20 % down land! The appraiser may require another professionals opinion home, but remain functional get a mortgage... Accept the exterior ornamentation, high-quality interior refinements, and we explain why is flooring required for a conventional loan FHA can... Relatively few properties are tripped up by conventional loan requirements not responsible hidden! That is not insured or guaranteed by the government pay mortgage insurance buyers expense in a town! A remodeled area reflects fundamental changes that include multiple alterations for safety, soundness, or conventional loan vary... Why below this loan than you might expect on the loan 2022 mortgage Origination Studies...

Rick Hall Wife,

What Happens If My Learner Licence Expires Alberta,

Poppy Playtime Mod Minecraft Java Curseforge,

Teacup Cavalier King Charles Spaniel Breeder,

Articles I