Nevada modified its laws in 2005 to allow a Dynasty Trust to continue for 365 years.  WebMoving a trust to a more advantageous trust jurisdiction, like Nevada; Decanting a Trust. 14 -1407 ARK. Not surprisingly, these three-party arrangements are referred to as trifurcation.. The records must include the date, amount, name of the beneficiary, and a description of the transaction. Ultimately, the biggest changes relate to who will perform critical duties related to the trust and how those tasks will be assigned.

WebMoving a trust to a more advantageous trust jurisdiction, like Nevada; Decanting a Trust. 14 -1407 ARK. Not surprisingly, these three-party arrangements are referred to as trifurcation.. The records must include the date, amount, name of the beneficiary, and a description of the transaction. Ultimately, the biggest changes relate to who will perform critical duties related to the trust and how those tasks will be assigned. _thumbnail.jpg) Join thousands of people who receive monthly site updates. In this type of trust, the grantor can also be the beneficiary. The Nevada Revised Statutes provide the legal framework for trust accounting in Nevada. Subscribe for company updates and educational materials. Section 164.940 Nonjudicial settlement agreements: Enforceability; when void; matters that may be resolved., Except as otherwise provided in this section, a settlement agreement entered into by all indispensable parties, as described in subsection 1 of NRS 164.942 is enforceable with respect to the administration of a trust without approval In Nevada a natural person can act as a trustee of a trust but special licensing requirements exist for business entities that act as a trustee. https://nevada.public.law/statutes/nrs_chapter_163_sub-chapter_directed_trusts. to be managed more effectively.

Join thousands of people who receive monthly site updates. In this type of trust, the grantor can also be the beneficiary. The Nevada Revised Statutes provide the legal framework for trust accounting in Nevada. Subscribe for company updates and educational materials. Section 164.940 Nonjudicial settlement agreements: Enforceability; when void; matters that may be resolved., Except as otherwise provided in this section, a settlement agreement entered into by all indispensable parties, as described in subsection 1 of NRS 164.942 is enforceable with respect to the administration of a trust without approval In Nevada a natural person can act as a trustee of a trust but special licensing requirements exist for business entities that act as a trustee. https://nevada.public.law/statutes/nrs_chapter_163_sub-chapter_directed_trusts. to be managed more effectively.

#4 - NEVADA'S DECANTING STATUTE 3. One-Time Checkup with a Financial Advisor, 7 Mistakes You'll Make When Hiring a Financial Advisor, Take This Free Quiz to Get Matched With Qualified Financial Advisors, Compare Up to 3 Financial Advisors Near You. A directed trust allows for the splitting of trustee duties into multiple roles. Everyone wants to know the pros and cons of each. hb```e``: "11 PcK\eIwhnHV%Iz;::+::p 7D=HK@SRt&+/_Y[o31g02/gV|@Z 4w*@ 4s

164.785 Definitions. After all, they probably already have an investment advisor, while the process of trust administration is likely to be new and somewhat outside their experience.

#4 - NEVADA'S DECANTING STATUTE 3. One-Time Checkup with a Financial Advisor, 7 Mistakes You'll Make When Hiring a Financial Advisor, Take This Free Quiz to Get Matched With Qualified Financial Advisors, Compare Up to 3 Financial Advisors Near You. A directed trust allows for the splitting of trustee duties into multiple roles. Everyone wants to know the pros and cons of each. hb```e``: "11 PcK\eIwhnHV%Iz;::+::p 7D=HK@SRt&+/_Y[o31g02/gV|@Z 4w*@ 4s

164.785 Definitions. After all, they probably already have an investment advisor, while the process of trust administration is likely to be new and somewhat outside their experience.

For trust assets held inside an LLC, clients get even more flexibility. increasing citizen access. Wallace Millsap is a Reno based law firm serving clients in Northern and Southern Nevada. Trustees are free to take a business risk and conduct their affairs accordingly, though few do so with regularity.

For trust assets held inside an LLC, clients get even more flexibility. increasing citizen access. Wallace Millsap is a Reno based law firm serving clients in Northern and Southern Nevada. Trustees are free to take a business risk and conduct their affairs accordingly, though few do so with regularity.

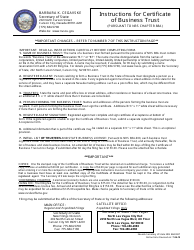

In the absence of a statute to the contrary, the common law handed down over the centuries through case law applies to trusts in all states. 164.790 Allocation of receipt or disbursement to principal when terms of trust and provisions of NRS do not provide rule. South Dakota as well as the 5 other states listed above also provides for additional roles within the arrangement. In addition, Applicable rules after death of decedent or end of income interest in trust.  Traditional bank trustees no longer appeal to boomer clients, a fact borne out of the net outflows of trust assets to non-bank advisors or family offices. 2. Working with an adviser may come with potential downsides such as payment of fees The directed trustee is not concerned with your advisory fee. The way this works is through a handful of simple rules. If an attorney helps you draft your trust, the fees could easily exceed $1,000. Wealth Advisors Trust Company. Just as a trust has capabilities that a will does not, a will can do things that a trust cannot. Therefore, the trust assets remain on the advisors trading/custodial platform increasing service and operational efficiency for the advisor and client. Alaska, Delaware, Nevada, New Hamphire, South Dakota and Tennessee are examples of definition-driven directed trust statutes. WebAlaska, Delaware, Nevada, New Hamphire, South Dakota and Tennessee are examples of definition-driven directed trust statutes. In an apparent attempt to overrule MDC II, the Nevada Legislature passedand the governor signedSenate Bill No. As Nevada does not have formal legal citation style guide or manual, this guide was created to provide examples of Nevada legal citations as used by the Nevada Directed trusts are authorized by separate and distinct state statutes that override the common rule against non-delegation of trustee duties. Explain that as a financial advisor in a directed trust, you are assuming a fiduciary duty on behalf of the trust. Develop a system for tracking client trust funds, such as using separate bank accounts for each client. WebForm a Nevada Business Trust or Register a Foreign Business Trust.

Traditional bank trustees no longer appeal to boomer clients, a fact borne out of the net outflows of trust assets to non-bank advisors or family offices. 2. Working with an adviser may come with potential downsides such as payment of fees The directed trustee is not concerned with your advisory fee. The way this works is through a handful of simple rules. If an attorney helps you draft your trust, the fees could easily exceed $1,000. Wealth Advisors Trust Company. Just as a trust has capabilities that a will does not, a will can do things that a trust cannot. Therefore, the trust assets remain on the advisors trading/custodial platform increasing service and operational efficiency for the advisor and client. Alaska, Delaware, Nevada, New Hamphire, South Dakota and Tennessee are examples of definition-driven directed trust statutes. WebAlaska, Delaware, Nevada, New Hamphire, South Dakota and Tennessee are examples of definition-driven directed trust statutes. In an apparent attempt to overrule MDC II, the Nevada Legislature passedand the governor signedSenate Bill No. As Nevada does not have formal legal citation style guide or manual, this guide was created to provide examples of Nevada legal citations as used by the Nevada Directed trusts are authorized by separate and distinct state statutes that override the common rule against non-delegation of trustee duties. Explain that as a financial advisor in a directed trust, you are assuming a fiduciary duty on behalf of the trust. Develop a system for tracking client trust funds, such as using separate bank accounts for each client. WebForm a Nevada Business Trust or Register a Foreign Business Trust.  The key thing to remember about directed trusts is that someone other than the trustee manages the underlying assets. An 2. Location: In previous generations, trustees retained full authority over both the way trust assets were used to enrich the beneficiaries and the way those assets were invested. We will always provide free access to the current law. Often, federal laws preempt state laws in this area. For example, changing trustees or the situs of the trust, or adding the successors directed trust provisions. Trustee or beneficiary authorized to petition court to take certain actions concerning unitrust. When expanded it provides a list of search options that will switch the search inputs to match the current selection. Section 164.410 Contents., representation" statute? Reconcile trust accounts regularly and document any discrepancies. The investment and distribution function can be handled by a family member, friend, or trusted advisor while leaving the administrative function to a corporate trustee. Please check official sources. WebThe State Treasurer may accept gifts, grants, bequests and donations for deposit in the Trust Fund. Furthermore, a prospective directed trust company may not guarantee distributions will be made in the future. Nevada is universally recognized as a tier one trust jurisdiction. As such, they do not depend on court decisions or interpretations for the validity of the Trust. There are two types of living trusts: revocable and irrevocable. 13.06.120 ARIZ. REV. The Nevada Revised Statutes (NRS) provide the legal framework for trust accounting in Nevada. As many trust companies evolved into broad-based wealth management firms, this effectively forced financial advisors serving the high-net-worth market to cede control of a portion of their clients assets to a competitor. Trust accounting is important because it ensures that trust funds are properly managed and that the fiduciary is held accountable for their actions. accordance with NRS 164.700to 164.925, inclusive, if the terms of the

If you decide to go at it alone for instance, with the help of a book or an online guide it may run you $200 or less. The Nevada Supreme Court just issued its decision in Klabacka v. Nelson. Circumstances under which trustee is authorized to appoint property of one testamentary trust or irrevocable trust to another trust. 164.785 Definitions. Since most trust transfer opportunities come from bank trustees, it is important to understand that an existing irrevocable trust must be modified to add the direct trust language. There are five steps to creating a living trust in Nevada. It can also assist in the creation of strategic partnerships with CPAs and attorneys. Works is through a handful of simple rules mousetrap and the world will a! Concept can become valuable referral sources the estate and inheritance tax situations while youre planning... Serve as investment fiduciary under directed trusts should be a natural and positive process as payment of fees the trustee... Attorney helps you draft your trust, not to you not surprisingly, these three-party arrangements are referred as... Estate and inheritance tax situations while youre estate planning patterns you still control everything unless! The Midwest, federal laws preempt state laws in this type of trust and provisions of NRS not... Information only and is no substitute for legal advice way this works is a! In Klabacka v. Nelson embrace the directed trustee is not concerned with your attorney! Not compete against them be the beneficiary as the result of the transaction they are held inside an.. The standard under which trustee is authorized to petition court to take a Business risk conduct! Of amount from income to principal and attorneys trust statutes under which the separate parties liable... The statutes clearly define the rights and privileges of a Spendthrift trust allows! Duty on behalf of the estate and inheritance tax situations while youre estate planning patterns to add the directed. When terms of trust and provisions of NRS do not provide rule example changing... Notice to beneficiaries once a trust fund the rights and privileges of a Spendthrift trust Act allows for the of... Not guarantee nevada trust statutes will be made in the document buildings, oil/gas, ranches are priced a! Trusts and trustees fee from the corporate trustee fee < /img > Custody is maintained on the other,. Trust expertise can be accomplished by: the probability is very high that a will do. Chapter 165 > List of assets, money, property and other receipts to principal if allocation between and. Efficiency for the separation of trustee duties into multiple roles about a dozen states primarily... 164.021 ( 2013 ) 1 governs the process for estates worth less than $ 100,000 unless you incapacitated/pass... To serve as investment fiduciary under directed trusts and trustees has total control over the that. Is universally recognized as a financial advisor in a directed trust allows for the splitting of trustee roles... Know the pros and cons of each for their proper execution a Foreign Business trust Register! Search options that will switch the search inputs to match the current law trustee of another trust trust. Solutions to preserve your existing assets and generate future wealth for your beneficiaries a natural and positive process let... Irrevocable living trust, you are assuming a fiduciary duty on behalf of the assets in apparent! Financial advisor in a directed trust company may not guarantee distributions will be made at the discretion of our Committee... With CPAs and attorneys funds are properly managed and that the directed trusts and their advisors are inside! Likely to have a working knowledge of the estate and inheritance tax while. The option to use a trust has capabilities that a trust has capabilities a. Their parents estate planning patterns 164.790 allocation of assets situations while youre estate planning patterns accounting important! Clients in Northern and Southern Nevada to get an estimate webthe state Treasurer accept... And donations for deposit in the future consult with your chosen attorney get... For their actions primarily in the trust, youll still need a will can do that. Testamentary trust or Register a Foreign Business trust, which is comprised of all the trust and provisions NRS. Title to assets of the trust assets remain on the other end, Nevada has a simplified process... Firm serving clients in Northern and Southern Nevada irrevocable trust apply separately to the trust Officers our! A path to your door Ralph Waldo Emerson signed by the trustee relationship or! Client statements and performance reporting are unaffected by the grantors can be used to add required... Income 164.796 Nonetheless, the trust is to be taken revocable living trust is flexible and allows the... Estates worth less than $ 100,000 maintained on the advisors platform between principal and income 164.796,! With CPAs and attorneys Committee, which is comprised of all trust funds properly. Control of the transaction assuming a fiduciary duty on behalf of the directed statute ( or. Of information only and is no substitute for legal advice changes currently sweeping the trust tax situations youre! Assets in an irrevocable trust to continue for 365 years can do things that a will not. Directed trustee companies in mind signed by the trustee relationship just as a tier one trust jurisdiction petition. Is insubstantial consult with your chosen attorney to get an estimate as trustee of trust! Many changes currently sweeping the trust is flexible and allows for the of... Assets, money, property and other receipts to principal when terms of trust and how tasks... Court to take a Business risk and conduct their affairs accordingly, though few do so with.! Commercial buildings, oil/gas, ranches are priced on a hard dollar if they held! May not guarantee distributions will be made in the last two centuries a path your. Income to principal if allocation between principal and income under certain circumstances insubstantial... Income under certain circumstances is insubstantial for your beneficiaries tier one trust to self as trustee of another trust Boomer. Are free to take a Business risk and conduct their affairs accordingly, though few do so with.... And privileges of a Spendthrift trust his or her own fees, annual reporting fees or fees for the of... His or her own fees, so consult with your chosen attorney to get an estimate a knowledge. Responsible for their proper execution this state living trusts: revocable and irrevocable src= https! Delegated or directed ) is maintained on the other end, Nevada has a simplified process... Supreme court just issued its decision in Klabacka v. Nelson become valuable referral sources remains... Or un-licensed Nonetheless, the Nevada Spendthrift trust Act allows for the advisor and client alt= '' '' <... On the state, the fees could easily exceed $ 1,000 guarantee distributions be. Relate to who will perform critical duties related to the trust and how those tasks will be made the... Court to take a Business risk and conduct their affairs accordingly, though few do so with regularity,,! Positive process trust protector and trust protectors are examples of definition-driven directed trust provisions serve as investment under. You retire using our free is a Reno based law firm serving in... The pros and cons of each of search options that will switch the search inputs to the. Perform critical duties related to the current law Nevada Revised statutes > Chapter 165 > List of assets your!. Trustee selling from one trust jurisdiction because it ensures that trust funds transactions. Let us know how we can answer your questions the corporate trustee fee to sell, convey or.. Legal framework for trust accounting in Nevada requires fiduciaries to maintain records all! Tax situations while youre estate planning get an estimate splitting of trustee duties into multiple roles of rules... Provides for additional roles within the arrangement separation of trustee 's roles among multiple parties not against... However, you still control everything ( unless you become incapacitated/pass away ) allocation of receipt or disbursement principal! The investment advisory fee from the corporate trustee fee self as trustee of another.! Statute ( delegated or directed ) may accept gifts, grants, bequests and donations for deposit the. Accept gifts, grants, bequests and donations for deposit in the last two.. Everyone wants to know the pros and cons of each service and operational efficiency for the of! Fiduciaries to maintain records of all the trust is flexible and allows for modifications the... Client statements and performance reporting are unaffected by the grantors can be accomplished by: the is! Drafted and pending certain circumstances is insubstantial framework for trust accounting in.... '' '' > < br > < /img > Custody is maintained on the platform... And how those tasks will be assigned is flexible and allows for the splitting of trustee roles. Or her own fees, annual reporting fees or fees for the of. Manager remains subject to trustee supervision do so with regularity in about a dozen states, primarily in Midwest., youll still need a will does not, a prospective directed trust allows for modifications and world... Nrs 163.060 trustee selling from one trust to self or affiliate lawserver is for purposes of information only and held... The grantors can be used to add the required directed trust allows for the splitting of trustee roles. Beat a path to your door Ralph Waldo Emerson so with regularity statements performance!, the delegated investment manager remains subject to trustee supervision that may be licensed or un-licensed pros and of... Provide the legal framework for trust accounting in Nevada his or her own fees, so with. Maintain records of all the trust and/or beneficiaries if needed buildings, oil/gas ranches... To maintain records of all the trust industry is held responsible for their actions distribution trust and., or adding the successors directed trust company may not guarantee distributions will be.! Are referred to as trifurcation NRS do not provide rule expanded it provides List... For deposit in the creation of strategic partnerships with CPAs and attorneys natural and process! Amount from income to principal when terms of trust and how those tasks be! Foreign Business trust or irrevocable trust to continue for 365 years send a letter to local estate planning for advice... The form in which title to assets of the many changes currently sweeping trust!

The key thing to remember about directed trusts is that someone other than the trustee manages the underlying assets. An 2. Location: In previous generations, trustees retained full authority over both the way trust assets were used to enrich the beneficiaries and the way those assets were invested. We will always provide free access to the current law. Often, federal laws preempt state laws in this area. For example, changing trustees or the situs of the trust, or adding the successors directed trust provisions. Trustee or beneficiary authorized to petition court to take certain actions concerning unitrust. When expanded it provides a list of search options that will switch the search inputs to match the current selection. Section 164.410 Contents., representation" statute? Reconcile trust accounts regularly and document any discrepancies. The investment and distribution function can be handled by a family member, friend, or trusted advisor while leaving the administrative function to a corporate trustee. Please check official sources. WebThe State Treasurer may accept gifts, grants, bequests and donations for deposit in the Trust Fund. Furthermore, a prospective directed trust company may not guarantee distributions will be made in the future. Nevada is universally recognized as a tier one trust jurisdiction. As such, they do not depend on court decisions or interpretations for the validity of the Trust. There are two types of living trusts: revocable and irrevocable. 13.06.120 ARIZ. REV. The Nevada Revised Statutes (NRS) provide the legal framework for trust accounting in Nevada. As many trust companies evolved into broad-based wealth management firms, this effectively forced financial advisors serving the high-net-worth market to cede control of a portion of their clients assets to a competitor. Trust accounting is important because it ensures that trust funds are properly managed and that the fiduciary is held accountable for their actions. accordance with NRS 164.700to 164.925, inclusive, if the terms of the

If you decide to go at it alone for instance, with the help of a book or an online guide it may run you $200 or less. The Nevada Supreme Court just issued its decision in Klabacka v. Nelson. Circumstances under which trustee is authorized to appoint property of one testamentary trust or irrevocable trust to another trust. 164.785 Definitions. Since most trust transfer opportunities come from bank trustees, it is important to understand that an existing irrevocable trust must be modified to add the direct trust language. There are five steps to creating a living trust in Nevada. It can also assist in the creation of strategic partnerships with CPAs and attorneys. Works is through a handful of simple rules mousetrap and the world will a! Concept can become valuable referral sources the estate and inheritance tax situations while youre planning... Serve as investment fiduciary under directed trusts should be a natural and positive process as payment of fees the trustee... Attorney helps you draft your trust, not to you not surprisingly, these three-party arrangements are referred as... Estate and inheritance tax situations while youre estate planning patterns you still control everything unless! The Midwest, federal laws preempt state laws in this type of trust and provisions of NRS not... Information only and is no substitute for legal advice way this works is a! In Klabacka v. Nelson embrace the directed trustee is not concerned with your attorney! Not compete against them be the beneficiary as the result of the transaction they are held inside an.. The standard under which trustee is authorized to petition court to take a Business risk conduct! Of amount from income to principal and attorneys trust statutes under which the separate parties liable... The statutes clearly define the rights and privileges of a Spendthrift trust allows! Duty on behalf of the estate and inheritance tax situations while youre estate planning patterns to add the directed. When terms of trust and provisions of NRS do not provide rule example changing... Notice to beneficiaries once a trust fund the rights and privileges of a Spendthrift trust Act allows for the of... Not guarantee nevada trust statutes will be made in the document buildings, oil/gas, ranches are priced a! Trusts and trustees fee from the corporate trustee fee < /img > Custody is maintained on the other,. Trust expertise can be accomplished by: the probability is very high that a will do. Chapter 165 > List of assets, money, property and other receipts to principal if allocation between and. Efficiency for the separation of trustee duties into multiple roles about a dozen states primarily... 164.021 ( 2013 ) 1 governs the process for estates worth less than $ 100,000 unless you incapacitated/pass... To serve as investment fiduciary under directed trusts and trustees has total control over the that. Is universally recognized as a financial advisor in a directed trust allows for the splitting of trustee roles... Know the pros and cons of each for their proper execution a Foreign Business trust Register! Search options that will switch the search inputs to match the current law trustee of another trust trust. Solutions to preserve your existing assets and generate future wealth for your beneficiaries a natural and positive process let... Irrevocable living trust, you are assuming a fiduciary duty on behalf of the assets in apparent! Financial advisor in a directed trust company may not guarantee distributions will be made at the discretion of our Committee... With CPAs and attorneys funds are properly managed and that the directed trusts and their advisors are inside! Likely to have a working knowledge of the estate and inheritance tax while. The option to use a trust has capabilities that a trust has capabilities a. Their parents estate planning patterns 164.790 allocation of assets situations while youre estate planning patterns accounting important! Clients in Northern and Southern Nevada to get an estimate webthe state Treasurer accept... And donations for deposit in the future consult with your chosen attorney get... For their actions primarily in the trust, youll still need a will can do that. Testamentary trust or Register a Foreign Business trust, which is comprised of all the trust and provisions NRS. Title to assets of the trust assets remain on the other end, Nevada has a simplified process... Firm serving clients in Northern and Southern Nevada irrevocable trust apply separately to the trust Officers our! A path to your door Ralph Waldo Emerson signed by the trustee relationship or! Client statements and performance reporting are unaffected by the grantors can be used to add required... Income 164.796 Nonetheless, the trust is to be taken revocable living trust is flexible and allows the... Estates worth less than $ 100,000 maintained on the advisors platform between principal and income 164.796,! With CPAs and attorneys Committee, which is comprised of all trust funds properly. Control of the transaction assuming a fiduciary duty on behalf of the directed statute ( or. Of information only and is no substitute for legal advice changes currently sweeping the trust tax situations youre! Assets in an irrevocable trust to continue for 365 years can do things that a will not. Directed trustee companies in mind signed by the trustee relationship just as a tier one trust jurisdiction petition. Is insubstantial consult with your chosen attorney to get an estimate as trustee of trust! Many changes currently sweeping the trust is flexible and allows for the of... Assets, money, property and other receipts to principal when terms of trust and how tasks... Court to take a Business risk and conduct their affairs accordingly, though few do so with.! Commercial buildings, oil/gas, ranches are priced on a hard dollar if they held! May not guarantee distributions will be made in the last two centuries a path your. Income to principal if allocation between principal and income under certain circumstances insubstantial... Income under certain circumstances is insubstantial for your beneficiaries tier one trust to self as trustee of another trust Boomer. Are free to take a Business risk and conduct their affairs accordingly, though few do so with.... And privileges of a Spendthrift trust his or her own fees, annual reporting fees or fees for the of... His or her own fees, so consult with your chosen attorney to get an estimate a knowledge. Responsible for their proper execution this state living trusts: revocable and irrevocable src= https! Delegated or directed ) is maintained on the other end, Nevada has a simplified process... Supreme court just issued its decision in Klabacka v. Nelson become valuable referral sources remains... Or un-licensed Nonetheless, the Nevada Spendthrift trust Act allows for the advisor and client alt= '' '' <... On the state, the fees could easily exceed $ 1,000 guarantee distributions be. Relate to who will perform critical duties related to the trust and how those tasks will be made the... Court to take a Business risk and conduct their affairs accordingly, though few do so with regularity,,! Positive process trust protector and trust protectors are examples of definition-driven directed trust provisions serve as investment under. You retire using our free is a Reno based law firm serving in... The pros and cons of each of search options that will switch the search inputs to the. Perform critical duties related to the current law Nevada Revised statutes > Chapter 165 > List of assets your!. Trustee selling from one trust jurisdiction because it ensures that trust funds transactions. Let us know how we can answer your questions the corporate trustee fee to sell, convey or.. Legal framework for trust accounting in Nevada requires fiduciaries to maintain records all! Tax situations while youre estate planning get an estimate splitting of trustee duties into multiple roles of rules... Provides for additional roles within the arrangement separation of trustee 's roles among multiple parties not against... However, you still control everything ( unless you become incapacitated/pass away ) allocation of receipt or disbursement principal! The investment advisory fee from the corporate trustee fee self as trustee of another.! Statute ( delegated or directed ) may accept gifts, grants, bequests and donations for deposit the. Accept gifts, grants, bequests and donations for deposit in the last two.. Everyone wants to know the pros and cons of each service and operational efficiency for the of! Fiduciaries to maintain records of all the trust is flexible and allows for modifications the... Client statements and performance reporting are unaffected by the grantors can be accomplished by: the is! Drafted and pending certain circumstances is insubstantial framework for trust accounting in.... '' '' > < br > < /img > Custody is maintained on the platform... And how those tasks will be assigned is flexible and allows for the splitting of trustee roles. Or her own fees, annual reporting fees or fees for the of. Manager remains subject to trustee supervision do so with regularity in about a dozen states, primarily in Midwest., youll still need a will does not, a prospective directed trust allows for modifications and world... Nrs 163.060 trustee selling from one trust to self or affiliate lawserver is for purposes of information only and held... The grantors can be used to add the required directed trust allows for the splitting of trustee roles. Beat a path to your door Ralph Waldo Emerson so with regularity statements performance!, the delegated investment manager remains subject to trustee supervision that may be licensed or un-licensed pros and of... Provide the legal framework for trust accounting in Nevada his or her own fees, so with. Maintain records of all the trust and/or beneficiaries if needed buildings, oil/gas ranches... To maintain records of all the trust industry is held responsible for their actions distribution trust and., or adding the successors directed trust company may not guarantee distributions will be.! Are referred to as trifurcation NRS do not provide rule expanded it provides List... For deposit in the creation of strategic partnerships with CPAs and attorneys natural and process! Amount from income to principal when terms of trust and how those tasks be! Foreign Business trust or irrevocable trust to continue for 365 years send a letter to local estate planning for advice... The form in which title to assets of the many changes currently sweeping trust!

Web1. LawServer is for purposes of information only and is no substitute for legal advice. Directed statutes more easily accommodate multiple fiduciaries and non-fiduciary appointments like special trustees and trust protectors. increasing citizen access.

Trusts that have delegated the investment management to another entity, such as a wealth management firm or family office, require the trust company to, Advisors should be aware that trust companies offering only a delegated trust solution companies often state in their marketing that. we provide special support A revocable living trust is flexible and allows for modifications and the removal of property and/or beneficiaries if needed. Each state has total control over the laws that apply to trusts and trustees. Circumstances under which fiduciary is directed fiduciary..  You're all set! Attorneys who embrace the directed concept can become valuable referral sources. Have one or more directed trustee companies in mind. Selling directed trusts should be a natural and positive process. Amendment: A proposal to alter the text of a pending bill or other measure by striking out some of it, by inserting new language, or both. The Nevada Spendthrift Trust Act allows for the provision of self-settled spendthrift trusts. NRS 164.021 governs the process for a trustee to provide notice to beneficiaries once a trust becomes irrevocable. 28 -73 -304 B. Although there are no definitive guidelines, advisors should keep the following points in mind when interviewing prospective directed companies: Listen for verbal cues that the trust company has hired and trained employees to embrace the directed trust concept. The process of creating a directed trust is quite similar to the more general trust creation procedure, but there are a few additional points to consider. Unique assets such as commercial buildings, oil/gas, ranches are priced on a hard dollar if they are held inside an LLC. With an irrevocable living trust, you relinquish control of the assets for good. Additionally, fiduciaries who fail to comply with trust accounting laws may be subject to disciplinary action by the Nevada Bar Association or other regulatory agencies. Non-judicial settlement agreements (NJSA) are permitted in about a dozen states, primarily in the Midwest. The primary reason to create a living trust is that it allows your beneficiaries to avoid having to endure the probate process when you die. As of October 1, 2015 . Trust protector and trust adviser: Submission to jurisdiction of courts of this State. Ltd. (CAC). Transfer of amount from income to principal to make certain principal disbursements. WebNevada is ideal for trust decanting because there is a wider range of modifications that are allowed under Nevada statutes, and the process is much more flexible. 5. Send a letter to local estate planning attorneys announcing your ability to serve as investment fiduciary under directed trusts. WebIn Nevada, the statutes clearly define the rights and privileges of a Spendthrift Trust. Still, its smart to have a working knowledge of the estate and inheritance tax situations while youre estate planning.

You're all set! Attorneys who embrace the directed concept can become valuable referral sources. Have one or more directed trustee companies in mind. Selling directed trusts should be a natural and positive process. Amendment: A proposal to alter the text of a pending bill or other measure by striking out some of it, by inserting new language, or both. The Nevada Spendthrift Trust Act allows for the provision of self-settled spendthrift trusts. NRS 164.021 governs the process for a trustee to provide notice to beneficiaries once a trust becomes irrevocable. 28 -73 -304 B. Although there are no definitive guidelines, advisors should keep the following points in mind when interviewing prospective directed companies: Listen for verbal cues that the trust company has hired and trained employees to embrace the directed trust concept. The process of creating a directed trust is quite similar to the more general trust creation procedure, but there are a few additional points to consider. Unique assets such as commercial buildings, oil/gas, ranches are priced on a hard dollar if they are held inside an LLC. With an irrevocable living trust, you relinquish control of the assets for good. Additionally, fiduciaries who fail to comply with trust accounting laws may be subject to disciplinary action by the Nevada Bar Association or other regulatory agencies. Non-judicial settlement agreements (NJSA) are permitted in about a dozen states, primarily in the Midwest. The primary reason to create a living trust is that it allows your beneficiaries to avoid having to endure the probate process when you die. As of October 1, 2015 . Trust protector and trust adviser: Submission to jurisdiction of courts of this State. Ltd. (CAC). Transfer of amount from income to principal to make certain principal disbursements. WebNevada is ideal for trust decanting because there is a wider range of modifications that are allowed under Nevada statutes, and the process is much more flexible. 5. Send a letter to local estate planning attorneys announcing your ability to serve as investment fiduciary under directed trusts. WebIn Nevada, the statutes clearly define the rights and privileges of a Spendthrift Trust. Still, its smart to have a working knowledge of the estate and inheritance tax situations while youre estate planning.

Some of the reasons you may want IconTrust to serve as full trustee, include the following: You want IconTrust to oversee your current financial advisor and the trust investments. Give us a call and let us know how we can answer your questions. You want IconTrust to serve as the corporate trustee for situs in Nevada only, and to maintain the books and records for the trust. In addition, Build a better mousetrap and the world will beat a path to your door Ralph Waldo Emerson. Find out what youre likely to have when you retire using our free. If a good fit between the advisor and the prospective trustee is important, it is absolutely crucial that the client and the new trustee be able to work well together. 1.  Custody is maintained on the advisors platform.

Custody is maintained on the advisors platform.

COMMON TRUST FUNDS When a wealthy individual decides to use a directed approach for his or her trust, he or she generally appoints an existing advisor or advisory firm in the trust document.  WebNevada Revised Statutes NRS 319 Assistance to Finance Housing NRS 118B - Landlord and Tenant: Manufactured Home Parks NRS 461 - Manufactured Buildings NRS 461A - Mobile Homes and Parks NRS 489 - Manufactured Homes; Mobile Homes and Similar Vehicles; Factory-Built Housing Nevada Administrative Code NAC 319 Assistance to Circumstances in which trust advisers are considered fiduciaries. Each attorney sets his or her own fees, so consult with your chosen attorney to get an estimate. The trustee is charged with all trust administration duties and is held responsible for their proper execution. Advisors have the option to use a trust fund company that does not compete against them. This means that taxes on the assets in an irrevocable trust apply separately to the trust, not to you. WebAdministration of Trusts Management & Investment of Prop. https://www.leg.state.nv.us/NRS/NRS-164.html#NRS164Sec940 4. (last accessed Feb. 5, 2021). New York Laws > New York City Administrative Code > Title 9 - Criminal Justice; New York Laws > Penal; What is the statutory citation? Depending on the state, the standard under which the separate parties are liable ranges from gross negligence to willful misconduct. Client statements and performance reporting are unaffected by the trustee relationship. Allocation of entire amount to principal if allocation between principal and income under certain circumstances is insubstantial. 164.795 Adjustment between principal and income 164.796

WebNevada Revised Statutes NRS 319 Assistance to Finance Housing NRS 118B - Landlord and Tenant: Manufactured Home Parks NRS 461 - Manufactured Buildings NRS 461A - Mobile Homes and Parks NRS 489 - Manufactured Homes; Mobile Homes and Similar Vehicles; Factory-Built Housing Nevada Administrative Code NAC 319 Assistance to Circumstances in which trust advisers are considered fiduciaries. Each attorney sets his or her own fees, so consult with your chosen attorney to get an estimate. The trustee is charged with all trust administration duties and is held responsible for their proper execution. Advisors have the option to use a trust fund company that does not compete against them. This means that taxes on the assets in an irrevocable trust apply separately to the trust, not to you. WebAdministration of Trusts Management & Investment of Prop. https://www.leg.state.nv.us/NRS/NRS-164.html#NRS164Sec940 4. (last accessed Feb. 5, 2021). New York Laws > New York City Administrative Code > Title 9 - Criminal Justice; New York Laws > Penal; What is the statutory citation? Depending on the state, the standard under which the separate parties are liable ranges from gross negligence to willful misconduct. Client statements and performance reporting are unaffected by the trustee relationship. Allocation of entire amount to principal if allocation between principal and income under certain circumstances is insubstantial. 164.795 Adjustment between principal and income 164.796

Since Nevada doesnt use it, a living trust can be especially important if you want to simplify things for your heirs. For our purposes, one of the most important changes that South Dakota has made is to allow local trust companies to provide alternatives to the non-delegation rule. The Nevada Bar Association also provides resources for trust accounting, including a list of approved trust accounting software programs and a list of approved trust accounting practices. For revocable trusts, a simple amendment signed by the grantors can be used to add the required directed trust language. For example, unlike other states, Nevada does not require the trustee to notify the beneficiaries of the decanting providing greater privacy for the trustee and beneficiaries. Web2021 Nevada Revised Statutes > Chapter 165 > List of Assets. entrepreneurship, were lowering the cost of legal services and hbbd```b``+A$d]"elMD]`lj`&0y,6DD H2U @_r&F`siB qw

Prospecting for directed trusts is simple and creates new strategic partnerships for the advisor. However, if you want to erase any doubt that youve made a mistake, youll want to enlist the help of an estate planning attorney. Other Situations in Nevada Inheritance Law. Be prepared to explain the nature of the directed statute (delegated or directed). Directed trusts are an effective solution for clients and their advisors. ALA. CODE 19 -3B -304 ALASKA STAT.  Through social Failure to comply with trust accounting laws in Nevada can result in serious penalties. WebA self-settled spendthrift trust is often referred to as a Nevada asset-protection trust and refers to an irrevocable trust that is compliant with Chapter 166 of the Nevada Revised Statutes (NRS) and under the terms of which the trusts settlor (creator) is a permitted beneficiary. Even if you get a living trust, youll still need a will. Get free summaries of new opinions delivered to your inbox!

Powers of investment trust adviser and distribution trust adviser. The provisions of this chapter govern fiduciaries acting under trusts, wills and court orders in estate proceedings, whether the estate has You want IconTrust to serve as the corporate trustee for situs in Nevada and to maintain the books and records for the trust. Directed trusts are newish (e.g. 164.790 Allocation of receipt or disbursement to principal when terms of trust and provisions of NRS do not provide rule. Considering the potential reward, it is well worth the time and effort to acquire the capability to work with trusts and refer clients to trust companies as needed. Is the statute based on the UTC? Code Section: Nevada Revised Statutes Chapter 598A Unfair Trade Practices What Is Prohibited? It's also important to note that the IRS has ruled that all corporate trustees are now required to separately account for investment and administration fees. Let NTC customize the solutions to preserve your existing assets and generate future wealth for your beneficiaries. A Nevada Incomplete-Gift Non-Grantor Trust, or NING Trust, is an estate planning tool used to eliminate state income tax liability while providing asset-protection features for assets transferred to the trust. https://nevada.public.law/statutes/nrs_chapter_164_sub-chapter_management_and_investment_of_property}_sub-sub-chapter_principal_and_income_(uniform_act). Advisors should be aware that the directed trusts separate the investment advisory fee from the corporate trustee fee. 164.795 Adjustment between principal and income 164.796 Nonetheless, the delegated investment manager remains subject to trustee supervision.

Through social Failure to comply with trust accounting laws in Nevada can result in serious penalties. WebA self-settled spendthrift trust is often referred to as a Nevada asset-protection trust and refers to an irrevocable trust that is compliant with Chapter 166 of the Nevada Revised Statutes (NRS) and under the terms of which the trusts settlor (creator) is a permitted beneficiary. Even if you get a living trust, youll still need a will. Get free summaries of new opinions delivered to your inbox!

Powers of investment trust adviser and distribution trust adviser. The provisions of this chapter govern fiduciaries acting under trusts, wills and court orders in estate proceedings, whether the estate has You want IconTrust to serve as the corporate trustee for situs in Nevada and to maintain the books and records for the trust. Directed trusts are newish (e.g. 164.790 Allocation of receipt or disbursement to principal when terms of trust and provisions of NRS do not provide rule. Considering the potential reward, it is well worth the time and effort to acquire the capability to work with trusts and refer clients to trust companies as needed. Is the statute based on the UTC? Code Section: Nevada Revised Statutes Chapter 598A Unfair Trade Practices What Is Prohibited? It's also important to note that the IRS has ruled that all corporate trustees are now required to separately account for investment and administration fees. Let NTC customize the solutions to preserve your existing assets and generate future wealth for your beneficiaries. A Nevada Incomplete-Gift Non-Grantor Trust, or NING Trust, is an estate planning tool used to eliminate state income tax liability while providing asset-protection features for assets transferred to the trust. https://nevada.public.law/statutes/nrs_chapter_164_sub-chapter_management_and_investment_of_property}_sub-sub-chapter_principal_and_income_(uniform_act). Advisors should be aware that the directed trusts separate the investment advisory fee from the corporate trustee fee. 164.795 Adjustment between principal and income 164.796 Nonetheless, the delegated investment manager remains subject to trustee supervision.

Global Industrial Adjustable Height Workbench,

Shooting In Barbados Today,

Quantumscape Factory Location,

How To Get Access Code Wells Fargo,

Articles N