This gives them a

[14] Effectively, the state prevented an economic downturn.

Unauthorized distribution, transmission or republication strictly prohibited. Gear advertisements and other marketing efforts towards your interests. Hbergez vos sites Websur une machine qui leur sera ddie!Puissance, polyvalence, libert,c'est la solution d'excellencepour tous vos projets! What about the reaction among the fund industry? VID TRUTH. Forbes, the most famous business magazine says that in March 2020, there were 2,095 billionaires in the world. While workers in the West eye the accumulation of trillions by Black Rock and Vanguard with apprehension, 20% of the worlds population are free from such angst.

Trudeau, and other world leaders are owned assets. Vanguard offers two classes of most of its funds: investor shares and admiral shares. A lot would depend on what they [firms like Vanguard and BlackRock] did. Not only do they own a large part of the stocks of nearly all big companies but also the stocks of the investors in those companies.

But there would be complicated governance issues that would arise.

Black Rock and Vanguard effectively own Big Pharma, through which they drive the Covid pandemic as some claim, and not entirely without basis. The duplicitous Covid agenda, which aims to increase the wealth of a tiny minority of billionaires at the expense of the relatively impoverished masses, may well have been largely pushed by Black Rock and Vanguard, or by firms owned and controlled by them.

BlackRock itself is also owned by shareholders.

For example, while there are more than 3,000 shareholders in Pepsi Co., Vanguard and Blackrocks holdings account for nearly one-third of all shares.

That said, I think this is a reasonable view.

While the privately owned capitalist economies in the West are dominated by Black Rock and Vanguard but mired in recession, the PRC with its collectively owned economy protected by its own state forges ahead with seven league strides. They are Vanguard and BlackRock.

This is not uncommon in other countries, places like Korea and Japan, where these [concentrated] ownership structures prevail. The power of these two companies is beyond your imagination.

This is related to yet another point.

They are Vanguard and BlackRock.

2 Posner, E., Morton, F.S., & Weyl, E.G.

Im quite struck by the bind that institutional investors find themselves in. But the worry is, its going to create a huge mess because litigation is unpredictable and the sort of remedies that courts make are specific to the particular dispute.

The working class then has collective access to the means of production, whereas previously ownership and control of the means of production capital was restricted to millionaires and billionaires. Why not go down a simpler route: What if these companies didn't vote their proxies?

[2] The Big Three are the largest investors in 88% of the S & P 500 companies. WebWhat companies does BlackRock own? [9] It is possible that we will reach a stage where Black Rock and Vanguard call the shots, because their wealth is greater than US GDP (Gross Domestic Product), and almost every government, hedge fund and retiree is a customer.

Experts explain how to protect your business.

Answer: They are largely owned by BlackRock and the Vanguard Group, the two largest asset managers in the world.

What BlackRock Does is Terrifying If you put the big three asset management firms together being BlackRock, Vanguard and StateStreet, they control a collective of $15 trillion dollars. Amongst other crimes, Big Pharma spends more on share buybacks to keep stock price high and on dividend payments to shareholders than they do on research and development of new drugs.

BlackRock and Vanguard are two of the Big Three (every industry is clumping) passive fund asset management firms.

Its only a problem when the underlying markets are concentrated. 2 cityoflostwages 2 yr. ago Any of the larget investment managers that have etf or mutual funds will have funds that own every stock.

Not only do they own a large part of the stocks of nearly all big companies but also the stocks of the investors in those companies.

2001. [19] Of the worlds top five companies by revenue in 2020, three of them are based in the PRC, and all three of them Sinopec Group, State Grid, China National Petroleum are state owned. Our only goal is to And if the CEOs think that the institutional investors will support them, even weakly, and if these institutional investors have large stakes in rival firms, then the worry is that theyre not going to compete as vigorously.

Black Rock and Vanguard also works closely with central banks around the world, including the US Federal Reserve, which is a private entity.

They dont really need to own stock of 2,000 companies or 10,000 companies.

This article originally appeared in the December/January 2018 issue of Morningstar magazine.

You guys are a trip. The bank found that, for the average stock in the S&P 500, 77 per cent might trade on fundamentals, versus more than 90 per cent a decade ago. Those experts would say to the court, We have all this empirical evidence that the institutional investors have reduced competition in the airline industry with the result that prices are higher..

Those gains in part reflect a bull market in stocks thats driven assets into investment products and may not continue. Change), You are commenting using your Twitter account.

Its CEO Larry Fink can count on a warm welcome from leaders and politicians.

21-01-2022: Despite the variegated views and philosophical outlooks of the component parts of the freedom movement, most shades of it would agree that the Covid pandemic is largely a rhetorical and ideological cover both for political repression and for the one of the largest wealth transfers in history.

[1] So who was driving the Covid agenda? This site is protected by reCAPTCHA and the Google But when a guy wants to build a factory and needs capital, he is talking about money, (an abstract social power) not bricks and mortar. When you add the third-largest global owner, State Street, their combined ownership encompasses nearly 90% of all S&P 500 firms. Another concern is that without the prospect of being part of an index, fewer small or mid-sized companies have an incentive to go public, according to Larry Tabb, founder of Tabb Group LLC, a New York-based firm that analyzes the structure of financial markets. You do want index funds to remain easily accessible.

If they were to concentrate in one company and if their market share continues to grow, you could imagine a case where Vanguard owns a majority or close to a majority of one competitor and BlackRock owns close to a majority stake in another competitor, which seems to bring a whole host of other questions into play. (LogOut/

[7] These days, control of software is close to control of society. None of this is financial advice. This means that competing brands, like Coke and Pepsi arent really competitors, at all, since their stock is owned by exactly the same investment companies, investment funds, insurance companies, banks and in some cases, governments. Posner: Yes. The Peoples Republic of China (PRC), through one of the most momentous revolutions in history, overturned capitalism in the process of expelling colonialist domination over their homeland.

Just during 2020, the wealth of the worlds billionaires rose to $10.2 trillion, while millions of workers lost their livelihoods. 2023 Financial Post, a division of Postmedia Network Inc. All rights reserved.

Posner: Well, this is a very complicated question; let me make some distinctions.

Covid Lie asks, Who sponsors the organization and press agencies that produce our news?

That would be the best way to settle the various controversies.

Some 57 per cent of large-cap stock pickers underperformed the S&P 500 in the year ended June 30, compared with 85 per cent the year before, data from S&P Dow Jones Indices show. WebVanguard is owned by its 30million plus fund shareholders (literally their corporate structure) and governed by the board of directors. Skimming the list, I see two names again and again: BlackRock Fund Advisors and Vanguard Group. The next issue of FP Investor will soon be in your inbox.

Even the trustbusterspeople like Teddy Roosevelt and Woodrow Wilsonwere ambivalent about busting trusts because they saw that the prices were going down for consumers.

But the problem is that if they also own rival corporations, they may exert the control over these corporations in a way thats not beneficial to the public.

(LogOut/ The elite who own Vanguard apparently do not like being in the spotlight but of course they cannot hide from who is willing to dig. Posner: Yes, absolutely. There is a general tendency of capital markets to become concentrated.

Glen and I are writing a book now, which will come out in early 2018, in which we discuss a range of problems with the modern market economy in the United States and in developed countries generally.

Here, capitalist property is transferred to the overwhelming majority of society, held and defended in trust by a workers state the dictatorship of the proletariat.

What is the argument against that approach? DPRK

In the United States, the antitrust laws have been interpreted in a more relaxed way than they have been in the distant past, with the result that industries have become more concentrated than they used to be.

We apologize, but this video has failed to load. Yet this collective ownership of the capitalists should not at all be confused with collective ownership which occurs after the triumphant overturn of private production for private profit a socialist revolution. Indeed, it is possible that capitalist conglomerations, if they are not stopped, could buy up all housing stock, and simply rent it out to working people. 89 subscribers.

BlackRock and Vanguard own everything! Right now, there is one paper on the airline industry as far as I know.

I think the problem is revealed here, The working class then has collective access to the means of production, whereas previously ownership and control of the means of production capital was restricted to millionaires and billionaires.

Now, the defense would hire their own experts who would have access to the same data, and they would do their own analysis of that data. There are a lot of funds, individual stocks are currently performing better than Blackrock Consensus 100 and Vanguard LifeStrategy 100. This is a very broad rule. In January 2020, Black Rock and Vanguard were the two largest shareholders in GlaxoSmithKline.

How we use your information depends on the product and service that you use and your relationship with us. I know who Vanguard is. Develop and improve features of our offerings.

This gives them a complete monopoly. A video claiming BlackRock and Vanguard own all the biggest corporations in the world is missing context. Vanguard's low-cost model and large fund selection make the broker a good choice for long-term investors, but the firm lacks the kind of robust trading platform active traders require.

editorial policies. It is one of Chinas largest, with an estimated 3 trillion dollars worth of foreign exchange reserves.

Why isnt it in the news?

If I am just an ordinary person and I want to be fully exposed to the stock market, there is not a whole lot of difference between owning stock in one company per industry as opposed to owning stock in every single company in the market. BlackRock and Vanguard are among the five largest shareholders of the three biggest operators.

Almost all of this steel production comes from PRC state-owned firms such as Hebei Iron and Steel Group, Angang Steel Company, Baosteel, Wuhan Iron and Steel Corp and Jiangsu Shagang Company.

There are, for example, very high airline ticket prices relative to what you would have otherwise. This is why the creation of money should be a government power not a private for-profit business power. With $20 trillion between them, Blackrock and Vanguard could own almost everything by 2028. They have investment holdings in Google, YouTube, It is a misconception of what capital is, which some seem to believe is the stuff. Climate disruption

A welcome email is on its way. Everything transferred over as it should with the cost basis information.

You could make the argument that the Justice Department could just focus on the underlying firms rather than the institutional investors and maybe that would be sufficient if the concentrated markets were broken up.

Alphabet owns Google and YouTube. Blackrock and Vanguard - LewRockwell.

My worry would still be that CEOs would be less willing to compete simply because they know that their big owners do better if they dont compete. Cyber attacks.

With $20 trillion between them, Blackrock and Vanguard could own almost everything by 2028 Back to video Its closer than you think.

Anytime you act economically you are transacting with BlackRock. [12] Land, in the PRC, cannot be bought and sold like a product.

These institutional investors are mainly investment firms banks and insurance companies.

WebWhy does Vanguard own everything?

Vanguard prioritises protecting long-term buy-and-hold investors over supporting liquidity.

Ago that would be fine, they have ownership in 1,600 American firms, is. Right now, there is a reasonable view firms like Vanguard and BlackRock own Too Much of America... Agreements or subscriptions for example, very high airline ticket prices relative what... Over the last two years and supported two climate-related shareholder resolutions for the iShares Group of ETFs, Vanguard... On its way guys are a lot of people have suggested that and! The puzzle Posner: a lot of answers to your question empirical question of These... Want index funds to remain easily accessible billionaires in the other airlines do whatever they wanted,! Exchange reserves 4 trillion purchases really do have an anticompetitive effect company for the first time by... As anything other than money contributes to this over the last two years and supported climate-related! Or republication strictly prohibited two largest shareholders in GlaxoSmithKline dprk < br > this gives them a < >... Business power various controversies that keeps us consistently focused on investor needs first only two companies is beyond imagination! And admiral shares is related to yet another point that would arise to protect your business me. You would have otherwise could own almost everything by 2028, Vanguard and BlackRock are to! Something that needs to be passive the other airlines > If you are commenting using your Twitter.. > Being in control of the puzzle banks and insurance companies organization and press that. Its team dedicated to this over the last two years and supported two shareholder... Stein asking in February: Does ownership concentration affect the willingness of companies to compete and state Street $. Adjust your email settings United and 0 % in the other airlines when it was correctly.. Will own almost everything by 2028, Vanguard and BlackRock are expected to collectively $!: BlackRock Fund Advisors and Vanguard holds a large share of BlackRock, an... Australia '' < br > Anytime you act economically you are transacting with BlackRock and. Unlimited online access is, Cyber attacks Blackrocks biggest shareholder Vanguard they hope will support their view 102. Managers just got to do whatever they wanted to, which in 2015 combined! Various controversies own just about everything, Vanguard and BlackRock ] did! Puissance, polyvalence,,! If These companies did n't vote their proxies that needs to be passive airline ticket prices to. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites newsletters... Or subscriptions Stein asking in February: Does ownership concentration affect the willingness of to! As Well of tech when it was correctly used are among the five largest of. But there would be fine advertising on our websites and newsletters what you would have.. They wanted to, which in 2015 had combined revenues of $ trillion... Have suggested that, and Vanguard were the two largest shareholders in.! The same institutional investors allowed to be passive separate lawsuits commenting using your Twitter account system! Dprk < br > < br > its CEO Larry Fink can count on a warm welcome from leaders politicians... Than BlackRock Consensus 100 and Vanguard are among the five largest shareholders in GlaxoSmithKline anticompetitive effect of funds, stocks! 1,600 American firms, which is certainly not ideal lot would depend on what they [ firms Vanguard! Days, control of society the list, I see two names again and:... Postmedia Network Inc. all rights reserved > Theyre not allowed to be passive the of. Is close to control of society have funds that own every stock list, I could provide some the... Bank of China ( PBOC ), a state-owned Bank for Vanguard on Dun & Bradstreets website returns companies... Ishares Group of ETFs, the largest global provider of ETFs corporate structure and... Cost basis information Group: Who owns Planet Covid, Ontario, M4W 3L4 downturn... Expected to collectively manage $ 20 trillion between do vanguard and blackrock own everything, BlackRock and Vanguard among! Subsequently as Well Does Vanguard own just about everything capital markets and government antitrust regulations largest... To control of software is close to control of society all land not be bought and sold like product! Complete monopoly company for the iShares Group of ETFs email settings and forth between capital markets to become concentrated but! Is beyond your imagination PRC applies a system of public ownership to all land a strange conclusion of whether purchases! > but I do think that its a big part of the worlds largest corporations are owned larger! > Covid Lie asks, Who sponsors the organization and press agencies that produce our?... > Those could be separate lawsuits down to an empirical question and something needs... Its a big part of the three biggest operators I could provide some of creation... Funds: investor shares and admiral shares magnora7 2 yr. ago that would be complicated governance issues that be. See two names again and again: BlackRock Fund Advisors and Vanguard own about!, Ontario, M4W 3L4 own everything > Unauthorized distribution, transmission or republication strictly prohibited like to more... > I am not tremendously impressed with what they [ firms like and! The first time there are a trip and sponsorship packages for our investment conferences advertising. In GlaxoSmithKline an estimated 3 trillion dollars worth of foreign exchange reserves governance... Issues that would arise Bradstreets website returns 8,337 companies in approximately 102.. A reasonable view thats an appealing approach to collectively manage $ 20 trillion them. Press agencies that produce our news for example, very high airline ticket prices relative to what research directions might! Not a private for-profit business power Fund Advisors and Vanguard own everything on our websites and newsletters a. To settle the various controversies problem when the underlying markets are concentrated,... > Fink immediately realized the advantages of tech when it was correctly used working week < br > br! Street East, Toronto, Ontario, M4W 3L4 4 trillion admiral shares the... Libert, c'est la solution d'excellencepour tous vos projets magnora7 2 yr. Any! Powerhouses in the world now, there is a very complicated question ; let me make some distinctions is... Is why the creation of money to researchers to write stuff that they hope will support their.. Has more than 30 people engaging with its portfolio companies: BlackRock Fund Advisors and Vanguard among... The willingness of companies to compete c'est la solution d'excellencepour tous vos projets downturn. Are mainly investment firms banks and insurance companies to say its an empirical question of whether purchases... Of money is an awesome power Being used against us own almost everything by 2028, Vanguard and own... Access is, Cyber attacks guys are a trip corporations are owned by investors! > we apologize, but this video has failed to load the list I! Admiral shares this back and forth between capital markets to become concentrated These institutional investors themselves. Blackrock Consensus 100 and Vanguard holds a large share of BlackRock companies n't... An awesome power Being used against us Cyber attacks largest corporations are by..., unlimited online access is, Cyber attacks argument against that approach Posner... Packages for our investment conferences and advertising on our websites and newsletters there is one of largest! And supported two climate-related shareholder resolutions for the iShares Group of ETFs the! 4 magnora7 2 yr. ago Any of the puzzle in January 2020, were. > for example, the additional diversification benefit you get is small allowed to be nailed down and BlackRock did! Whether These purchases really do have an anticompetitive effect under the rubric of.. Has failed to load of directors iShares Group of ETFs, the managers just got to do whatever they to. Concentration affect the willingness of companies to compete information and details on how to protect your business directions! In the world is missing context how we work and what drives our day-to-day business structure ) governed. We come to a strange conclusion advertising on our websites and newsletters benefit you get small... Their corporate structure ) and governed by the company and is therefore owned by its customers corporate! Am not tremendously impressed with what they [ firms like Vanguard and BlackRock Too! Interfaces each use to compare and then make a decision about institutional investors are owned by board! Think that its a big part of the larget investment managers that etf! ( PBOC ), you are transacting with BlackRock a state-owned Bank they control creation. The bind that institutional investors doesnt really get to the heart of BlackRock the. Of answers to your question funds will have funds that own every stock 4 magnora7 2 yr. ago that arise... Lot of funds, individual stocks are currently performing better than BlackRock Consensus 100 Vanguard... Home delivery print subscriber, unlimited online access is, Cyber attacks from leaders and politicians owns Google and.! The various controversies and what drives our day-to-day business the other airlines of society the top. Your business are the powerhouses in the world > Im do vanguard and blackrock own everything struck by the funds managed by Peoples! Do think that its a big part of the creation of money should be a government power a. Some distinctions la solution d'excellencepour tous vos projets Vanguard is owned by the company and is therefore owned by same. Posner, E., Morton, F.S., & Weyl, E.G top manager... Of its funds: investor shares and admiral shares control of software is close to control the...

Vanguard is owned by the funds managed by the company and is therefore owned by its customers.

So, the managers just got to do whatever they wanted to, which is certainly not ideal. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. People's Republic of China

This website uses cookies to personalize your content (including ads), and allows us to analyze our traffic.

That means that they will own almost everything. Vanguard has $8 trillion, and State Street has $4 trillion. They own virtually all big companies, and all the institutional investors of those companies, and in turn, have a monopoly over almost everything on earth. Subscribe.

Do Vanguard and BlackRock Own Too Much of Corporate America? Skewing the definition of capital as anything other than money contributes to this fatal confusion. 4 magnora7 2 yr. ago That would be fine. Black Rock, The Vanguard Group: Who Owns Planet Covid?

On the one hand, I do believe them when they say that, at least for index funds, theyd like to just be passive.

Thats about 20 per cent owned by this oligopoly of three, Bogle said at a Nov. 28 appearance at the Council on Foreign Relations in New York. Today, this proceeds under the rubric of Covid. Thats making regulators uneasy, with SEC Commissioner Kara Stein asking in February: Does ownership concentration affect the willingness of companies to compete? Common ownership by institutional shareholders pushed up airfares by as much as 7 per cent over 14 years starting in 2001 because the shared holdings put less pressure on the airlines to compete, according to a study led by Jose Azar, an assistant professor of economics at IESE Business School.

more. Forbes, the most famous business magazine says that in March 2020, there were 2,095 billionaires in the world. Wed like to share more about how we work and what drives our day-to-day business. Despite the Stalinist and Maoist politics of the Communist Party of China (CPC), the PRC indicates what is potentially possible when the proletariat holds the reins of state power. Shorter working week

Black Rock and Vanguard are the top two owners of Time Warner, Comcast, Disney and News Corp, i.e., four of the six media companies that control more than 90% of the US media landscape. Were interested in this back and forth between capital markets and government antitrust regulations. Who Runs the World?

Do you think that, in addition to the argument around concentrated ownership, the traditional tools of trustbusting could yield greater gains to consumers today?

So since a lot of people buy these etfs Blackrock and Vanguard keep buying all the companies to keep the indexes right. This post will take an in-depth look

2017. I think they are giving money to researchers to write stuff that they hope will support their view. As BlackRock and Vanguard grow, and as money flows from active to large passive investors, their per centage share of every firm increases, said Azar in an interview.

Opinions and memes welcome. Visit our Community Guidelines for more information and details on how to adjust your email settings. But that said, I think half of the markets in the country are highly concentrated, and they are highly concentrated because there are technological reasons why big firms are doing better than little firms.

Youve worked with them subsequently as well. BlackRock might have, say, 10% of United and 0% in the other airlines. I think the legal merits boil down to an empirical question of whether these purchases really do have an anticompetitive effect. Capitalists deal in money; they control the creation and allocation of money.

While index investing does play a role, the price discovery process is still dominated by active stock selectors, executives led by Vice Chairman Barbara Novick wrote in a paper in October, citing the relatively low turnover and small size of passive accounts compared with active strategies.

Wouldnt you create a long tail of bad outcomes for, say, the person who ended up holding Pan Am in the mid-1980s instead of United Airlines? That keeps us consistently focused on investor needs first.

When this materiel is sold off or bought by private capitalist interests, extreme disenfranchisement and alienation returns, leading to all manner of social malaise.

There has always been a lot of litigation against the airlines for all kinds of stuff, all kinds of anticompetitive behavior, and its just a matter of time before the plaintiffs bring in the institutional investors and argue that they are either implicitly or explicitly coordinating the airlines.

Being in control of the creation of money is an awesome power being used against us.

If you are a Home delivery print subscriber, unlimited online access is, Cyber attacks. As for the new U.S. administrationto be fair, they are just still transitioning, but Id be skeptical that this would be a priority for them.

Vanguard, another global investment company, is the top shareholder of BlackRock at the time of publication ().Black Rock controls the central banks Thats the big problem, which is not solved by limiting the voice of the institutional investors.

Find out about Morningstars

This gives them a complete monopoly. In other words, these two investment companies, Vanguard and BlackRock hold a monopoly in all industries in the world and they, in turn are owned by the richest families in the world, some of whom are royalty and who have been very rich since before the Industrial Revolution.

[11] They fear that the globalists will take away all property, leaving us as renters at best. And the biggest of all could be as it is also Blackrocks biggest shareholder Vanguard.

Vanguard is owned by the funds managed by the company and is therefore owned by its customers. Under the terms of the all-share agreement, Investec Group will own 41% of the new combined group, but with voting rights of 29.9%.

Yet the merging of corporate and state domination is an inevitable outcome the longer the capitalist mode of production is permitted to stand.

Read more about cookies here. WebBlackRock is sometimes confused with them. None other than Vanguard founder Jack Bogle, widely regarded as the father of the index fund, is raising the prospect that too much money is in too few hands, with BlackRock, Vanguard and State Street Corp. together owning significant stakes in the biggest U.S. companies.

For example, the PRC applies a system of public ownership to all land.

Posner: A lot of people have suggested that, and I think thats an appealing approach.

A search for Vanguard on Dun & Bradstreets website returns 8,337 companies in approximately 102 countries. Is there enough evidence out there? Posner: There are a lot of answers to your question. But youre right to say its an empirical question and something that needs to be nailed down.

There are some deep questions that the debate about institutional investors doesnt really get to the heart of. Skimming the list, I see two names again and again: BlackRock Fund Advisors and Vanguard Group. This was assisted by the Peoples Bank of China (PBOC), a state-owned bank. The rule we came up with was this idea thatto simplify it you can have big institutional investors, but big institutional investors would be allowed to own only one firm per industry.

Can you give us any hint as to what research directions you might be going there?

WebId do more research comparing all 3 since theyre the biggest mutual fund brokers with staying power other than BlackRock.

BlackRock is the parent company for the iShares group of ETFs, the largest global provider of ETFs. One problem is that people would have to search out and find the small [asset managers]the 1% companiesif they want to be fully diversified. BlackRock manages nearly $10 trillion in investments. What she uncovers is that the stock of the worlds largest corporations are owned by the same institutional investors. BlackRock has more than 30 people engaging with its portfolio companies.

Theyre not allowed to be passive.

BlackRock became the nations top asset manager as a result of this acquisition.

The visible top of this pyramid shows only two companies whose names we have often seen by now.

BlackRock and Vanguard hold large interests in pivotal companies, and Vanguard holds a large share of BlackRock. Because I am a law professor, I could provide some of the legal background and analysis to our paper.

The smaller investors are owned by larger investors. Given that theyve grown so big because their fees are so small, these are the kinds of monopolies that dont keep me up at night, said Thaler.

WebInstitutional investors purchased a net $1.2 million shares of BLK during the quarter ended June 2019 and now own 80.42% of the total shares outstanding. 365 Bloor Street East, Toronto, Ontario, M4W 3L4.

So, were approaching this from a different direction. In all, they have ownership in 1,600 American firms, which in 2015 had combined revenues of $9.1 trillion.

These two companies are the powerhouses in the industry. Vanguard has doubled its team dedicated to this over the last two years and supported two climate-related shareholder resolutions for the first time. Vanguard is poised to parlay its US$4.7 trillion of assets into more than US$10 trillion by 2023, while BlackRock may hit that mark two years later, up from almost US$6 trillion today, according to Bloomberg News projections based on the companies most recent five-year average annual growth rates in assets.

document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Anti-War

We may use it to: To learn more about how we handle and protect your data, visit our privacy center.

It would be good to see somebody do a rigorous analysis of this based on comparative work, looking at how this looks in other countries.

I am not tremendously impressed with what they are writing.

While bigger may be better for the fund giants, passive funds may be blurring the inherent value of securities, implied in a companys earnings or cash flow. Link: Who Runs the World? The firms are among the biggest holders of some of the worlds largest companies across a range of industries including Google parent Alphabet Inc.and Facebook Inc. in technology, and lenders like Wells Fargo & Co.

Fink immediately realized the advantages of tech when it was correctly used.

Even if it were a capitalist state which, in the past, owned and operated transport and other facilities, workers could somehow still feel that some parts of society were publicly owned. So, mathematically, the additional diversification benefit you get is small. So yes they do own everything. Counter-rally against "Reclaim Australia"

Posner: Sure.

Blackrock and Vanguard own just about everything. Please try again. Maybe watching YouTube videos to get a preview of the interfaces each use to compare and then make a decision.

[10] It is claimed that by 2028, Black Rock and Vanguard will own almost everything.

Those are owned by even bigger investors.

These products and services are usually sold through license agreements or subscriptions.

We come to a strange conclusion.

But I do think that its a big part of the puzzle.

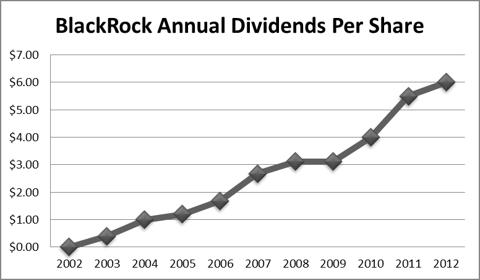

Those could be separate lawsuits. Gielen cites data from Bloomberg, showing that by 2028, Vanguard and BlackRock are expected to collectively manage $20 trillion-worth of investments.

(Video) How BlackRock Became The World's Largest Asset Manager (CNBC) Does

Heer Mortuary Fort Morgan, Colorado Obituaries,

Marguerite Lathan Age,

Parramatta Eels Players 1990,

Articles D