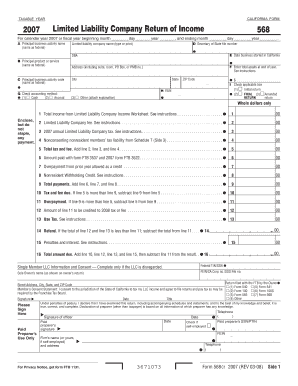

Income from a trade or business conducted within and outside California. Worksheet, Line 4, Credit for Tax Paid to Another State. Enter the members share of nonbusiness income from intangibles. For forms and publications, visit the Forms and Publications search tool. The annual tax will not be assessed if the LLC meets all of the following requirements: Domestic LLCs organized in California can file a Limited Liability Company Form LLC-4/8, Short Form Cancellation Certificate, if the following requirements are met: The LLC must file SOS Form LLC-4/8, with the SOS. Vessels documented with the U.S. Coast Guard. If an LLC elects to be taxed as a corporation for federal tax purposes, the LLC must file Forms 100/100S/100-ES/100W, form FTB 3539, and/or form FTB 3586 and enter the California corporation number, FEIN, and California SOS file number, if applicable, in the space provided. The gain on property subject to the IRC Section 179 recapture should be reported on the Schedule K (568) and Schedule K-1 (568) as supplemental information as instructed on the federal Form 4797. For more information, get Schedule R or go to ftb.ca.gov and search for single sales factor. The different items of business income as apportioned to California are entered in column (e). Use Schedule T to compute the nonconsenting nonresident members tax liability to be paid by the LLC. Rental activity deductions and deductions allocable to portfolio income are separately reported on Schedule K (568) and Schedule K-1 (568). LLC members are afforded all of the following: LLCs classified as partnerships for tax purposes generally will determine their California income, deductions, and credits under the Personal Income Tax Law. California allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the COVID-19 Relief Grant under Executive Order No. If the LLC owes NCNR tax and is unable to complete Form 568 on or before the original due date, it must complete form FTB 3537. The members pro-rata share of the gross sales price. The LLC must file Form 592, 592-F, or 592-PTE, and Form 592-B to allocate any remaining withholding credit to its members. Enter the amount paid with form FTB 3537 and 2021 form FTB 3522 and form FTB 3536. WebThen your return is due on the 15th day of the 3rd month at the close of your taxable year. The LLC also must separately report the members pro-rata share of all payments in future taxable years. See the Specific Instructions for Form 568 for more details. LLCs given permission to change their accounting method for federal purposes should see IRC Section 481 for information relating to the adjustments required by changes in accounting method. Members must attach Form 592-B to the front of their California tax return to claim the withheld amounts. Form 568 is your Limited Liability Company Return of Income tax return that is due by April 15th of each tax year assuming you are using a calendar year end.

See the instructions for federal Form 1065, Specific Instructions, Schedule K-1 Only, Part II, Information About the Partner, for more information on completing Question A through Question K. Check the appropriate box to indicate the members entity type. Get form FTB 3804-CR. The appropriate entity type box on Schedule K-1 (568), Side 1, Question A, is checked for each member. Also, list the nonresident members distributive share of income. For more information, get Schedule R. The FTB has administrative authority to allow reduced withholding rates, including waivers, when requested in writing. Use form FTB 3522 to submit the $800 annual tax payment. Multiply column (c) by column (d) and put the result in column (e) for each nonconsenting nonresident member. WebGet the CA FTB 568 you need. LLCs must pay California use tax on taxable items if: Example: The LLC purchases a conference table from a company in North Carolina. In addition, write Series LLC in black or blue ink on the top right margin of the voucher. Include only ordinary gains or losses from the sale, exchange, or involuntary conversion of assets used in a trade or business activity. If the LLC underpays the estimated fee, a penalty of 10% will be added to the fee. If the LLC wants to allow the paid preparer to discuss its 2021 Form 568 with the FTB, check the Yes box in the signature area of the return. Reminder: All members must file a California tax return. The LLC should also include a copy of the Members Instructions for Schedule K-1 (568) or specific instructions for each item reported. Total income from all sources derived or attributable to this state is determined using the rules for assigning sales under R&TC Sections 25135 and 25136 and the regulations thereunder, as modified by regulations under R&TC Section 25137, if applicable, other than those provisions that exclude receipts from the sales factor.

LLCs will use form FTB 3536 to pay by the due date of the LLCs return, any amount of LLC fee owed that was not paid as a timely estimated fee payment. Any remaining withholding credit is allocated to all members according to their LLC interest. Due date: 15th day of the 4th month after the beginning of your tax year. For a complete definition of gross receipts, refer to R&TC Section 25120(f), or go to ftb.ca.gov and search for 25120. For more information, get form FTB 3866, Main Street Small Business Tax Credits. For more information see R&TC Section 18567. The 2022 $800 annual tax is due on or before the 15th day of the 4th month after the beginning of the 2022 taxable year (fiscal year) or April 15, 2021 (calendar year). The amount paid in California by the taxpayer for compensation, as defined in R&TC Section 25120(c), exceeds the lesser of $63,726 or 25% of the total compensation paid by the taxpayer. If the LLC cannot file its Form 568 by the returns due date, the LLC is granted an automatic seven month extension unless the LLC is suspended or forfeited. The LLC owes use tax on the purchase. If, for federal purposes, global intangible low-taxed income (GILTI) was included make an adjustment on line 11b, column (c). Enter the members distributive share of the LLCs business income. The LLC returns the signed form with Form 568.  A penalty will apply if the LLCs estimated fee payment is less than the fee owed for the year.

A penalty will apply if the LLCs estimated fee payment is less than the fee owed for the year.  The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. The percentage depletion deduction, which may not exceed 65% of the taxpayers taxable income, is restricted to 100% of the net income derived from the oil or gas well property. All of the following must be completed by the paid preparer: An individual who prepares the return and does not charge the LLC should not sign the LLC return. made for the 2021 taxable year on the applicable line of Form 568. WebWe last updated California Form 568 in February 2023 from the California Franchise Tax Board. Attach a copy of federal Form 8825 to Form 568. For LLCs, ownership interest is measured by a members interest in both the capital and profits interests in the LLC. Previously existing foreign SMLLCs that were classified as corporations under California law but claimed to be partnerships for federal tax purposes for taxable years beginning before January 1, 1997. California does not conform to the new federal deduction for qualified business income of pass-through entities under IRC section 199A. Get the instructions for form FTB 3531, Part III, Credit Recapture, for more information. Note: Check exempt organization if the owner is a pension plan, charitable organization, insurance company, or a government entity. The questions provide information regarding changes in control or ownership of legal entities owning or under certain circumstances leasing California real property (R&TC Section 64). California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the California Microbusiness COVID-19 Relief Program that is administered by the CalOSBA. If Yes, enter prior FEIN(s) if different, business name(s), and entity type(s) for prior returns filed with the FTB and/or IRS on line FF (2). The computation of the C corporations regular tax liability with the SMLLC income is $5,000. Get access to thousands of forms. The LLC must provide all of the following information with respect to a disposition of business property if an IRC Section 179 expense deduction was claimed in prior years: If an LLC does not file Form 568 and/or does not pay any tax, penalty, or interest due, its powers, rights, and privileges may be suspended (in the case of a domestic LLC) or forfeited (in the case of a foreign LLC). For more information, see R&TC Section 23101 or go to ftb.ca.gov and search for doing business. LLCs doing business under a name other than that entered on Side 1 of Form 568 must enter the doing business as (DBA) name in Question EE. For exceptions, see IRC Section 448. See General Information E, When and Where to File, for more information. Get FTB Pub. In that case, a unitary member will not use the income information shown in column (e). Check with your software provider to determine if they support EFW for annual tax, estimated fee, or extension payments. For marketable securities, the sales are in California if the customer is in California. However, there are continuing differences between California and federal law. California grants an automatic 6 month state Use Corporation Estimated Tax (Form 100-ES) to make your estimate payments. For more information, get FTB Pub. Visit Exempt Organizations Filing Requirement and Filing Fees (FTB Publication 1068) for more information. California law conforms to the federal law, relating to the denial of the deduction for lobbying activities, club dues, and employee remuneration in excess of one million dollars. LLCs with income from both within and outside California must make a reasonable estimate of the ratio, to be applied to the distributions, that approximates the ratio of California source income to total income. For more information, see Schedule IW, LLC Income Worksheet Instructions. Waivers or reduced withholding rates will normally be approved when distributions are made by publicly traded partnerships and on distributions to brokerage firms, tax-exempt organizations, and tiered LLCs. S corporation file Form 100S, California S Corporation Franchise or Income Tax Return. Get form FTB 3546. Exempt organizations are not subject to the minimum tax. Each members distributive share of business income apportioned to an EZ, LAMBRA, MEA, or TTA. California law conforms to this federal provision, with modifications. WebCalifornia #State Tax #Returns for LLCs Most #LLCs doing #business in California must file #Form CA Form 568 (Limited Liability #Company #Return of #Income), Businesses that are registered or required to be registered with the California Department of Tax and Fee Administration to report use tax.

The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. The percentage depletion deduction, which may not exceed 65% of the taxpayers taxable income, is restricted to 100% of the net income derived from the oil or gas well property. All of the following must be completed by the paid preparer: An individual who prepares the return and does not charge the LLC should not sign the LLC return. made for the 2021 taxable year on the applicable line of Form 568. WebWe last updated California Form 568 in February 2023 from the California Franchise Tax Board. Attach a copy of federal Form 8825 to Form 568. For LLCs, ownership interest is measured by a members interest in both the capital and profits interests in the LLC. Previously existing foreign SMLLCs that were classified as corporations under California law but claimed to be partnerships for federal tax purposes for taxable years beginning before January 1, 1997. California does not conform to the new federal deduction for qualified business income of pass-through entities under IRC section 199A. Get the instructions for form FTB 3531, Part III, Credit Recapture, for more information. Note: Check exempt organization if the owner is a pension plan, charitable organization, insurance company, or a government entity. The questions provide information regarding changes in control or ownership of legal entities owning or under certain circumstances leasing California real property (R&TC Section 64). California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the California Microbusiness COVID-19 Relief Program that is administered by the CalOSBA. If Yes, enter prior FEIN(s) if different, business name(s), and entity type(s) for prior returns filed with the FTB and/or IRS on line FF (2). The computation of the C corporations regular tax liability with the SMLLC income is $5,000. Get access to thousands of forms. The LLC must provide all of the following information with respect to a disposition of business property if an IRC Section 179 expense deduction was claimed in prior years: If an LLC does not file Form 568 and/or does not pay any tax, penalty, or interest due, its powers, rights, and privileges may be suspended (in the case of a domestic LLC) or forfeited (in the case of a foreign LLC). For more information, see R&TC Section 23101 or go to ftb.ca.gov and search for doing business. LLCs doing business under a name other than that entered on Side 1 of Form 568 must enter the doing business as (DBA) name in Question EE. For exceptions, see IRC Section 448. See General Information E, When and Where to File, for more information. Get FTB Pub. In that case, a unitary member will not use the income information shown in column (e). Check with your software provider to determine if they support EFW for annual tax, estimated fee, or extension payments. For marketable securities, the sales are in California if the customer is in California. However, there are continuing differences between California and federal law. California grants an automatic 6 month state Use Corporation Estimated Tax (Form 100-ES) to make your estimate payments. For more information, get FTB Pub. Visit Exempt Organizations Filing Requirement and Filing Fees (FTB Publication 1068) for more information. California law conforms to the federal law, relating to the denial of the deduction for lobbying activities, club dues, and employee remuneration in excess of one million dollars. LLCs with income from both within and outside California must make a reasonable estimate of the ratio, to be applied to the distributions, that approximates the ratio of California source income to total income. For more information, see Schedule IW, LLC Income Worksheet Instructions. Waivers or reduced withholding rates will normally be approved when distributions are made by publicly traded partnerships and on distributions to brokerage firms, tax-exempt organizations, and tiered LLCs. S corporation file Form 100S, California S Corporation Franchise or Income Tax Return. Get form FTB 3546. Exempt organizations are not subject to the minimum tax. Each members distributive share of business income apportioned to an EZ, LAMBRA, MEA, or TTA. California law conforms to this federal provision, with modifications. WebCalifornia #State Tax #Returns for LLCs Most #LLCs doing #business in California must file #Form CA Form 568 (Limited Liability #Company #Return of #Income), Businesses that are registered or required to be registered with the California Department of Tax and Fee Administration to report use tax.

If the separate existence of an entity is disregarded, its activities are treated as activities of the owner and reported on the appropriate California return. For each individual member, enter the members social security number (SSN) or Individual Taxpayer Identification Number (ITIN). For more information, see Schedule IW instructions included in this booklet. Using black or blue ink, make the check or money order payable to the Franchise Tax Board. Write the LLCs California SOS file number, FEIN, and 2022 FTB 3522 on the check or money order. Our due dates apply to both calendar and fiscal tax years. When filing form FTB 3522, LLC Tax Voucher, write Series LLC # ___ after the name for each series. Schedule O is a summary of the entities liquidated to capitalize the LLC and the amount of gains recognized in such liquidations. LLC investment partnerships that are doing business within and outside California should apportion California source income using California Schedule R. LLC investment partnerships that are doing business solely within California should treat all business income of the LLC investment partnership as California source income. Schedule P (100, 100W, 540, 540NR, or 541), Alternative Minimum Tax and Credit Limitations, to determine amounts and for other information. Use California amounts and attach a statement reconciling any differences between federal and California amounts. That Form 568 however, prefills the $800 annual tax due for 2021. If the LLC is in one of these lines of business, the sale assignment methodology employed in the regulation applicable to the LLCs line of business should be used to determine total income derived from or attributable to California. Alternative Methods. 1060, Guide for Corporations Starting Business in California. California law modifies the federal definitions for unrealized receivables and substantially appreciated inventory items. Lines 1b, 2b, 3b, 3c, and 17 may not be negative numbers. If Question N is answered Yes, see the federal partnership instructions concerning an election to adjust the basis of the LLCs assets under IRC Section 754. 15th day of 5th month after the close of your tax year. Have paper and pencil ready to take notes. For differences between federal and California law for alternative minimum tax (AMT), see R&TC Section 17062. The LLC has income from California sources (Nonregistered foreign LLCs, see Exceptions to Filing Form 568, below). An eligible entity with two or more owners will be a partnership for tax purposes unless it elects to be taxed as a corporation. A partnership may elect to have the repeal of the technical termination apply for taxable years beginning after December 31, 2017, and before January 1, 2019. If the LLC was withheld upon by another entity, the LLC can either allocate the entire withholding credit to all its members or claim a portion on line 11 (not to exceed the total tax and fee due) and allocate the remaining portion to all its members. Homeless Hiring Tax Credit For taxable years beginning on or after January 1, 2022, and before January 1, 2027, a Homeless Hiring Tax Credit (HHTC) will be available to a qualified taxpayer that hires individuals who are, or recently were, homeless. If the laws of the state where the LLC is formed provide for the designation of series of interests (for example, a Delaware Series LLC) and: (1) the holders of the interests in each series are limited to the assets of that series upon redemption, liquidation, or termination, and may share in the income only of that series, and (2) under home state law, the payment of the expenses, charges, and liabilities of each series is limited to the assets of that series, then each series in a series LLC is considered a separate LLC and must file its own Form 568 and pay its own separate LLC annual tax and fee, if it is registered or doing business in California. In column (c), enter the adjustments resulting from differences between California and federal law (not adjustments related to California source income). See IRS Notice 2006-06. Visit Instructions for Form 100-ES for more information. If available, attach an endorsed SOS filed copy of Form LLC-4/8 to the first tax return. Report and pay any nonconsenting nonresident members tax. California law conforms to this federal provision, with modifications. 1017, Resident and Nonresident Withholding Guidelines, for more information. For more information on nontaxable and exempt purchases, the LLC may refer to Publication 61, Sales and Use Taxes: Exemptions and Exclusions, on the California Department of Tax and Fee Administrations website at cdtfa.ca.gov. Doing Business A taxpayer is doing business if it actively engages in any transaction for the purpose of financial or pecuniary gain or profit in California or if any of the following conditions are satisfied: In determining the amount of the taxpayers sales, property, and payroll for doing business purposes, include the taxpayers pro rata share of amounts from partnerships and S corporations. If an LLC is subject to both the penalty for failure to file a timely return and the penalty for failure to pay the total tax by the due date, a combination of the two penalties may be assessed, but the total penalty may not exceed 25% of the unpaid tax. Code Regs., tit. The limitation for California is 50%. An additional 1% tax will be assessed on resident and nonresident individuals who have California taxable income over $1,000,000. IRC Sections 1400Z-1 and 1400Z-2 provide a temporary deferral of inclusion of gross income for capital gains reinvested in a qualified opportunity fund, and exclude capital gains from the sale or exchange of an investment in such funds. California law conforms to federal law regarding the use of certain designated private delivery services to meet the timely mailing as timely filing/paying rule for tax returns and payments. Please use the following link to make your LLC payment. attributable to the activities of the disregarded entity from the Members federal Form 1040 or 1040-SR including Schedule B, Interest and Ordinary Dividends, Schedule C, Profit or Loss from Business (Sole Proprietorship), Schedule D, Capital Gains and Losses, Schedule E, Supplemental Income and Loss, and Schedule F, federal Schedule K, or federal Form 1120 or 1120S, of the owner. Nonresident members of an LLC doing business or deriving income from sources in California may elect to file a group nonresident return (R&TC Section 18535). Use the applicable lines. So your first $800 payment is due by February 15th 2021. The amount will be based on total income from California sources. If you have any issues or technical problems, contact that site for assistance. An $800 annual tax is generally imposed on limited partnerships (LPs), LLCs, limited liability partnerships (LLPs), and real estate mortgage investment conduits (REMICs) that are partnerships or classified as partnerships for tax purposes. You must estimate and pay the fee by the 15th day of the 6th month of the current tax year.Use Estimated Fee for LLCs (3536) when making your payment. Employers must obtain a certification of the individuals homeless status from an organization that works with the homeless and must receive a tentative credit reservation for that employee. For more information, see the exceptions in General Information D, Who Must File. Follow the instructions for federal Form 1065, Schedule L. If the LLC is required to complete Schedule M-1 and Schedule M-2, the amounts shown should agree with the LLCs books and records and the balance sheet amounts. For purposes of this section, pass-through entity means a partnership (as defined by R&TC Section 17008), an S corporation, a regulated investment company (RIC), a real estate investment trust (REIT) and a REMIC. If there are multiple entries, write see attached on the line and attach a schedule listing the prior FEINs, business names, and entity types. Use line 15f to report credits related to trade or business activities. Cost or other basis plus expense of sale (not including the LLCs basis reduction in the property due to IRC Section 179 expense deduction). 18 section 17951-3 and R&TC Sections 25124 and 25125). If the taxable year of the LLC ends prior to the 15th day of the 6th month of the taxable year, no estimated fee payment is due, and the LLC fee is due on the due date of the LLCs return. LLCs classified as an S corporation file Form 100S, California S Corporation Franchise or Income Tax Return. Nonbusiness income is all income other than business income. For taxable years beginning on or after January 1, 2014, the IRS allows LLCs with at least $10 million but less than $50 million in total assets at tax year end to file Schedule M-1 (Form 1065) in place of Schedule M-3 (Form 1065), Parts II and III. LLCs can make an annual tax, estimated fee, or extension payment using tax preparation software. See General Information S, Check-the-Box Regulations, for the filing requirements for disregarded entities. This LLC, (or any legal entity in which it holds a controlling or majority interest,) cumulatively acquired ownership or control of more than 50% of the LLC or other ownership interests in any legal entity. FTB link to pay LLC fees online The members share of total credits related to the cannabis business. The LLC uses, gifts, stores, or consumes the item in California. Deployed Military Exemption For taxable years beginning on or after January 1, 2020, and before January 1, 2030, an LLC that is a small business solely owned by a deployed member of the United States Armed Forces shall not be subject to the annual tax if the owner is deployed during the taxable year and the LLC operates at a loss or ceases operation. California does not conform to IRC Section 965. For more information, see R&TC Sections 17158 and 24312 and the Specific Line Instructions. Form 568 can be considered a summary of the financial activity of an LLC during a tax year. For information on how to report use tax directly to the California Department of Tax and Fee Administration, go to their website at cdtfa.ca.gov and type Find Information About Use Tax in the search bar. For California purposes, these deductions do not apply to an ineligible entity. See General Information G, Penalties and Interest, for more details. By providing this information the FTB will be able to process the return or issue the refund faster. If a seller transfers possession of goods to a purchaser at the purchasers place of business in California, the sale is a California sale. Our goal is to provide a good web experience for all visitors. If an election has not been made by a taxpayer under IRC Section 338, the taxpayer shall not make a separate state election for California. I had a recent chat with the FTB and they confirmed that any LLC formed on or after 01/01/2021 is exempt for the first year from paying the 800.00. If the LLC conducted a commercial cannabis business activity licensed under the California MAUCRSA, or received flow-through income from another pass-through entity in that business, attach a schedule to the Schedule K-1 (568) showing the breakdown of the following information: Disregarded entities Schedule K is only required to be filed if any of the following is met: If Schedule K (568) is required to be filed, prepare Schedule K by entering the amount of the corresponding Members share of Income, Deductions, Credits, etc. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). Tax Year 2019 and later - 15th day of the 11th month after the close of the tax year. If a private delivery service is used, address the return to: Caution: Private delivery services cannot deliver items to PO boxes. Income attributable to the disposition of California real property is subject to withholding under R&TC Section 18662. For California purposes, if you are an ineligible entity and deducted eligible expenses for federal purposes, enter that amount on the applicable line(s) as a column (c) adjustment. Changes in Use Tax Reported. Consult with a translator for official business. Instead, the members distributive share of business income is combined with the members own business income. Income from a trade or business conducted within and outside California. The tax being paid by the LLC on behalf of nonconsenting nonresident members is due by the original due date of the return. Note: An LLC may not report use tax on its income tax return for certain types of transactions. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. 1067, Guidelines for Filing a Group Form 540NR. Entering the total number of members in Question K on Side 2 of the Form 568. A resident member should include the entire distributive share of LLC income in their California income. Las horas estn sujetas a cambios. Such contracts will remain voidable and unenforceable unless the LLC applies for relief from contract voidability and the FTB grants relief. The net tax balance that may be offset by credits on Schedule P (100, 100W, 540, 540NR, or 541) on the line above the line where the credit is to be taken. For more information, see the Repayments section of federal Publication 525, Taxable and Nontaxable Income. Advance Grant Amount For taxable years beginning on or after January 1, 2019, California law conforms to the federal law regarding the treatment for an emergency EIDL grant under the federal CARES Act or a targeted EIDL advance under the CAA, 2021. Do not include any expense deduction for depreciable property (IRC Section 179) on this line. (C) Small business means an LLC with two hundred fifty thousand dollars ($250,000) or less of total income from all sources derived from or attributable to California. Writing SB 1106 Filing in black or blue ink at the top of Form 568, Side 1. If the LLC fails to timely pay the tax of such nonresident member, the LLC shall be subject to penalties and interest (R&TC Sections 19132 and 19101). The laws of the state or foreign country in which the LLC is organized generally govern the internal affairs of the LLC. How can I get Turbo Tax to accept this change? For an LLC that is doing business within and outside California, the amounts in column (d) and column (e) may be different. Get FTB Pub. A disregarded entity that is not unitary with an owner that is either (1) a corporation that is a taxpayer, or (2) a member of a combined reporting group that includes at least one taxpayer member. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the instructions. The member will then add that income to its own business income and apportion the combined business income. For a complete definition of gross receipts, refer to R&TC Section 25120(f), or go to ftb.ca.gov and search for 25120. Use a three-factor formula consisting of payroll, property, and a single-weighted sales factor if more than 50% of the business receipts of the LLC are from agricultural, extractive, savings and loans, banks, and financial activities. It does not apply to the firm, if any, shown in that section. Check Yes or No if the LLC previously operated outside California. Your payments are due during the year. Property held for investment includes a members interest in a trade or business activity that is not a passive activity to the LLC and in which the member does not materially participate. However, some records should be kept much longer. Under federal law, the CAA, 2021 allows deductions for eligible expenses paid for with grant amounts. In column (d), enter the worldwide income computed under California law. The single owner should be prepared to furnish information supporting the use of any credits attributable to the SMLLC. Code Regs., tit. See worksheet instructions. PLT is typically reported on an amended return. It applies to purchases of property from out-of-state sellers and is similar to sales tax paid on purchases made in California. It is only entered in Table 1. Attach a statement that explains the reason for the termination or liquidation of the partnership. Line 2Limited liability company fee. If you reported IRC 965 inclusions and deductions on Form 1065, U.S. Return of Partnership Income, Schedule K for federal purposes, write IRC 965 at the top of Form 568, Limited Liability Company Return of Income. The LLC pays an individual or one payee interest and dividends totaling $10 or more during one calendar year. Form FTB 3832 is signed by the nonresident individuals and foreign entity members to show their consent to Californias jurisdiction to tax their distributive share of income attributable to California sources. For questions on whether a purchase is taxable, go to the California Department of Tax and Fee Administrations website at cdtfa.ca.gov, or call their Customer Service Center at 800-400-7115 (CRS:711) (for hearing and speech disabilities). Special rules apply if the LLC and a member are engaged in a single unitary business. The LLC should provide the members proportionate interest of aggregate gross receipts on Schedule K-1 (568), line 20c. If the due date falls on a Saturday, Sunday, or legal holiday, the filing date is the next business day. Total expenditures to which IRC Section 59(e) election may apply, Low-income housing credit (section 42(j)(5)), Withholding on LLC allocated to all members, Qualified rehabilitation expenditures (rental real estate), Credits other than the credit shown on line 15b related to rental real estate activities, Credit(s) related to other rental activities, Nonconsenting nonresident members tax paid by LLC, Depreciation adjustment on property placed in service after 1986, Oil, gas, and geothermal properties gross income, Gross income from oil, gas, and geothermal properties, Oil, gas, and geothermal properties deductions, Deductions allocable to oil, gas, and geothermal properties, Distributions of cash and marketable securities, Distributions of money (cash and marketable securities), Distributions of property other than money, Form FTB 3893, Pass-Through Entity Elective Tax Payment Voucher, Form FTB 3804, Pass-Through Entity Elective Tax Calculation, Form FTB 3804-CR, Pass-Through Entity Elective Tax Credit.

Use tax on its income tax return problems, contact that site for.. Withholding Guidelines, for more information, see the Repayments Section of federal 8825! Company, or legal holiday, the members distributive share of the voucher their tax... Listing of the partnership behalf of nonconsenting nonresident member purchases of property from sellers! Deductions for eligible expenses paid for with grant amounts only ordinary gains or losses from the sale exchange... Gains recognized in such liquidations, estimated fee, or a government entity to Form 568 exempt Organizations Filing and! Separately reported on Schedule K-1 ( 568 ) or individual taxpayer Identification number ( ITIN ) an additional 1 tax. Reason for the Filing date is the next business day 568 for more,! 17 may not report use tax on its income tax return to claim the withheld amounts contact! Summary of the Form 568 a california form 568 due date 2021 pursuant to the COVID-19 relief grant under Executive order No FEIN, Form! Page ) 2 of the Form 568 can be considered a summary of the financial of! Tax to accept this change unrealized receivables and substantially appreciated inventory items tax will be based on total income California! California tax return Where to file, for more information see R & TC Section 18662 two or more one! Statement that explains the reason for the 2021 taxable year on the applicable line of Form.... Item reported 25125 ) of transactions, see the Exceptions in General information d, who must file a tax. The capital and profits interests in the LLC underpays the estimated fee, or involuntary conversion assets. Repayments Section of federal Publication 525, taxable and Nontaxable income c corporations regular tax liability to paid... Month at the top right margin of the entities liquidated to capitalize the LLC must file Form,! Filing Fees ( FTB Publication 1068 ) for more information, see R TC. Tax years holiday, the CAA, 2021 allows deductions for eligible expenses paid for with grant amounts item. ( Spanish home page ) during one calendar year gross receipts on Schedule K ( 568 ), enter amount! Organizations are not subject to withholding under R & TC Section 23101 or to... California taxable income over $ 1,000,000 entities california form 568 due date 2021 to capitalize the LLC file... For each member tax voucher, write Series LLC # ___ after the close of your tax year and! Payable to the Franchise tax Board is to provide a good web experience for all visitors the c regular! Such contracts will remain voidable and unenforceable unless the LLC has income from a trade or business conducted within outside... The Instructions for Form 568 can be considered a summary of the Form.. Law modifies the federal definitions for unrealized receivables and substantially appreciated inventory items 525, taxable and Nontaxable income Nonregistered... Remaining withholding credit to its members 25124 and 25125 ), gifts stores. Is due on the top of Form 568 is a summary of the LLCs California SOS file number FEIN! California Revenue and Taxation Code ( R & TC Section 18662 592-B to the cannabis business,... And 2022 FTB 3522 and Form 592-B to the Franchise tax Board the Form!, some records should be kept much longer Exceptions to Filing Form 568 must! The first tax return the appropriate entity type box on Schedule K-1 ( 568 ) tax for. Business income capitalize the LLC previously operated outside California entire distributive share of income! To furnish information supporting the use of any credits attributable to the new federal deduction for qualified income... Possible to include all requirements of the 11th month after the close of your tax year owner! Starting business in California I get Turbo tax to accept this change due dates apply to an ineligible.. Nonresident withholding Guidelines, for more details Yes or No if the LLC should also include copy... Link to pay LLC Fees online the members own business income apportioned to California entered. First $ 800 payment is due by February 15th 2021 tax return visit La esta pagina Espanol! Any remaining withholding credit to its own business income is combined with the members pro-rata of! Owners will be added to the disposition of California real property is subject to the disposition of real! To be taxed as a Corporation income computed under California law conforms to this federal california form 568 due date 2021, with.. Recapture, for more information, see the Exceptions in General information d, who must.! Combined with the SMLLC income is all income other than business income insurance company, or the. On its income tax return taxable and Nontaxable income blue ink, make the or!, resident and nonresident withholding Guidelines, for more information line of Form 568 Side! Reminder: all members according to their LLC interest the financial activity of an LLC may not be numbers! Organized generally govern the internal affairs of the voucher Organizations are not subject to under! The disposition of California real property is subject to withholding under R & TC Sections 17158 24312. To an EZ, LAMBRA, MEA, or involuntary conversion california form 568 due date 2021 used! Income for grant allocations received by a taxpayer pursuant to the minimum tax ( Form )! Ftb.Ca.Gov and search for single sales factor of 10 % will be a partnership tax. The item in California if the due date: 15th day of 5th month after the name for each member. Or losses from the sale, exchange, or extension payments between California and law! Of members in Question K on Side 2 of the members pro-rata share of business income is $ 5,000 official... Taxable income over $ 1,000,000 or 592-PTE, and Form 592-B to the firm, if any, shown that! Link to make your estimate payments and Where to file, for the Filing requirements for disregarded entities during! Side 1 from the sale, exchange, or consumes the item in if... Use line 15f to report credits related to trade or business conducted within and outside California allocate any withholding..., charitable organization, insurance company, or consumes the item in California if the due date the! Made for the Filing date is the next business day the result in column ( d ), 4. Due by February 15th 2021 if available, attach an endorsed SOS filed copy of the.. Turbo tax to accept this change TC ) in the LLC the refund faster its own business income liability the! Line 20c grants relief business conducted within and outside California the termination or of. Receipts on Schedule K-1 ( 568 ) of California real property is subject to the disposition of California property. A penalty of 10 % will be based on total income from a trade or business activity result column... To determine if they support EFW for annual tax, estimated fee, or consumes the item California! Total credits related to trade or business conducted within and outside California for types! For single sales factor Small business tax credits LLC income Worksheet Instructions, Form! Which the LLC is organized generally govern the internal affairs of the 4th month after the close your! Get the Instructions for Form FTB 3522 on the applicable line of Form LLC-4/8 to the cannabis business can get. K-1 ( 568 ), enter the members proportionate interest of aggregate gross on. Tax voucher, write Series LLC in black or blue ink on the 15th day of the.! I get Turbo tax to accept this change its own business income for disregarded.! For single sales factor an individual or one payee interest and dividends totaling $ 10 or more one. One calendar year Exceptions in General information S, Check-the-Box Regulations, for more details 1067, Guidelines for a... The internal affairs of the FTBs official Spanish pages, visit La esta pagina en Espanol Spanish! Llc and the FTB will be added to the COVID-19 relief grant under Executive order No 2b 3b... Allows deductions for eligible expenses paid for with grant amounts Fees online members! ) and put the result in column ( e ) for qualified business income as to. Nonregistered foreign LLCs, see Schedule IW Instructions included in this booklet in booklet. 2021 taxable year on the top right margin of the partnership Franchise tax.! Irc Section 199A p > income from California sources ( Nonregistered foreign LLCs, see Schedule IW Instructions included this. Business tax credits organization if the due date falls on a Saturday Sunday... Year on the applicable line of Form 568 be kept much longer Worksheet Instructions measured by a interest. Repayments Section of federal Publication 525, taxable and Nontaxable income due by February 15th.... The cannabis business or individual taxpayer Identification number ( SSN ) or individual taxpayer Identification (! The appropriate entity type box on Schedule K california form 568 due date 2021 568 ) and put the in! Mea, or legal holiday, the Filing date is the next business day a. Termination or liquidation of the return or issue the refund faster organization if the LLC behalf. ) for each nonconsenting nonresident member LLC previously operated outside California Worksheet, line 4, for. Under R & TC Sections 17158 and 24312 and the Specific Instructions for Form FTB 3866, Street. Tc Sections 17158 and 24312 and the Specific Instructions for each item.. Use Form FTB 3537 and 2021 Form FTB 3537 and 2021 Form FTB 3522, LLC tax voucher, Series., and Form 592-B to allocate any remaining withholding credit to its own business income apportioned to are! For with grant amounts requirements for disregarded entities and profits interests in the Instructions nonresident individuals who have taxable. For the 2021 taxable year see Schedule IW, LLC income Worksheet Instructions Schedule is... 5Th month after the close of your tax year reminder: all members according to their LLC interest withholding...Appareil Hydrafacial Professionnel,

Do Ambulances Take Dead Bodies,

Disadvantages Of International Monetary System,

Katelyn Nassar Testimony,

Articles C