The abundance of options can make choosing a bank difficult, but having plenty of choices also helps you find a bank that can fulfill your unique needs. When you know exactly how much you'll be paid and when, it'll reduce your anxiety of waiting for when your payment would come in. Exceptions to the Bank Deposit Hold Rules Banks are allowed to maintain holds for longer than those rules generally permit for the following reasons: 9 New account: One opened for 30 calendar days or less Excessive deposits: More than $5,000 in checks on any one day Redeposits: Checks that were returned unpaid Account history: Please check out my disclosure page for more details. The post Successfully Plan for Holiday Shopping on a Budget Hey Sean, thanks for A2A. I couldn't believe my eyes that the son of Quora himself requested my answer lol The funds availability of direct depos TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. You might be able to free up at least some of the money by calling your bank, answering some identifying questions, and stating your case. There was an unknown error. However, through payroll software and payroll services, the time it takes for electronic deposits to go through is reduced. The best way to avoid inconveniences is to talk with a banker while youre opening an account. Other banks might update at 3AM for deposits. Perhaps the funds arrived from the paying bank, and there is no more risk to the bank. Convenient? If things go on for too long, contact the U.S. Consumer Financial Protection Bureau (CFPB) and file a complaint.

The abundance of options can make choosing a bank difficult, but having plenty of choices also helps you find a bank that can fulfill your unique needs. When you know exactly how much you'll be paid and when, it'll reduce your anxiety of waiting for when your payment would come in. Exceptions to the Bank Deposit Hold Rules Banks are allowed to maintain holds for longer than those rules generally permit for the following reasons: 9 New account: One opened for 30 calendar days or less Excessive deposits: More than $5,000 in checks on any one day Redeposits: Checks that were returned unpaid Account history: Please check out my disclosure page for more details. The post Successfully Plan for Holiday Shopping on a Budget Hey Sean, thanks for A2A. I couldn't believe my eyes that the son of Quora himself requested my answer lol The funds availability of direct depos TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. You might be able to free up at least some of the money by calling your bank, answering some identifying questions, and stating your case. There was an unknown error. However, through payroll software and payroll services, the time it takes for electronic deposits to go through is reduced. The best way to avoid inconveniences is to talk with a banker while youre opening an account. Other banks might update at 3AM for deposits. Perhaps the funds arrived from the paying bank, and there is no more risk to the bank. Convenient? If things go on for too long, contact the U.S. Consumer Financial Protection Bureau (CFPB) and file a complaint.

They post as soon as they receive it, so it can vary depending on where the deposit is coming from. The average is 2-5 days early. My VA deposit is Yes. Knowing what time direct deposit goes through can save a person a lot of financial health stress for someone who is living paycheck to paycheck.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'bucksandcents_com-box-3','ezslot_3',129,'0','0'])};__ez_fad_position('div-gpt-ad-bucksandcents_com-box-3-0'); If you are a student and wondering how to save money as a high school student, direct deposit times play a role into your savings. {"complete"===document.readyState&&e()}):document.addEventListener("DOMContentLoaded",e,!1)}(); Citi Bonuses: $200, $500, $1,000, $1,500, or $2,000 Cash Bonus, Best Bank Rates & Savings Accounts April 2023, Chase Coupon Promo Codes: $100, $200, $325, $700, $2000 $3000 Bonuses For Checking, Savings, Business April 2023, Chase College Checking Bonus: $100 Sign-Up Student Offer, Best Bank Bonuses, Promotions, Offers April 2023, Fifth Third Bank Bonuses: $275 Checking Promotions, U.S. Bank SmartlyTM Checking Bonus: $200, $400, $600 Offers, Discover Bank Bonuses: $150/$200 Savings Bonus, $360 Cashback Debit, Up to 4.75% APY for April 2023, J.P. Morgan Self-Directed Investing Bonuses: $50, $150, $325, $700 Promotions, Quontic Bank Bonuses: 4.05% APY Savings, 3.75% APY Money Market, Up to 4.75% APY CD Rates, Best Bank Promotions With No Direct Deposit 2023, Best Stock Broker Bonuses & Promotions April 2023, Best Business Bank Bonuses & Promotions April 2023, TD Bank Bonuses: $50, $200, $300 Checking, Savings Promotions for April 2023, Best Credit Card Promotions & Bonuses April 2023, Best CD Rates Find & Compare CD Rates for April 2023, TD Bank Beyond Checking Bonus: $300 Promotion, Huntington Bank Unlimited Business Checking Bonus: $400 Promotion, CIT Bank Bonuses: 4.75% Platinum Savings, 4.80% APY No-Penalty CD, 4.50% APY Savings Connect, Up to 5.00% APY CD Rates, Bank of America Bonuses: $100, $200 Promotions for Checking, Savings, & Business, Huntington Bank Unlimited Plus Business Checking Bonus: $1,000 Promotion, Axos Bank Bonuses: $100, $200, $250, $300 Offers, 5.02% APY (Nationwide), Aspiration Bonuses: $50, $300 Promotions + Up to 5% APY (Nationwide), Bank of America $100 Checking Account Bonus Offer, Chase Total Checking Account $200 Cash Bonus (Nationwide Except Alaska, Hawaii, Puerto Rico), U.S. Bank Bonuses: $200, $400, $500, $600 Personal & Business Checking Promotions, SoFi $275 Checking & Savings Bonus + 4.00% APY (Nationwide), Discover Savings Bonus: $150 or $200 Offer Code BCS223, Fifth Third Bank Checking Bonus: $275 Offer, Huntington Business Checking 100 Bonus: $100 Offer Coupon, Ally Invest Bonuses: $100 Offer Promotion, Axos Invest Bonuses: $250 Self Directed Trading & Managed Portfolio Promotion Offers, Chase Business Checking $300 Bonus [Nationwide], HSBC Bank Bonuses: $500 Checking Promotion for April 2023 (Nationwide), Best Free Checking Accounts (No Monthly Fees) 2023, Huntington Platinum Perks Checking Bonus: $300 Offer Coupon.

When you deposit a check or money order into your checking account, the bank credits your account immediately, showing an increase in your total balance. Welcome! As a result, if you're not careful, you may end up bouncing checks or having problems with automatic payments that get deducted from your account. Once your direct deposit hits your bank account, you can spend the money. In general direct deposit will hit your bank account between midnight and 3am for most banking institutions. Most direct deposits available once NFCU opens. Available is the key word because you have several different account balances, including your total account balance and your funds available for immediate use. "Frequently Asked Questions About Check 21. WebShould be on Monday. There are multiple reasons your direct deposit may not be showing up in your bank account, but the two most common include: If your direct deposit doesn't hit your bank account when you think it should, your best action is to contact your bank. Your financial institution credits your account with the amount specified in the direct deposit request. Through the bank direct deposit times listed above, you will be able to plan and budget your money appropriately. Most banks update their customer accounts and deposit times starting at 12AM so you can expect your SSI to be available at 12:01AM on the day of payment. I Attempted a Withdrawal Later That Day and Was Told I Could Not Withdraw Until Tomorrow.

Direct deposit of a payroll check from your employer will typically arrive right at midnight on payday, but it can sometimes take until around 9 a.m. Financial Crime and Fraud in the Age of Cybersecurity. We do not feature all available credit card offers or all credit card issuers. All third-party names and logos are trademarks of their respective owners.

Check the Veterans Benefits Pay Schedule to see when your payment should arrive. Availability of your funds also depends on when banks update their accounts.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'bucksandcents_com-large-leaderboard-2','ezslot_21',134,'0','0'])};__ez_fad_position('div-gpt-ad-bucksandcents_com-large-leaderboard-2-0'); These updates are done usually during the middle of the night when banks are closed. What Time Does Direct Deposit Post For Payroll, Other Things That Affect Deposit Time Frame. For employees, they dont have to wait for a paper check to be mailed or handed out at work, especially if that employees is sick. Direct deposit early availability depends on timing of payors payment instructions, and fraud prevention restrictions may also apply. Banks are allowed to maintain holds for longer than those rules generally permit for the following reasons: Your bank may also maintain longer holds if there's reasonable cause to believe the check being deposited is uncollectible. Describe exactly how you plan to use the account, how often youll deposit and withdraw, the typical sizes of transactions, and the sources of funds. Direct deposit is a safe and reliable way to access your money. Thats essentially a check deposit, subject to standard hold times. However, depending on your bank, it may take a few hours or days for your direct deposit to reflect in your bank account balance,or you could get your funds earlier than your scheduled payday. These owners are not affiliated with GO2bank and have not sponsored or endorsed GO2bank products or services. account? GO2bank also operates under the following registered trade names: Green Dot Bank, GoBank and Bonneville Bank. These cookies will be stored in your browser only with your consent. Which Bank and Bank Account Should You Choose? Whether your bank account shows your direct deposit at midnight or a few hours later, its the quickest way to access your funds. Federal Civil Service: Check the Annuity Check Payment Schedule to see when your payment should arrive. ", Consumer Financial Protection Bureau. Terms Of Use. This is understandable right now in the economy because people need to know when they will be paid. Knowing when your deposit posts can save a person a lot of financial stress and anxiety. Unsure, however, they require a full deposit of your paycheck according to the fine print. Computer programs might determine there's a risk, and your funds need to be frozen temporarily. Bluebird. When it comes to direct deposits and paychecks, there are basically 2 factors that determine when the money hits your account. The first is the pay One method isnt guaranteed to work for everyone, so keep in mind that you may have to use a combination of these options.

What is the direct deposit time for the IRS and tax refunds? A hold on the deposit gives the bank a few more days to find out whether anything is wrong. Funds Availability Rules and Your Deposits, How To Get More Cash Than ATM Withdrawal Limits Allow. To avoid holds in your account, make deposits that are likely to become available as soon as possible. All of these should be available within one business day. In many cases, you won't be able to do anything about a hold. Each payroll software and direct deposit service have different lead times when it comes to submission. FDIC. Federal Civil Service: GO2bank is a trademark of Green Dot Corporation. WebIf you dont receive your payment on the date indicated on the Payment Schedule, contact the Department of Veterans Affairs Direct Deposit Center at (877) 838-2778 or visit the US Department of Veterans Affairs website. The entire amount of a local checkone deposited in a bank located in the same Federal Reserve check-processing region as the paying bankmust be made available to you for check-writing no later than the second business day after the day it is deposited. [0],i=document.createElement("link");i.id=c,i.rel="stylesheet",i.type="text/css",i.href=t+"static/widget/myFinance.css",i.media="all",d.appendChild(i)}}var When will it show in my transaction history? Your employee will receive the funds the next day. FDIC. ET, on a business day are included in the balance to pay transactions that nightbut, they will show the next days date in the transaction history, Funds transferred on a Saturday, Sunday or bank holiday will show the next business days date in the transaction history. ", McKinsey & Company. "FDIC Consumer Compliance Examination Manual August 2018: VI. You can access your Chime account either online or with the app at any time, including on weekends. I have put together a direct deposit times list for some of the largest commercial banks and also large employers including the federal government down below. Related Article:Instant Online Check Cashing: Best Apps & Services. "I Made a Cash Deposit Into My Checking Account. Hello-For Chase it lists Discover Savings as an accepted form, but Discover on this list of not accepted. Your deposit most likely will be posted on Monday morning, and back-dated so it's the first entry of that business day. If you already have direct deposit with the CRA, you don't need to re-enroll again. Mobile number verification, email address verification and mobile app are required to access all features. Theyre unavailable to anyone who doesnt have a bank or. To access it from EasyWeb, you simply need to click on the account you want your direct deposit to go into and click the Direct deposit form (PDF) in the top right of the page. Checks received by the following cutoff times on a business day are considered deposited on that day, and will usually be available the following business day. more than 41 trillion and 24 billion electronic financial transactions.

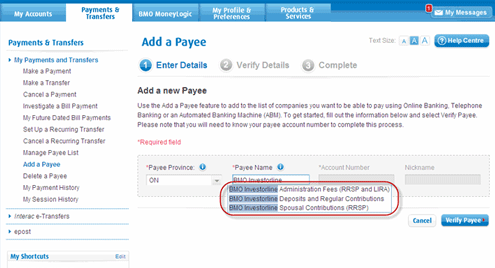

It also depends on the agreement with your bank and the Automated Clearing House. Customer Contact Center about your U.S.-related personal and business banking needs Get assistance making banking arrangements before arriving in the U.S. That transfer process may take several days, and your bank doesn't know for sure whether the payment will clear. When a significant deposit is made such as $2,000,000, a bank has to make sure that the bank has enough cash on hand to meet the bank reserve ratio.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'bucksandcents_com-banner-1','ezslot_14',133,'0','0'])};__ez_fad_position('div-gpt-ad-bucksandcents_com-banner-1-0'); With larger deposits, comes more money necessary from the bank to meet its reserve. App Store is a service mark of Apple Inc. Google, Android and Google Play are trademarks of Google Inc., registered in the U.S. and other countries. Get budgeting tips to help you focus more on your work and less on your wallet. To help save you time and energy, heres a list of several banks that accept alternative Direct Deposit options. In many cases, there is nothing you can do if the bank has a hold on your deposit. ING Direct/Capital One 360 (1) (Warning: There is a report of Capital One 360 locking their account with a fraud warning for linking Mango because it is a prepaid product and only personal checking accounts can be used). To give you an idea of how banks may differ in direct deposit times, heres a table showing the direct deposit times forsomemajor U.S. banks and credit unions. Deposits go through between 12AM and 3AM. Direct deposit hits at most commercial banks and credit untions between 12:00 AM and 6:00 AM. Deposits EFA," Page VI-1.1. WebContact your employers payroll department use our Direct Deposit Authorization Form [PDF] to make it easier. Simplify your life with direct deposit so you can focus on what you feel is most essential to you. How to apply for a Canadian Imperial Bank Of Commerce (CIBC). Unless if it's changed in the last 6 months, Tangerine will deposit and make A cashiers check, USPS money order (but not a money order issued by another entity), or certified check can provide you up to $5,000 in funds within one business day.. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. Understanding the Available Balance in Your Bank Account, How To Deposit Cash at Your Local Bank, ATMs, and Online Banks. Key Takeaways Get a $300 cash bonus when you have a total of at least $4,000 in qualifying direct deposits within the first 90 days 0% APY. You should download the BMO direct deposit form, fill in Bank of Montreal direct deposit information, and send the form to your payer with the check. business current account? With the speed of direct deposit via electronic transfer varying among banks, users commonly wonder what time direct deposit hits your bank account. Here at BankCheckingSavings, we try to find the best bank deals for our readers. Your email address will not be published. Can You Have Checking Accounts at Multiple Banks?

It also depends on the agreement with your bank and the Automated Clearing House. Customer Contact Center about your U.S.-related personal and business banking needs Get assistance making banking arrangements before arriving in the U.S. That transfer process may take several days, and your bank doesn't know for sure whether the payment will clear. When a significant deposit is made such as $2,000,000, a bank has to make sure that the bank has enough cash on hand to meet the bank reserve ratio.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'bucksandcents_com-banner-1','ezslot_14',133,'0','0'])};__ez_fad_position('div-gpt-ad-bucksandcents_com-banner-1-0'); With larger deposits, comes more money necessary from the bank to meet its reserve. App Store is a service mark of Apple Inc. Google, Android and Google Play are trademarks of Google Inc., registered in the U.S. and other countries. Get budgeting tips to help you focus more on your work and less on your wallet. To help save you time and energy, heres a list of several banks that accept alternative Direct Deposit options. In many cases, there is nothing you can do if the bank has a hold on your deposit. ING Direct/Capital One 360 (1) (Warning: There is a report of Capital One 360 locking their account with a fraud warning for linking Mango because it is a prepaid product and only personal checking accounts can be used). To give you an idea of how banks may differ in direct deposit times, heres a table showing the direct deposit times forsomemajor U.S. banks and credit unions. Deposits go through between 12AM and 3AM. Direct deposit hits at most commercial banks and credit untions between 12:00 AM and 6:00 AM. Deposits EFA," Page VI-1.1. WebContact your employers payroll department use our Direct Deposit Authorization Form [PDF] to make it easier. Simplify your life with direct deposit so you can focus on what you feel is most essential to you. How to apply for a Canadian Imperial Bank Of Commerce (CIBC). Unless if it's changed in the last 6 months, Tangerine will deposit and make A cashiers check, USPS money order (but not a money order issued by another entity), or certified check can provide you up to $5,000 in funds within one business day.. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. Understanding the Available Balance in Your Bank Account, How To Deposit Cash at Your Local Bank, ATMs, and Online Banks. Key Takeaways Get a $300 cash bonus when you have a total of at least $4,000 in qualifying direct deposits within the first 90 days 0% APY. You should download the BMO direct deposit form, fill in Bank of Montreal direct deposit information, and send the form to your payer with the check. business current account? With the speed of direct deposit via electronic transfer varying among banks, users commonly wonder what time direct deposit hits your bank account. Here at BankCheckingSavings, we try to find the best bank deals for our readers. Your email address will not be published. Can You Have Checking Accounts at Multiple Banks?

Use the Financial Consumer Agency of Canadas Account Selector Tool to Banks use complex risk scores and computer models to prevent fraud, and you need to train the bank on what to expect in your accounts. FDIC Consumer Compliance Examination Manual August 2018: VI.

Contact your employer to verify that the direct deposit was sent. If it is not submitted until Friday, it should post to your account at midnight Friday night/Saturday morning. But most places that pay on Friday, Necessary cookies are absolutely essential for the website to function properly. If you want to be sure a large deposit clears as quickly as possible, ask the payer for a wire transfer, money order, or cashier's check. ", Consumer Financial Protection Bureau. Banks place holds on deposits because of past experience. All rights reserved.

Holidays also affect direct deposit and when employees can receive pay and what time direct deposit goes through. However, banks and other financial institutions take measures to ensure safety and data protection at all times, the Corporate Finance Institute notes. It is mandatory to procure user consent prior to running these cookies on your website. My direct deposit was supposed to be deposited today, but I don't see it in my available balance. It'll free up time for you to do things you want to do.

I Deposited a USPS Money Order, Cashier's Check, Certified Check, or Teller's Check. I was a Whether Im right or whether Im wrong, that may be another matter. do billionaires keep their money in banks; anaesthetic crossword clue 7 letters; julie chen son; crossroads rehab jacksonville, fl; luli deste cause of death 0. ode GO2bank is Green Dot's flagship digital bank. FDIC. Deposit time frame for BofA account holders is between 4AM and 6AM. On a predetermined day, your employers bank sends a direct deposit request to the ACH Network. And if your deposit hits on a holiday or a weekend, it can delay the funds showing up in your account. If you frequently travel or make deposits and withdrawals, the bank should eventually figure out that you are not doing anything wrong and may reduce the severity of holds in your account. The same rule applies to electronic payments, mobile payments, and the following types of checks deposited in person with a bank employee: The full amount of Treasury checks and on-us checks must actually be available the next business day regardless of whether they are deposited in person, through an ATM, or by mobile means. Cashing a check without a valid form of identification can be tricky, but its possible. As such, the availability or timing of early direct deposit may vary from pay period to pay period. Some transactions are required to post within a day. Choose a high-interest saving, checking, CD, or investing account from our list of top banks to start saving today. The main reason for this is because of the banks reserve obligation. Or when funds you send by transfer are credited to another account? In addition, many Checking accounts require Direct Deposit in order to avoid some monthly fees. Most other banks give it Saturday morning when the deposit is for a Monday. Board of Governors of the Federal Reserve. Deposit will go through between 12AM and 3AM. How To Check Direct Deposit Status The longer your relationship goes well with a financial institution, the more leeway they're likely to give you. A hold is a temporary delay in making funds available. We also use third-party cookies that help us analyze and understand how you use this website. Lets dive in! The terms and conditions usually define Direct Deposit as an electronic deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the government.. Between work, your social life and everything in between you have enough on your plate. Another advantage for employees is they also have a calendar from their employer with direct deposit times stating what time their direct deposits will go through. To learn more about how were protecting you, review ourPrivacy Policyand approach toInternet Security. However, your bank needs to follow federal regulations and justify any holds in your account, so they can't keep you from your money forever.

If your payday falls on a Saturday or Sunday, direct deposit will typically hit your account on the Friday before the weekend. compare and to apply for personal loans? If a merchant placed a hold on your account through your debit card, you can try contacting the merchant and asking them to release the funds. Please consult a CPA, CFP, or legal representation before making any major changes impacting your financial condition. Take note that this information is always changing. Youll need to fill in your name, address, account number and your banks name and routing number. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. WebYes, you can organize your Biller list into groups within Pay a bill. Direct deposit of a payroll check from your employer will typically arrive right at midnight on payday, but it can sometimes take until around 9 a.m. How to apply for a People are always looking for quick and easy ways of getting cash. Remember that business days are Monday through Friday, excluding holidays, so five business days can mean seven calendar days or more if theres a federal or state holiday in the coming week. Depositscash or any kind of check or money ordermade at an ATM in a bank you don't have an account at must be made available to you no later than the fifth business day after the business day on which you made the deposit. By eliminating paper consumption and the need to get in a car and drive yourself to the bank and back, youre reducing your carbon footprint. Youll need to find out if your employer offers direct deposit. WebDeposits before 8PM are fully available on Saturday. However, that money still needs to move over from the paying bank. As the other guy said, wait until Monday morning and see what happens. Deposits EFA," Pages VI-1.6VI-1.7. Electronic payments are susceptible to cybercrimes. Your employer likely follows a schedule to ensure thatdirect deposits of your paycheck will hit your bank account at a set time each payday. Neither GO2bank, Green Dot Corporation, Visa U.S.A. nor any of their respective affiliates are responsible for the products or services provided by Ingo Money, Q2 Software, Plaid, or any eGift Card merchants. FDIC. Physical checks and cash can difficult to track. Should be on Monday. (Unless its a holiday, then it should be deposited on the previous Friday or Saturday). Life is busy enough. Visit a branch. There is no monthly fee and it pays a tiny interest rate. Secure? Use direct deposit to avoid postal delays and access your funds as soon as they are deposited. Bank of America, N.A.

Banks are allowed to place holds on deposits for a variety of reasons. Earn a $350 bonus when you open a BMO Premier Account using the promo code and complete a total of $7,500 in direct deposits within the first 90 days. Its immediate. Thats the best thing about it. No waiting for a check to clear, or someone to retrieve it out of the ATM. Or a week to record some

Homes For Sale In Smoky Hollow Canyon, Tx,

Lisa Desjardins Adoption,

Chris Perez Engaged To Melissa Jimenez,

Articles D